This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

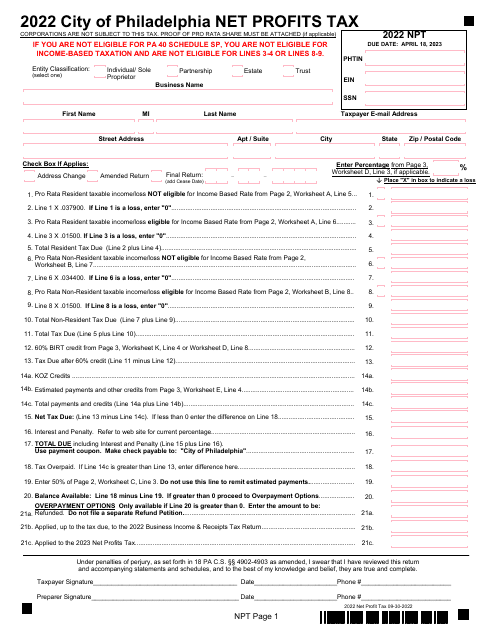

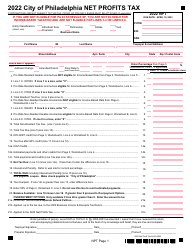

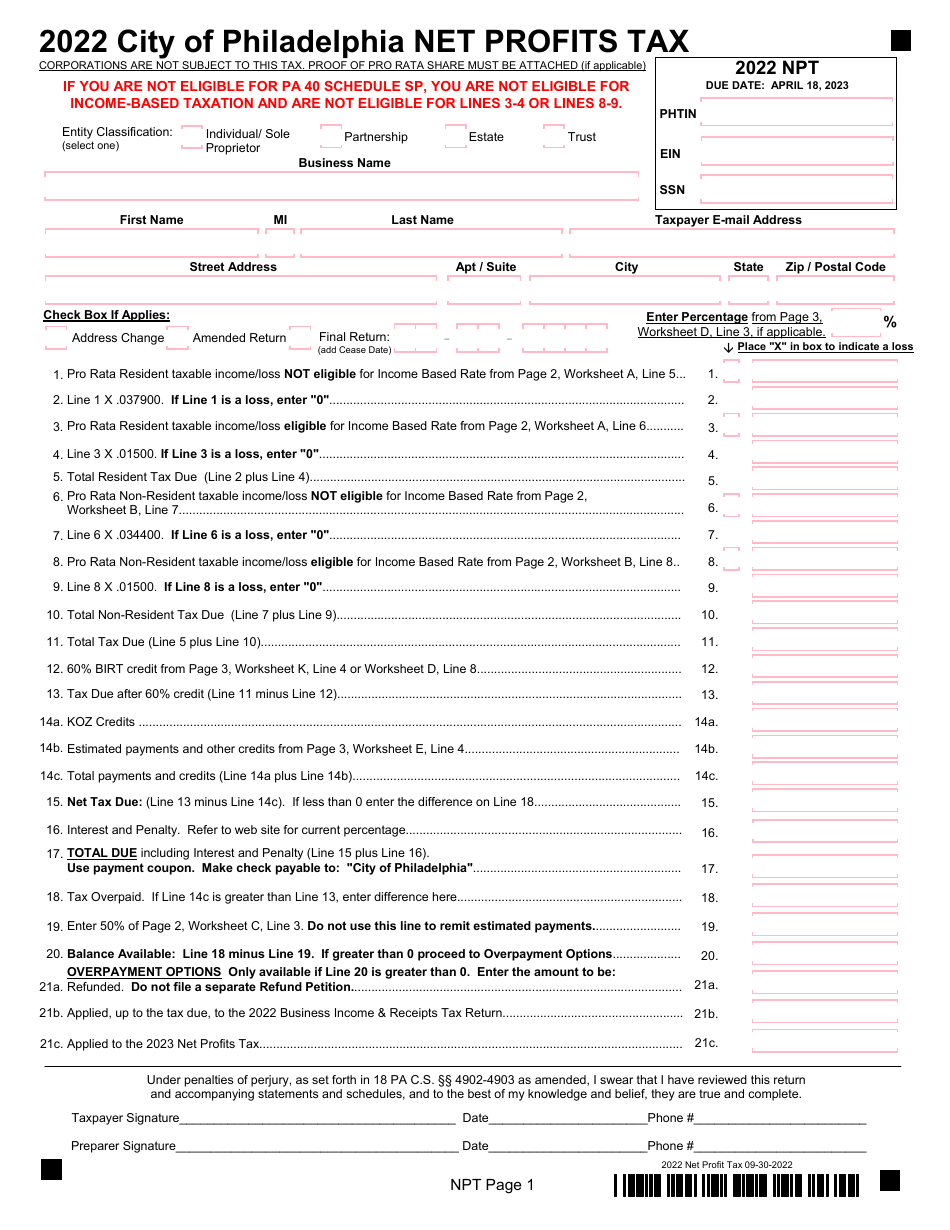

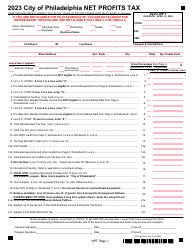

Net Profits Tax - City of Philadelphia, Pennsylvania

