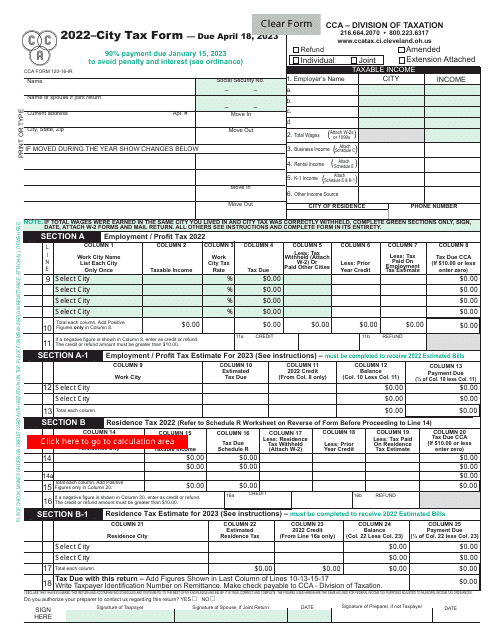

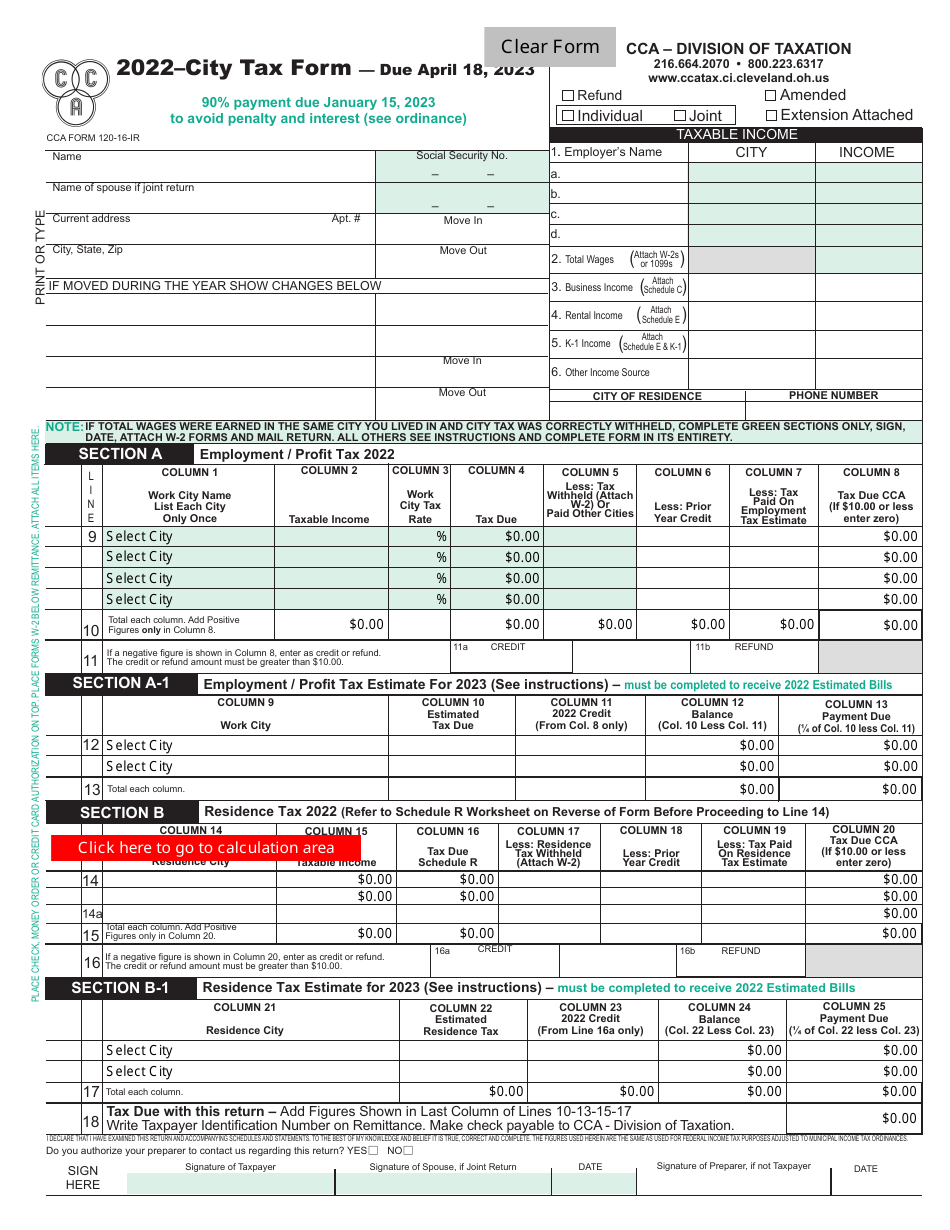

City Tax Form - City of Cleveland, Ohio

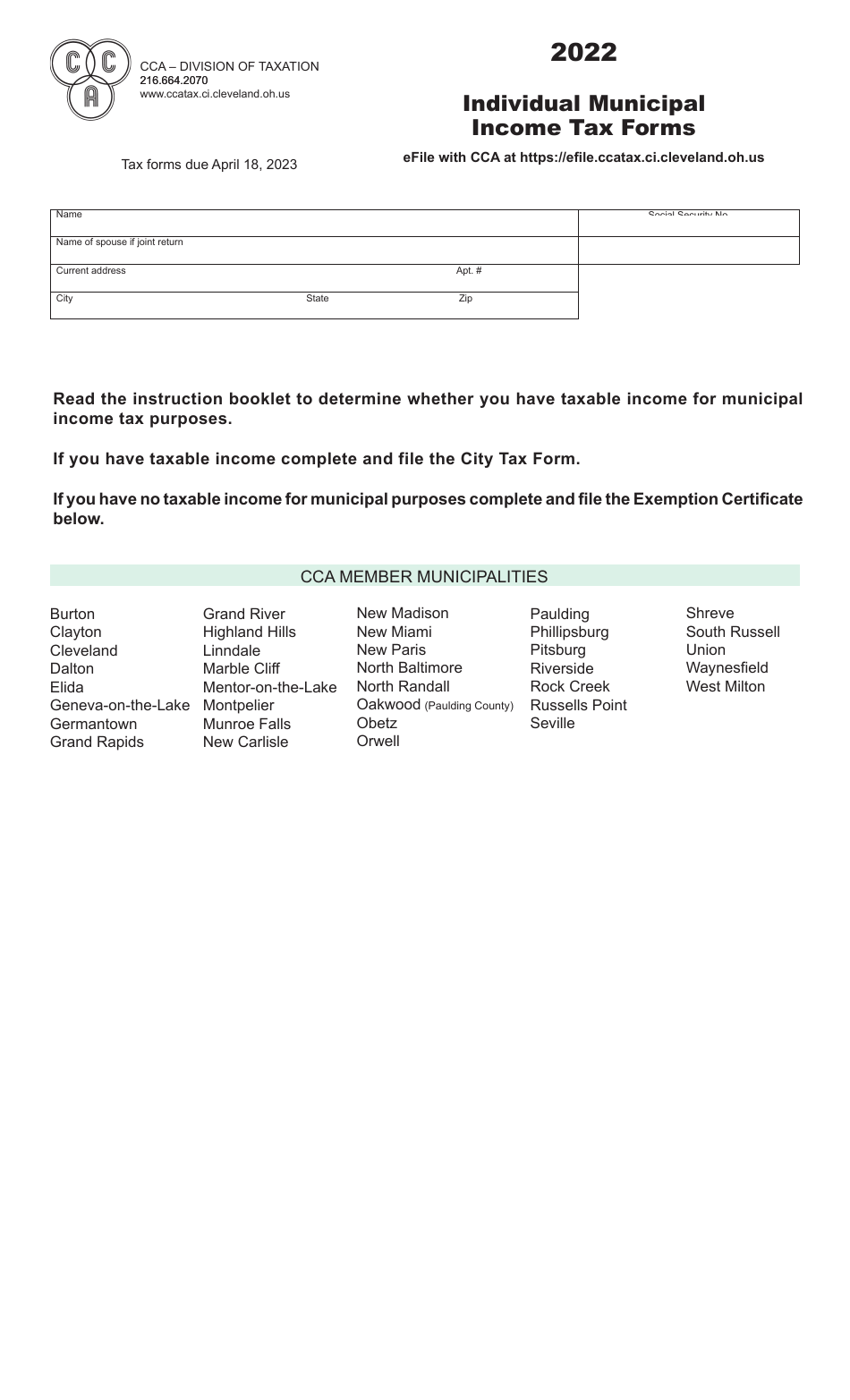

City Tax Form is a legal document that was released by the Division of Taxation - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

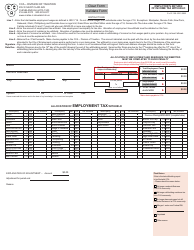

Q: What is the City Tax Form?

