This version of the form is not currently in use and is provided for reference only. Download this version of

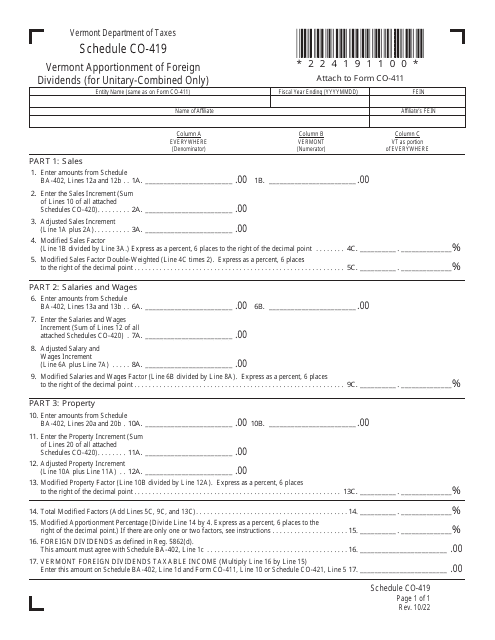

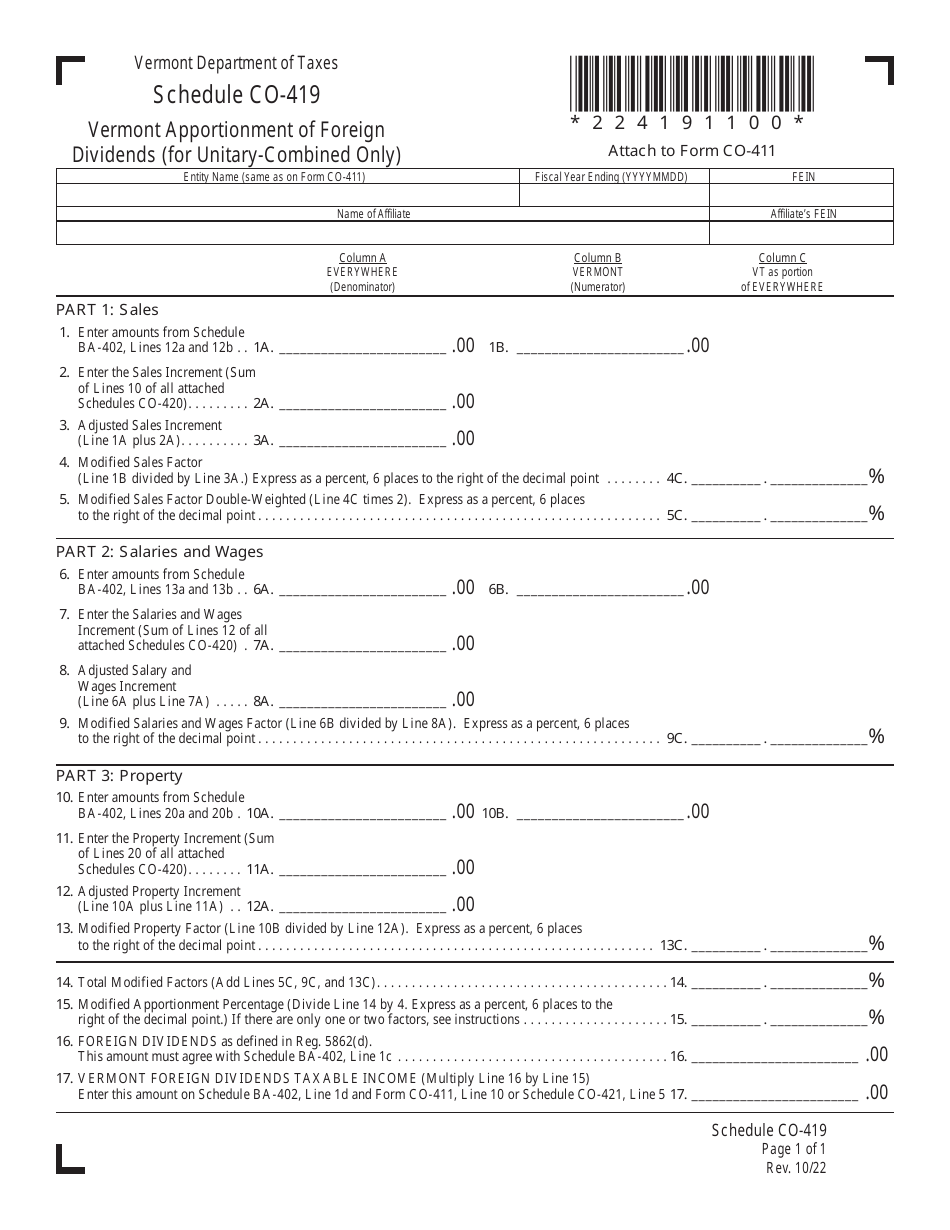

Schedule CO-419

for the current year.

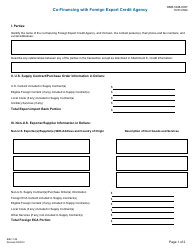

Schedule CO-419 Vermont Apportionment of Foreign Dividends (For Unitary-Combined Only) - Vermont

What Is Schedule CO-419?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule CO-419?

A: Schedule CO-419 is the Vermont form used to apportion foreign dividends for unitary-combined companies.

Q: Who needs to file Schedule CO-419?

A: Unitary-combined companies in the state of Vermont need to file Schedule CO-419.

Q: What is the purpose of Schedule CO-419?

A: The purpose of Schedule CO-419 is to determine the apportionment of foreign dividends for unitary-combined companies.

Q: What information is needed to complete Schedule CO-419?

A: To complete Schedule CO-419, you will need information about the unitary-combined company's total foreign dividends and the factors used for apportionment.

Q: When is Schedule CO-419 due?

A: The deadline for filing Schedule CO-419 varies each year. It is best to check with the Vermont Department of Taxes for the specific due date.

Q: Are there any penalties for late filing of Schedule CO-419?

A: Yes, there may be penalties for late filing of Schedule CO-419. It is important to file the form by the deadline to avoid any potential penalties.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CO-419 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.