This version of the form is not currently in use and is provided for reference only. Download this version of

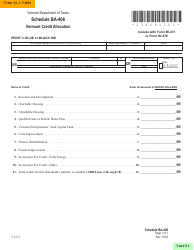

Schedule BA-402

for the current year.

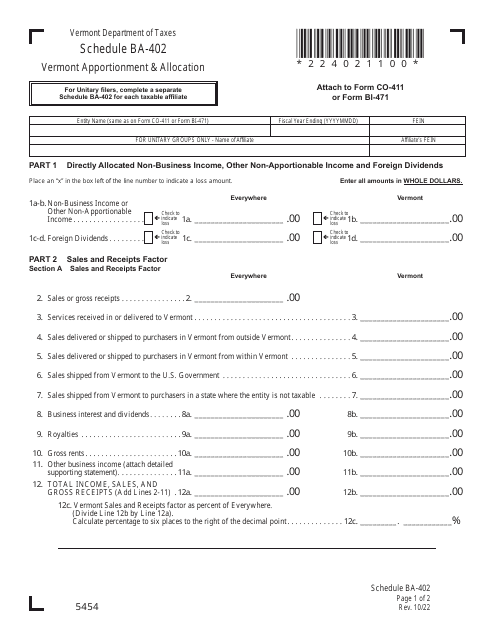

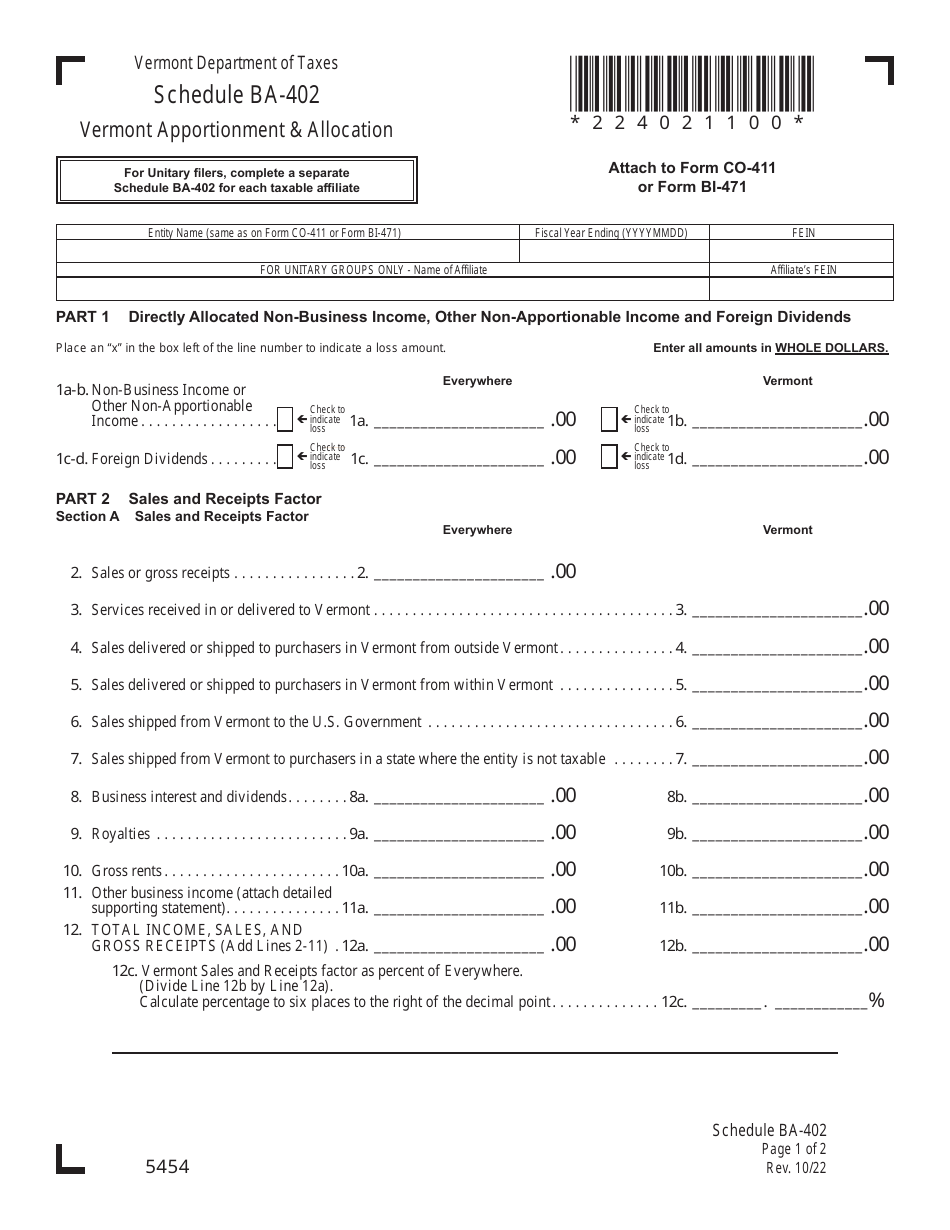

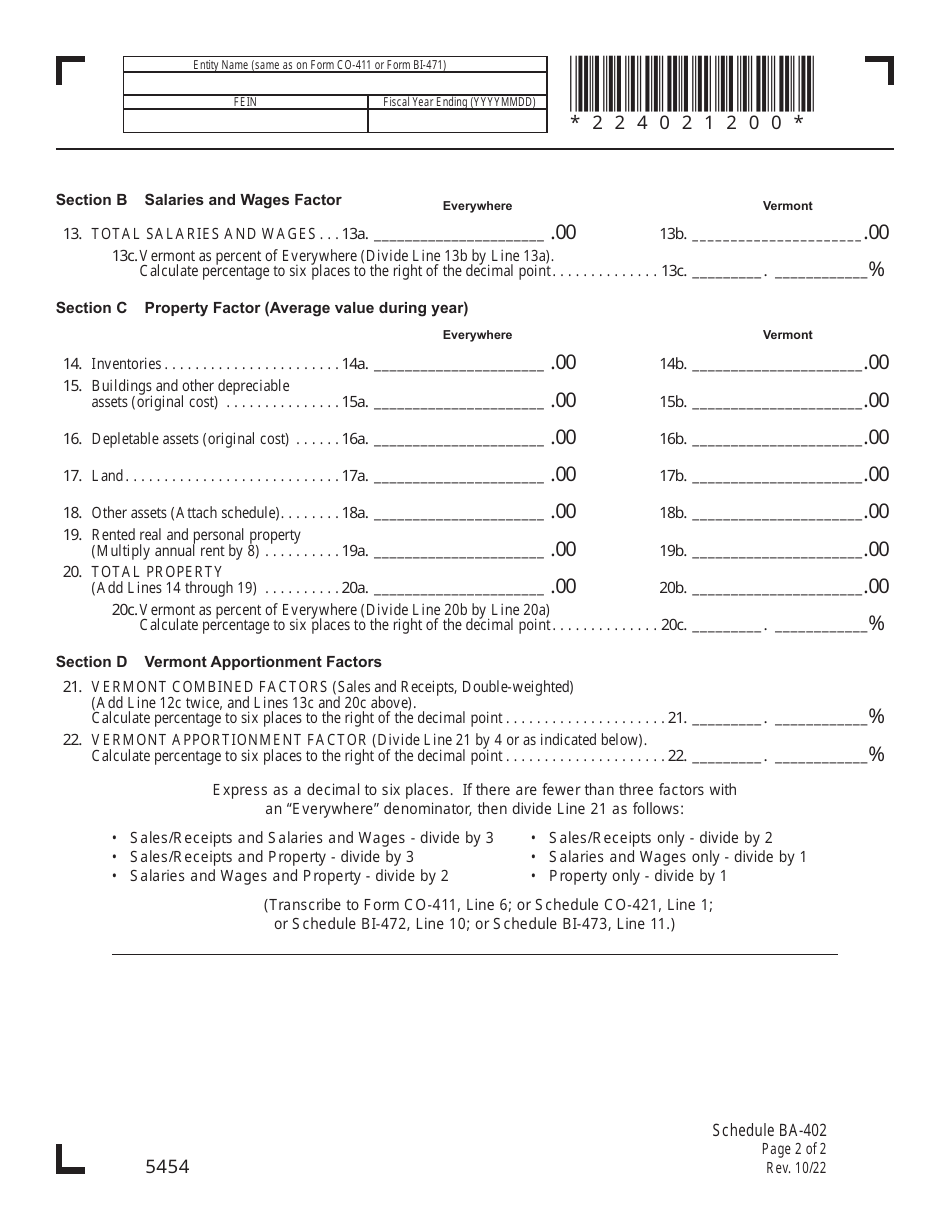

Schedule BA-402 Vermont Apportionment & Allocation - Vermont

What Is Schedule BA-402?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

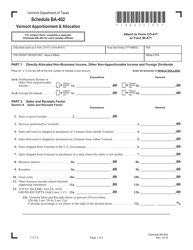

Q: What is the BA-402 Vermont Apportionment & Allocation?

A: The BA-402 Vermont Apportionment & Allocation is a schedule used in Vermont to apportion and allocate income for tax purposes.

Q: Who is required to file the BA-402 Vermont Apportionment & Allocation?

A: Certain businesses that operate in Vermont and have income from both within and outside the state are required to file the BA-402 Vermont Apportionment & Allocation.

Q: What is the purpose of the BA-402 Vermont Apportionment & Allocation?

A: The purpose of the BA-402 Vermont Apportionment & Allocation is to determine the portion of a business's income that is subject to Vermont taxation.

Q: How is the income apportioned and allocated on the BA-402 Vermont Apportionment & Allocation?

A: The income is apportioned based on factors such as sales, payroll, and property in Vermont compared to total sales, payroll, and property everywhere.

Q: Are there specific instructions for filling out the BA-402 Vermont Apportionment & Allocation?

A: Yes, the Vermont Department of Taxes provides instructions and guidance on how to complete the BA-402 Vermont Apportionment & Allocation.

Q: What happens if I fail to file the BA-402 Vermont Apportionment & Allocation?

A: Failure to file the BA-402 Vermont Apportionment & Allocation can result in penalties and interest being assessed by the Vermont Department of Taxes.

Q: When is the deadline for filing the BA-402 Vermont Apportionment & Allocation?

A: The deadline for filing the BA-402 Vermont Apportionment & Allocation is usually the same as the deadline for filing the Vermont business income tax return.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-402 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.