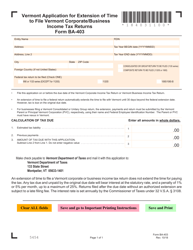

This version of the form is not currently in use and is provided for reference only. Download this version of

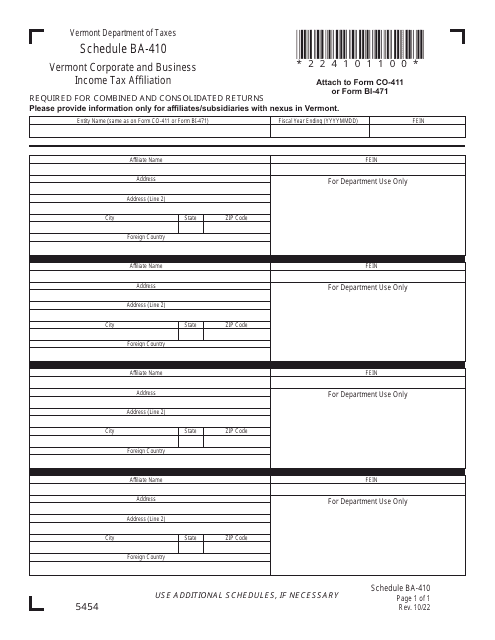

Schedule BA-410

for the current year.

Schedule BA-410 Vermont Corporate and Business Income Tax Affiliation - Vermont

What Is Schedule BA-410?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BA-410?

A: Schedule BA-410 is a form used for Vermont corporate and business income tax affiliation.

Q: Who needs to file Schedule BA-410?

A: Schedule BA-410 needs to be filed by corporations and businesses that have affiliated entities and are subject to Vermont corporate and business income tax.

Q: What is meant by 'affiliation' when it comes to Vermont corporate and business income tax?

A: Affiliation refers to the relationship between entities that are under common ownership or control, where one entity has a direct or indirect ownership interest in another entity.

Q: What information is required to complete Schedule BA-410?

A: Schedule BA-410 requires information about the affiliated entities, including their names, federal employer identification numbers (FEIN), ownership percentages, and types of affiliations.

Q: When is the deadline to file Schedule BA-410?

A: The deadline to file Schedule BA-410 is the same as the deadline for filing the Vermont corporate and business income tax return, which is generally the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for not filing Schedule BA-410?

A: Yes, failure to file Schedule BA-410 may result in penalties imposed by the Vermont Department of Taxes.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-410 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.