A: The City Tax Form is a form used to report and pay city taxes in Cleveland, Ohio.

Q: Who needs to file the City Tax Form?

A: Any individual or business that earns income within the city of Cleveland, Ohio needs to file the City Tax Form.

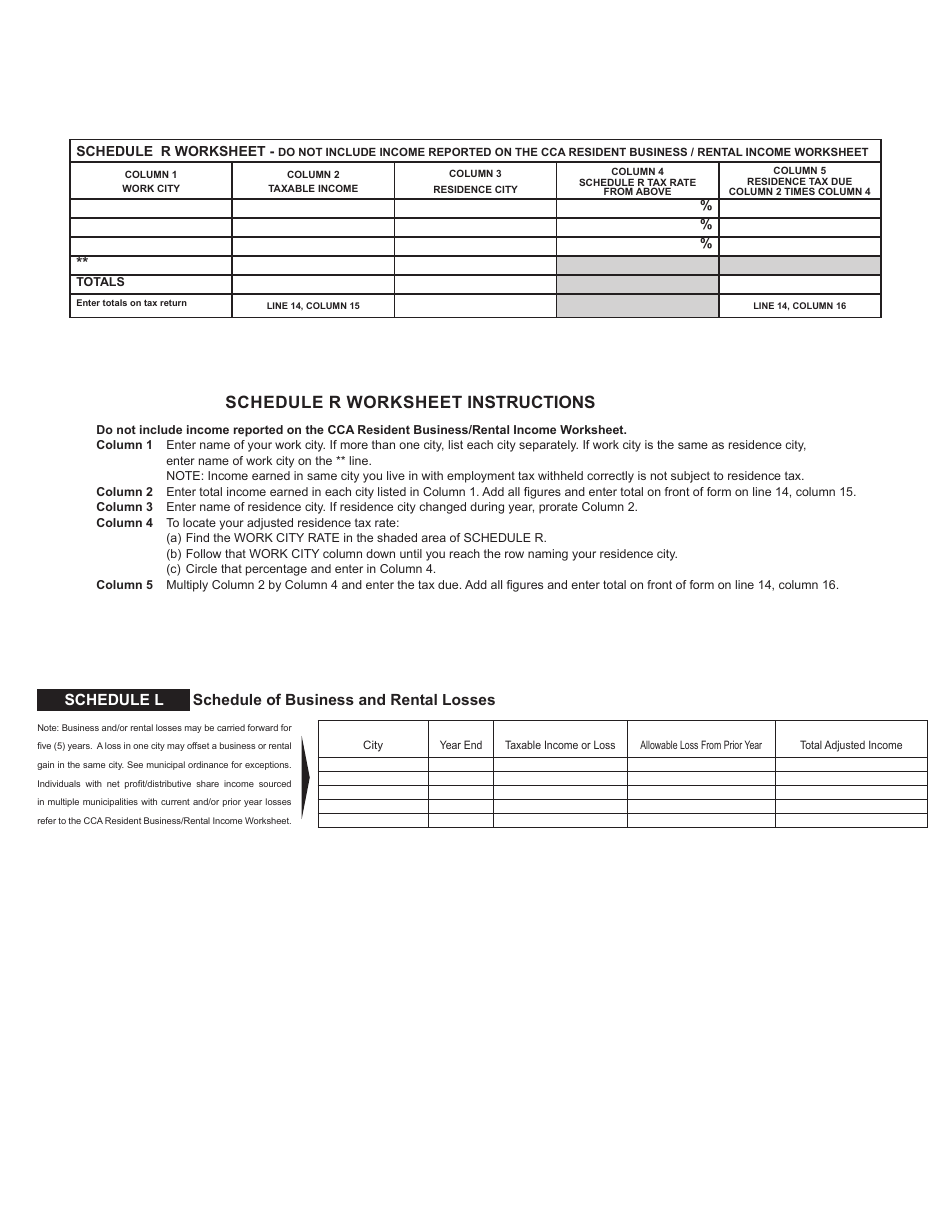

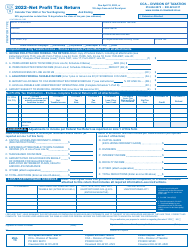

Q: What taxes does the City Tax Form cover?

