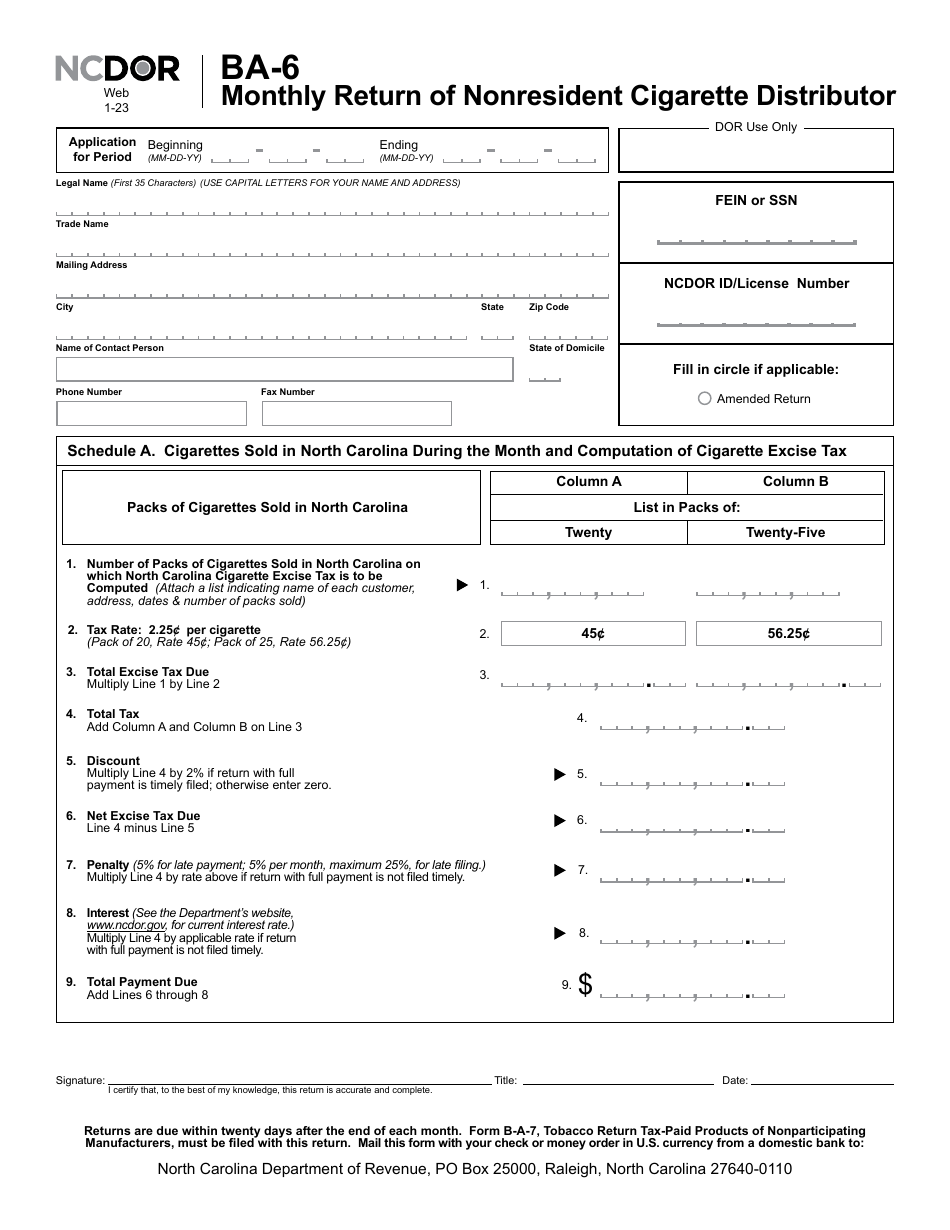

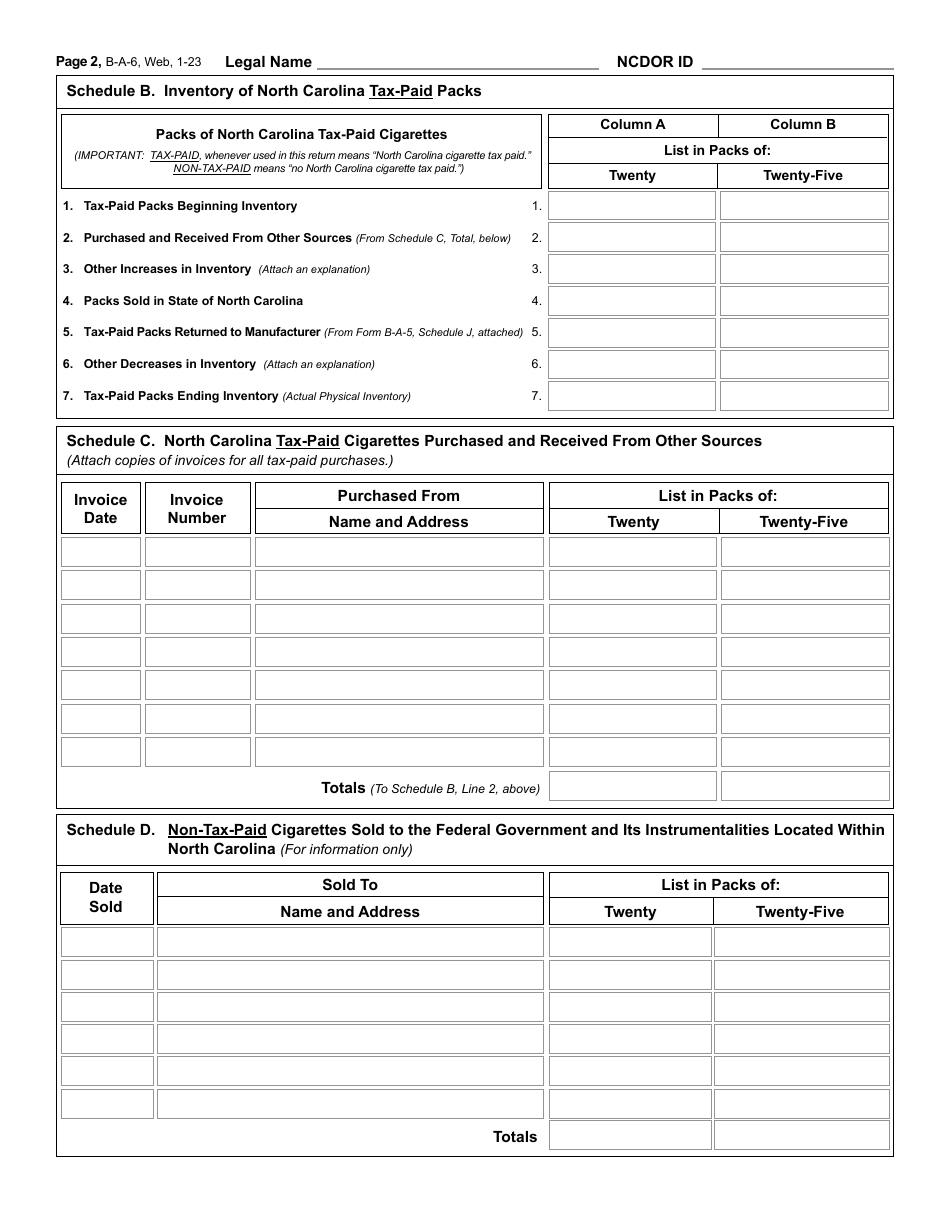

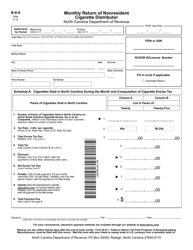

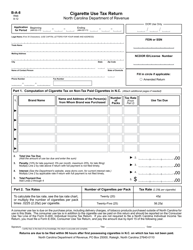

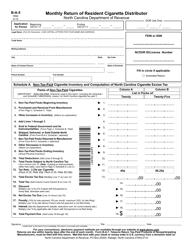

Form BA-6 Monthly Return of Nonresident Cigarette Distributor - North Carolina

What Is Form BA-6?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BA-6?

A: Form BA-6 is a monthly return form for nonresident cigarette distributors in North Carolina.

Q: Who needs to file Form BA-6?

A: Nonresident cigarette distributors in North Carolina need to file Form BA-6.

Q: What is the purpose of Form BA-6?

A: Form BA-6 is used to report and remit the tax on cigarettes sold or distributed in North Carolina by nonresident cigarette distributors.

Q: How often should Form BA-6 be filed?

