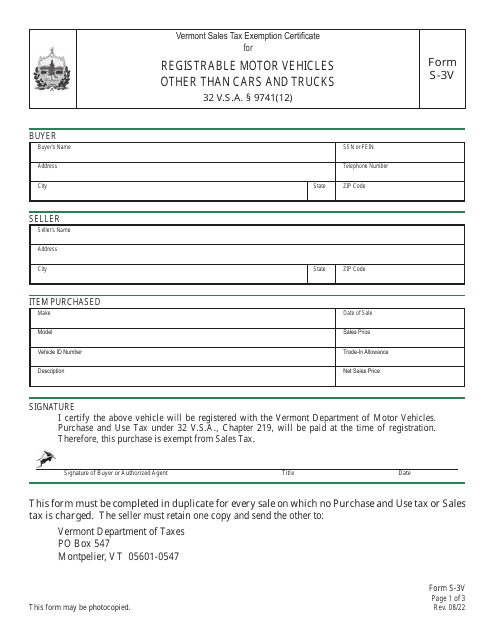

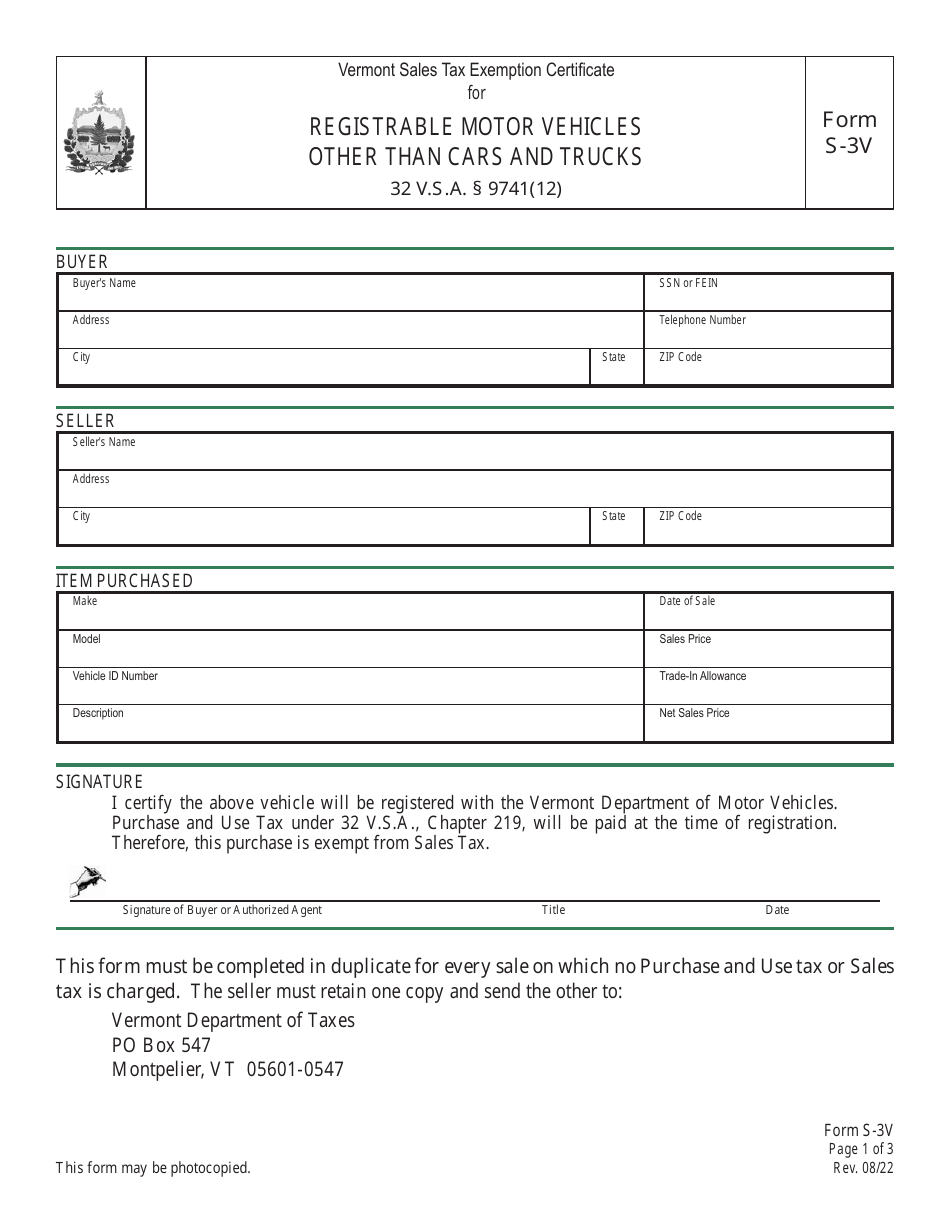

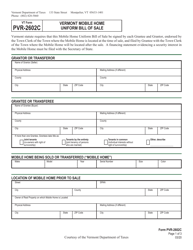

VT Form S-3V Vermont Sales Tax Exemption Certificate for Registrable Motor Vehicles Other Than Cars and Trucks - Vermont