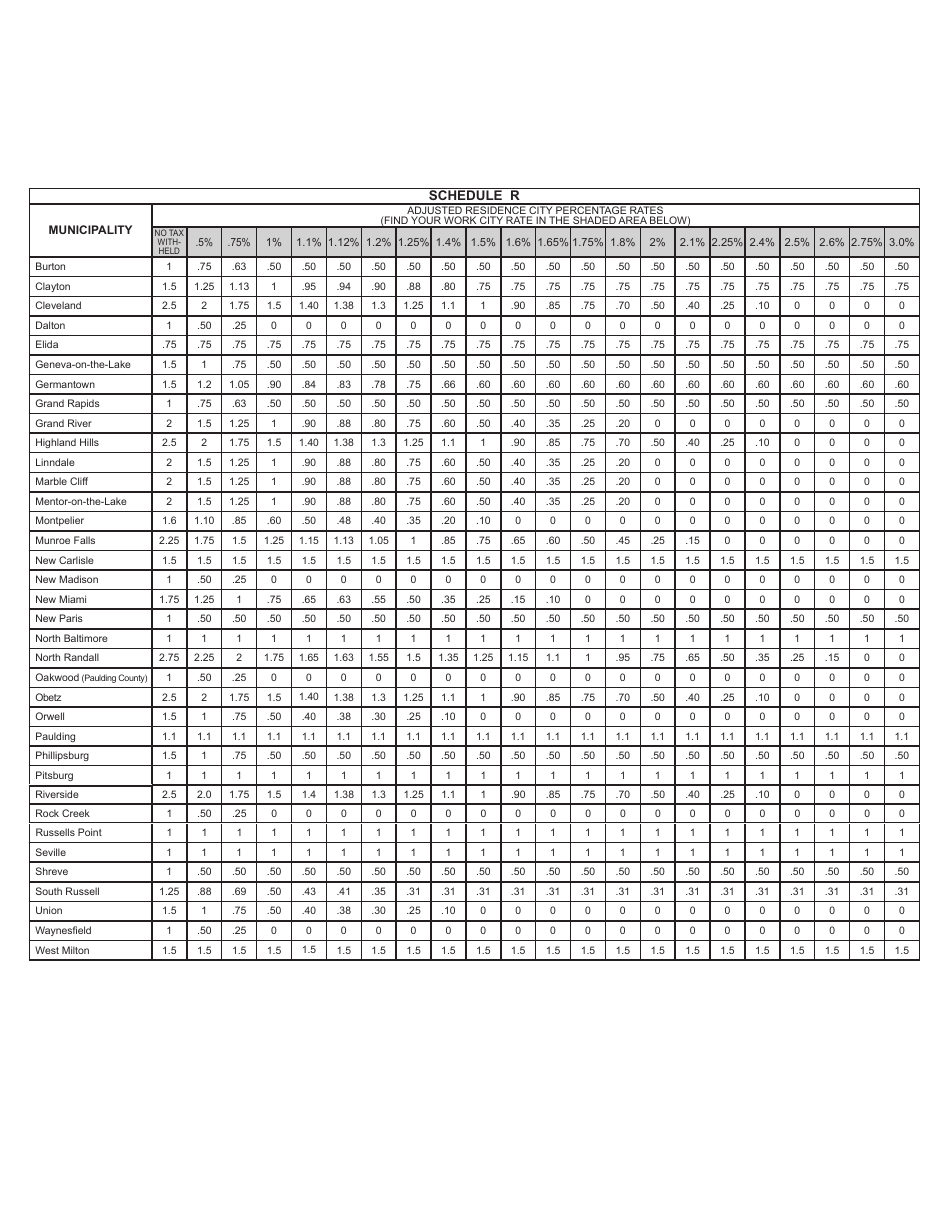

A: The City Tax Form covers the municipal income tax for the city of Cleveland, Ohio.

Q: When is the deadline to file the City Tax Form?

A: The deadline to file the City Tax Form in Cleveland, Ohio is generally April 15th of each year.

