This version of the form is not currently in use and is provided for reference only. Download this version of

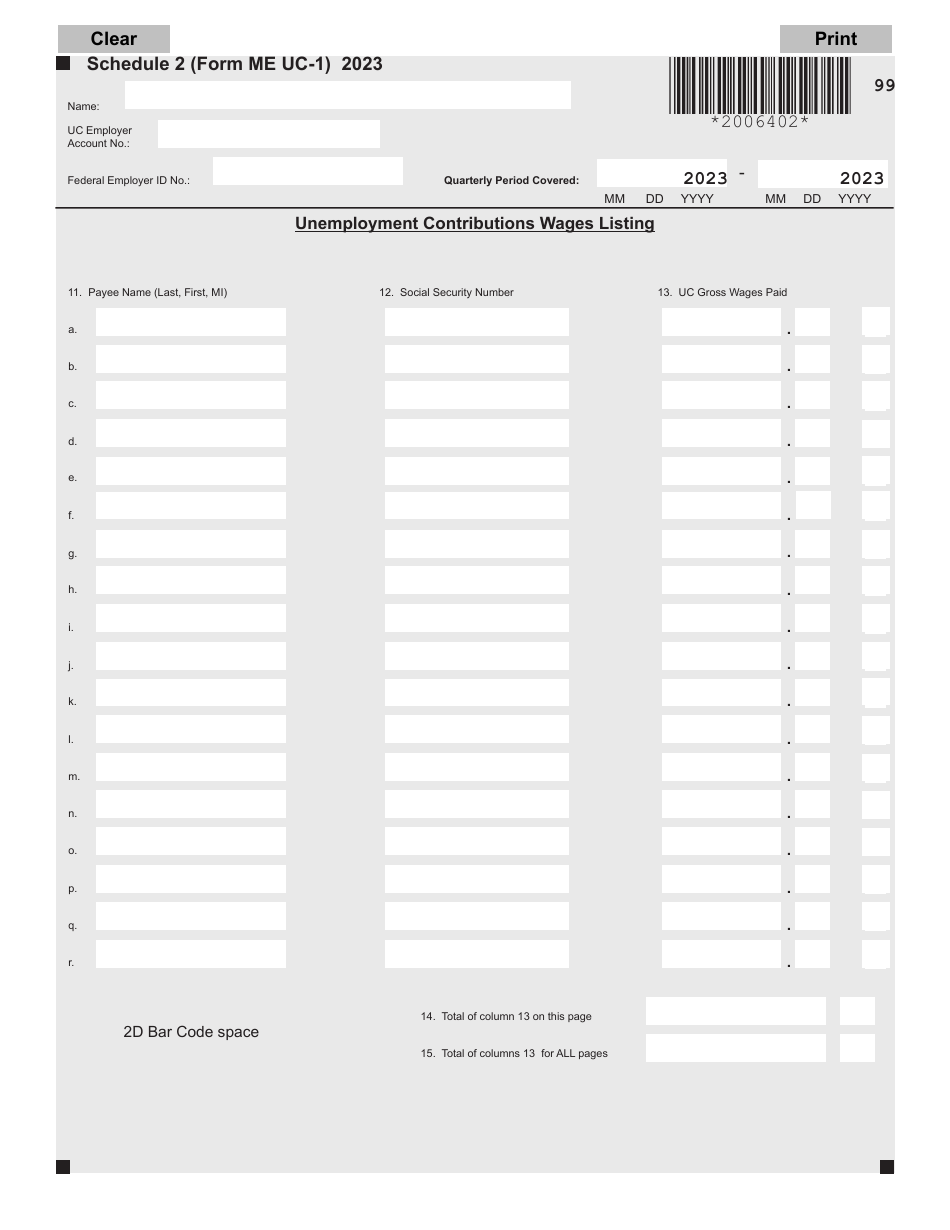

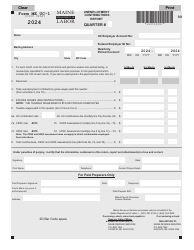

Form ME UC-1 Schedule 2

for the current year.

Form ME UC-1 Schedule 2 Unemployment Contributions Wages Listing - Maine

What Is Form ME UC-1 Schedule 2?

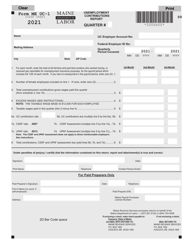

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form ME UC-1, Unemployment Contributions Report. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ME UC-1 Schedule 2?

A: Form ME UC-1 Schedule 2 is a document used in Maine for reporting unemployment contributions wages.

Q: Who needs to fill out Form ME UC-1 Schedule 2?

A: Employers in Maine who are subject to unemployment contributions need to fill out this form.

Q: What information is required on Form ME UC-1 Schedule 2?

A: Form ME UC-1 Schedule 2 requires employers to list the wages subject to unemployment contributions.

Q: When is Form ME UC-1 Schedule 2 due?

A: Form ME UC-1 Schedule 2 is typically due quarterly, on the last day of the month following the end of the quarter.

Q: What happens if I don't file Form ME UC-1 Schedule 2?

A: Failure to file Form ME UC-1 Schedule 2 may result in penalties or fines imposed by the Maine Department of Labor.

Q: Are there any exemptions to filing Form ME UC-1 Schedule 2?

A: Certain employers may be exempt from filing Form ME UC-1 Schedule 2. You should check with the Maine Department of Labor to determine if you qualify for an exemption.

Q: Is there a fee for filing Form ME UC-1 Schedule 2?

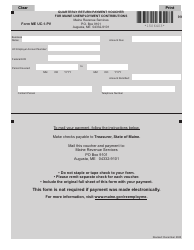

A: There is no fee for filing Form ME UC-1 Schedule 2.

Q: What should I do if I have questions about Form ME UC-1 Schedule 2?

A: If you have questions about Form ME UC-1 Schedule 2, you should contact the Maine Department of Labor for assistance.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ME UC-1 Schedule 2 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.