What Is VT Form S-3V?

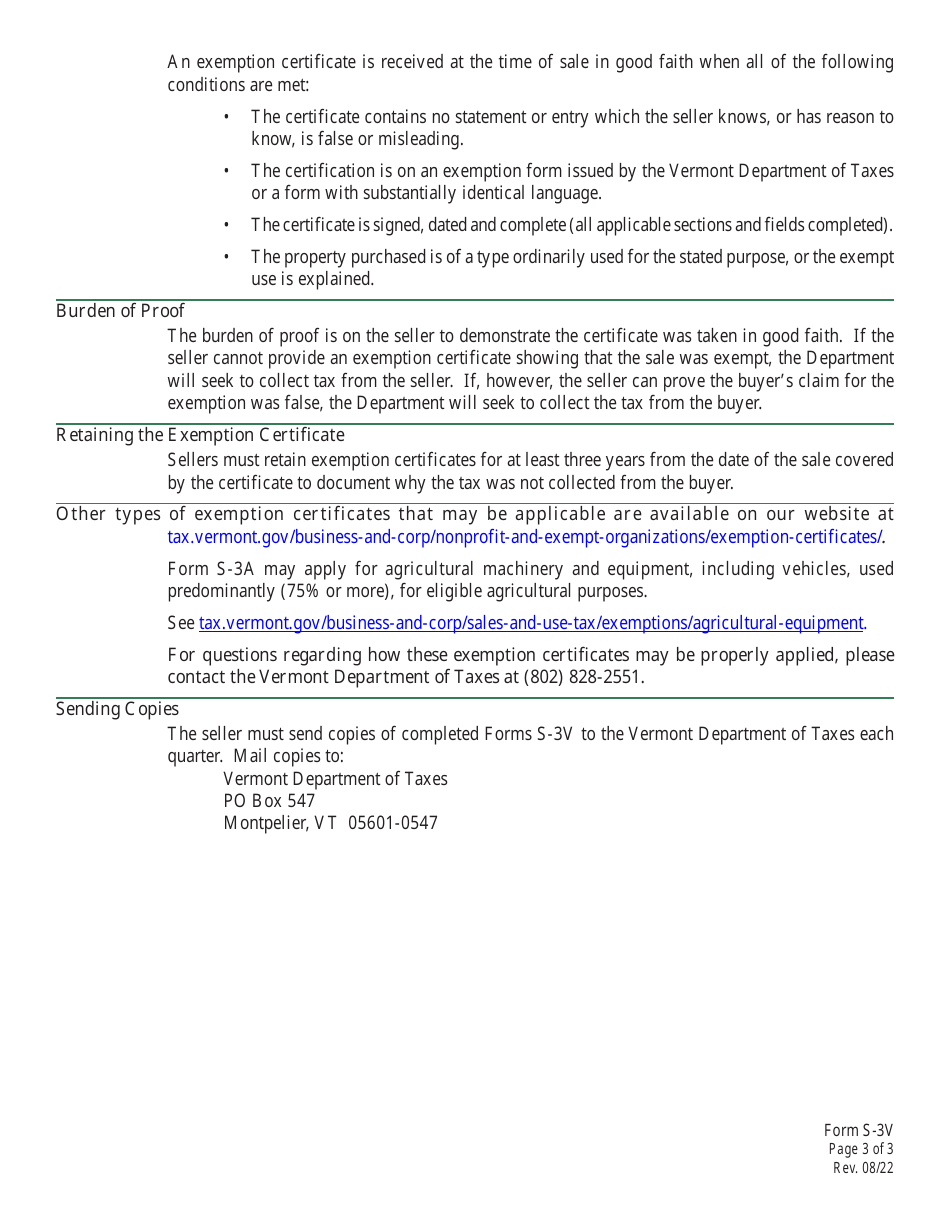

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form S-3V?

