This version of the form is not currently in use and is provided for reference only. Download this version of

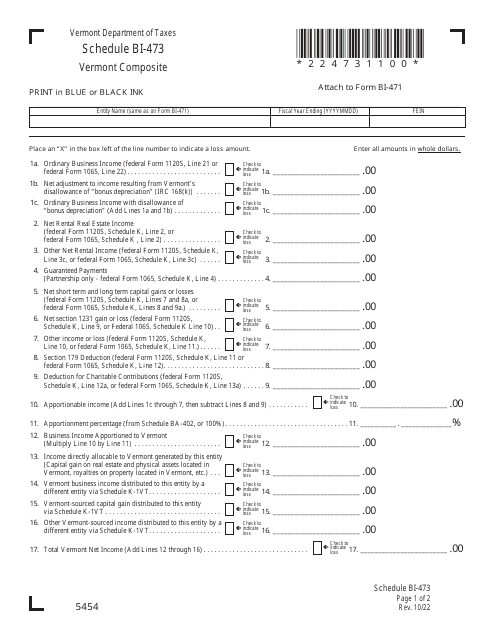

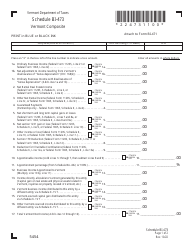

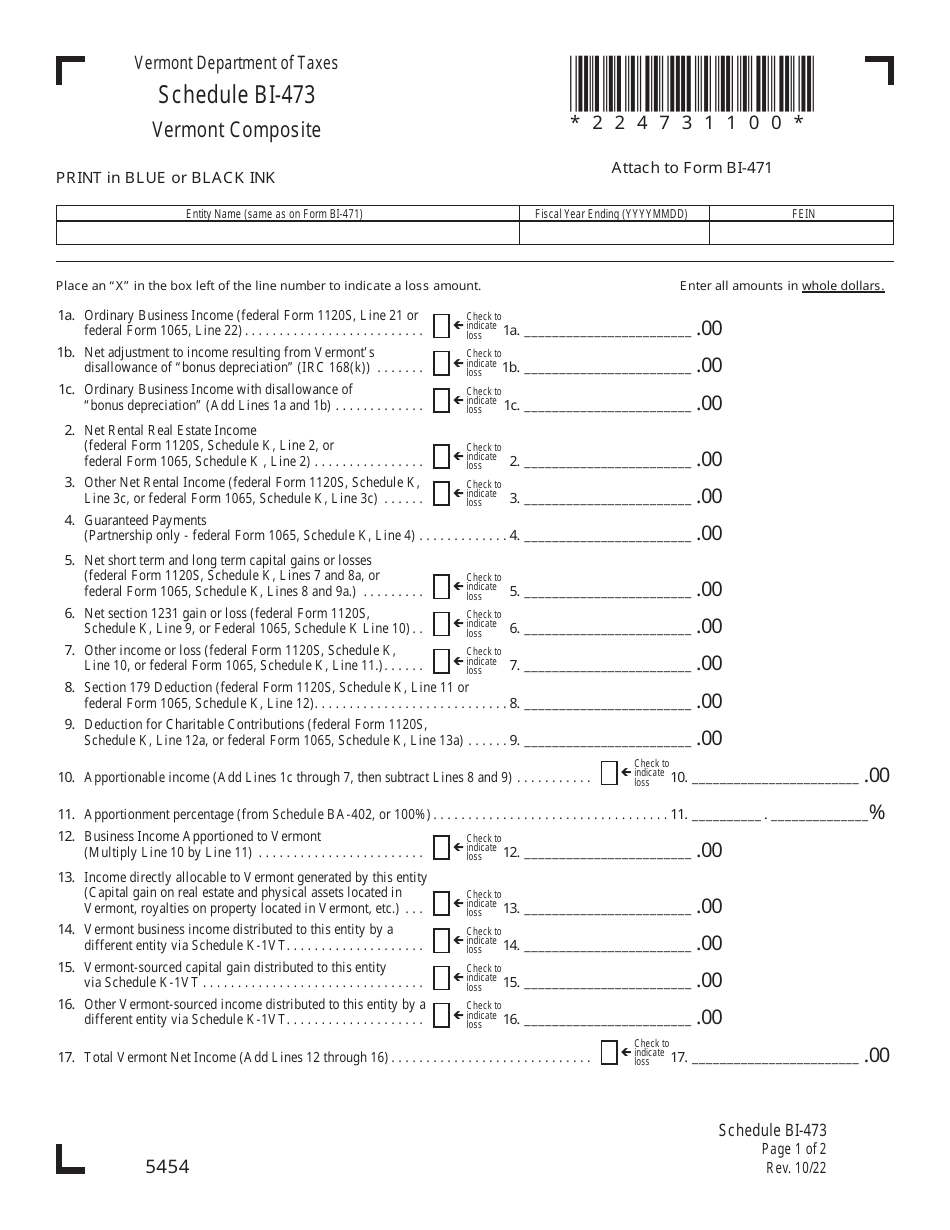

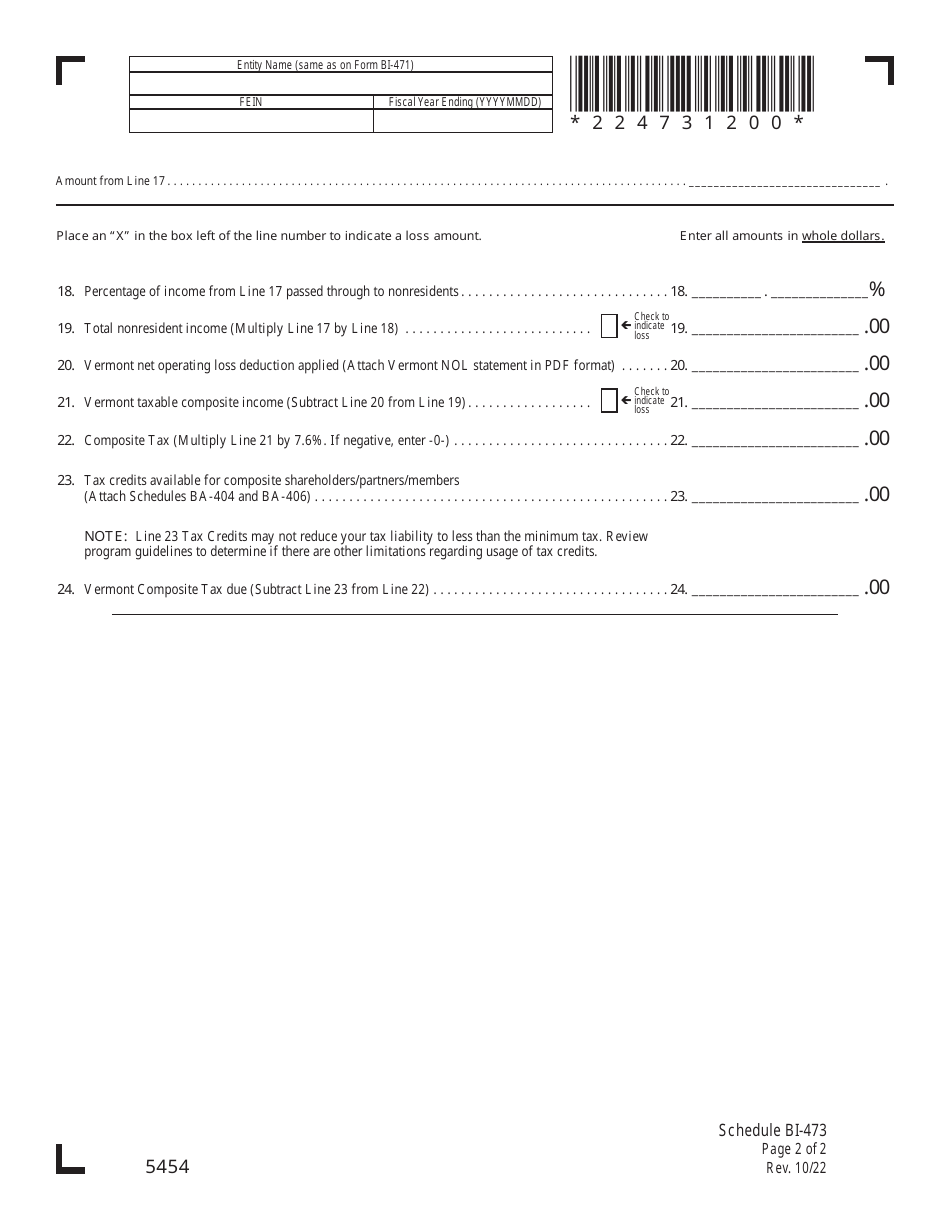

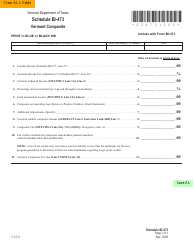

Schedule BI-473

for the current year.

Schedule BI-473 Vermont Composite - Vermont

What Is Schedule BI-473?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BI-473?

A: Schedule BI-473 is a form used for reporting composite income for Vermont.

Q: What is composite income?

A: Composite income refers to the income earned by a business entity, such as a partnership or S corporation, that is derived from Vermont sources.

Q: Who needs to file Schedule BI-473?

A: Partnerships and S corporations that have income from Vermont sources and have nonresident owners need to file Schedule BI-473.

Q: What information is required on Schedule BI-473?

A: On Schedule BI-473, you will need to provide details of the nonresident owners' distributive shares of the composite income.

Q: When is the deadline for filing Schedule BI-473?

A: The deadline for filing Schedule BI-473 is the same as the deadline for filing the Vermont Composite Return, which is usually April 15th.

Q: Are there any penalties for not filing Schedule BI-473?

A: Yes, failure to file Schedule BI-473 or filing it late may result in penalties imposed by the Vermont Department of Taxes.

Q: Can Schedule BI-473 be electronically filed?

A: Yes, Schedule BI-473 can be electronically filed using the Vermont e-file system.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BI-473 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.