Net Profits Tax is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Net Profits Tax?

A: The Net Profits Tax is a tax imposed by the City of Philadelphia in Pennsylvania.

Q: Who is subject to the Net Profits Tax?

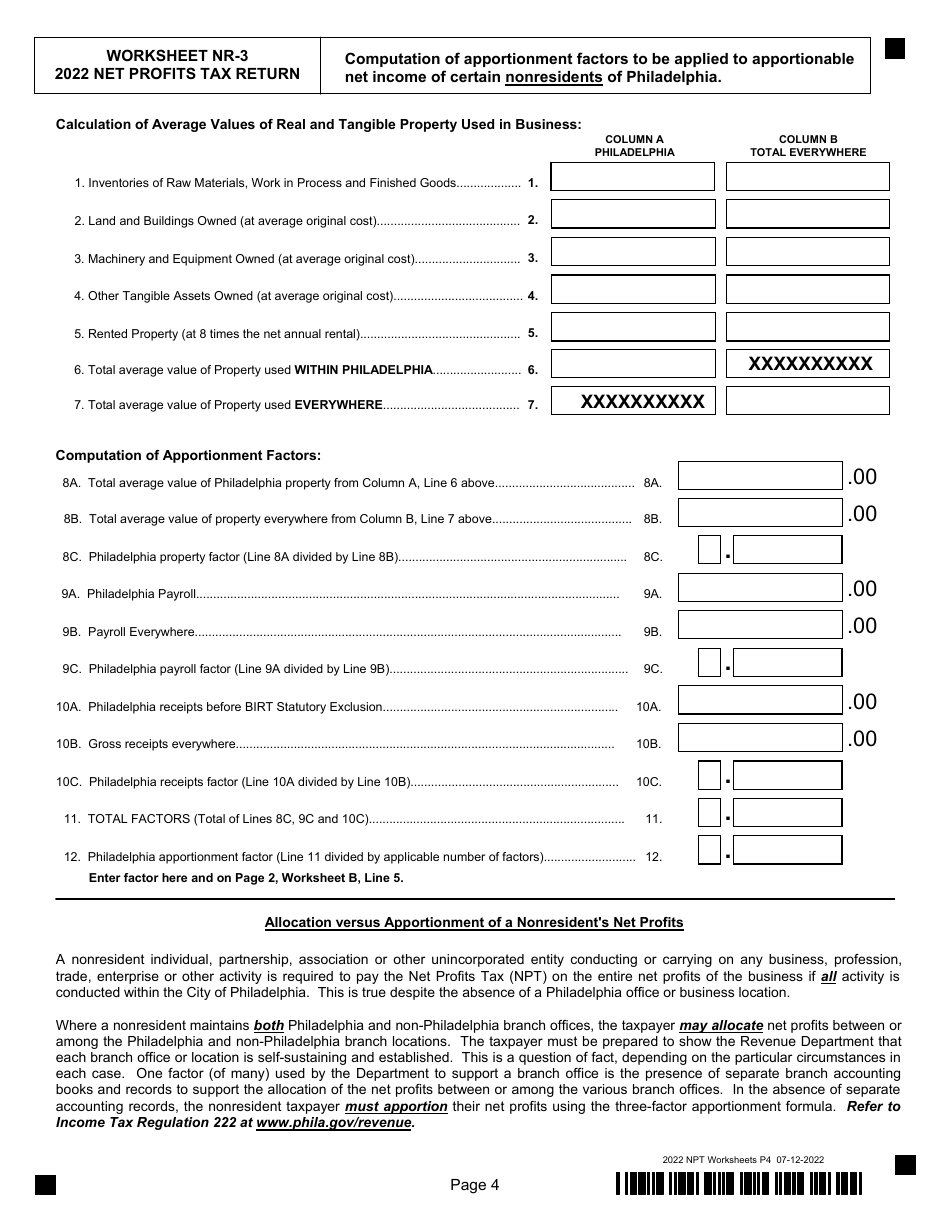

A: All businesses that operate in Philadelphia and generate net profits are subject to the tax.

