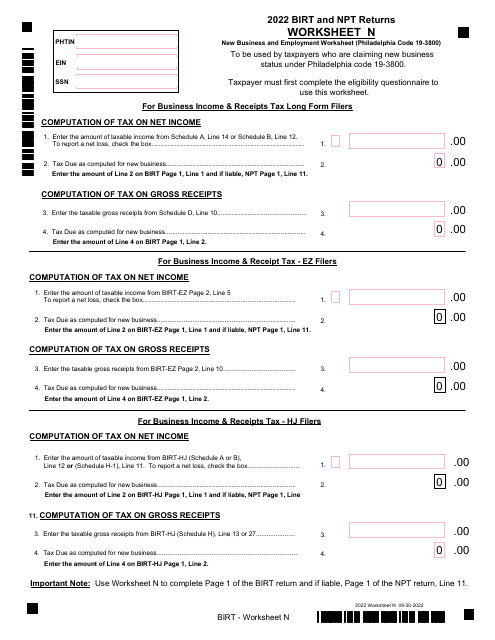

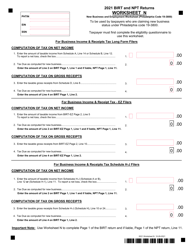

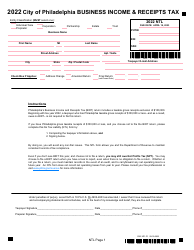

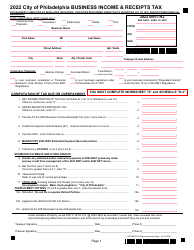

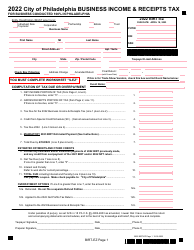

Form BIRT Worksheet N Birt and Npt Returns - City of Philadelphia, Pennsylvania

What Is Form BIRT Worksheet N?

This is a legal form that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a BIRT Worksheet?

A: A BIRT worksheet is a form used to file Business Income and Receipts Tax (BIRT) returns in the City of Philadelphia, Pennsylvania.

Q: What is a N BIRT return?

A: An N BIRT return is a specific type of Business Income and Receipts Tax (BIRT) return.

Q: What is a Npt return?

A: An Npt return refers to the Net Profits Tax (NPT) return.

Q: What is the purpose of filing BIRT returns?

A: The purpose of filing BIRT returns is to report and pay taxes on business income and receipts in the City of Philadelphia, Pennsylvania.

Q: What is the Net Profits Tax (NPT)?

A: The Net Profits Tax (NPT) is a tax imposed on net profits earned by businesses in the City of Philadelphia, Pennsylvania.

Q: Are BIRT returns required to be filed in Philadelphia?

A: Yes, BIRT returns are required to be filed in Philadelphia if you have business income and receipts in the city.

Q: What is Pennsylvania's tax system?

A: Pennsylvania has a relatively complex tax system which includes various taxes, including the BIRT and NPT.

Q: What is the due date for BIRT returns?

A: The due date for BIRT returns in the City of Philadelphia varies depending on the filing status, but generally falls on April 15th.

Form Details:

- Released on September 30, 2022;

- The latest edition provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BIRT Worksheet N by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.