This version of the form is not currently in use and is provided for reference only. Download this version of

Form AA1

for the current year.

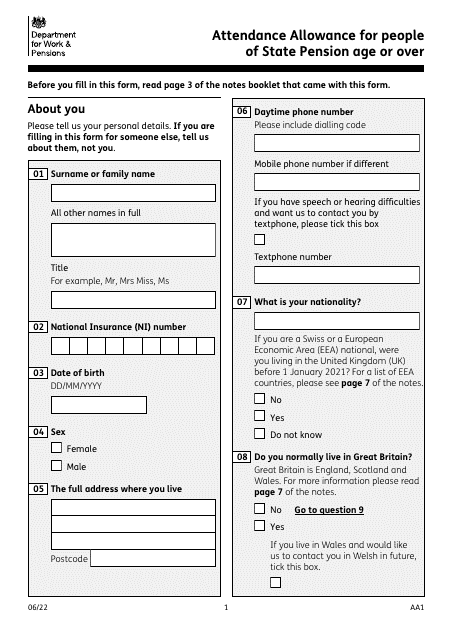

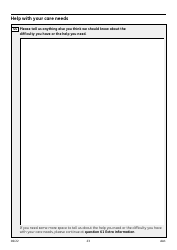

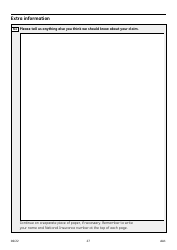

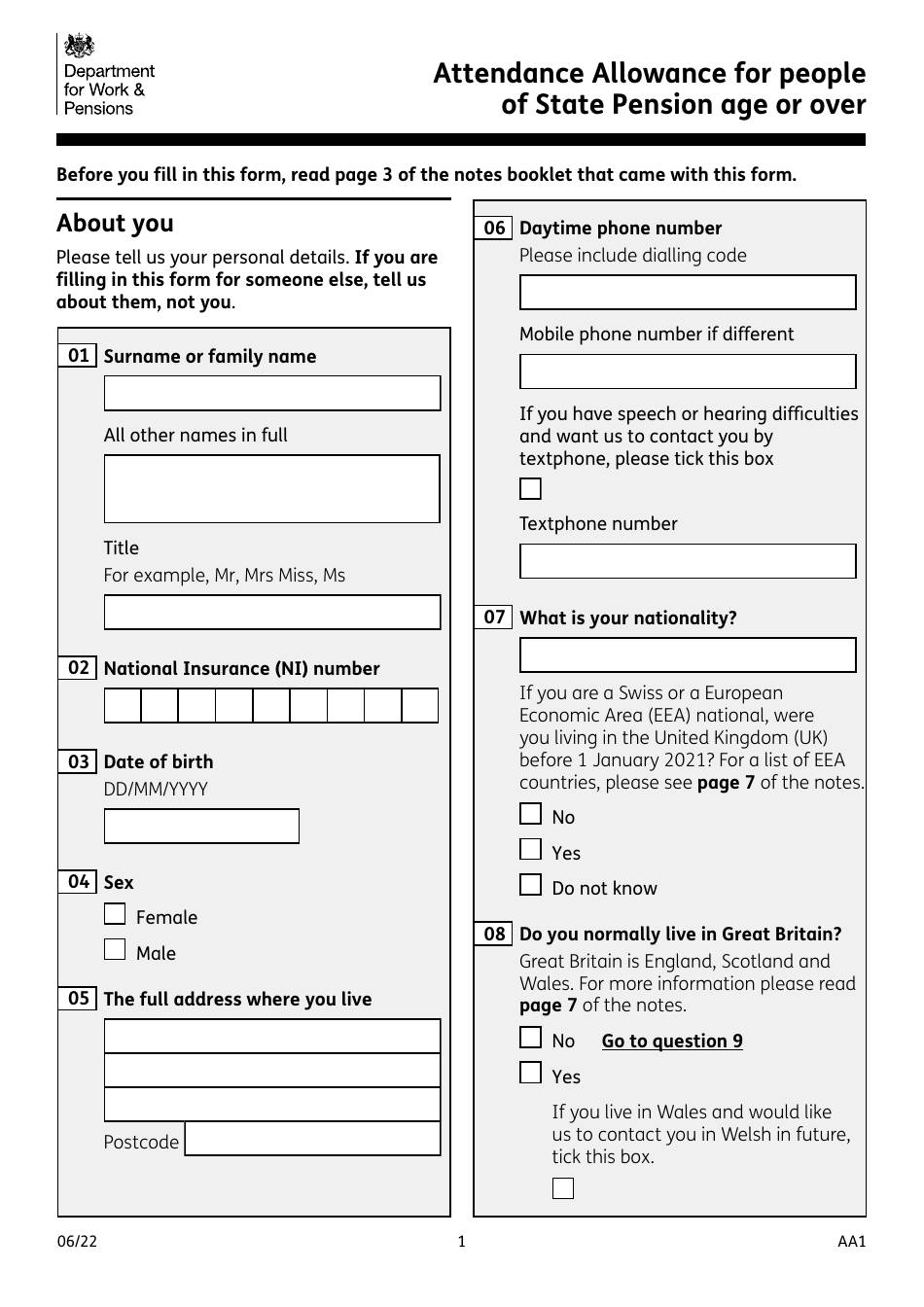

