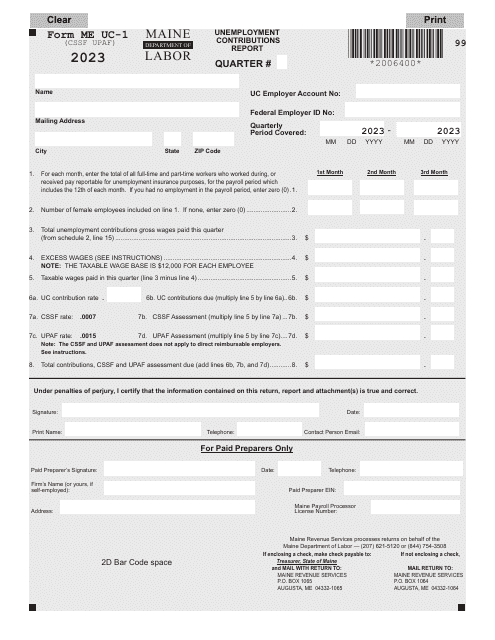

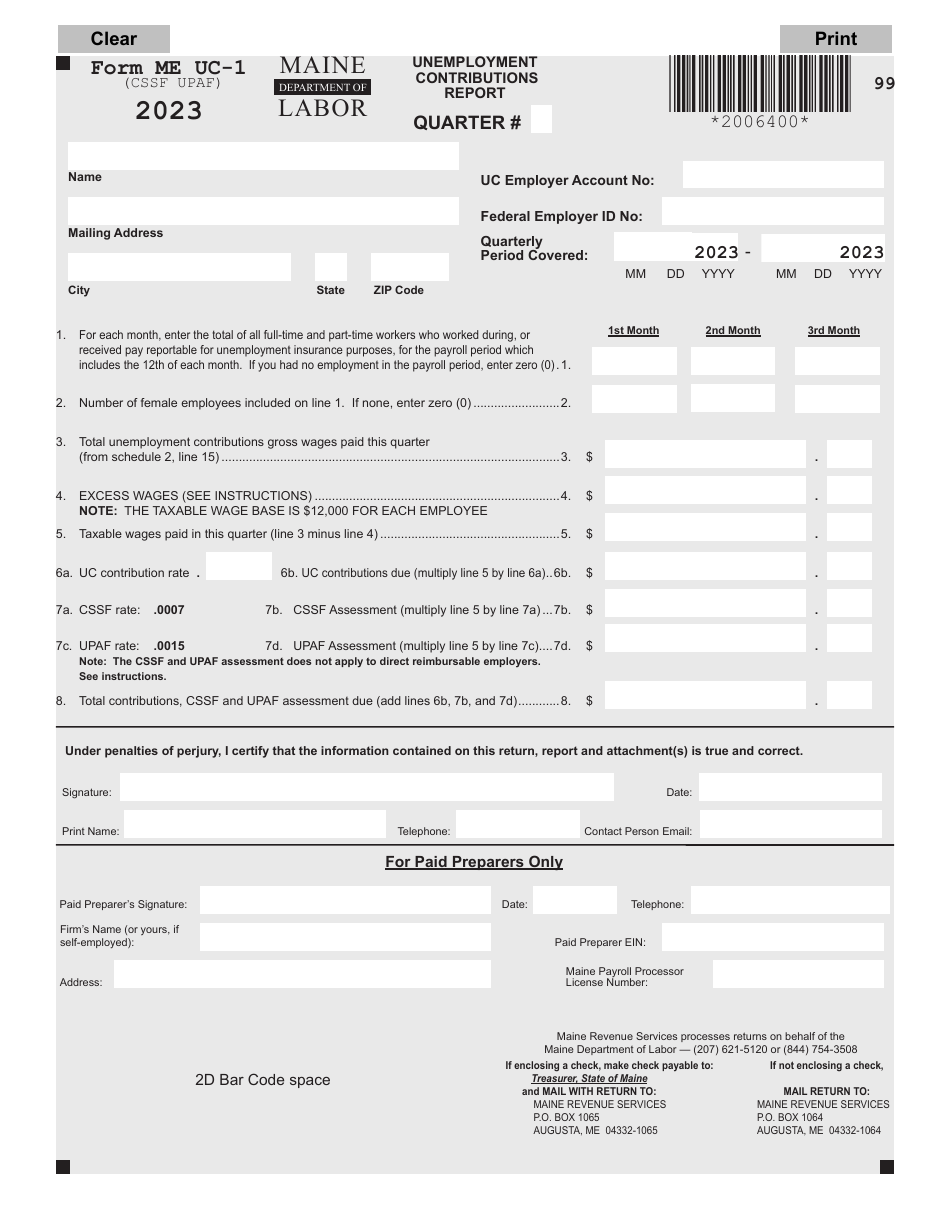

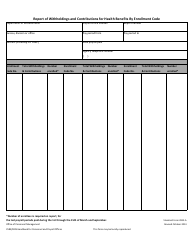

This version of the form is not currently in use and is provided for reference only. Download this version of

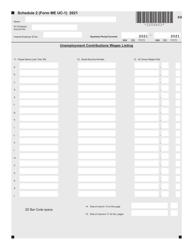

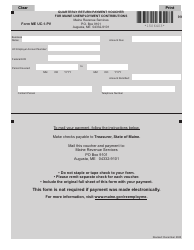

Form ME UC-1

for the current year.

Form ME UC-1 Unemployment Contributions Report - Maine

What Is Form ME UC-1?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ME UC-1?

A: Form ME UC-1 is the Unemployment Contributions Report for employers in Maine.

Q: Who needs to file Form ME UC-1?

A: Employers in Maine who have paid wages to employees during the reporting quarter need to file Form ME UC-1.

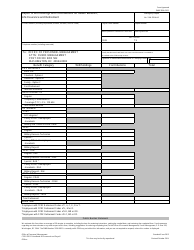

Q: What information is required on Form ME UC-1?

A: Form ME UC-1 requires employers to provide information about their business, the number of employees, and wages paid during the reporting quarter.

Q: When is Form ME UC-1 due?

A: Form ME UC-1 is due on the last day of the month following the end of the reporting quarter.

Q: What happens if I don't file Form ME UC-1?

A: Failure to file Form ME UC-1 or late filing may result in penalties and interest charges.

Q: Are there any exemptions from filing Form ME UC-1?

A: Certain types of employers, such as nonprofit organizations, may be exempt from filing Form ME UC-1. It is advisable to check with the Maine Department of Labor to determine if you qualify for an exemption.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ME UC-1 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.