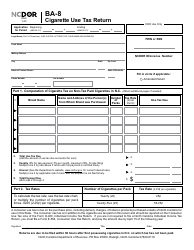

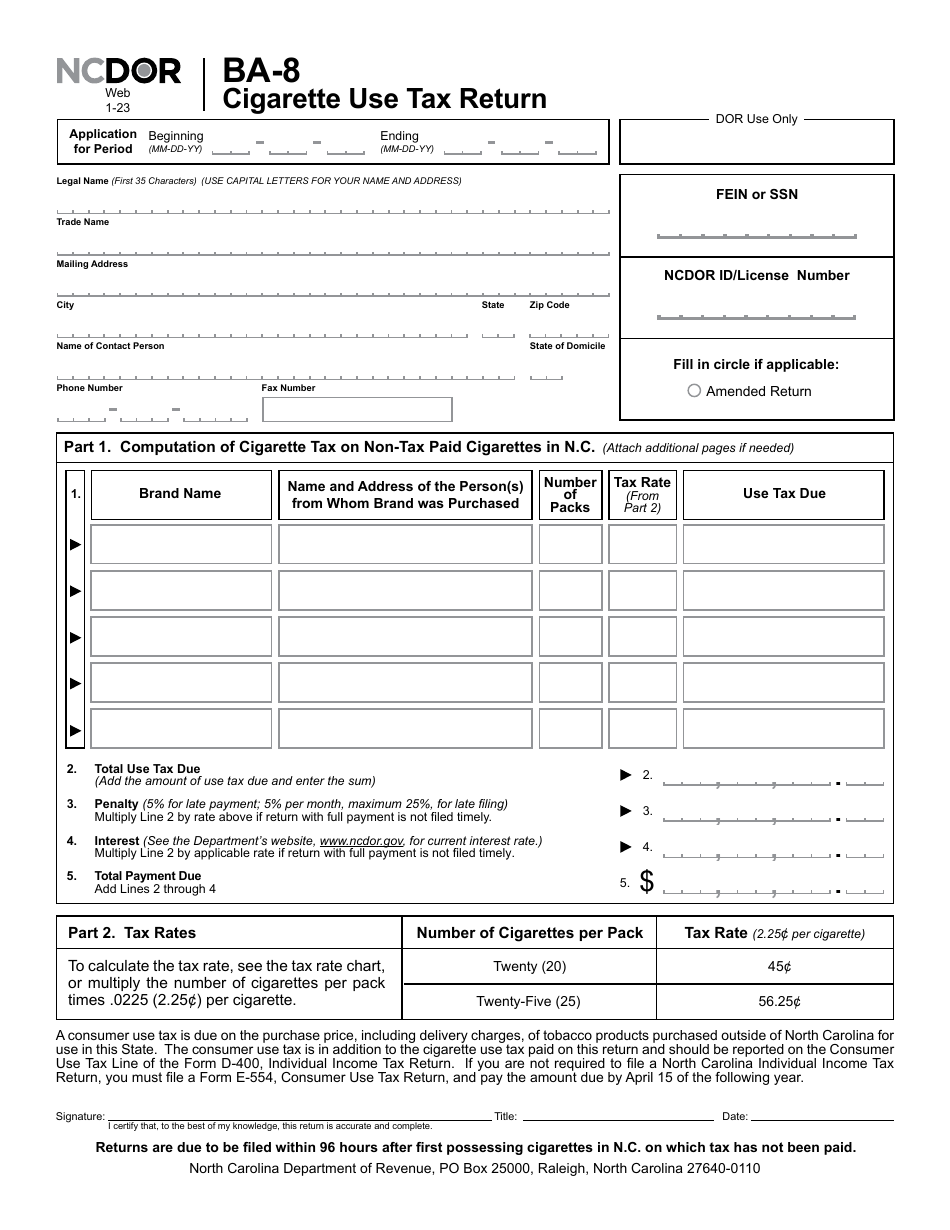

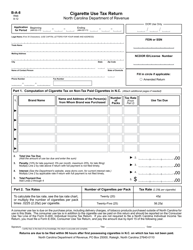

Form BA-8 Cigarette Use Tax Return - North Carolina

What Is Form BA-8?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form BA-8?

A: Form BA-8 is the Cigarette Use Tax Return in North Carolina.

Q: Who needs to file form BA-8?

A: Any individual or business that sells or distributes cigarettes in North Carolina needs to file form BA-8.

Q: What is the purpose of form BA-8?

A: Form BA-8 is used to report and pay the cigarette use tax owed on cigarettes sold or distributed in North Carolina.

Q: When is form BA-8 due?

A: Form BA-8 is due on the 20th day of the month following the close of the reporting period.

Q: What information is required on form BA-8?

A: Form BA-8 requires information about the number of cigarettes sold or distributed, the cost or selling price of the cigarettes, and the amount of tax owed.

Q: Are there any penalties for not filing form BA-8?

A: Yes, there are penalties for failure to file form BA-8 or for filing a late or incorrect return.