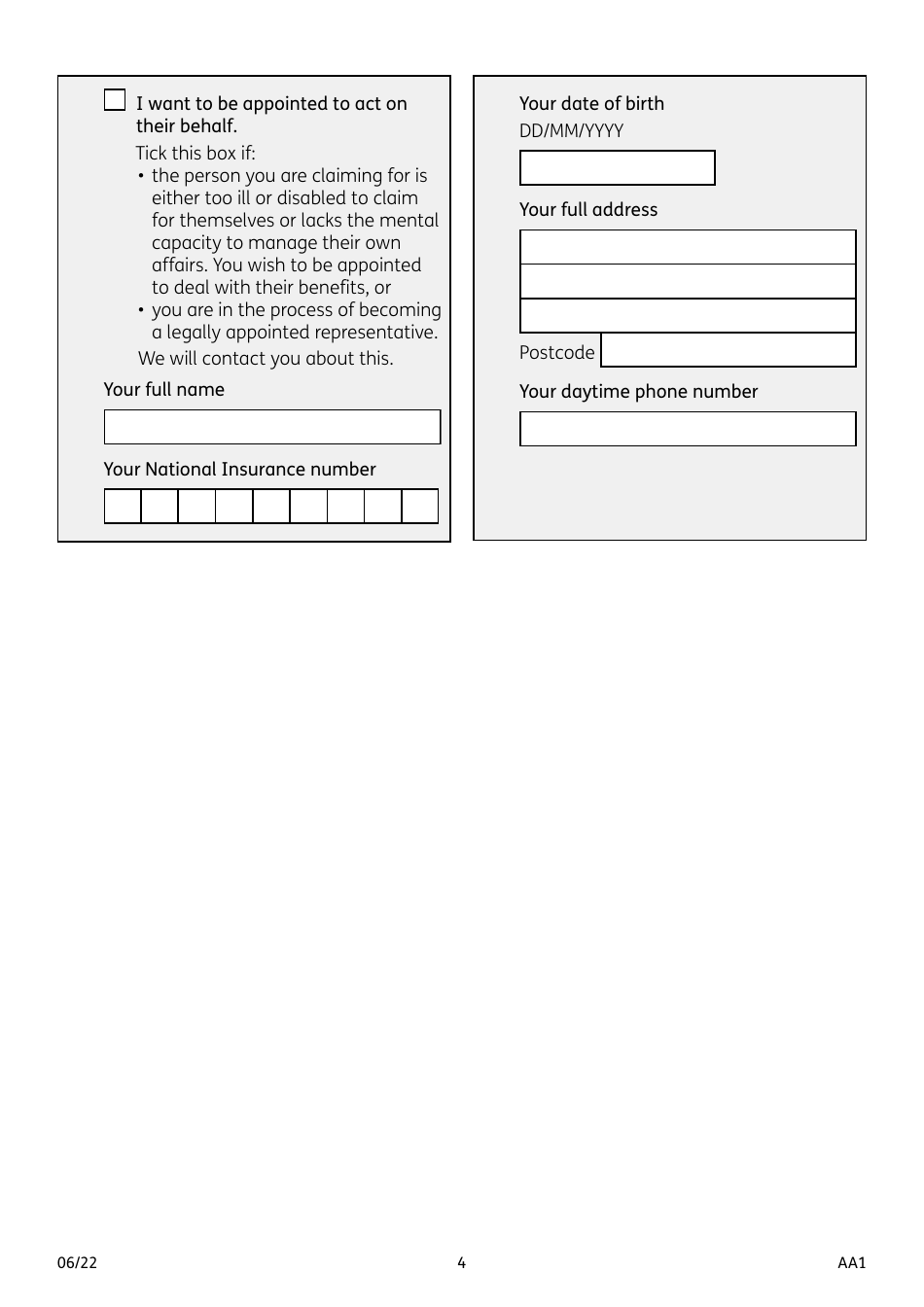

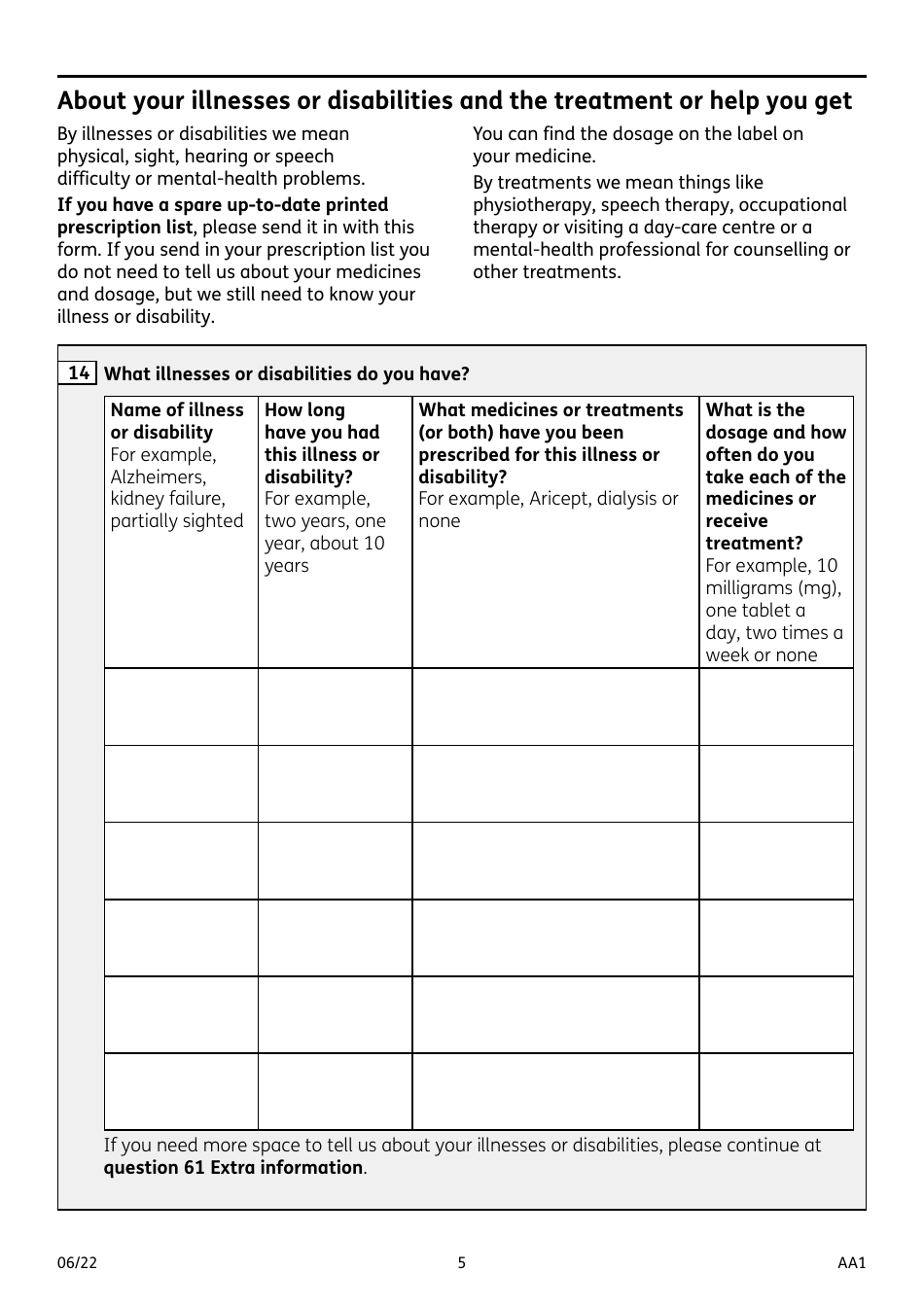

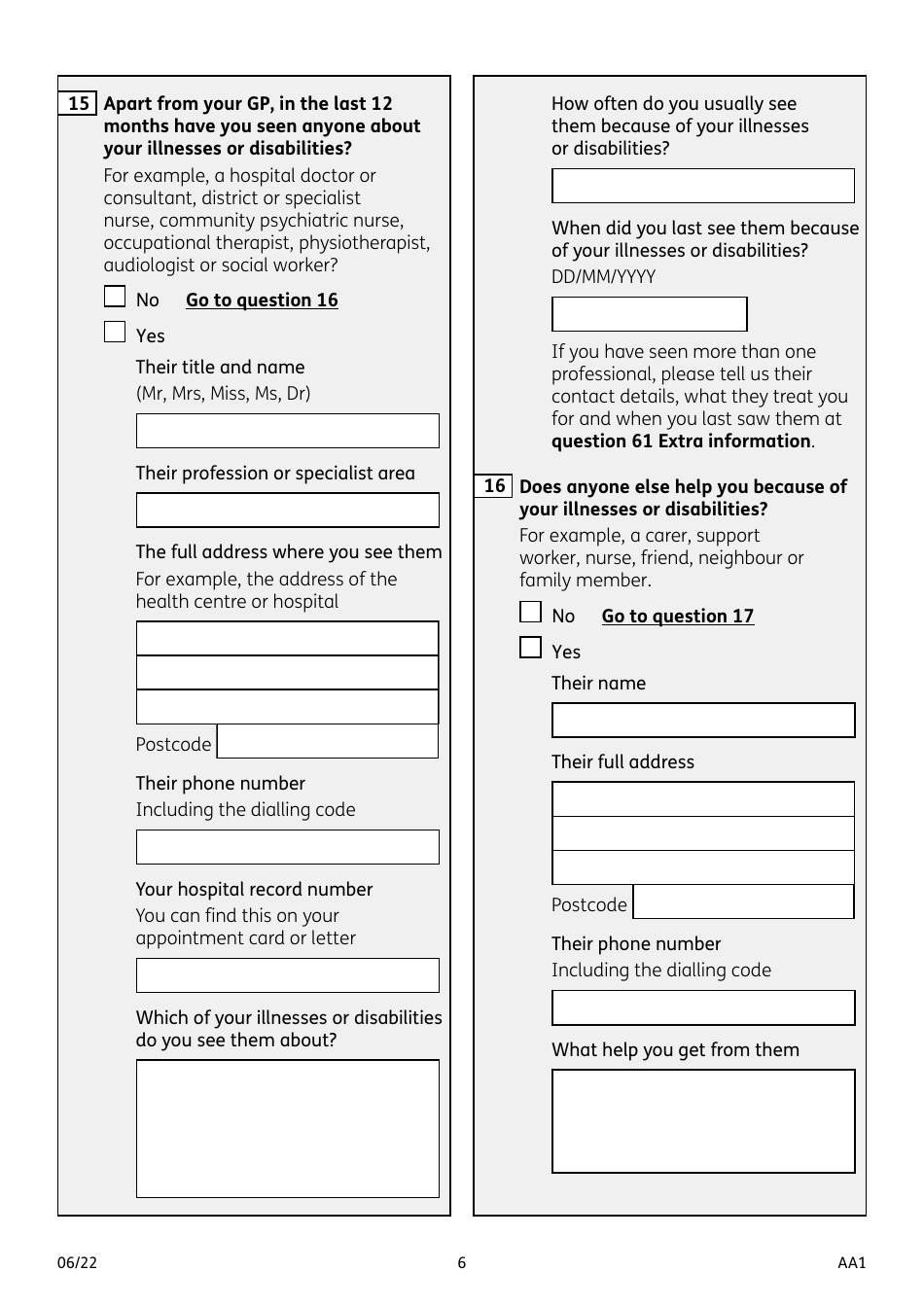

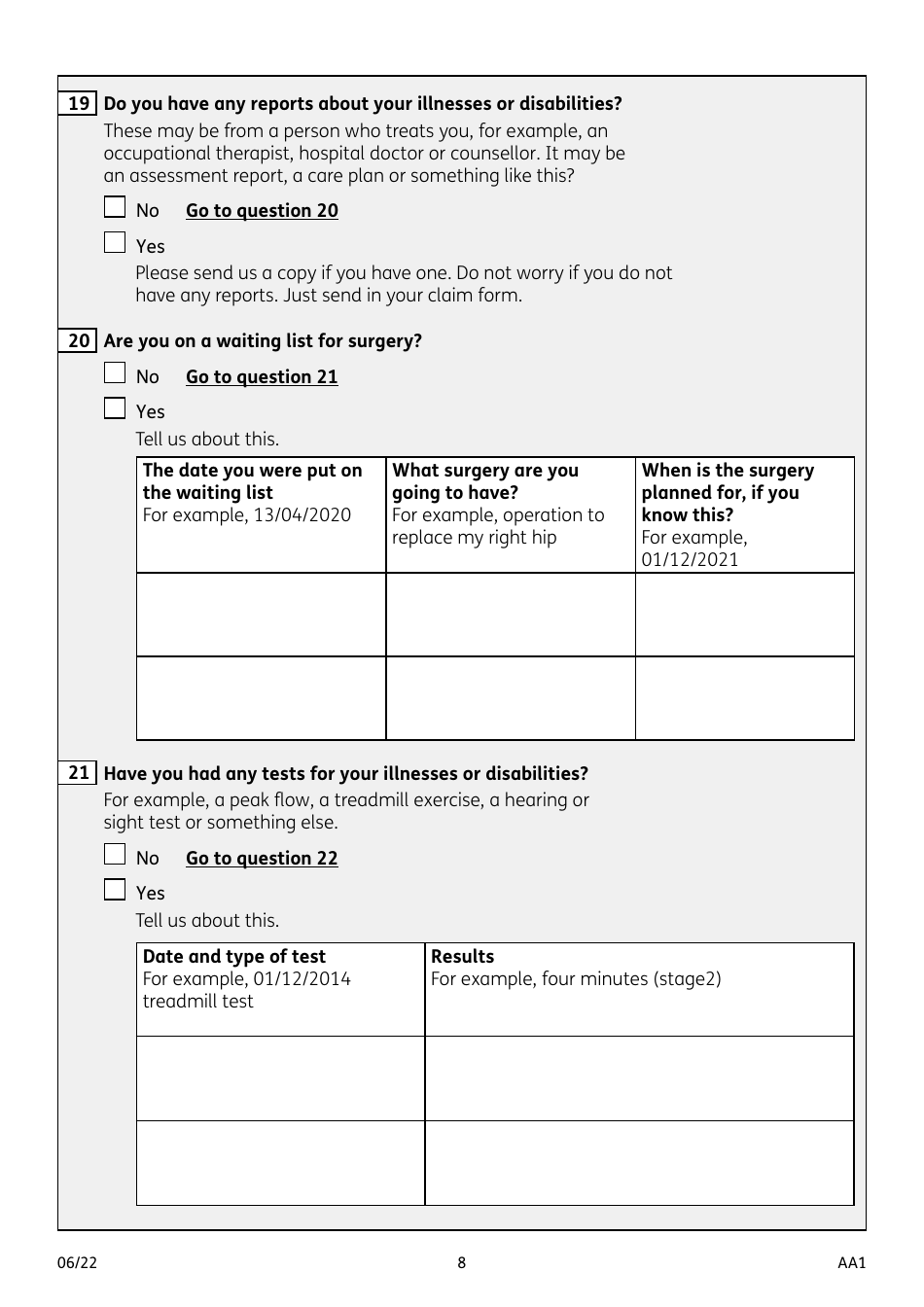

