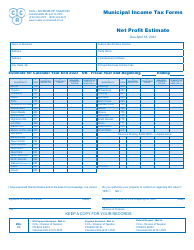

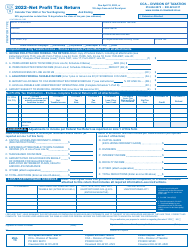

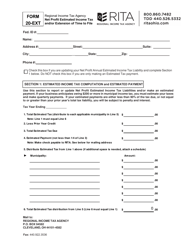

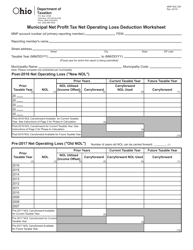

Net Profit Forms Instruction Booklet - City of Cleveland, Ohio

Net Profit Forms Instruction Booklet is a legal document that was released by the Division of Taxation - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

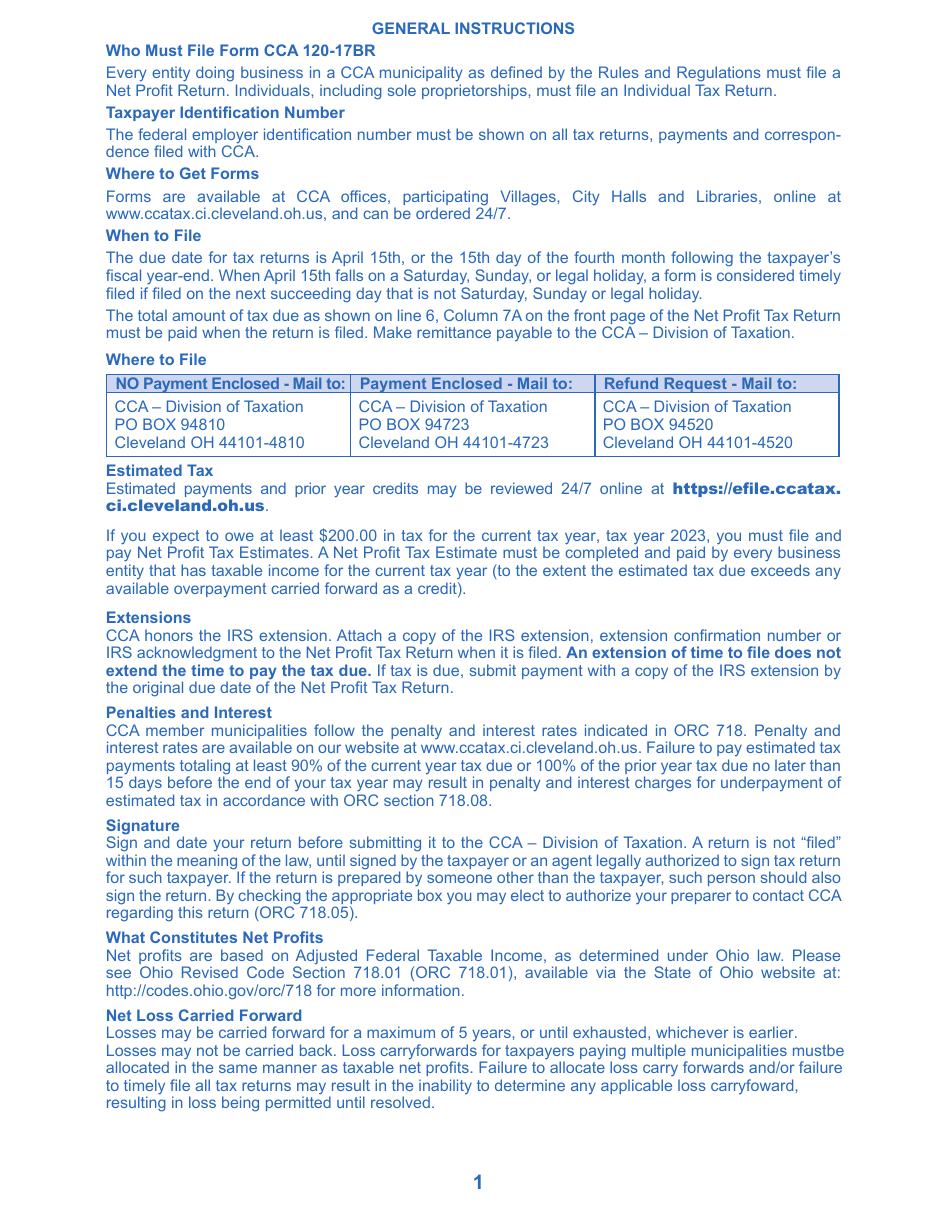

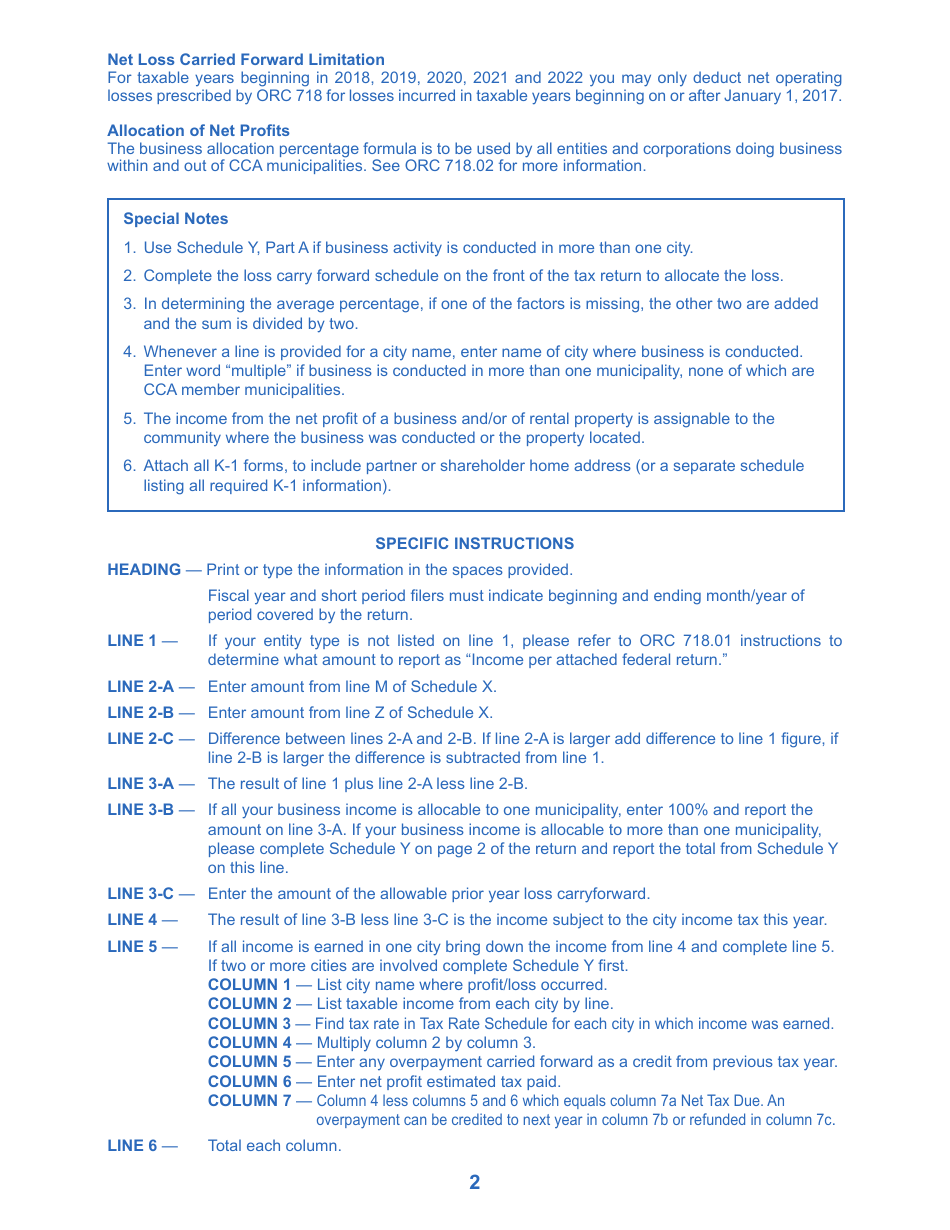

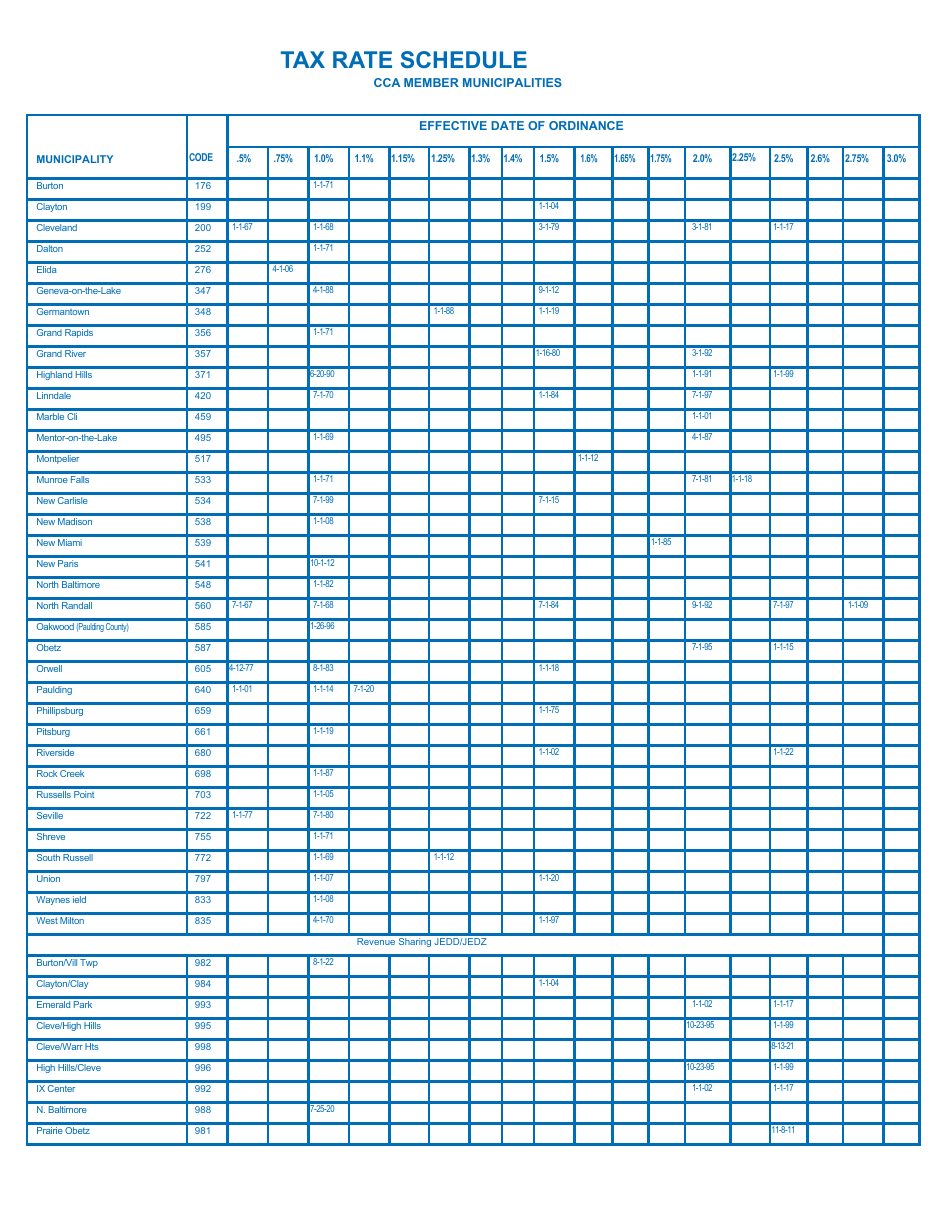

Q: What is the purpose of the Net Profit Forms Instruction Booklet?

A: The Net Profit Forms Instruction Booklet provides guidance on how tofill out the net profit forms for businesses in Cleveland, Ohio.

Q: Who is required to fill out the net profit forms?

A: Businesses operating in Cleveland, Ohio are required to fill out the net profit forms.

