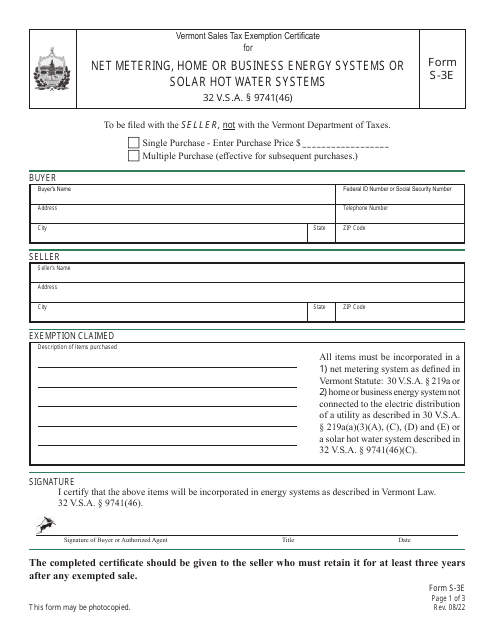

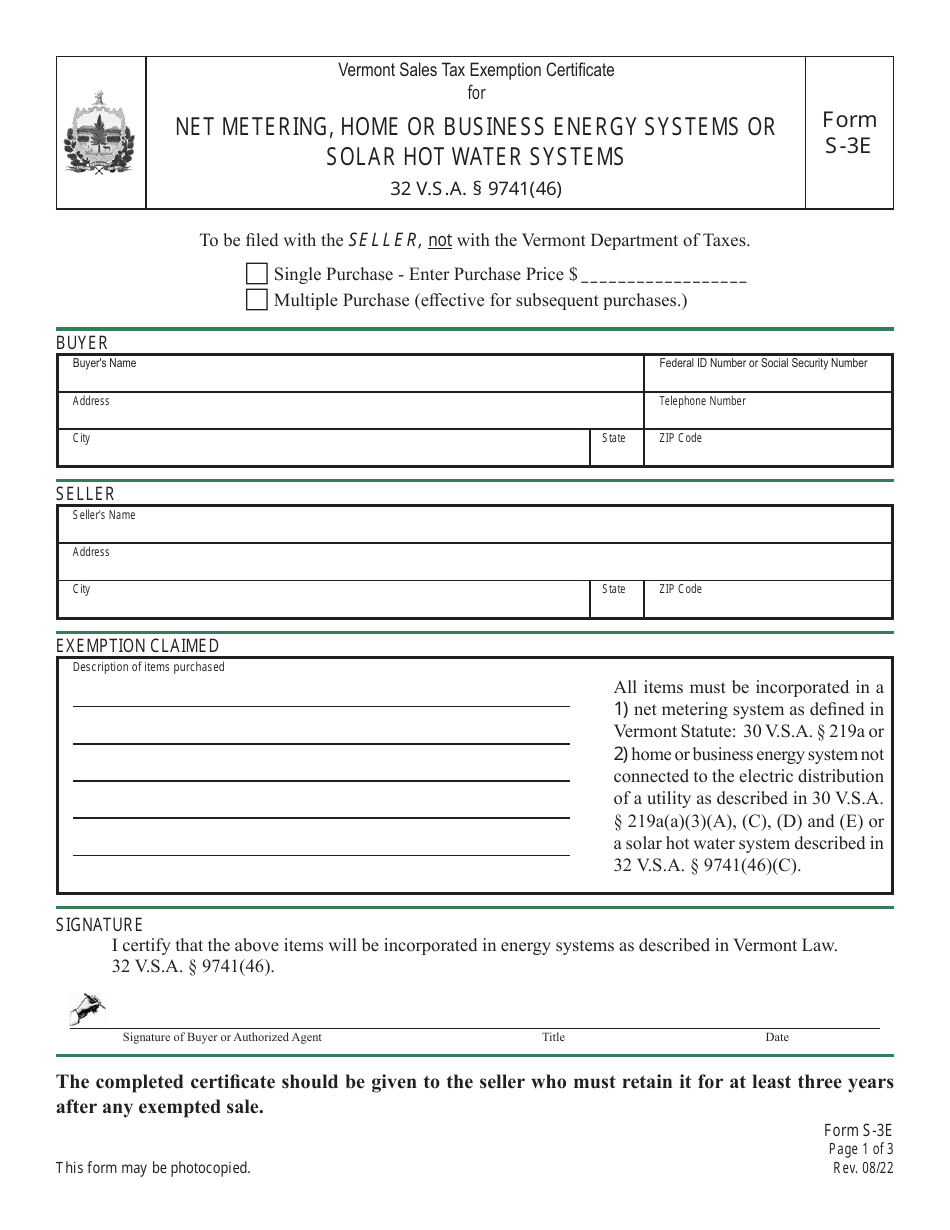

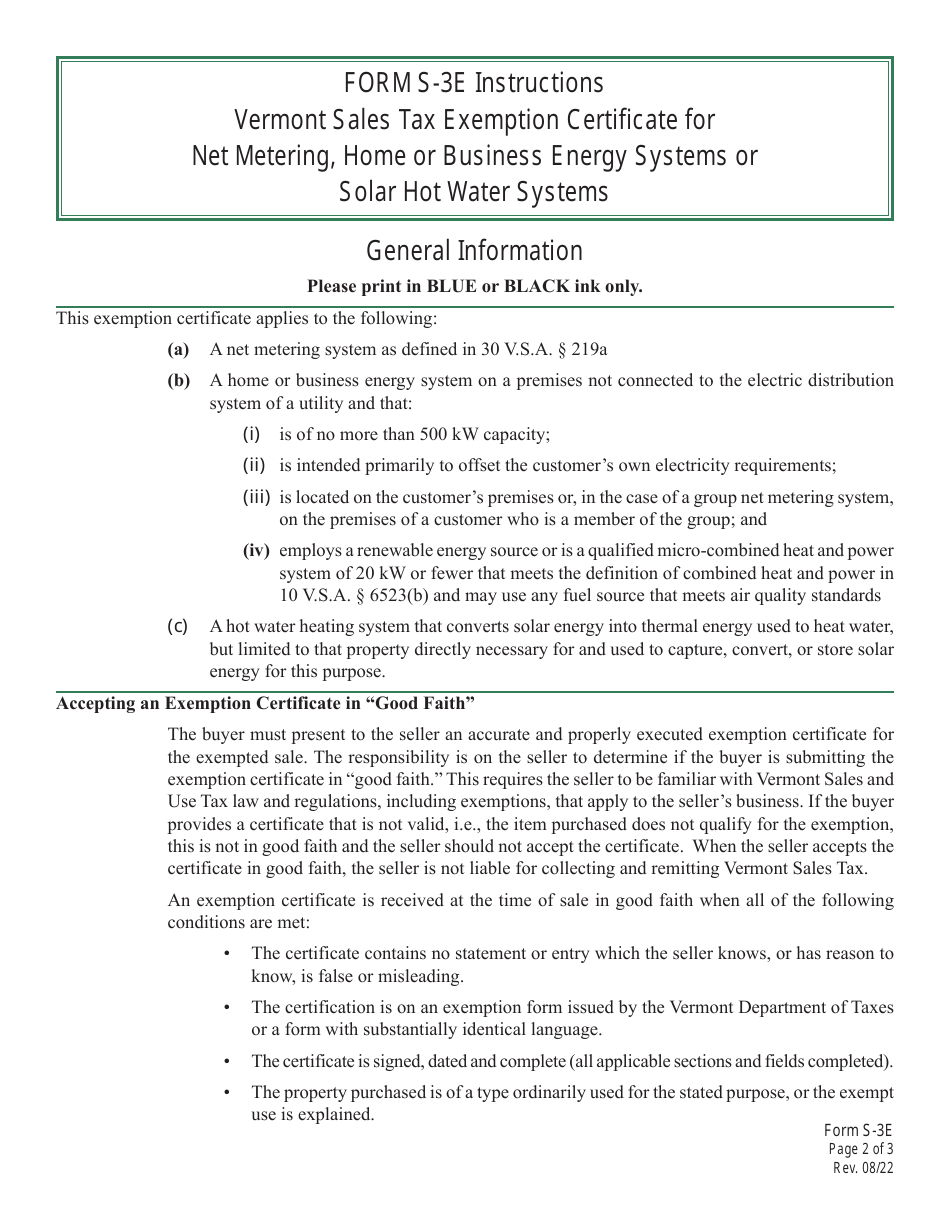

VT Form S-3E Vermont Sales Tax Exemption Certificate for Net Metering, Home or Business Energy Systems or Solar Hot Water Systems - Vermont

What Is VT Form S-3E?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form S-3E?

A: VT Form S-3E is a Vermont Sales Tax Exemption Certificate for Net Metering, Home or Business Energy Systems or Solar Hot Water Systems.

Q: Who can use VT Form S-3E?

A: VT Form S-3E can be used by individuals or businesses in Vermont who are purchasing net metering, home or business energy systems, or solar hot water systems.

Q: What is the purpose of VT Form S-3E?

A: The purpose of VT Form S-3E is to claim exemption from paying sales tax on eligible purchases of net metering, home or business energy systems, or solar hot water systems.