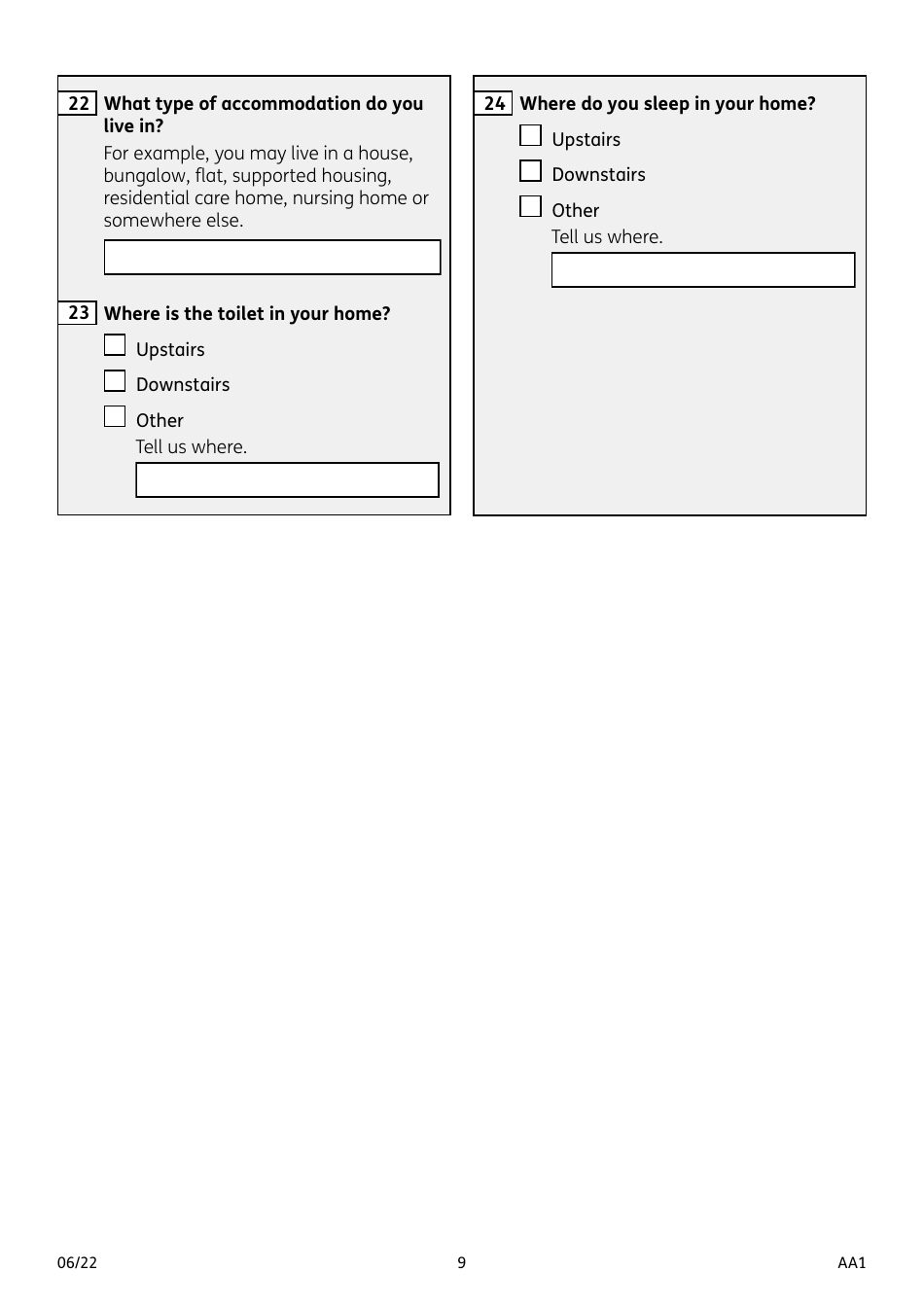

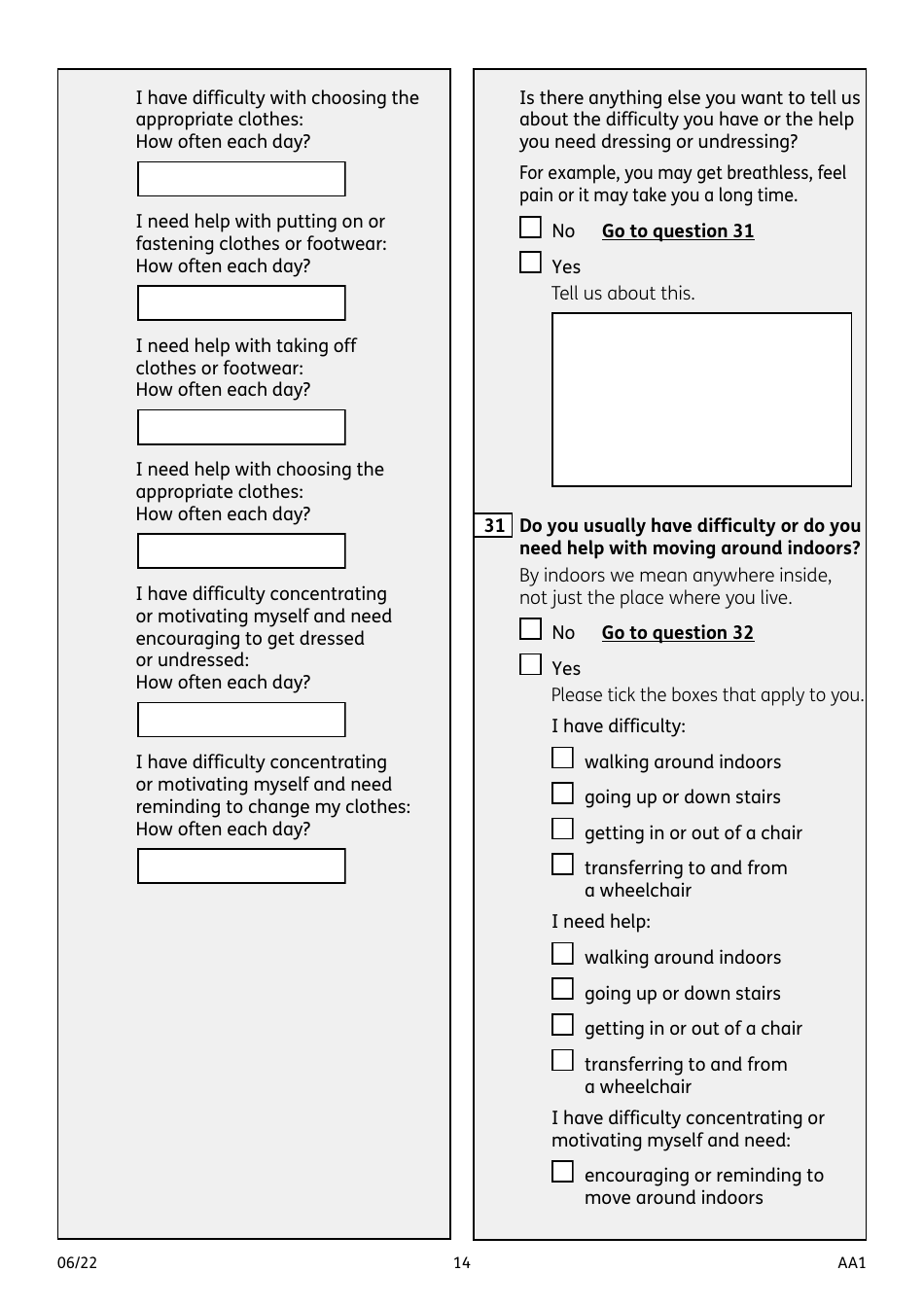

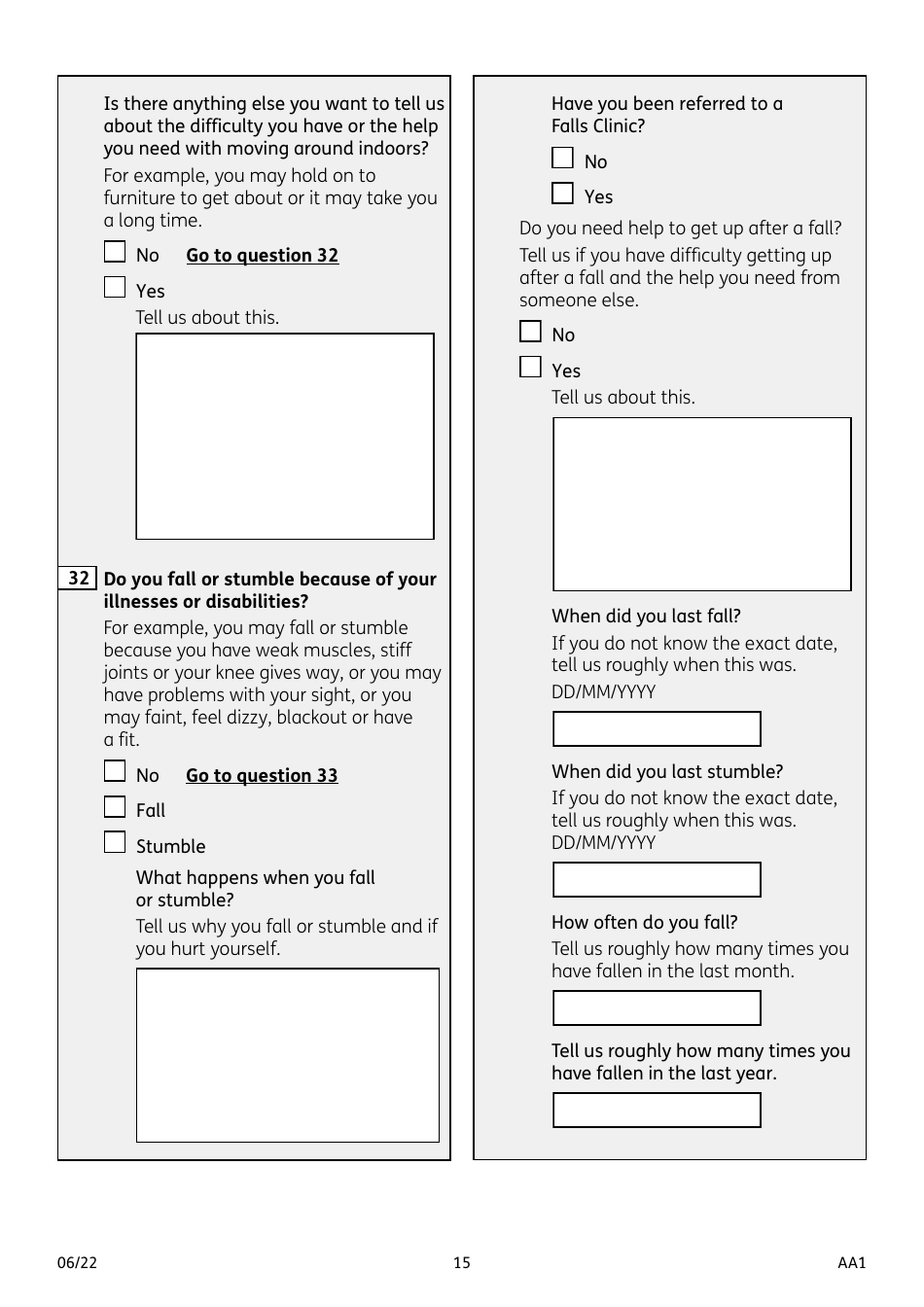

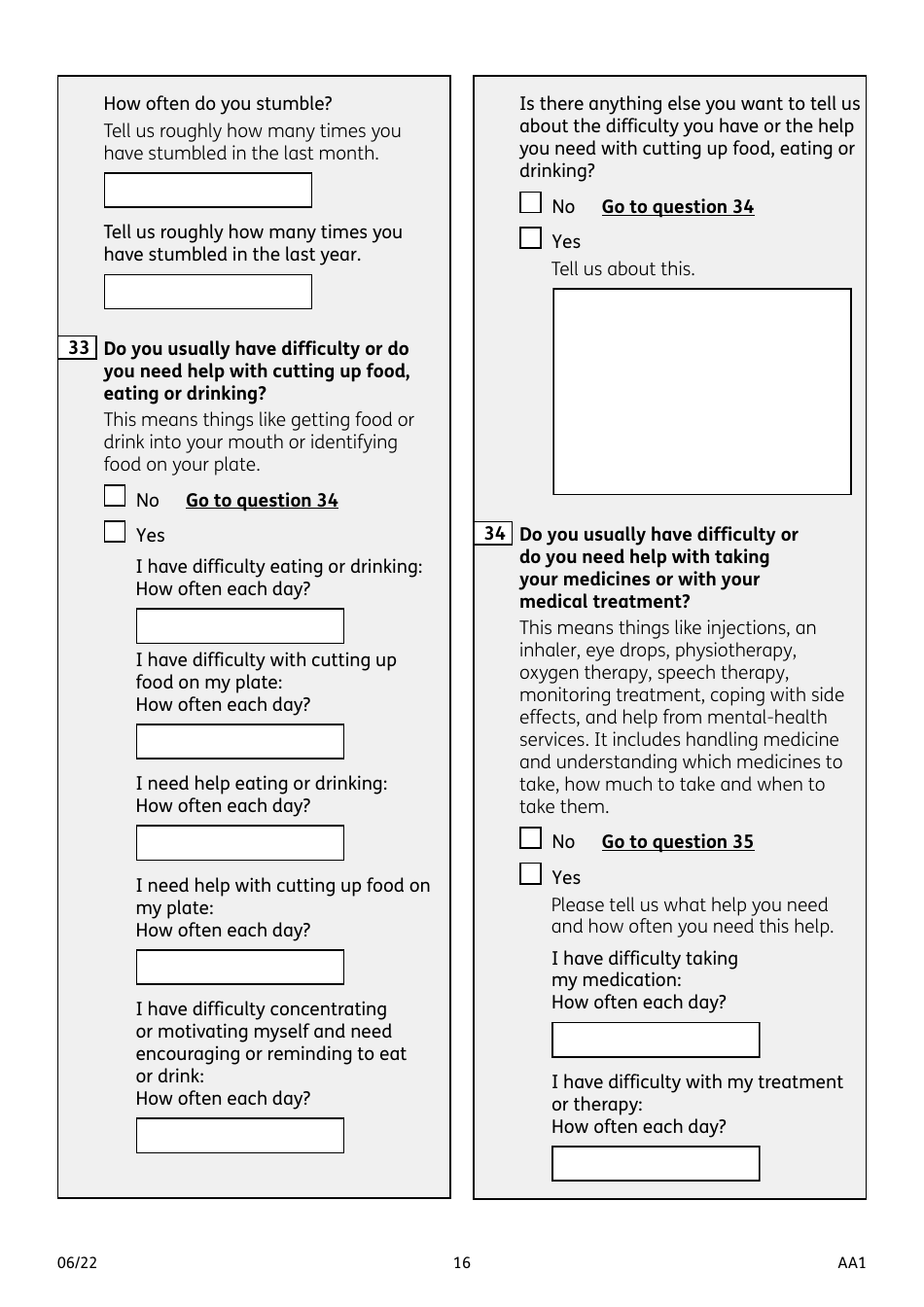