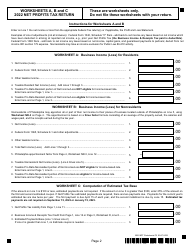

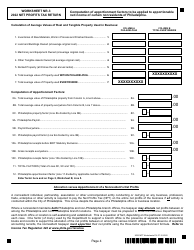

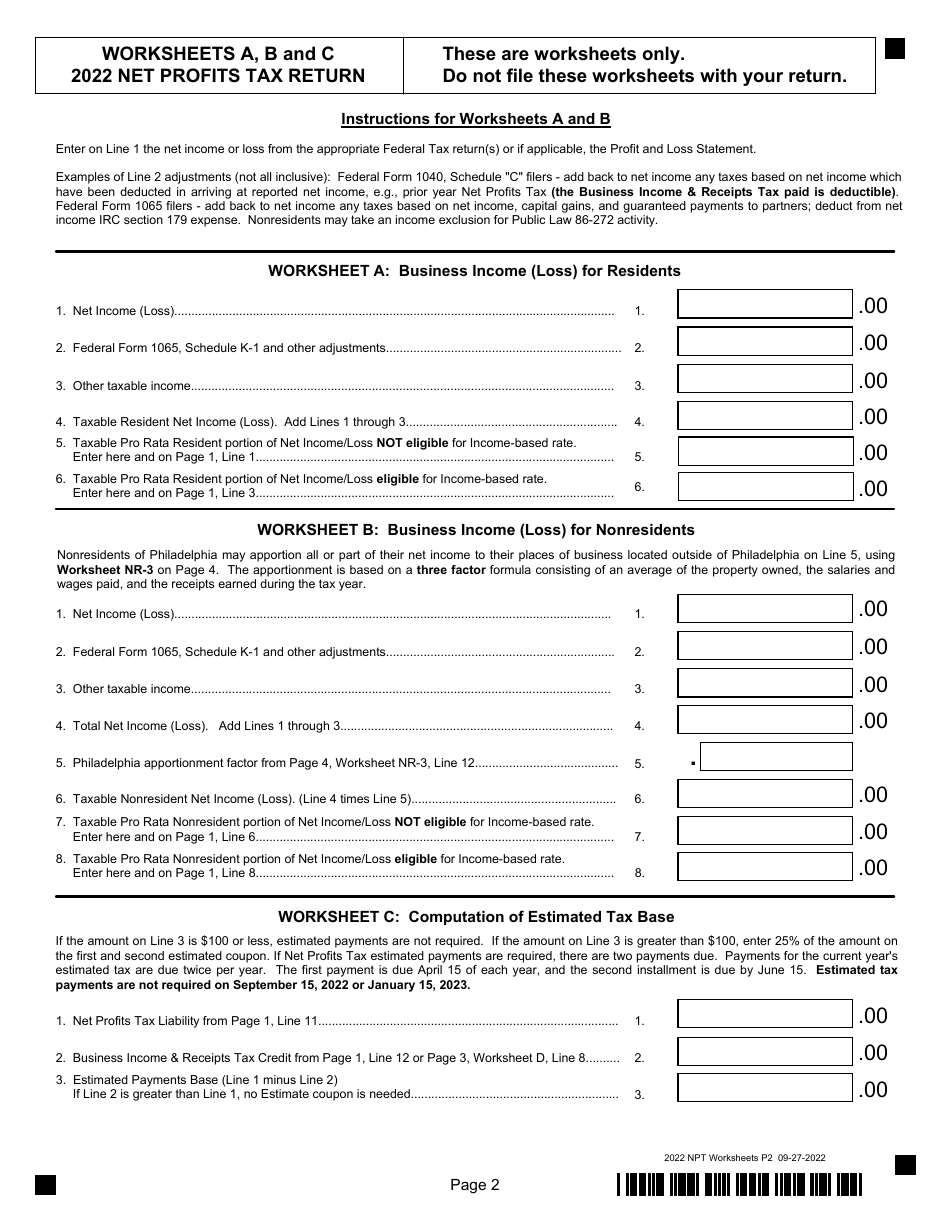

Q: How is the Net Profits Tax calculated?

A: The tax is calculated based on a percentage of a business's net profits.

Q: What is the current Net Profits Tax rate in Philadelphia?

A: The current tax rate for the Net Profits Tax in Philadelphia is 6.45%.

Q: Is there a minimum threshold for the Net Profits Tax?

A: Yes, businesses with net profits less than $100,000 are exempt from the tax.