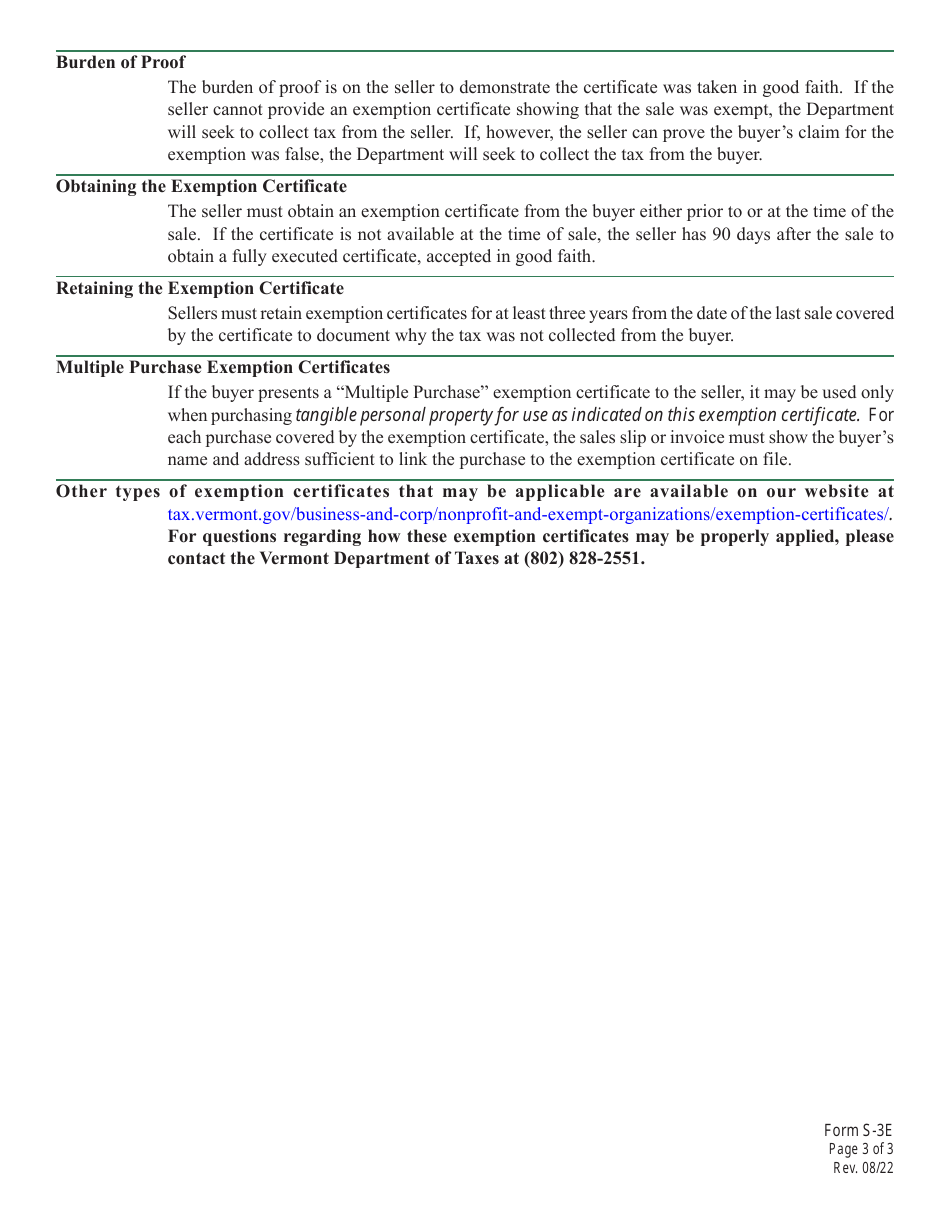

Q: What documentation is required to accompany VT Form S-3E?

A: VT Form S-3E must be accompanied by an invoice or receipt clearly showing the purchase price and description of the eligible system.

Q: How long is VT Form S-3E valid for?

A: VT Form S-3E is typically valid for three years from the date of issuance, unless stated otherwise by the Vermont Department of Taxes.

Q: Can VT Form S-3E be filed electronically?

A: At this time, VT Form S-3E cannot be filed electronically. It must be completed manually and submitted in paper form.

Q: Are there any fees associated with filing VT Form S-3E?

A: No, there are no fees associated with filing VT Form S-3E.

Q: Who should I contact for further information or assistance regarding VT Form S-3E?

A: For further information or assistance regarding VT Form S-3E, you can contact the Vermont Department of Taxes.

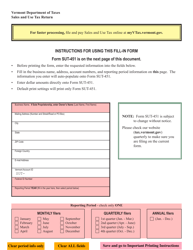

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form S-3E by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.