This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

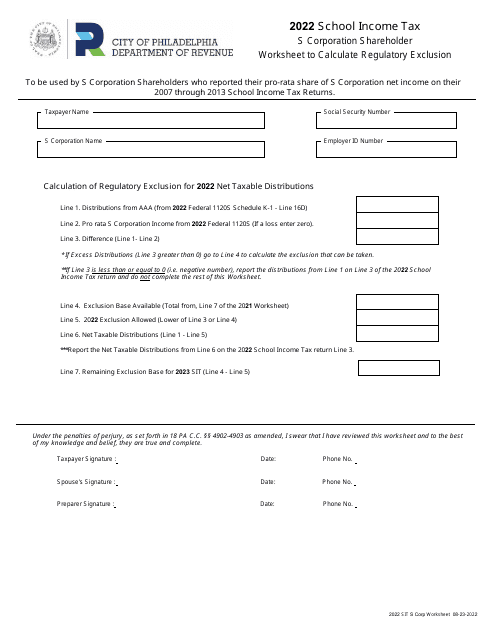

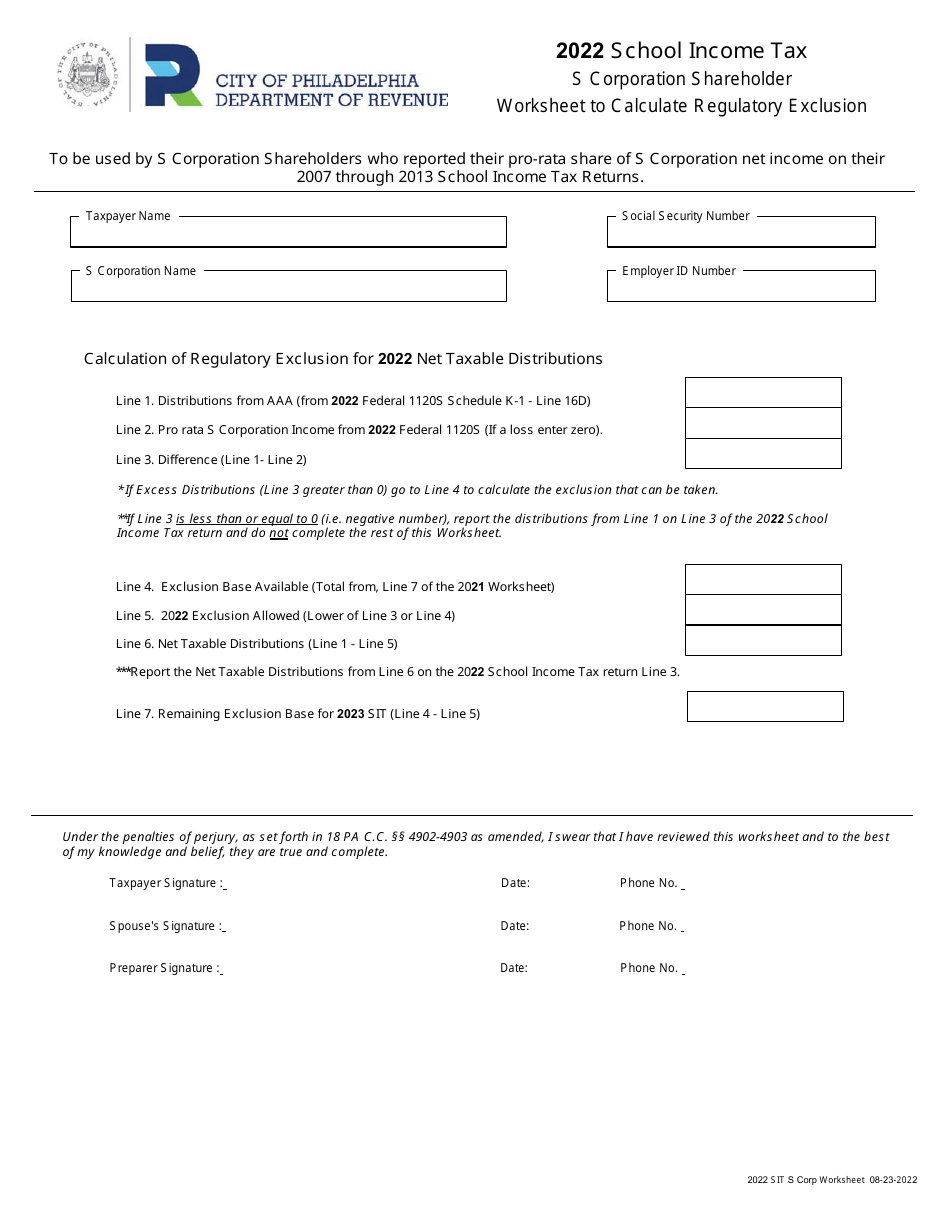

School Income Tax - S Corporation Shareholder Worksheet to Calculate Regulatory Exclusion - City of Philadelphia, Pennsylvania

School Income Tax - S Corporation Shareholder Worksheet to Calculate Regulatory Exclusion is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the School Income Tax?

A: The School Income Tax is a tax imposed on individuals and businesses in the City of Philadelphia, Pennsylvania.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that passes corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes.

Q: What is the Regulatory Exclusion?

A: The Regulatory Exclusion is a provision in the School Income Tax that allows certain S Corporation shareholders to exclude a portion of their income from the tax.

Q: Who is eligible for the Regulatory Exclusion?

A: S Corporation shareholders who meet certain criteria, including holding the stock for at least 6 months and actively participating in the business, may be eligible for the Regulatory Exclusion.

Q: How is the Regulatory Exclusion calculated?

A: The calculation of the Regulatory Exclusion is based on the shareholder's percentage of stock ownership and the corporation's taxable income.

Q: Why is the Regulatory Exclusion important?

A: The Regulatory Exclusion provides a tax benefit for eligible S Corporation shareholders by reducing their taxable income for School Income Tax purposes.

Form Details:

- Released on August 23, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.