This version of the form is not currently in use and is provided for reference only. Download this version of

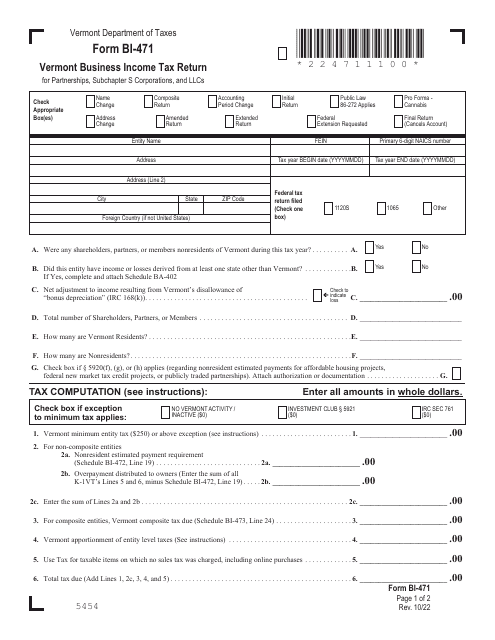

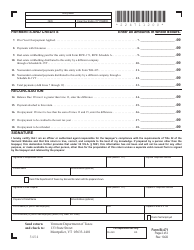

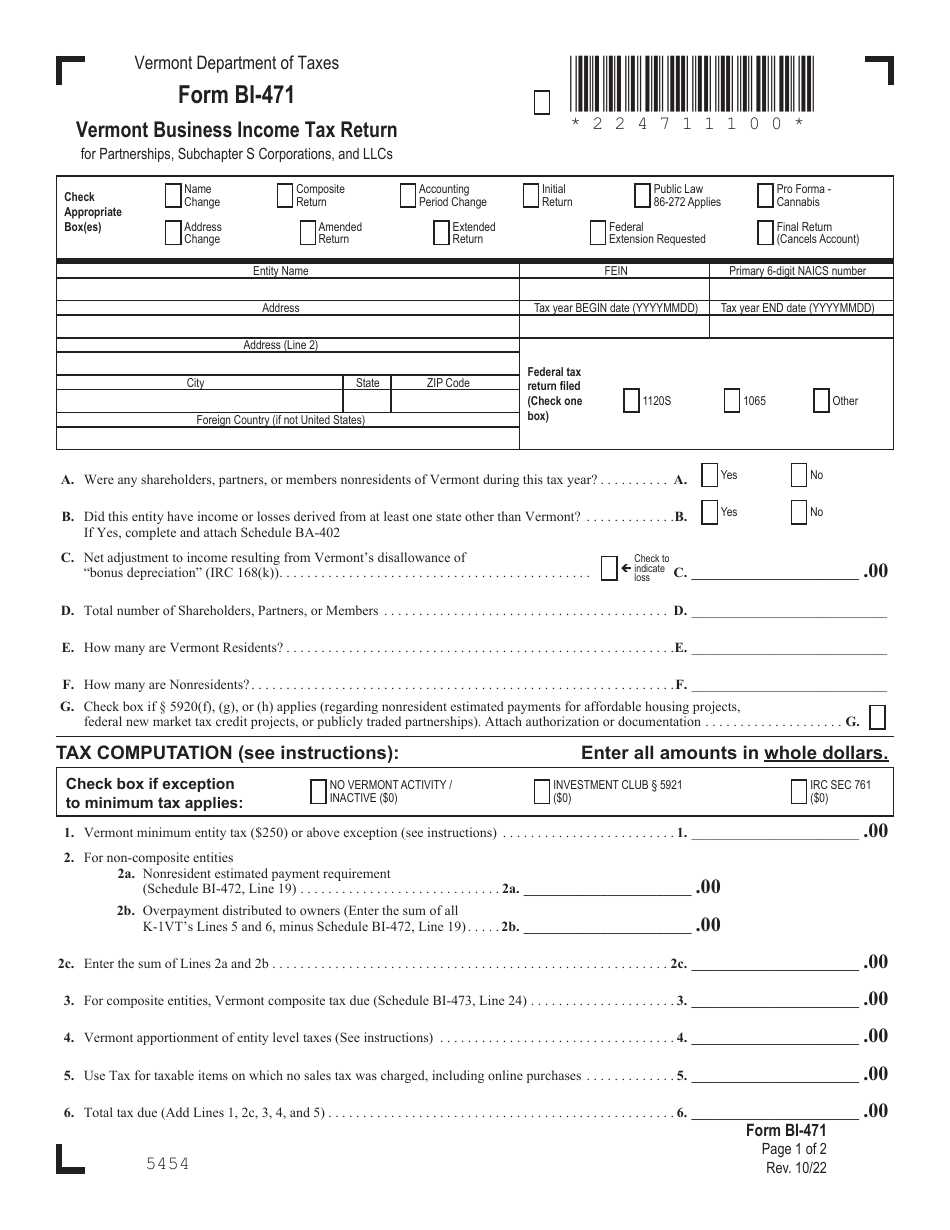

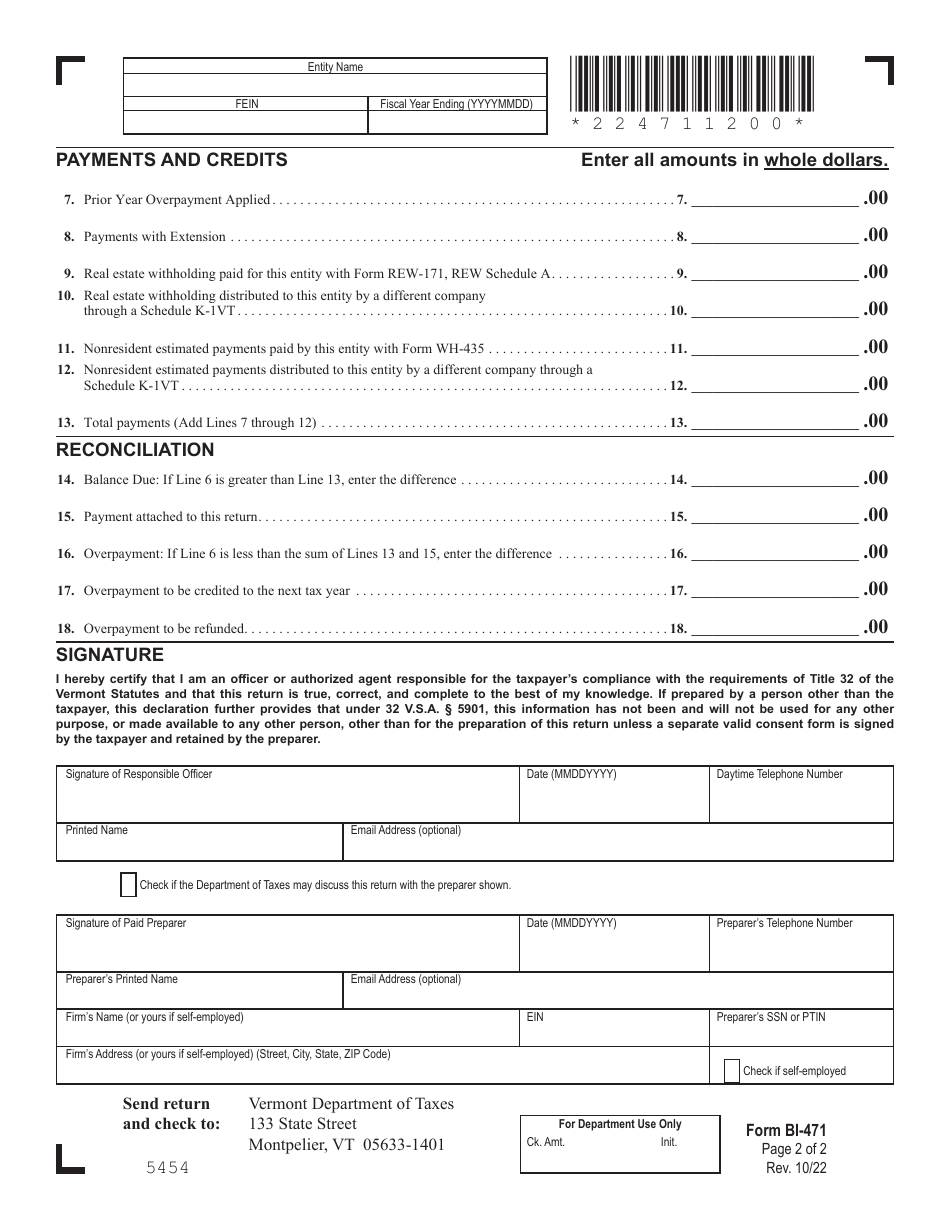

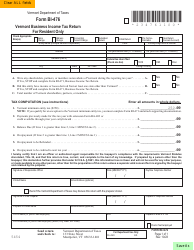

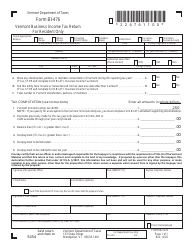

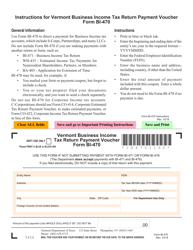

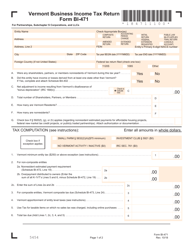

Form BI-471

for the current year.

Form BI-471 Vermont Business Income Tax Return for Partnerships, Subchapter S Corporations, and Llcs - Vermont

What Is Form BI-471?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form BI-471?

A: Form BI-471 is the Vermont Business Income Tax Return for Partnerships, Subchapter S Corporations, and LLCs.

Q: Who should file form BI-471?

A: Partnerships, Subchapter S Corporations, and LLCs doing business in Vermont should file form BI-471.

Q: What is the purpose of form BI-471?

A: The purpose of form BI-471 is to report business income and calculate the tax liability for partnerships, Subchapter S corporations, and LLCs.

Q: When is the deadline to file form BI-471?

A: The deadline to file form BI-471 is the 15th day of the fourth month following the end of the tax year, which is usually April 15th.

Q: Is form BI-471 only for Vermont businesses?

A: Yes, form BI-471 is specifically designed for businesses that operate in the state of Vermont.

Q: Are there any additional forms or attachments required with form BI-471?

A: Yes, depending on the specific circumstances of the business, additional forms and attachments may be required with form BI-471.

Q: What should I do if I need assistance with form BI-471?

A: If you need assistance with form BI-471, you can contact the Vermont Department of Taxes or seek help from a tax professional.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BI-471 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.