A: Form BA-6 must be filed monthly.

Q: What information is required on Form BA-6?

A: Form BA-6 requires information such as the total number of cigarettes sold or distributed, the total tax due, and the amount of stamps affixed to the cigarettes.

Q: When is Form BA-6 due?

A: Form BA-6 is due on or before the 20th day of the month following the reporting period.

Q: Is there a penalty for late filing of Form BA-6?

A: Yes, there is a penalty for late filing of Form BA-6.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the North Carolina Department of Revenue;

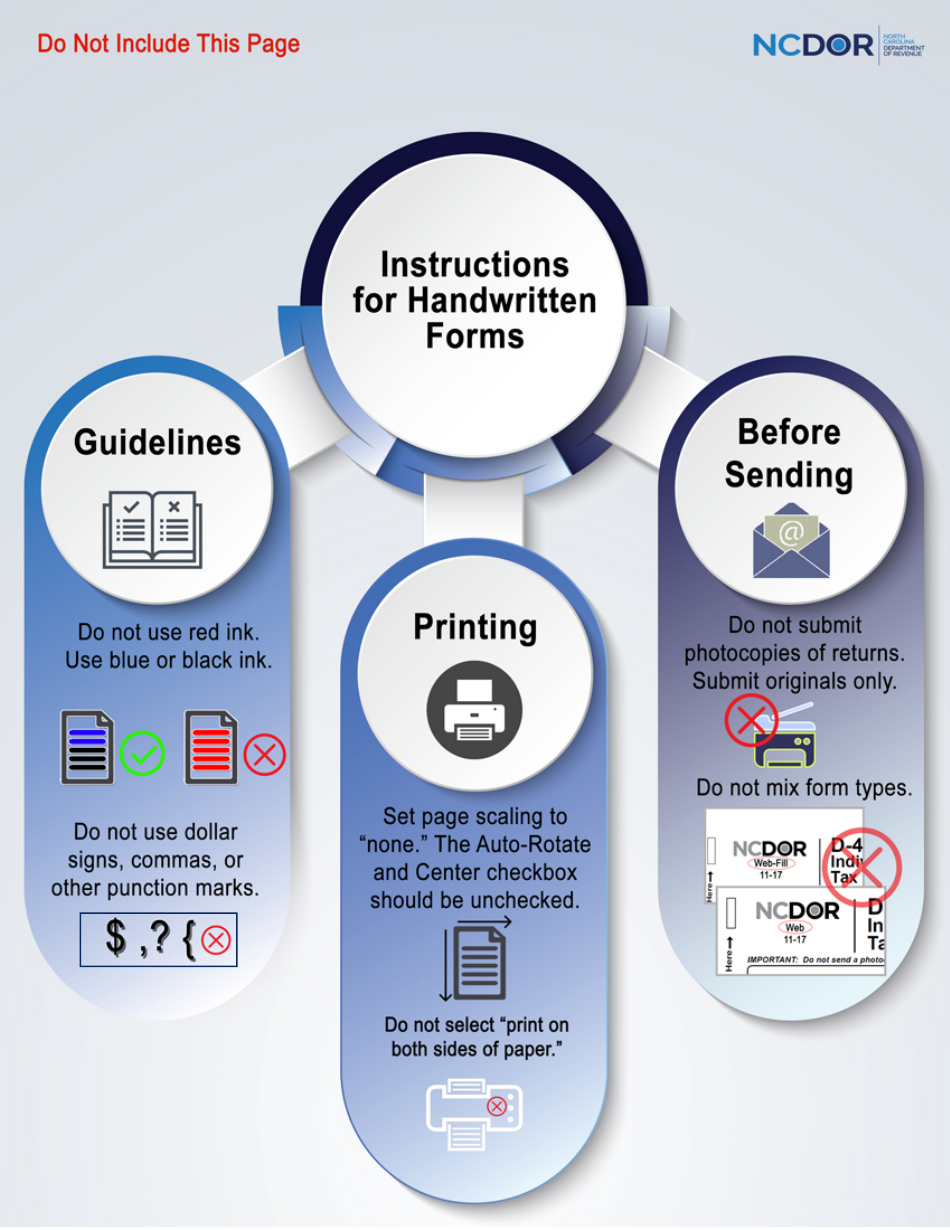

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BA-6 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.