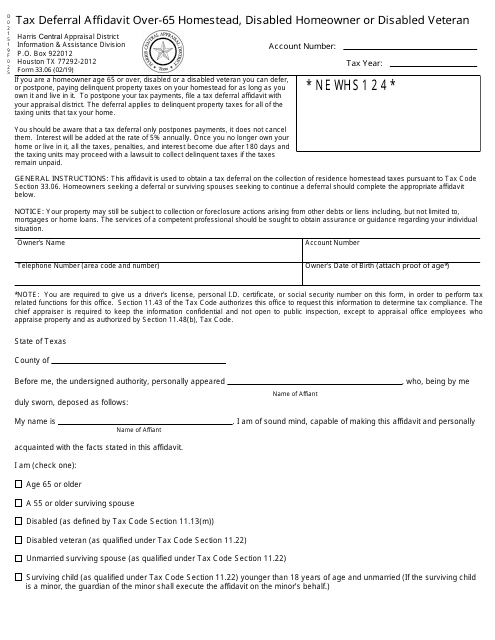

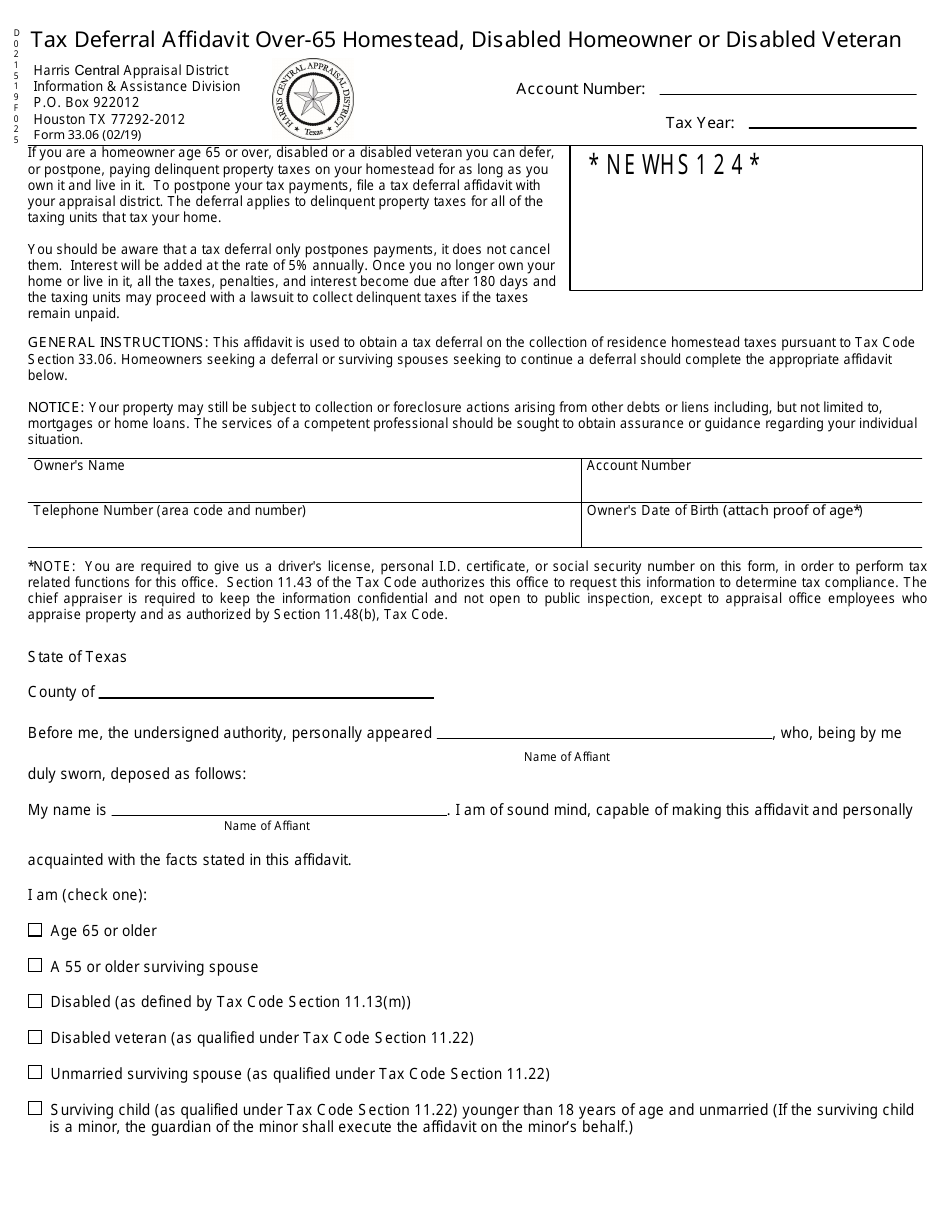

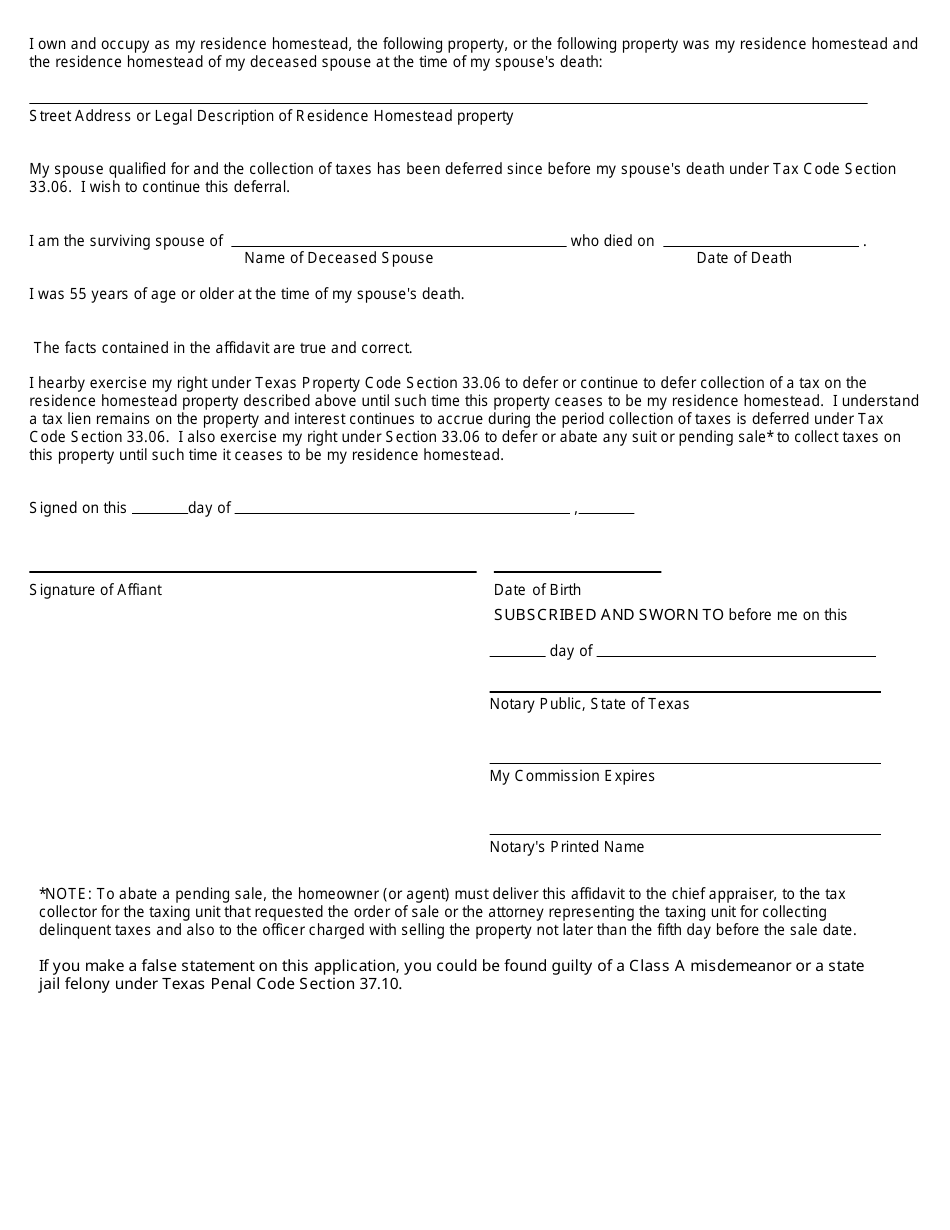

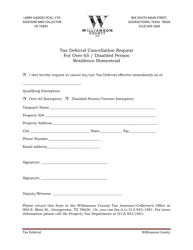

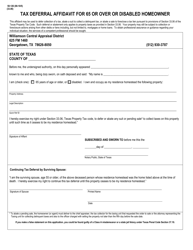

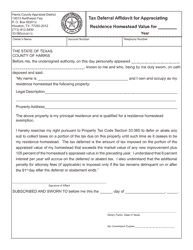

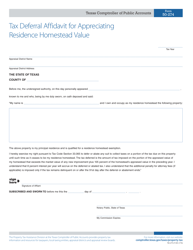

Form 33.06 Tax Deferral Affidavit Over-65 Homestead, Disabled Homeowner or Disabled Veteran - Harris County, Texas

What Is Form 33.06?

This is a legal form that was released by the Appraisal District - Harris County, Texas - a government authority operating within Texas. The form may be used strictly within Harris County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 33.06?

A: Form 33.06 is the Tax Deferral Affidavit specifically for over-65 homestead, disabled homeowner or disabled veteran in Harris County, Texas.

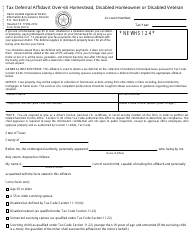

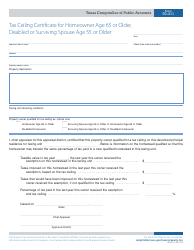