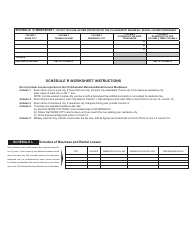

Q: Do I need to include any supporting documentation with the City Tax Form?

A: Yes, you may need to include supporting documentation such as W-2 forms, 1099 forms, and other proof of income with your City Tax Form.

Q: What happens if I don't file the City Tax Form?

A: If you fail to file the City Tax Form in Cleveland, Ohio, you may be subject to penalties and interest on any unpaid taxes.

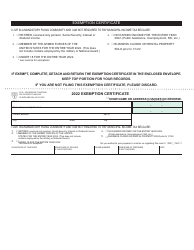

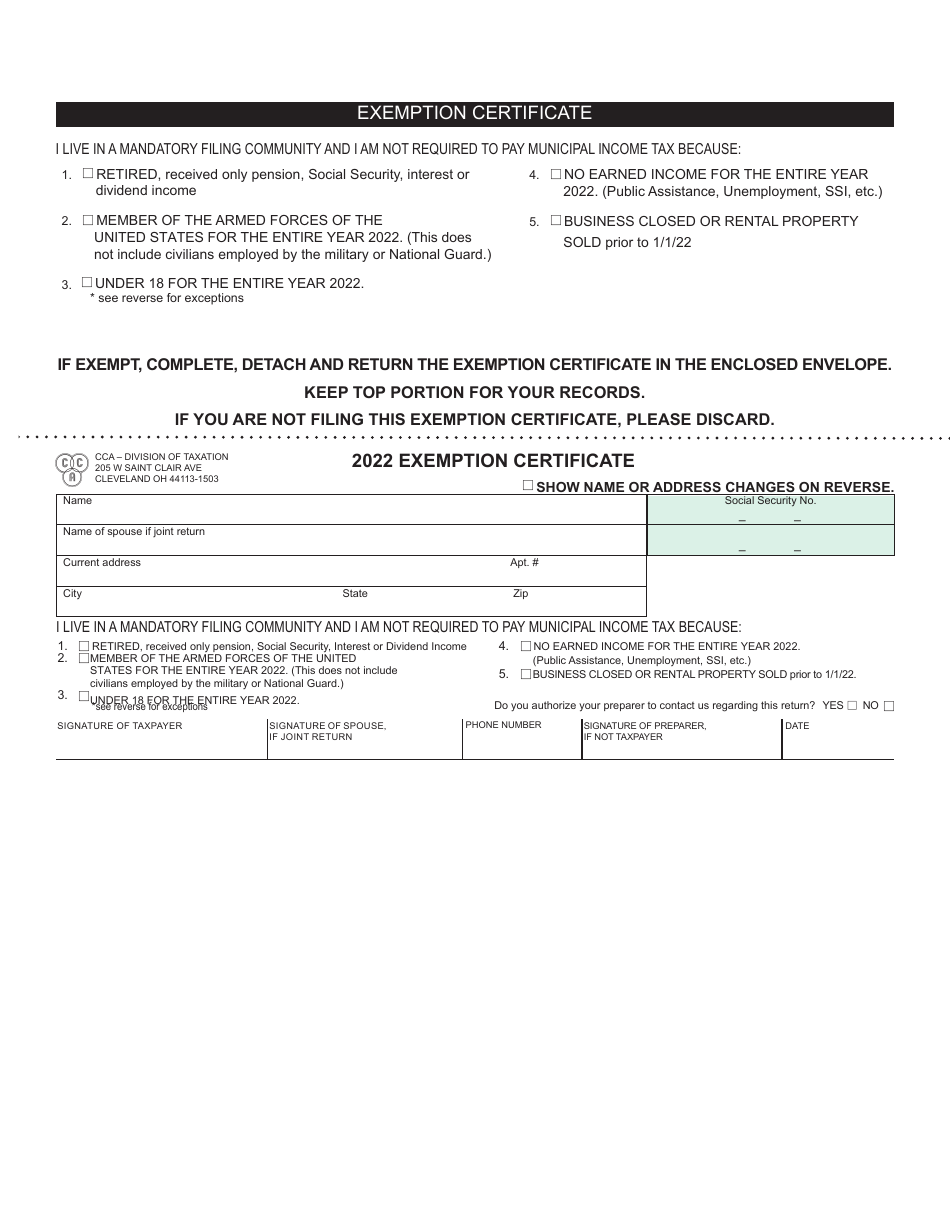

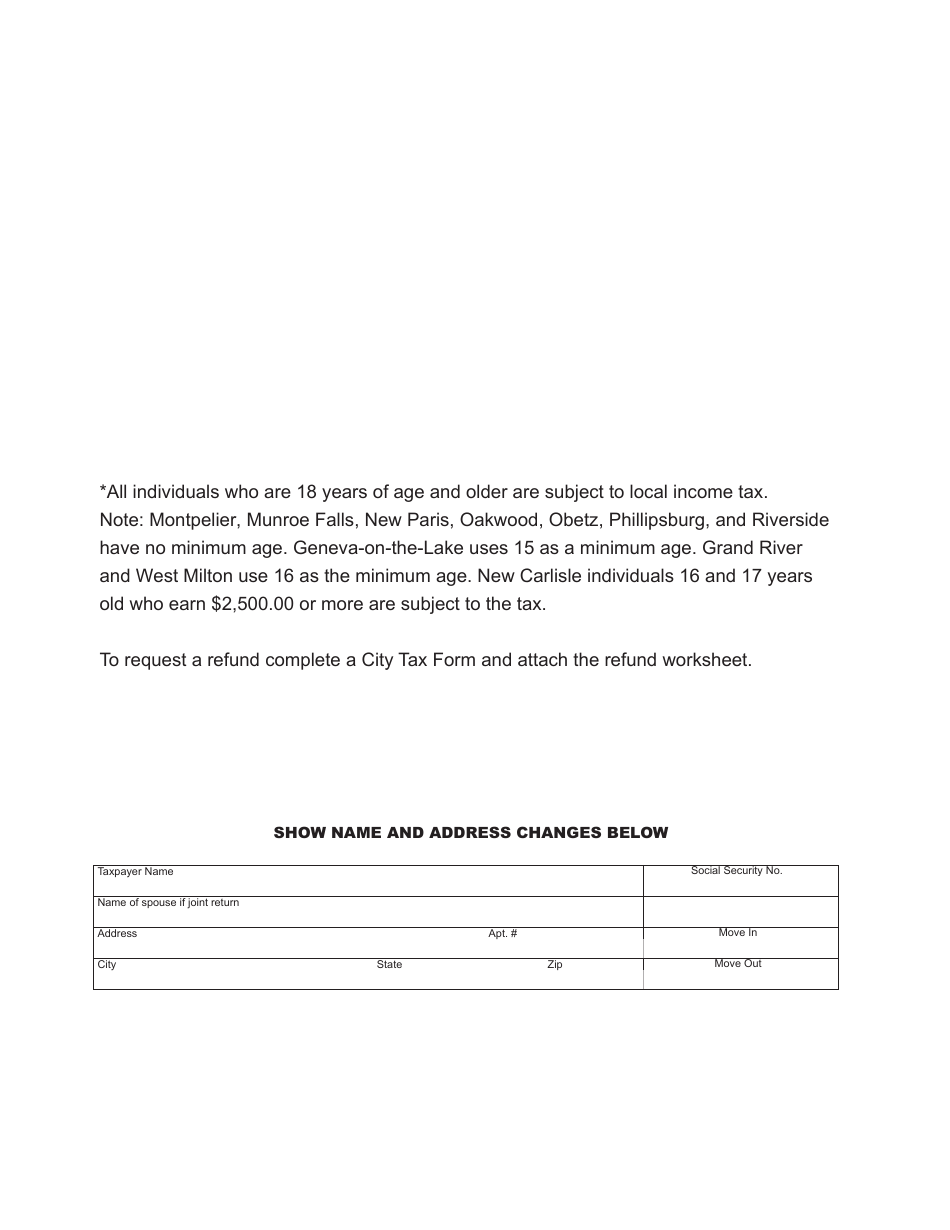

Q: Are there any exemptions or deductions available on the City Tax Form?

A: Yes, there are various exemptions and deductions available on the City Tax Form, such as exemptions for certain types of income or deductions for certain expenses.

Q: Who can I contact for help with the City Tax Form?

A: You can contact the local tax office or the City of Cleveland, Ohio for assistance with the City Tax Form.

Form Details:

- The latest edition currently provided by the Division of Taxation - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Cleveland, Ohio.