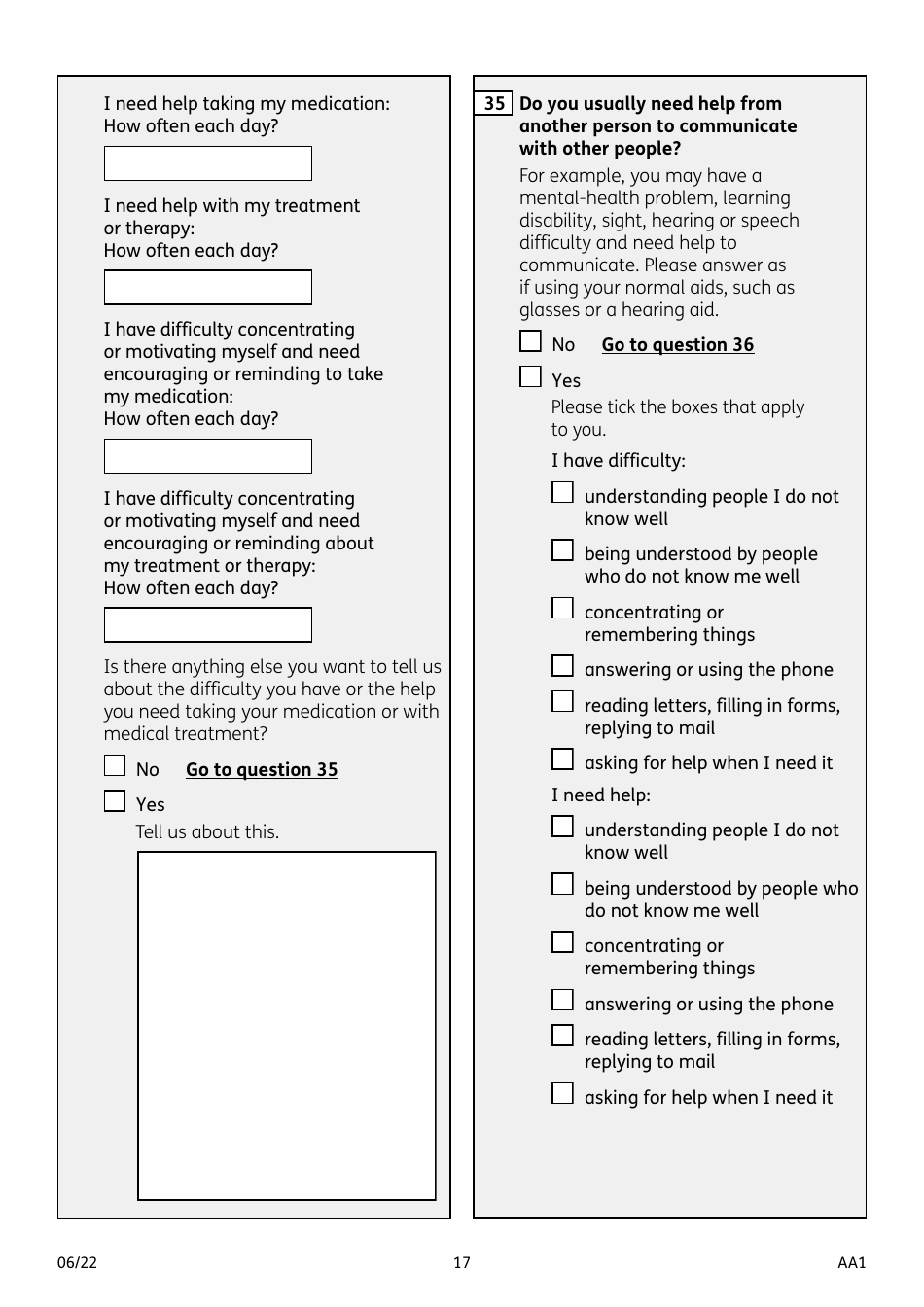

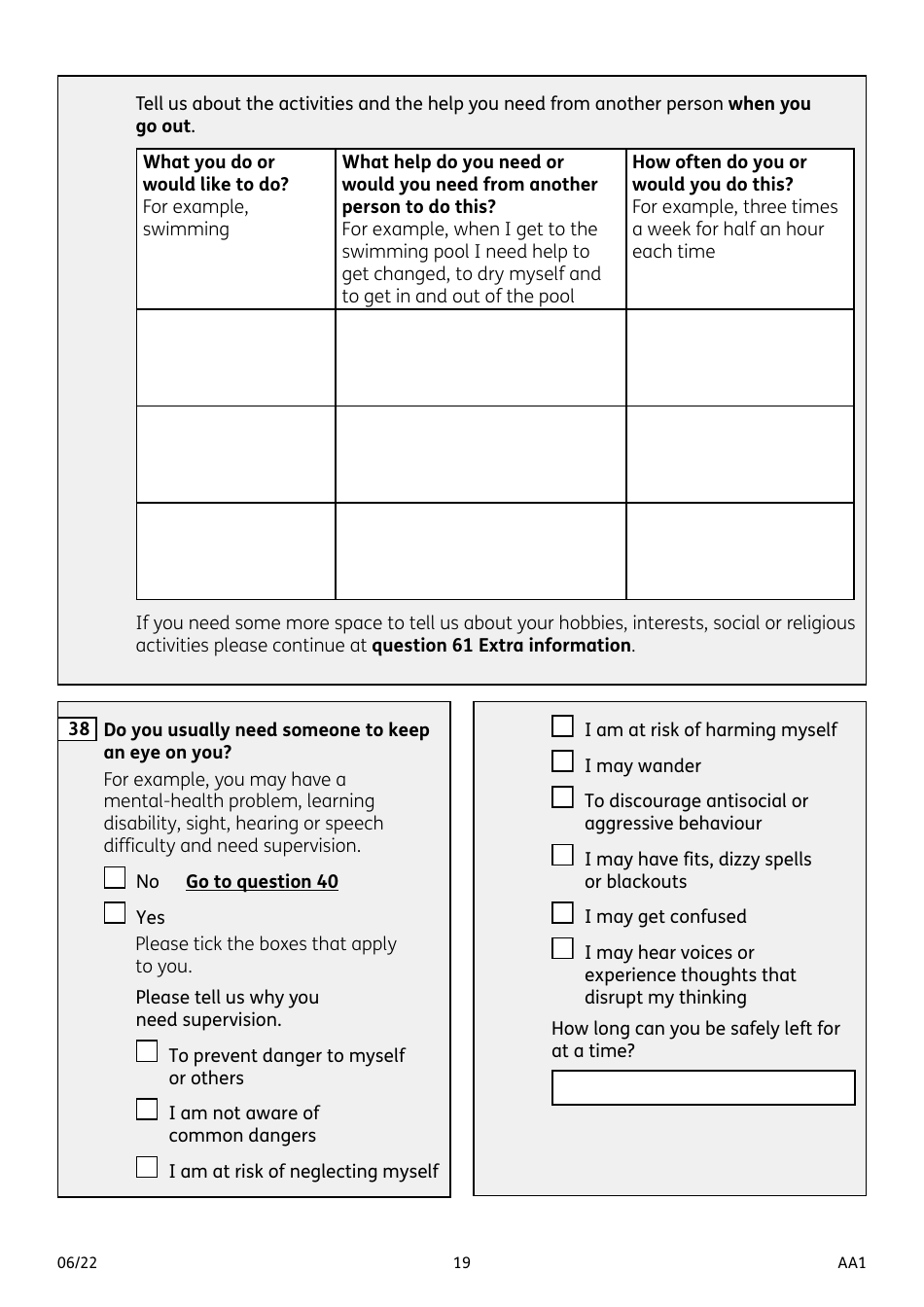

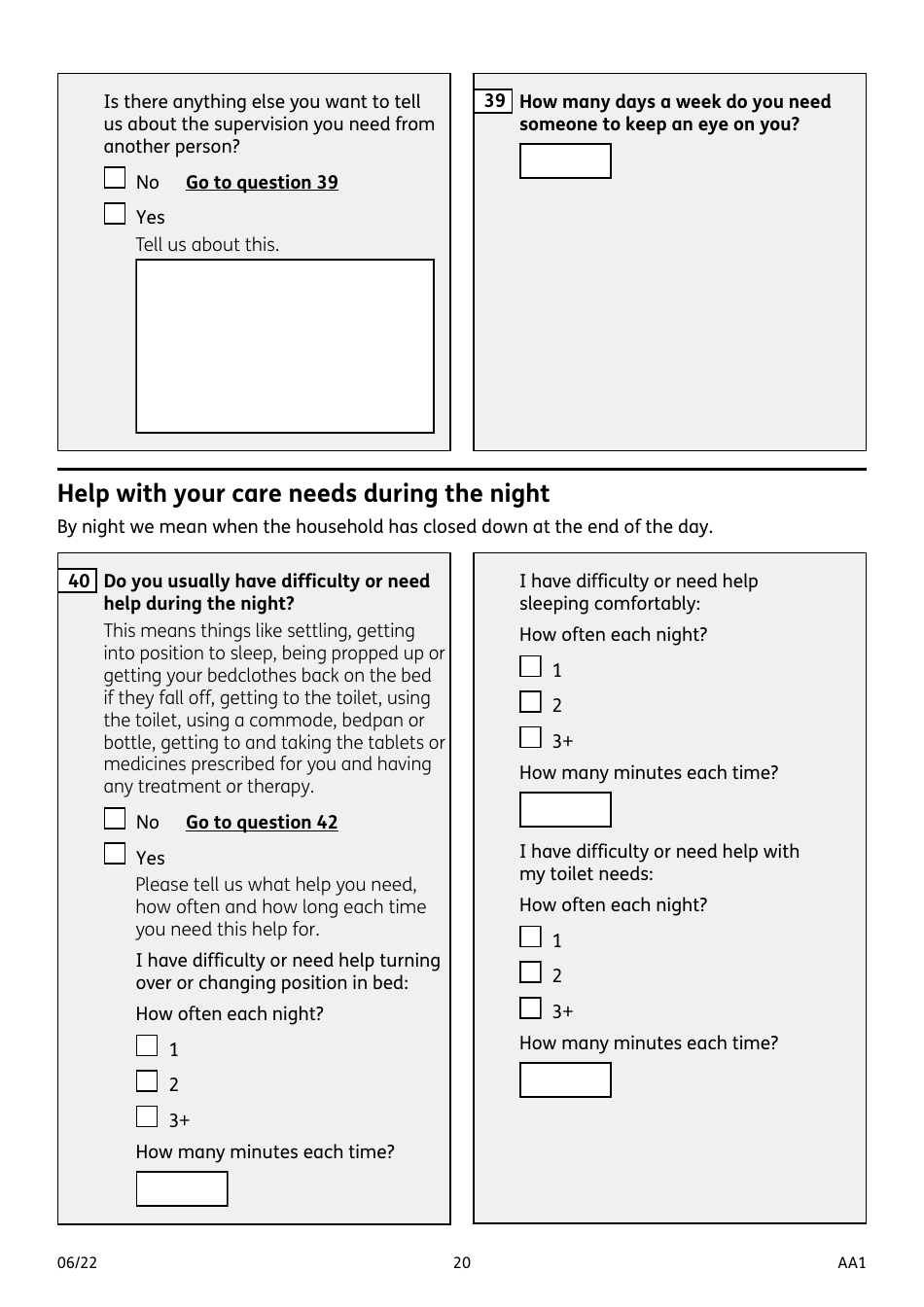

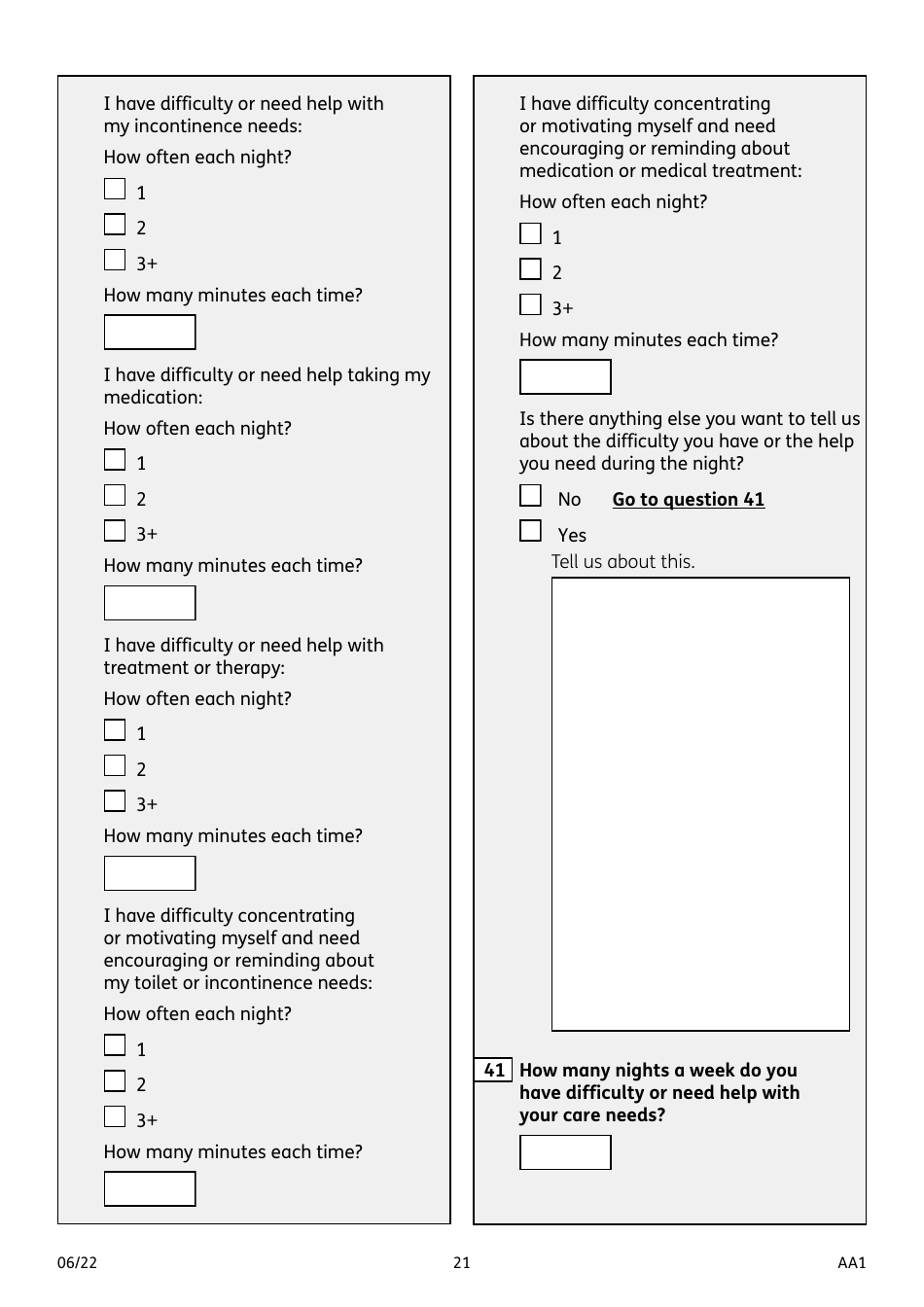

