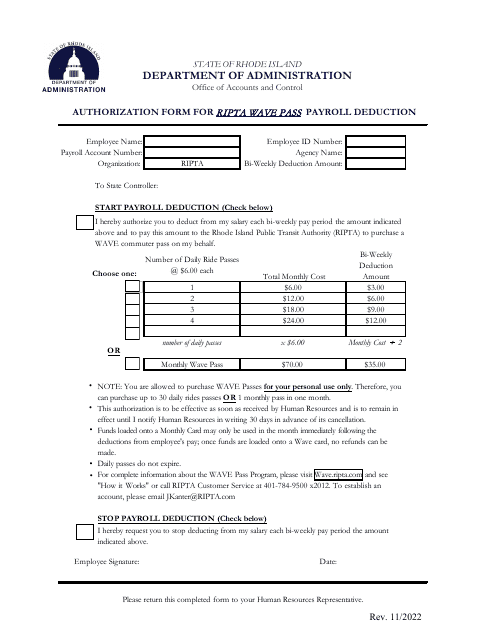

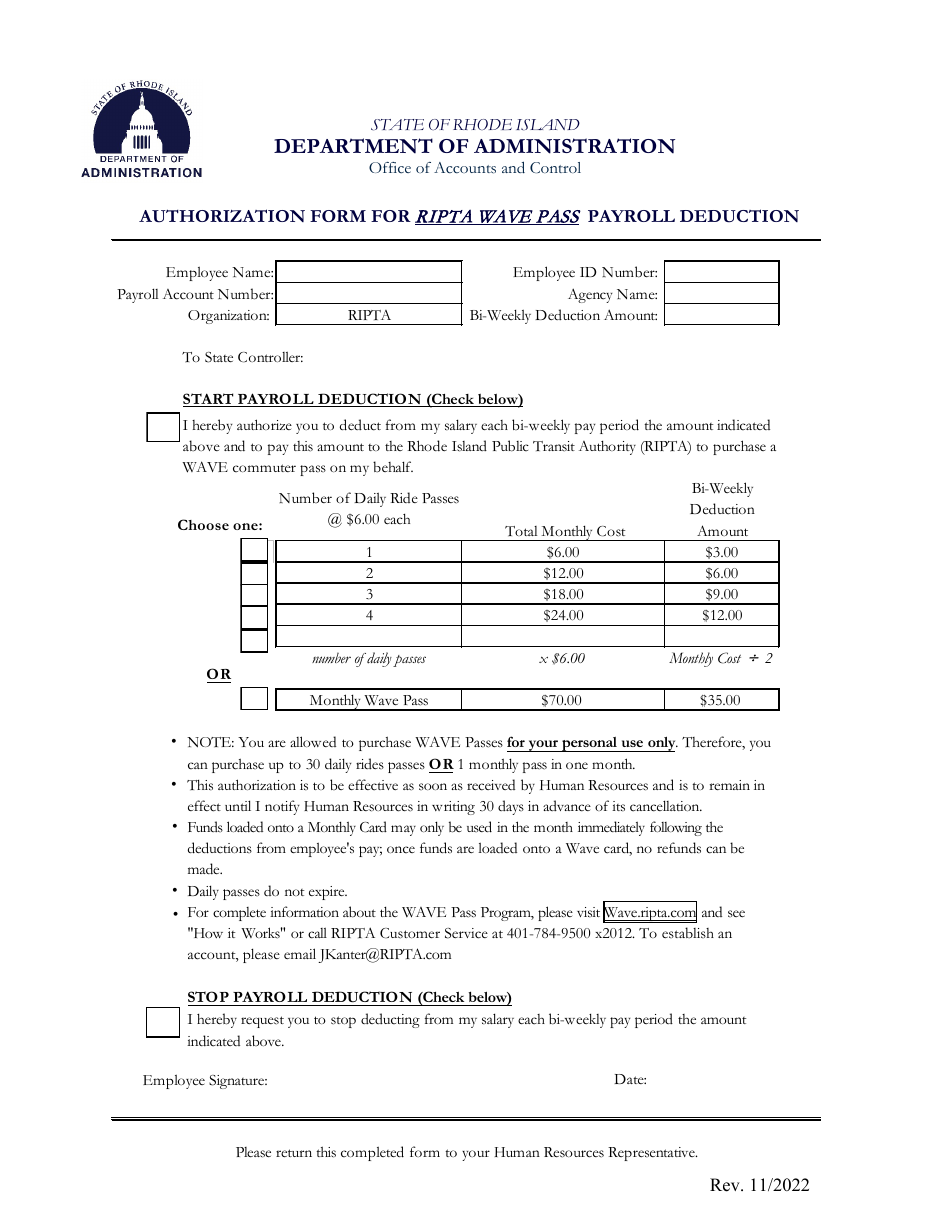

Authorization Form for Ripta Wave Pass Payroll Deduction - Rhode Island

Authorization Form for Ripta Wave Pass Payroll Deduction is a legal document that was released by the Rhode Island Department of Administration - Office of Accounts and Control - a government authority operating within Rhode Island.

FAQ

Q: What is the Authorization Form for Ripta Wave Pass Payroll Deduction?

A: The Authorization Form for Ripta Wave Pass Payroll Deduction is a form that allows employees to authorize the deduction of the cost of their Ripta Wave Pass from their payroll.

Q: What is Ripta Wave Pass?

A: Ripta Wave Pass is a transportation pass offered by the Rhode Island Public Transit Authority (RIPTA) that allows unlimited travel on RIPTA buses and trolleys.

Q: What is payroll deduction?

A: Payroll deduction is when an employer subtracts money from an employee's paycheck for a particular purpose, such as paying for a transportation pass.

Q: Why would someone use the Authorization Form for Ripta Wave Pass Payroll Deduction?

A: Someone would use the form to conveniently have the cost of their Ripta Wave Pass deducted directly from their paycheck, making it easier to budget for transportation expenses.

Form Details:

- Released on November 1, 2022;

- The latest edition currently provided by the Rhode Island Department of Administration - Office of Accounts and Control;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Administration - Office of Accounts and Control.