A: VT Form S-3V is the Vermont Sales Tax Exemption Certificate for Registrable Motor Vehicles Other Than Cars and Trucks.

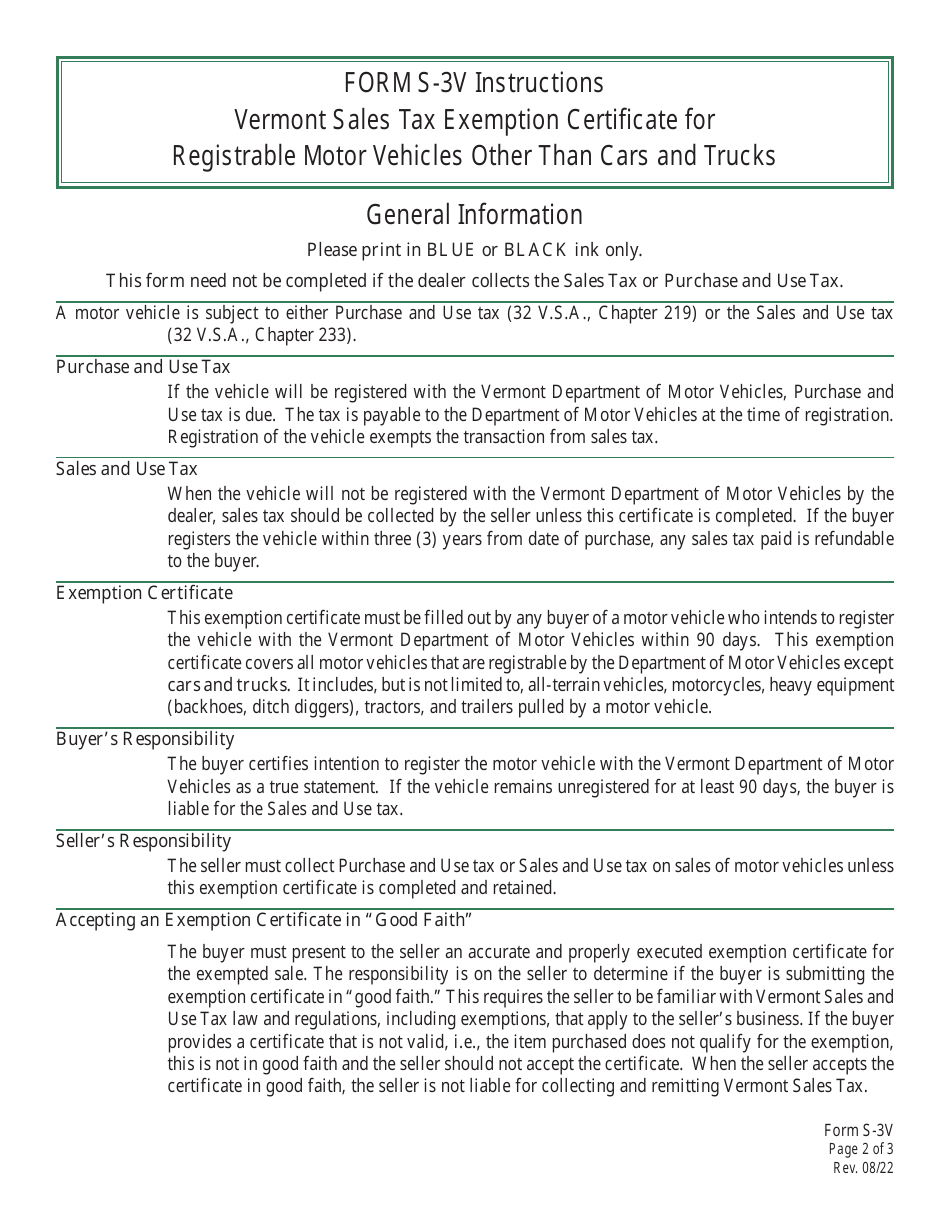

Q: What is the purpose of VT Form S-3V?

A: The purpose of VT Form S-3V is to claim a sales tax exemption when purchasing registrable motor vehicles other than cars and trucks in Vermont.

Q: Who needs to use VT Form S-3V?

A: Anyone who is purchasing a registrable motor vehicle other than a car or truck in Vermont and wants to claim a sales tax exemption needs to use VT Form S-3V.

Q: What types of motor vehicles are eligible for the exemption?

A: The exemption applies to registrable motor vehicles other than cars and trucks.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form S-3V by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.