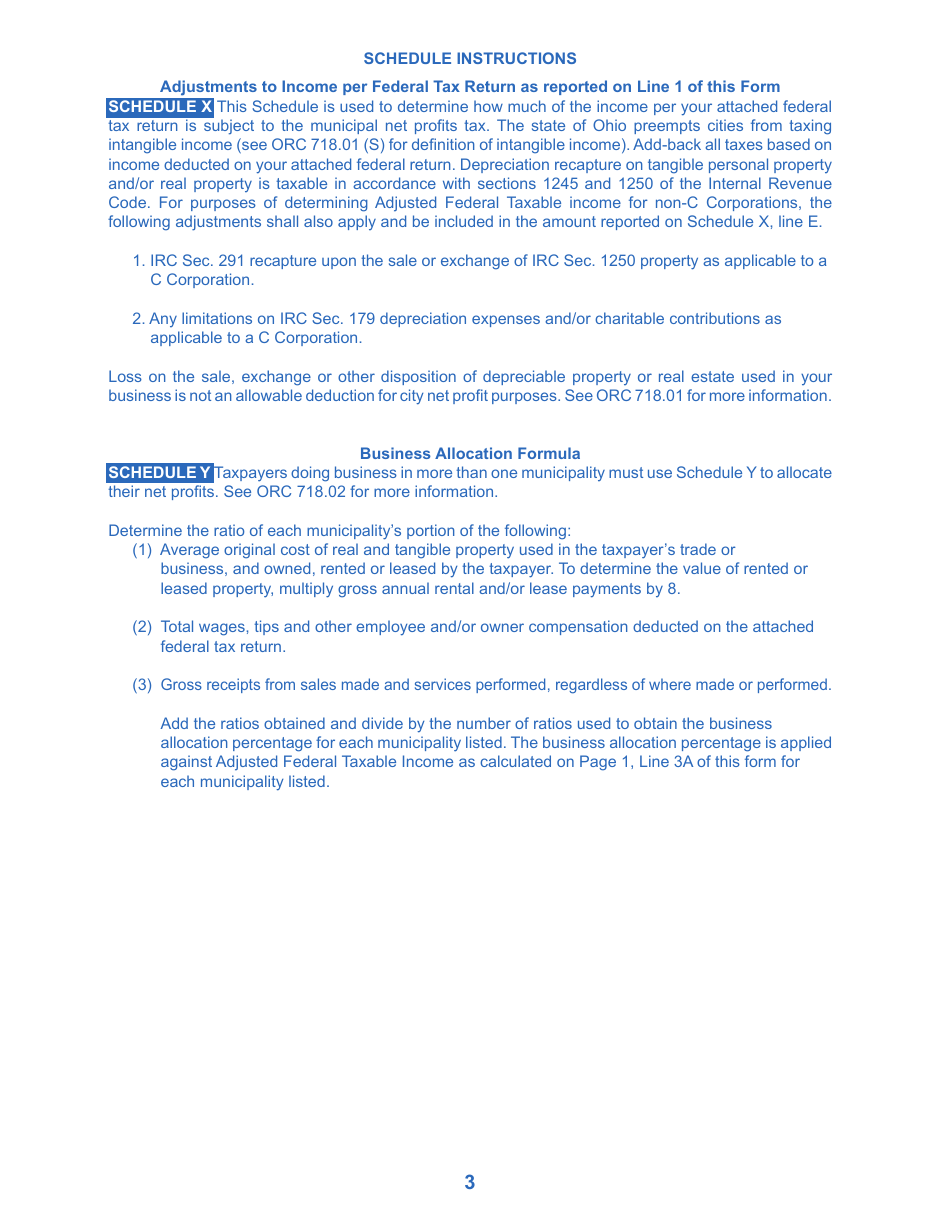

Q: What information is needed to fill out the net profit forms?

A: The net profit forms require information about the business's income, expenses, and net profit.

Q: Are there any deadlines for submitting the net profit forms?

A: Yes, businesses are required to submit the net profit forms by a specific deadline. The exact deadline can be found in the Net Profit Forms Instruction Booklet.

Q: What happens if I don't fill out the net profit forms?

A: Failure to fill out the net profit forms may result in penalties or fines.

Q: Are there any exemptions for filling out the net profit forms?

A: Some businesses may be exempt from filling out the net profit forms. The exemptions are outlined in the Net Profit Forms Instruction Booklet.

Q: Can I get assistance with filling out the net profit forms?

A: Yes, the City of Cleveland, Ohio provides assistance for businesses that need help with filling out the net profit forms. Contact the appropriate department for assistance.

Form Details:

- The latest edition currently provided by the Division of Taxation - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Cleveland, Ohio.