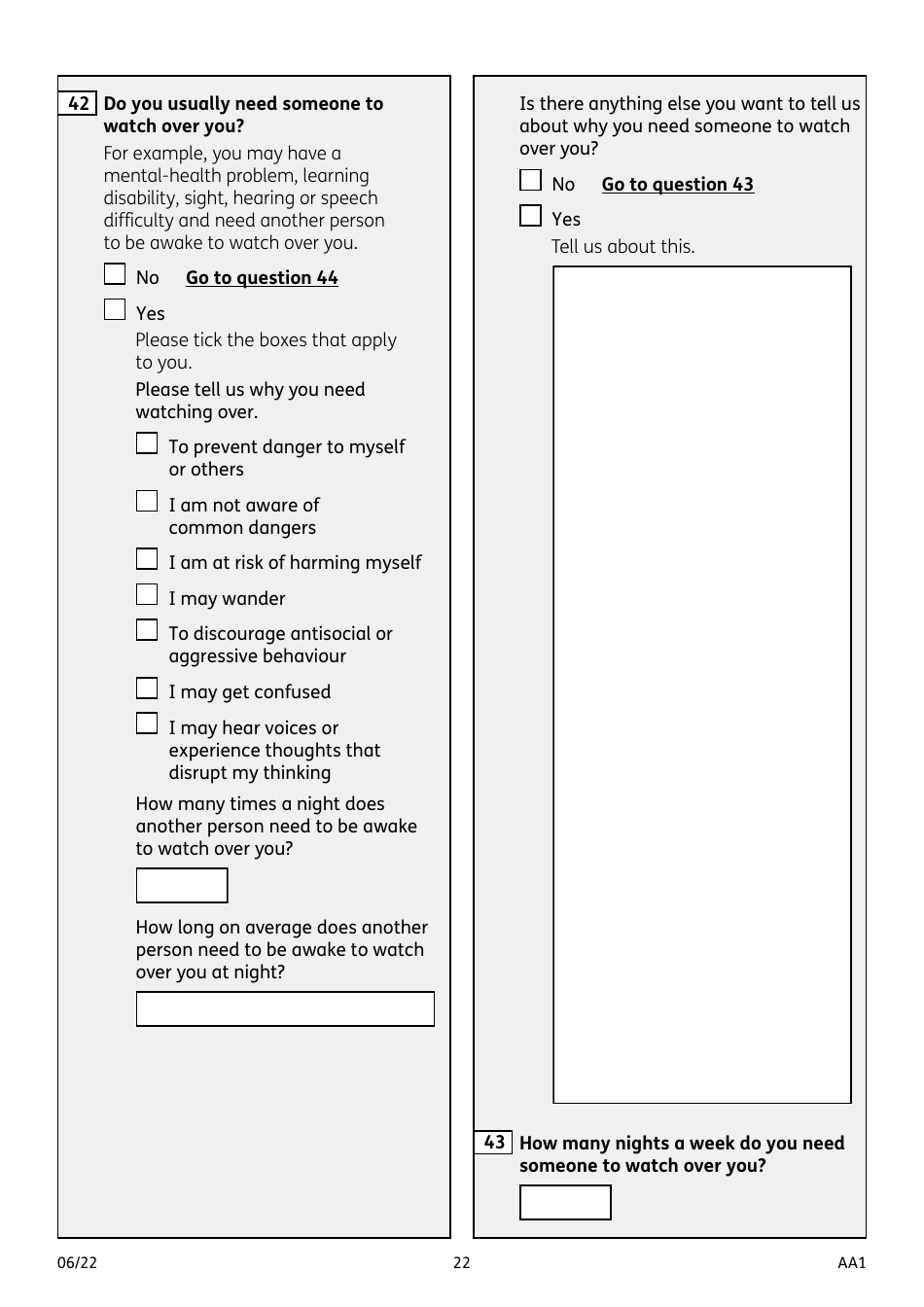

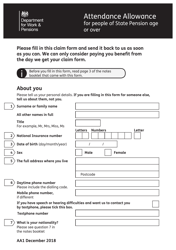

Form AA1 Attendance Allowance for People of State Pension Age or Over - United Kingdom