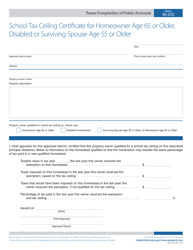

Q: Who is eligible to use Form 33.06?

A: Over-65 homestead owners, disabled homeowners, or disabled veterans in Harris County, Texas are eligible to use Form 33.06.

Q: What is the purpose of Form 33.06?

A: The purpose of Form 33.06 is to allow eligible individuals to defer property taxes on their homestead.

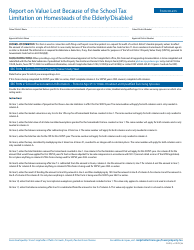

Q: What does 'tax deferral' mean?

A: Tax deferral means postponing the payment of property taxes until a later date.

Q: Who classifies as an over-65 homestead owner?

A: An over-65 homestead owner is a person who is at least 65 years old and resides in their homestead property as their primary residence.

Q: Who qualifies as a disabled homeowner or disabled veteran?

A: A disabled homeowner is a person who has a disability that restricts their ability to engage in gainful employment. A disabled veteran is a person who has a service-related disability.

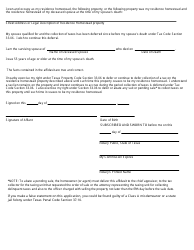

Q: Is there a deadline to submit Form 33.06?

A: Yes, Form 33.06 must be submitted to the Harris County Appraisal District before the delinquency date of the property taxes.

Q: Are there any fees or interest associated with tax deferral?

A: Yes, there are fees and interest associated with tax deferral. The specific details can be found on the Form 33.06.

Q: Can I still sell my property if I have a tax deferral?

A: Yes, you can sell your property even if you have a tax deferral. However, the deferred taxes will become due and payable upon sale.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Appraisal District - Harris County, Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 33.06 by clicking the link below or browse more documents and templates provided by the Appraisal District - Harris County, Texas.