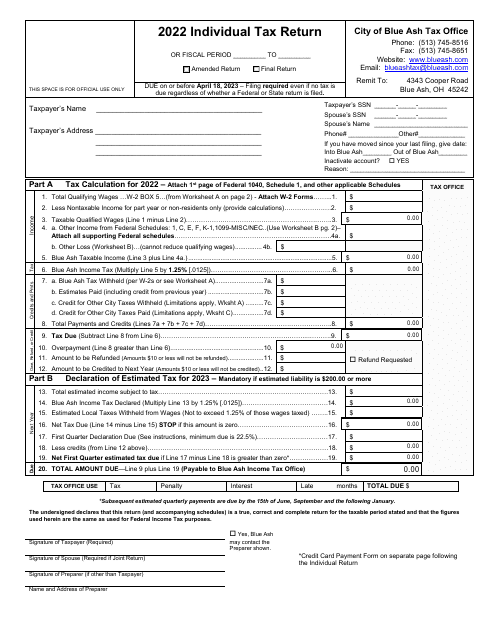

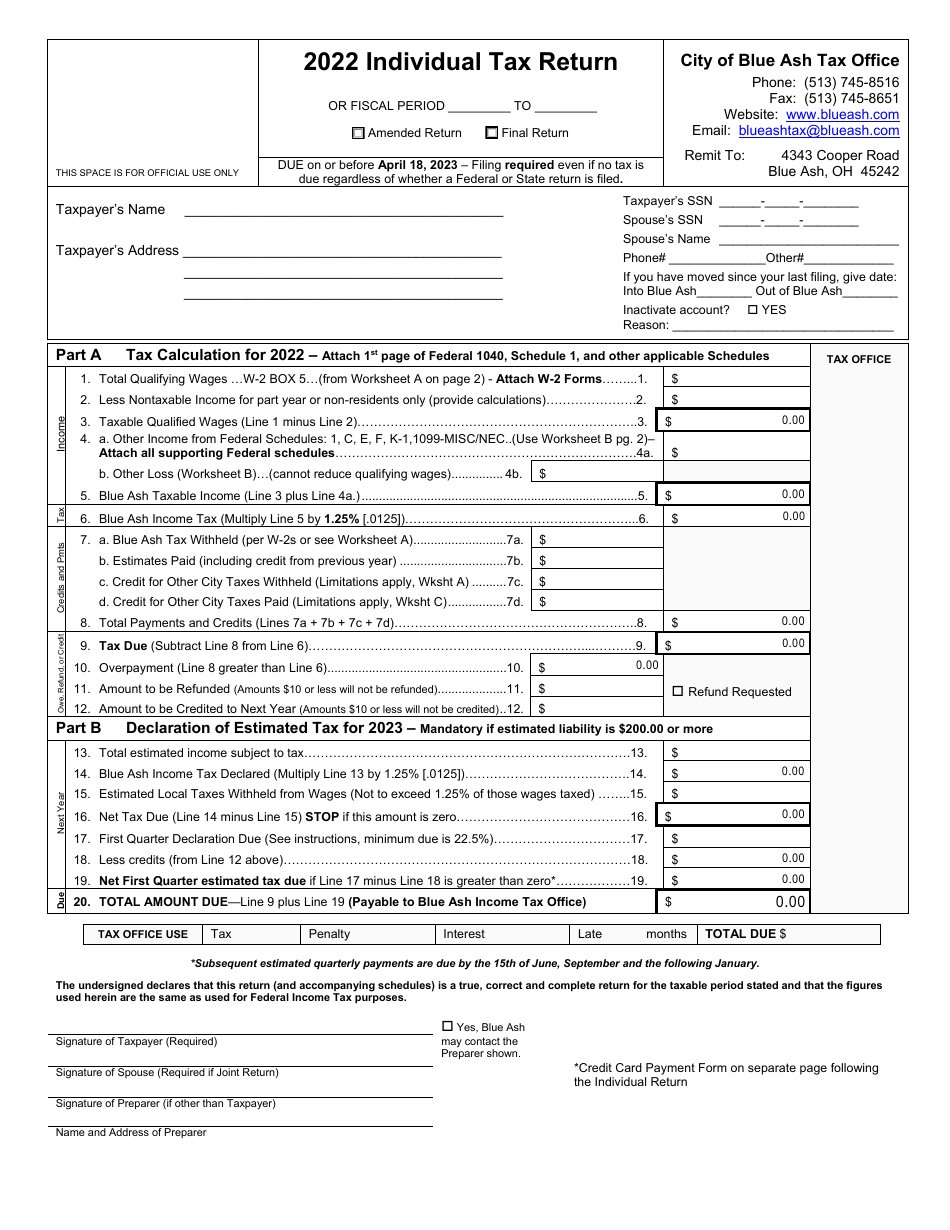

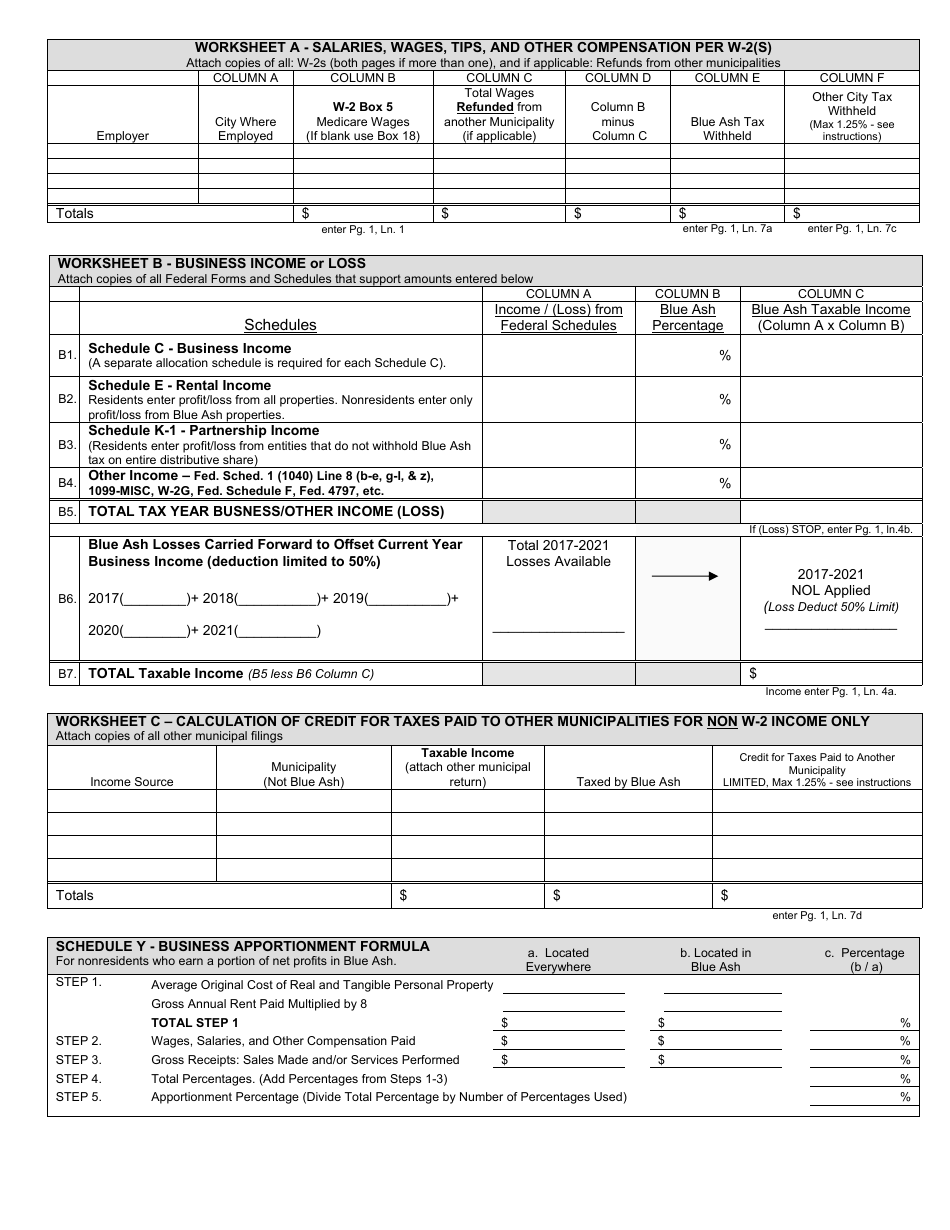

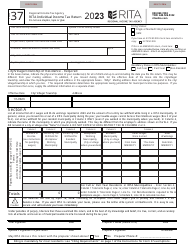

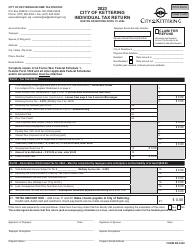

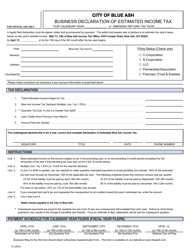

Individual Tax Return - Calculating - City of Blue Ash, Ohio

Individual Tax Return - Calculating is a legal document that was released by the Tax Office - City of Blue Ash, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Blue Ash.

FAQ

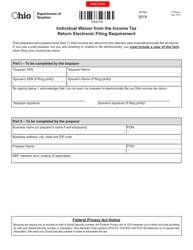

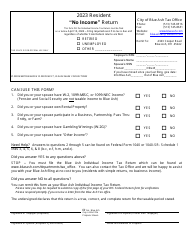

Q: What is an individual tax return?

A: An individual tax return is a form used by taxpayers to report their income and calculate the amount of tax they owe on their income.

Q: Why would I need to file an individual tax return?

A: You would need to file an individual tax return if you earned income during the tax year and meet the filing requirements set by the IRS.

Q: What does it mean to calculate a tax return?

A: Calculating a tax return means determining the total amount of income, deductions, and credits to determine the tax liability or refund.

Q: Who is required to file an individual tax return?

A: Generally, individuals who earn above a certain income threshold are required to file an individual tax return. The income threshold depends on filing status, age, and other factors.

Q: What is the City of Blue Ash, Ohio tax?

A: The City of Blue Ash, Ohio levies a local income tax on individuals who live or work in Blue Ash. The tax rate varies depending on income and filing status.

Q: How do I calculate the City of Blue Ash, Ohio tax?

A: To calculate the City of Blue Ash, Ohio tax, you will need to determine your taxable income earned in Blue Ash and apply the applicable tax rate.

Form Details:

- The latest edition currently provided by the Tax Office - City of Blue Ash, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

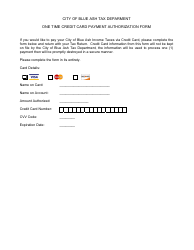

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tax Office - City of Blue Ash, Ohio.