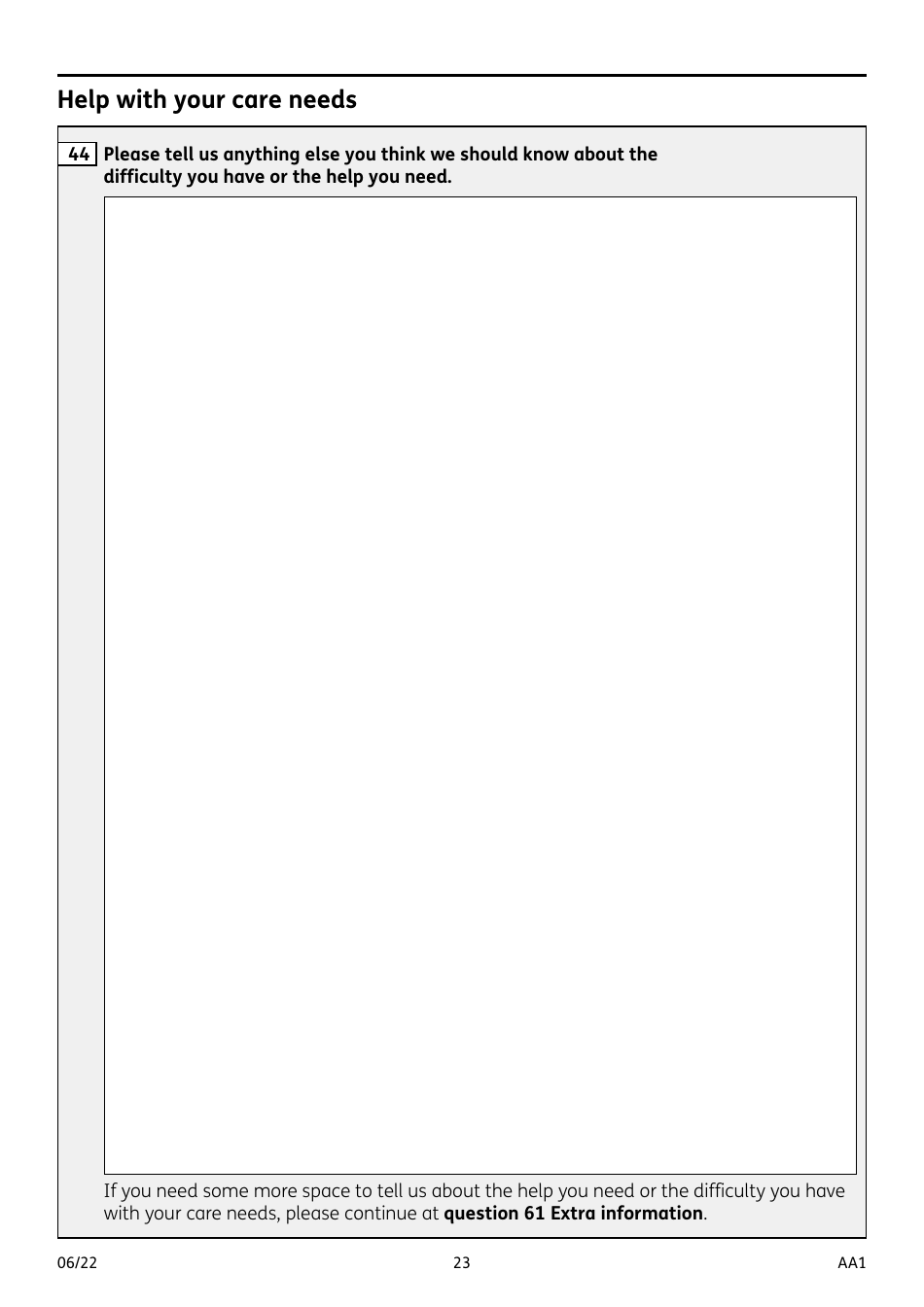

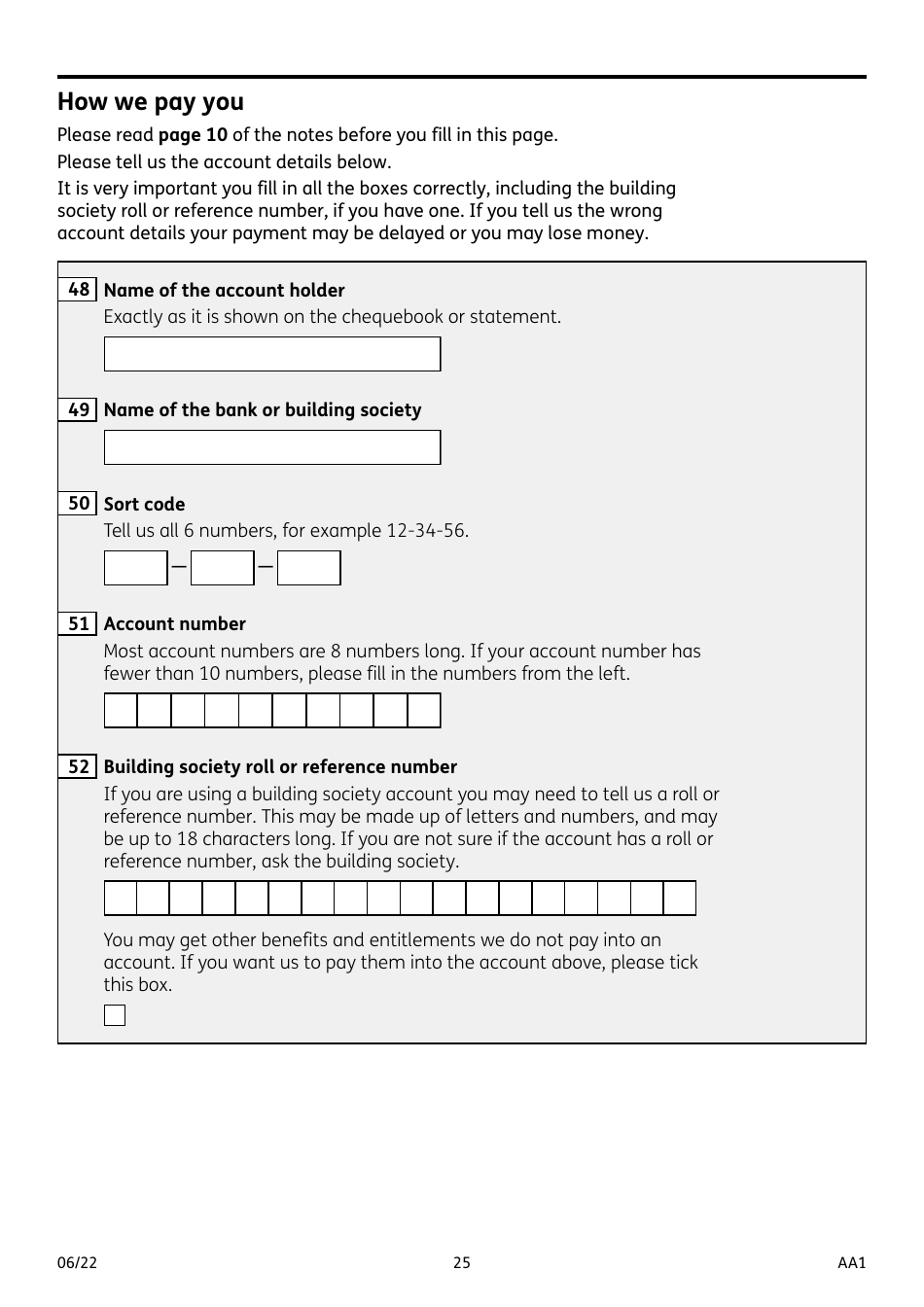

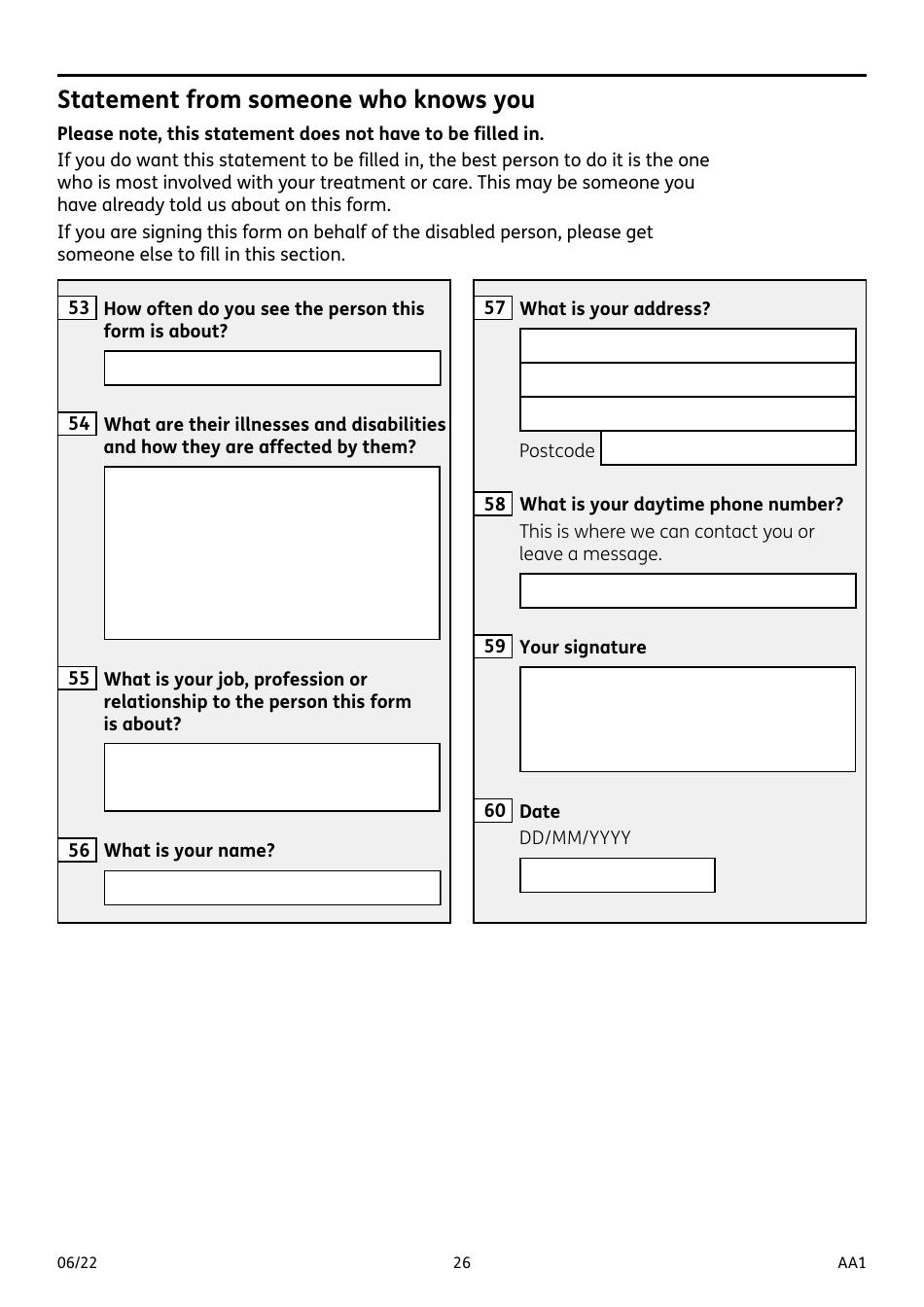

Form AA1 Attendance Allowance for People of State Pension Age or Over in the United Kingdom is a document used to apply for Attendance Allowance, a benefit provided by the government to individuals who have a disability or illness that requires them to have someone assist them with their personal care needs. This form is specifically for individuals who are of state pension age or older and need financial support to help with their care costs.

In the United Kingdom, individuals of state pension age or over can file the Form AA1 Attendance Allowance themselves.

FAQ

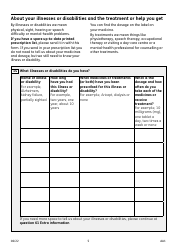

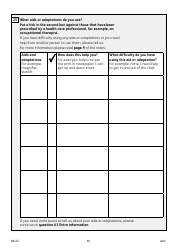

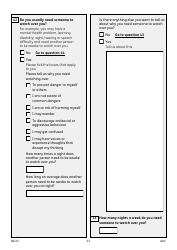

Q: What is Attendance Allowance?

A: Attendance Allowance is a financial benefit provided by the United Kingdom government to help people who have a disability or illness that requires them to have extra care or assistance with personal tasks.

Q: Who is eligible for Attendance Allowance?

A: To be eligible for Attendance Allowance, you must be of state pension age or over, have a disability or illness, and need help or supervision during the day or night or both.

Q: What is the amount of Attendance Allowance?

A: The amount of Attendance Allowance you can receive depends on the level of care or supervision you need. There are two rates: the lower rate is £60.00 per week and the higher rate is £89.60 per week.

