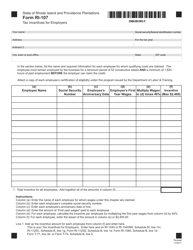

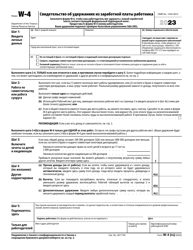

This version of the form is not currently in use and is provided for reference only. Download this version of

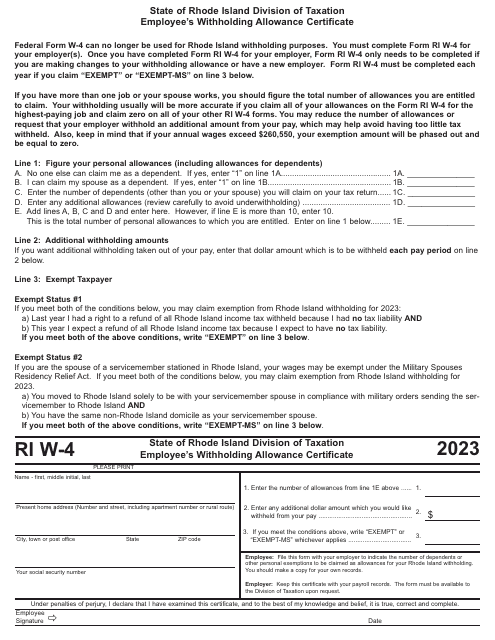

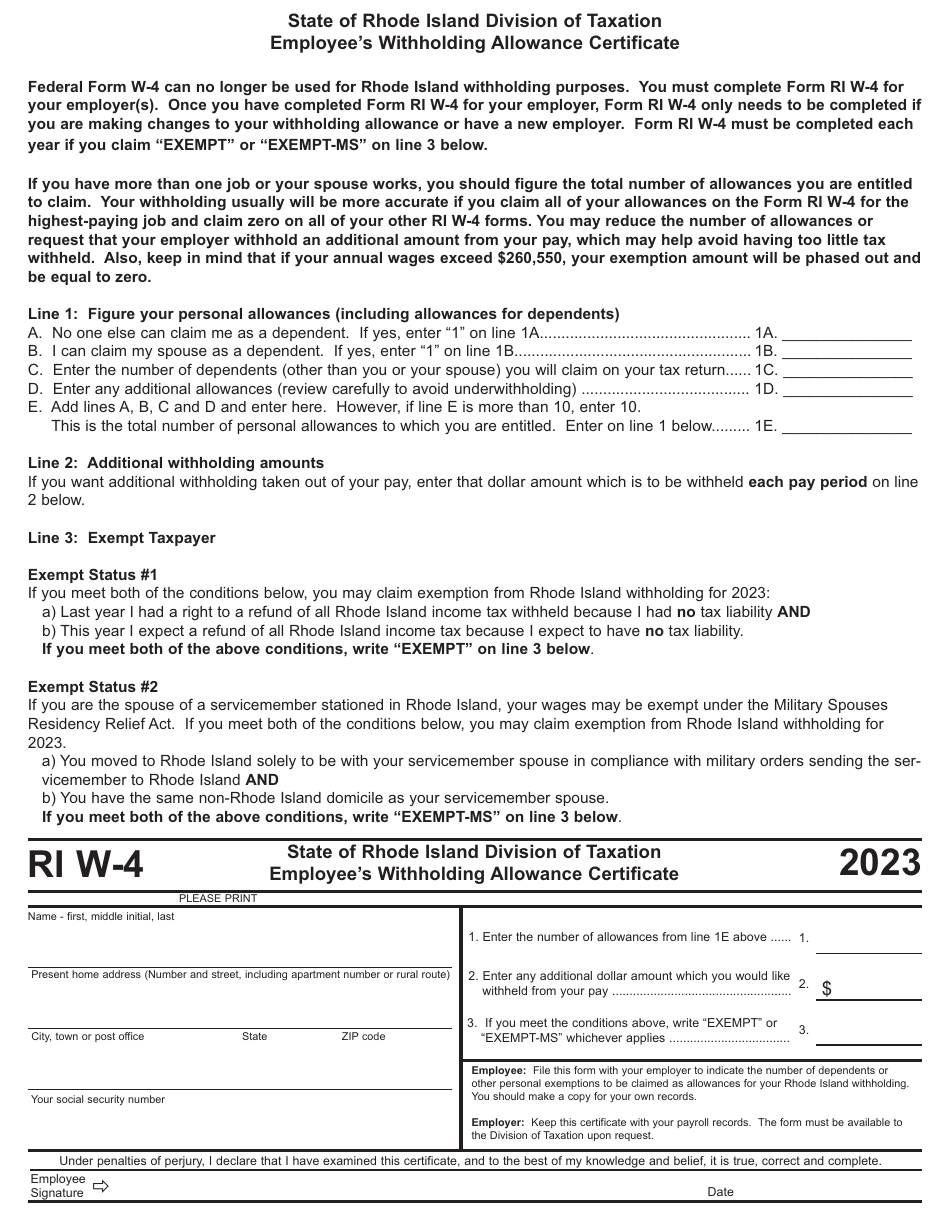

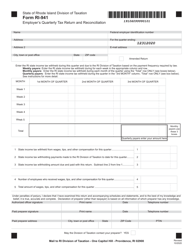

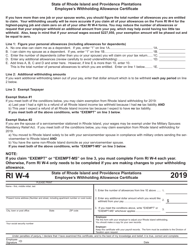

Form RI W-4

for the current year.

Form RI W-4 Employee's Withholding Allowance Certificate - Rhode Island

What Is Form RI W-4?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RI W-4 form?

A: The RI W-4 form is the Employee's Withholding Allowance Certificate for the state of Rhode Island.

Q: What is the purpose of the RI W-4 form?

A: The purpose of the RI W-4 form is to determine the amount of state income tax that will be withheld from an employee's wages.

Q: Who needs to fill out the RI W-4 form?

A: All Rhode Island employees must fill out the RI W-4 form.

Q: What information do I need to fill out the RI W-4 form?

A: You will need to provide your personal information, such as your name, address, and Social Security number, as well as the number of withholding allowances you are claiming.

Q: How many withholding allowances can I claim on the RI W-4 form?

A: The number of withholding allowances you can claim on the RI W-4 form depends on your personal circumstances. The more allowances you claim, the less state income tax will be withheld from your wages.

Q: Can I change my withholding allowances on the RI W-4 form?

A: Yes, you can change your withholding allowances on the RI W-4 form at any time. If your personal or financial situation changes, you should update your form to ensure the correct amount of state income tax is being withheld.

Q: When should I submit the RI W-4 form?

A: You should submit the RI W-4 form to your employer as soon as possible, preferably before you start working.

Q: Do I need to submit a new RI W-4 form every year?

A: No, you do not need to submit a new RI W-4 form every year. However, if your personal or financial situation changes, you should update your form to reflect those changes.

Q: What should I do if I make a mistake on the RI W-4 form?

A: If you make a mistake on the RI W-4 form, you should notify your employer as soon as possible and request a new form to correct the error.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI W-4 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.