Q: When is the Net Profits Tax return due?

A: The Net Profits Tax return is generally due by April 15th of each year.

Q: Can I deduct expenses from my net profits before calculating the tax?

A: Yes, businesses can deduct allowable expenses from their net profits before calculating the tax.

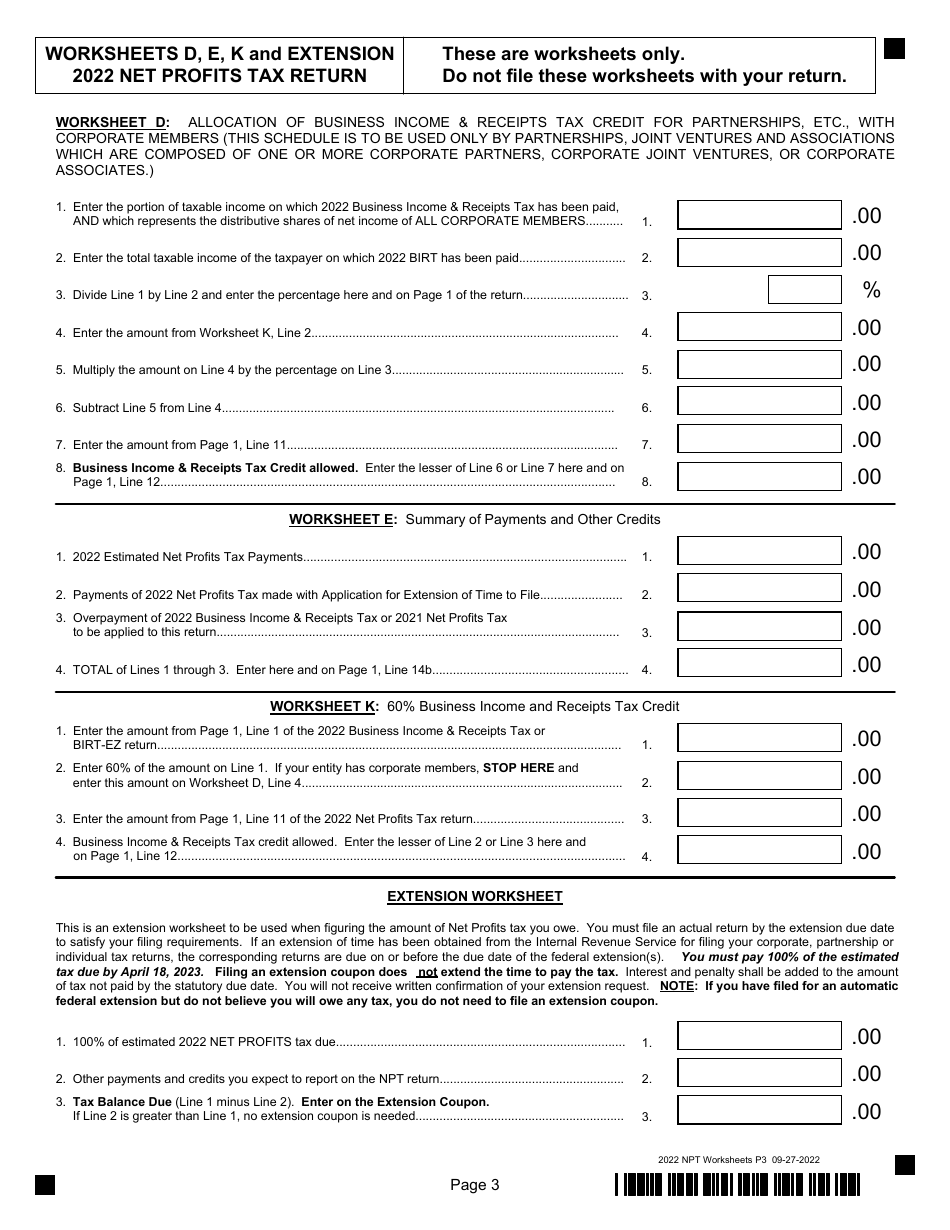

Q: Are there any credits or exemptions available for the Net Profits Tax?

A: Yes, there are various credits and exemptions available for certain businesses and industries.

Q: Who do I contact for more information about the Net Profits Tax in Philadelphia?

A: For more information about the Net Profits Tax, you can contact the Department of Revenue of the City of Philadelphia.

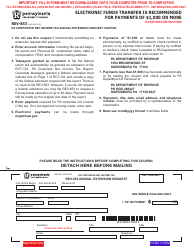

Form Details:

- Released on September 30, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.