Q: Is Attendance Allowance means-tested?

A: No, Attendance Allowance is not means-tested. It is based on your care needs rather than your income or savings.

Q: Do I need a medical assessment for Attendance Allowance?

A: No, you do not need a medical assessment for Attendance Allowance. The decision is based on the information provided in your application form, and the Department for Work and Pensions may contact your healthcare professionals for further information if needed.

Q: Is Attendance Allowance taxable?

A: No, Attendance Allowance is not taxable. It is a non-taxable benefit.

Q: What happens if my circumstances change after receiving Attendance Allowance?

A: If your circumstances change, such as your care needs increase or decrease, you should inform the Department for Work and Pensions as soon as possible. They will reassess your eligibility and the amount of Attendance Allowance you receive.

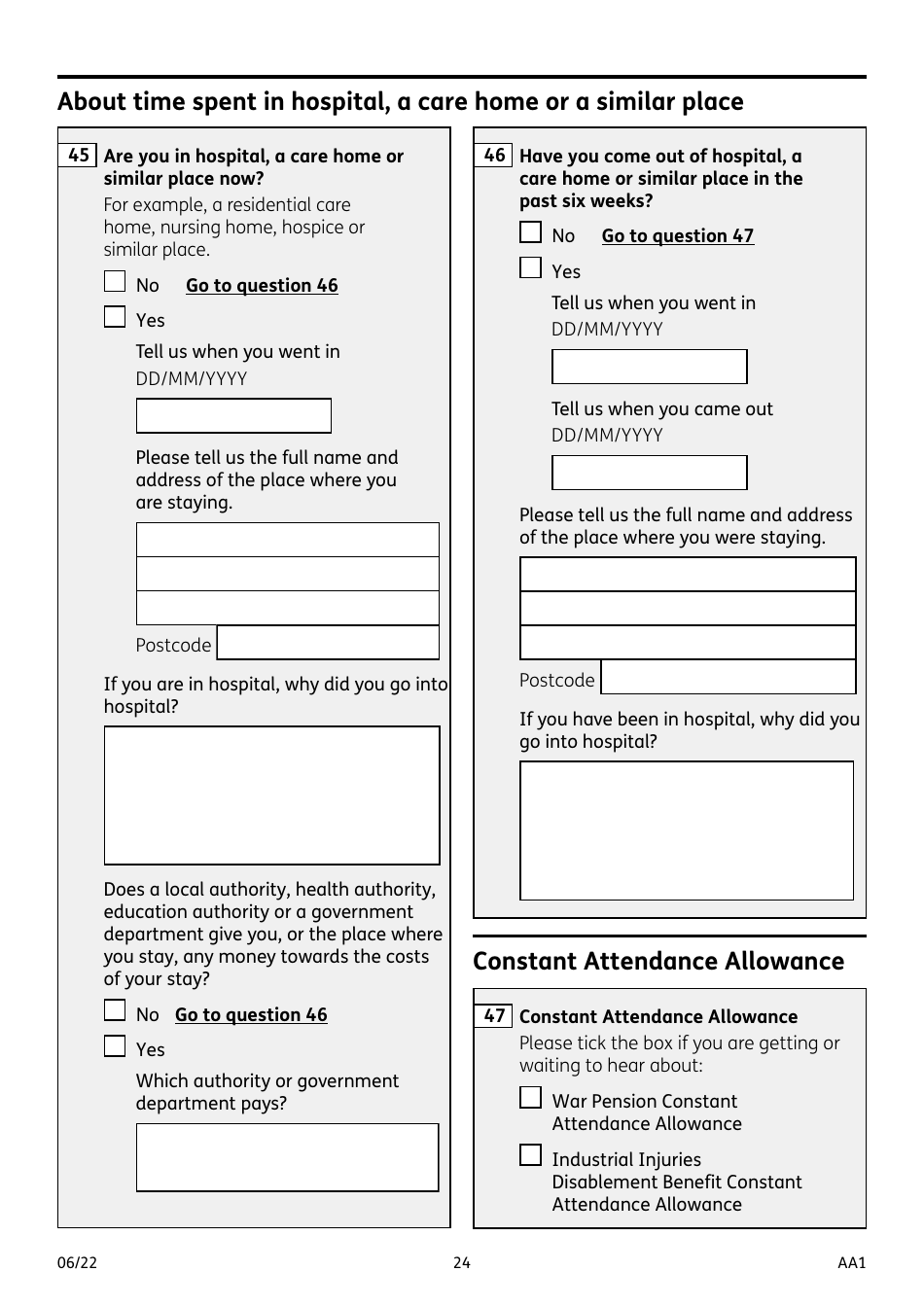

Q: Can I receive Attendance Allowance if I live in a care home?

A: Yes, you can still receive Attendance Allowance if you live in a care home. The amount you receive may be different depending on the level of care provided by the care home.

Q: How long does it take to receive a decision on my Attendance Allowance application?

A: The processing time for Attendance Allowance applications can vary, but you should receive a decision within 8 weeks of submitting your application. However, in some cases, it may take longer.