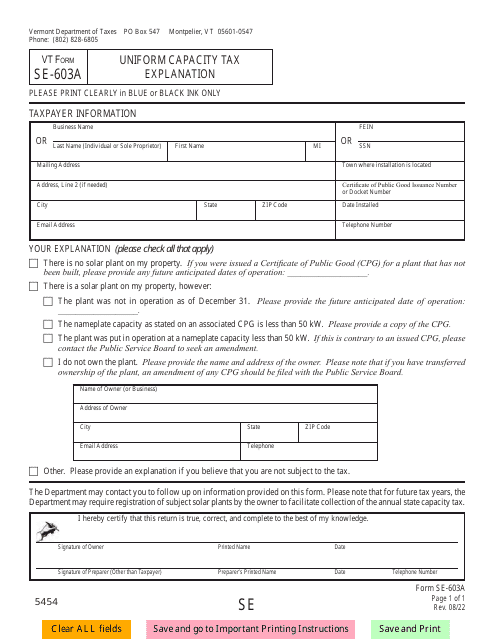

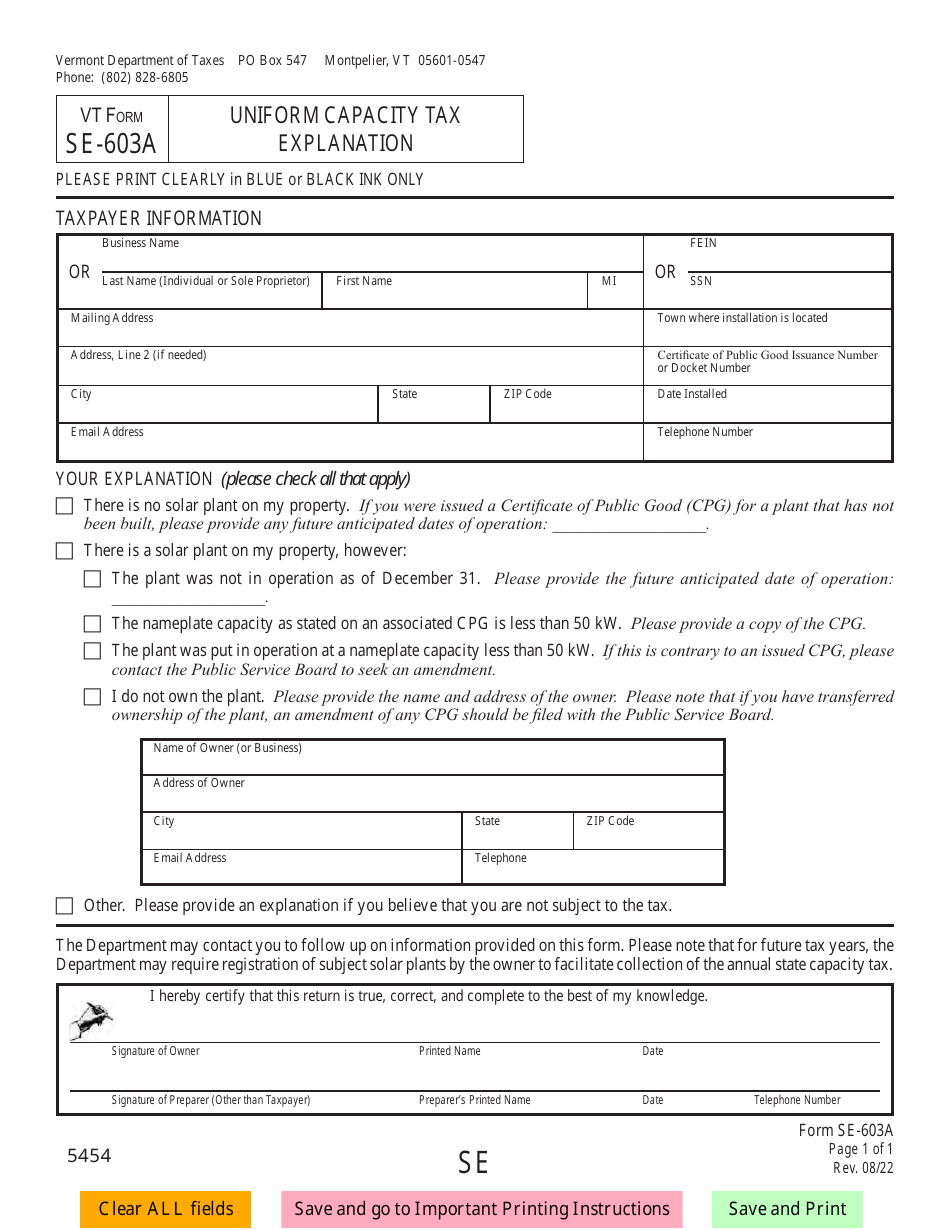

VT Form SE-603A Uniform Capacity Tax Explanation - Vermont

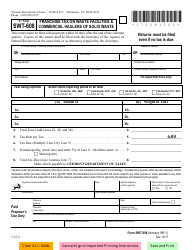

What Is VT Form SE-603A?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form SE-603A?

A: The VT Form SE-603A is the Uniform Capacity Tax form in Vermont.

Q: What is the Uniform Capacity Tax in Vermont?

A: The Uniform Capacity Tax is a tax that is imposed on certain business entities in Vermont, such as partnerships and limited liability companies.

Q: What is the purpose of the VT Form SE-603A?

A: The purpose of the VT Form SE-603A is to calculate and report the Uniform Capacity Tax owed by eligible business entities in Vermont.

Q: Who needs to file the VT Form SE-603A?

A: Business entities, such as partnerships and limited liability companies, that are subject to the Uniform Capacity Tax in Vermont need to file the VT Form SE-603A.

Q: When is the VT Form SE-603A due?

A: The due date for the VT Form SE-603A varies each year, so you will need to check the instructions provided by the Vermont Department of Taxes for the specific due date.

Q: What information do I need to complete the VT Form SE-603A?

A: To complete the VT Form SE-603A, you will need to provide information about your business entity's income, credits, and other relevant details as instructed by the form.

Q: Are there any penalties for not filing the VT Form SE-603A?

A: Yes, there are penalties for not filing the VT Form SE-603A or for filing the form late. It is important to file the form by the due date to avoid penalties.

Q: Is the VT Form SE-603A the only tax form I need to file in Vermont?

A: No, the VT Form SE-603A is specific to the Uniform Capacity Tax. Depending on your business entity and activities, you may need to file additional tax forms in Vermont.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form SE-603A by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.