Q: Is form BA-8 required for personal use of cigarettes?

A: No, form BA-8 is only required for individuals or businesses engaged in the sale or distribution of cigarettes in North Carolina.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the North Carolina Department of Revenue;

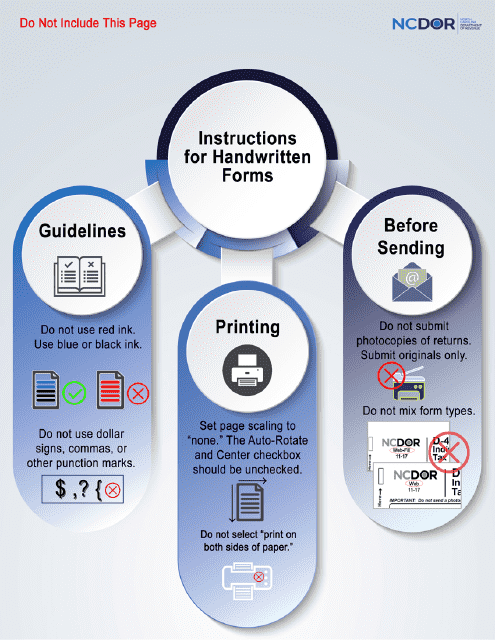

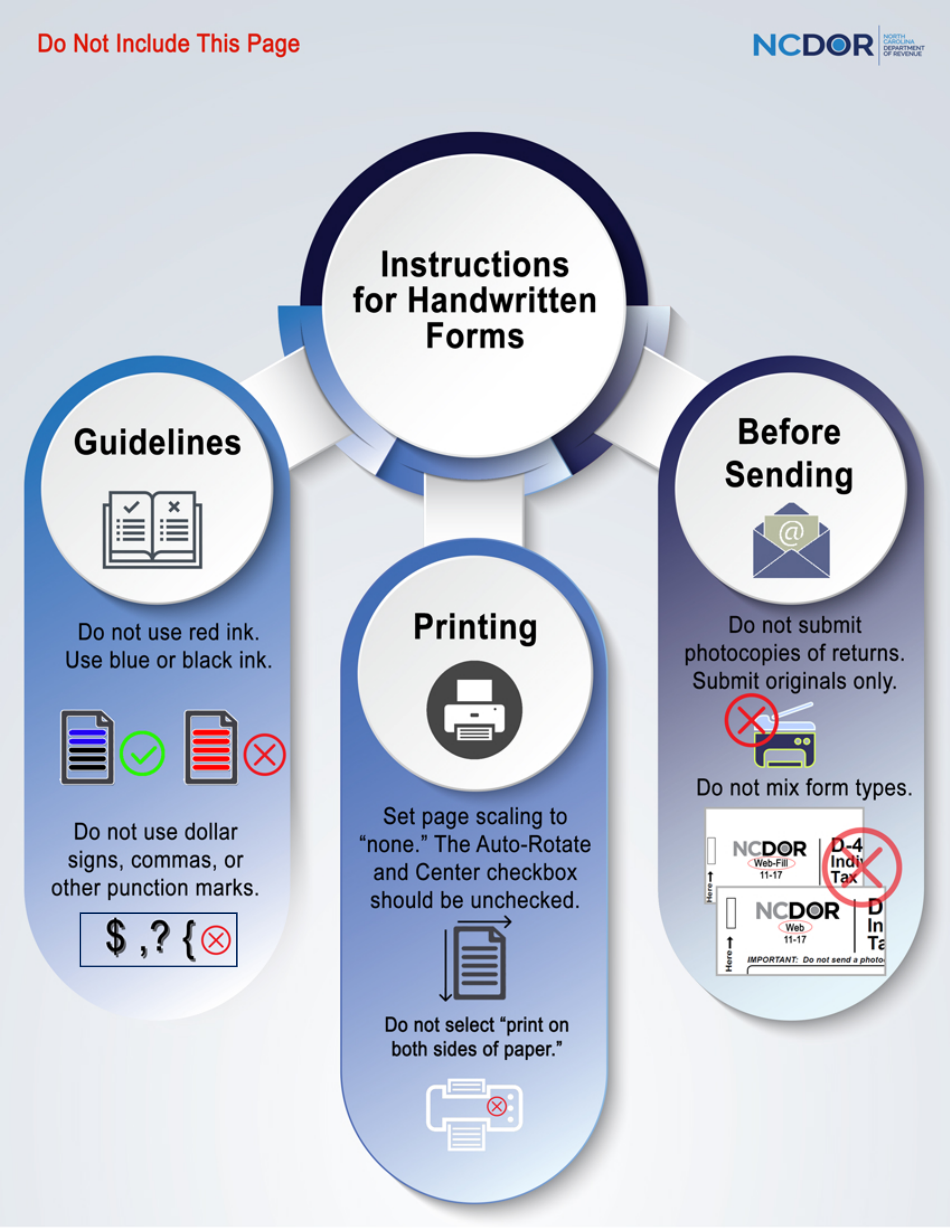

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BA-8 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.