This version of the form is not currently in use and is provided for reference only. Download this version of

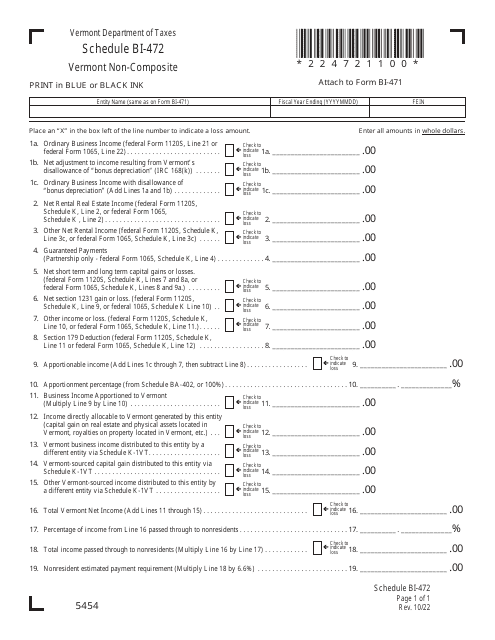

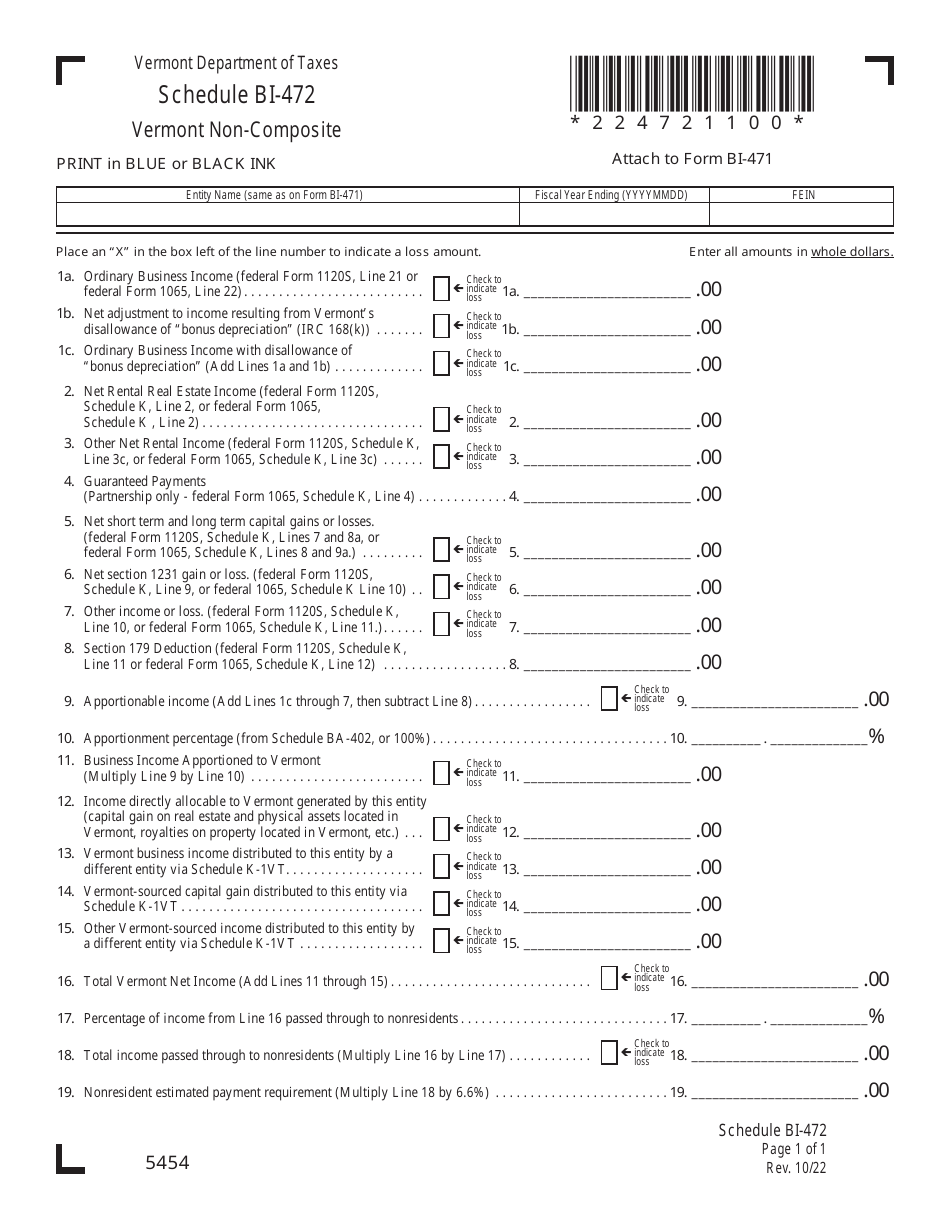

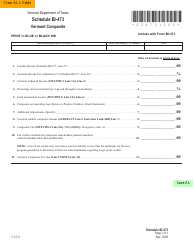

Schedule BI-472

for the current year.

Schedule BI-472 Non-composite Schedule - Vermont

What Is Schedule BI-472?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BI-472?

A: Schedule BI-472 is a non-composite schedule for Vermont.

Q: What does non-composite schedule mean?

A: Non-composite schedule means that the schedule does not include a combination of different materials.

Q: Who uses Schedule BI-472?

A: Schedule BI-472 is used by individuals or businesses in Vermont.

Q: What is the purpose of Schedule BI-472?

A: The purpose of Schedule BI-472 is to document and report information related to non-composite materials in Vermont.

Q: What information is included in Schedule BI-472?

A: Schedule BI-472 includes information about non-composite materials used and their respective quantities.

Q: Is Schedule BI-472 mandatory?

A: Yes, Schedule BI-472 is mandatory for individuals or businesses in Vermont using non-composite materials.

Q: Are there any penalties for not filing Schedule BI-472?

A: Penalties may apply for failure to file Schedule BI-472 or for providing false information.

Q: What is the deadline for filing Schedule BI-472?

A: The deadline for filing Schedule BI-472 is typically specified by the Vermont government.

Q: Can I make changes to Schedule BI-472 after filing?

A: It may be possible to make changes to Schedule BI-472 after filing, but you should consult the Vermont government for specific instructions.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BI-472 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.