This version of the form is not currently in use and is provided for reference only. Download this version of

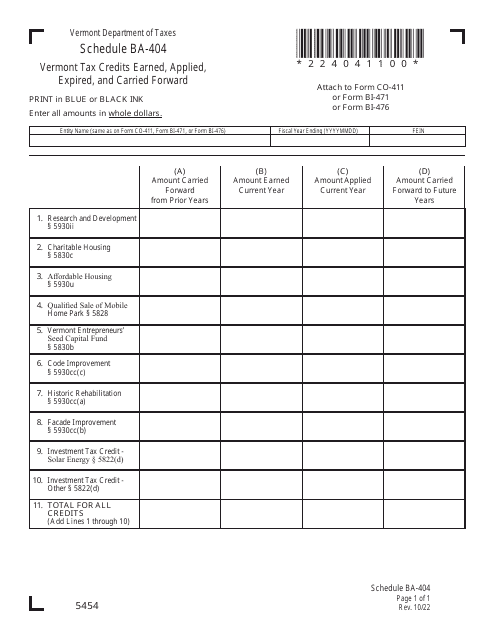

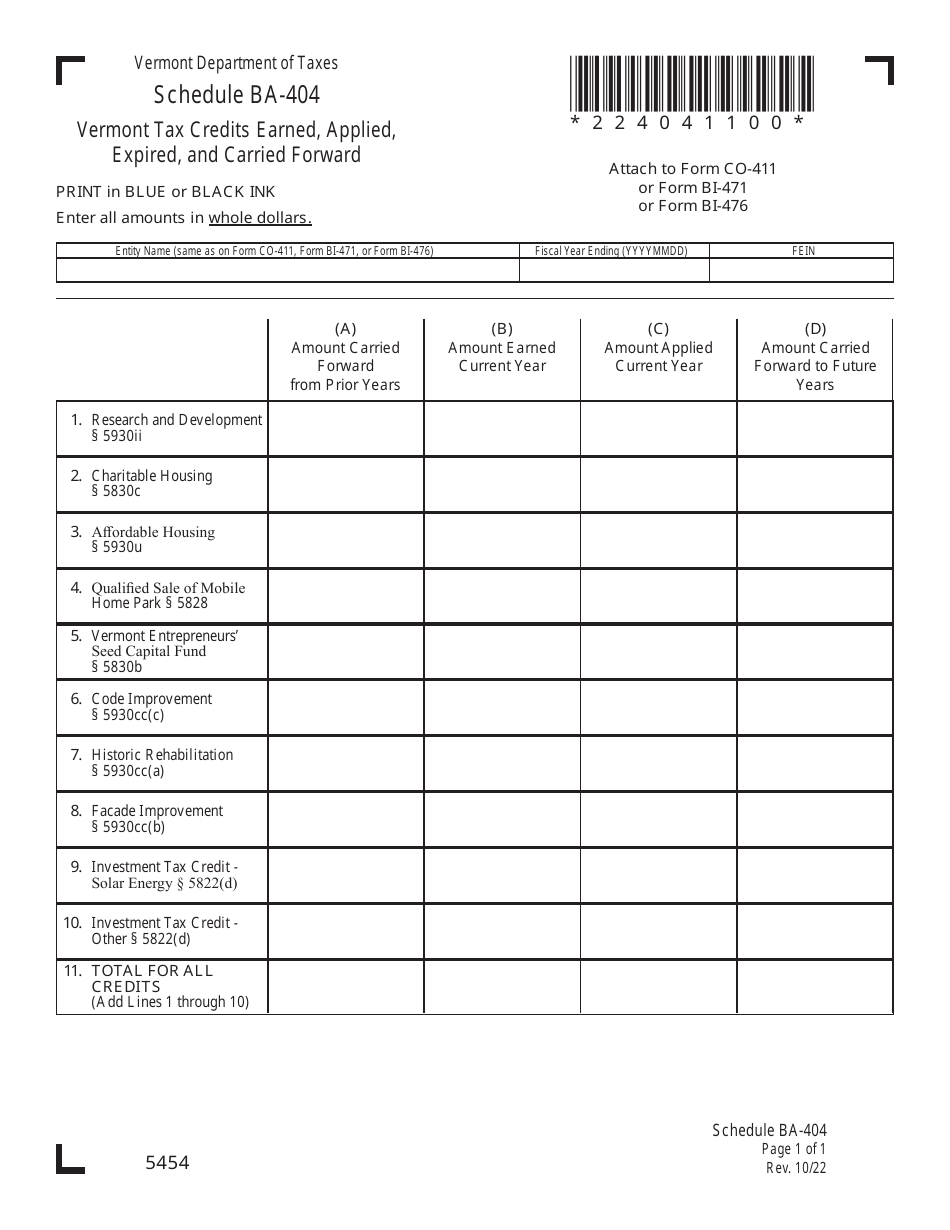

Schedule BA-404

for the current year.

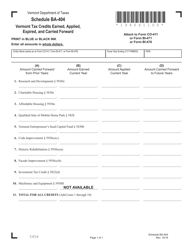

Schedule BA-404 Vermont Tax Credits Earned, Applied, Expired, and Carried Forward - Vermont

What Is Schedule BA-404?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule BA-404?

A: The Schedule BA-404 is a form used in Vermont to report tax credits earned, applied, expired, and carried forward.

Q: What is a tax credit?

A: A tax credit is a reduction in the amount of tax owed.

Q: What types of tax credits are reported on Schedule BA-404?

A: Schedule BA-404 reports various tax credits earned in Vermont, including renewable energy tax credits, historic preservation tax credits, and other specific credits.

Q: What is the purpose of reporting tax credits on Schedule BA-404?

A: The purpose is to track the amount of tax credits earned, applied, expired, and carried forward for tax purposes.

Q: What does 'earned' mean on Schedule BA-404?

A: 'Earned' refers to the tax credits that have been obtained or acquired during the tax year.

Q: What does 'applied' mean on Schedule BA-404?

A: 'Applied' refers to the tax credits that have been used to reduce the tax liability for the current tax year.

Q: What does 'expired' mean on Schedule BA-404?

A: 'Expired' refers to the tax credits that have passed their expiration date and can no longer be used.

Q: What does 'carried forward' mean on Schedule BA-404?

A: 'Carried forward' means that unused tax credits from a previous tax year can be applied to future tax years to reduce tax liability.

Q: Who needs to fill out Schedule BA-404?

A: Taxpayers who have earned and/or used various tax credits in Vermont may need to complete Schedule BA-404.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-404 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.