This version of the form is not currently in use and is provided for reference only. Download this version of

Form SEV502 (RV-R0002101)

for the current year.

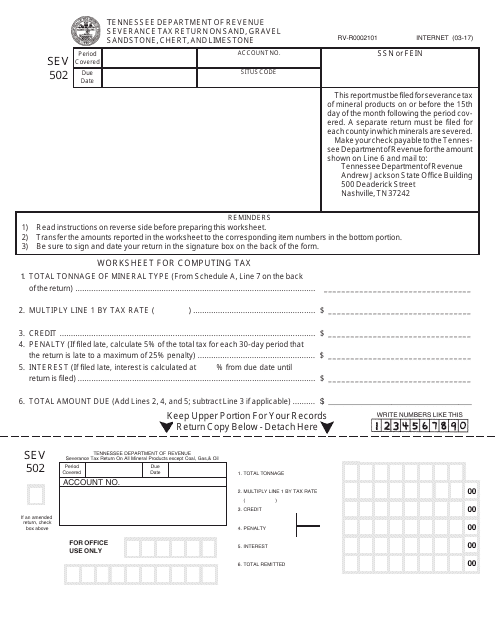

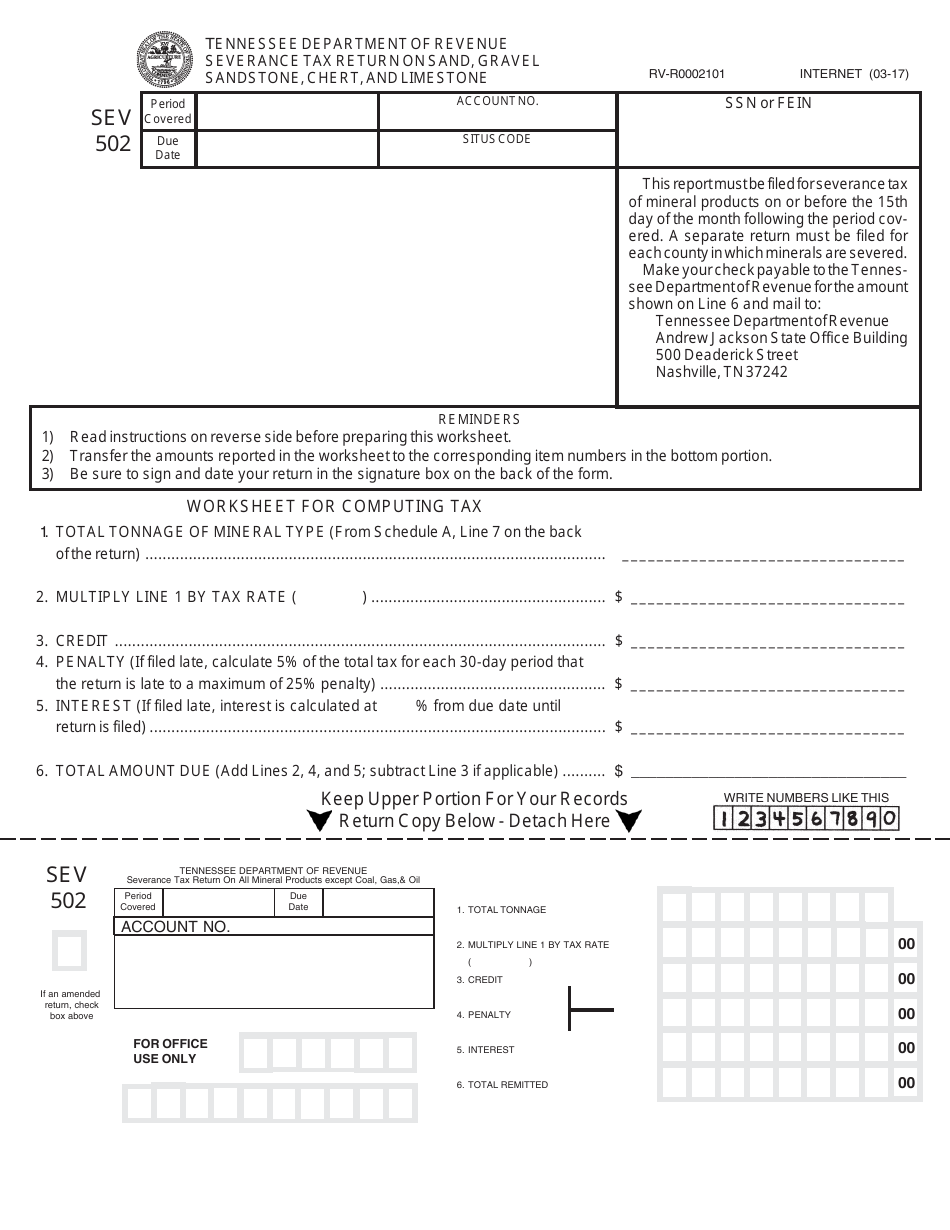

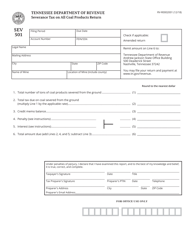

Form SEV502 (RV-R0002101) Severance Tax Return on Sand, Gravel Sandstone, Chert, and Limestone - for Tax Periods Prior to May 1, 2019 - Tennessee

What Is Form SEV502 (RV-R0002101)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SEV502?

A: Form SEV502 is the Severance Tax Return specifically for sand, gravel, sandstone, chert, and limestone.

Q: Who should file Form SEV502?

A: Anyone who extracted or produced sand, gravel, sandstone, chert, or limestone in Tennessee and is liable for severance tax.

Q: What are the tax periods covered by Form SEV502?

A: Form SEV502 is for tax periods prior to May 1, 2019.

Q: What is the purpose of the Severance Tax Return?

A: The purpose of the Severance Tax Return is to report and pay the severance tax owed on the extraction or production of sand, gravel, sandstone, chert, or limestone.

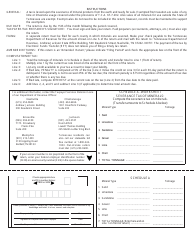

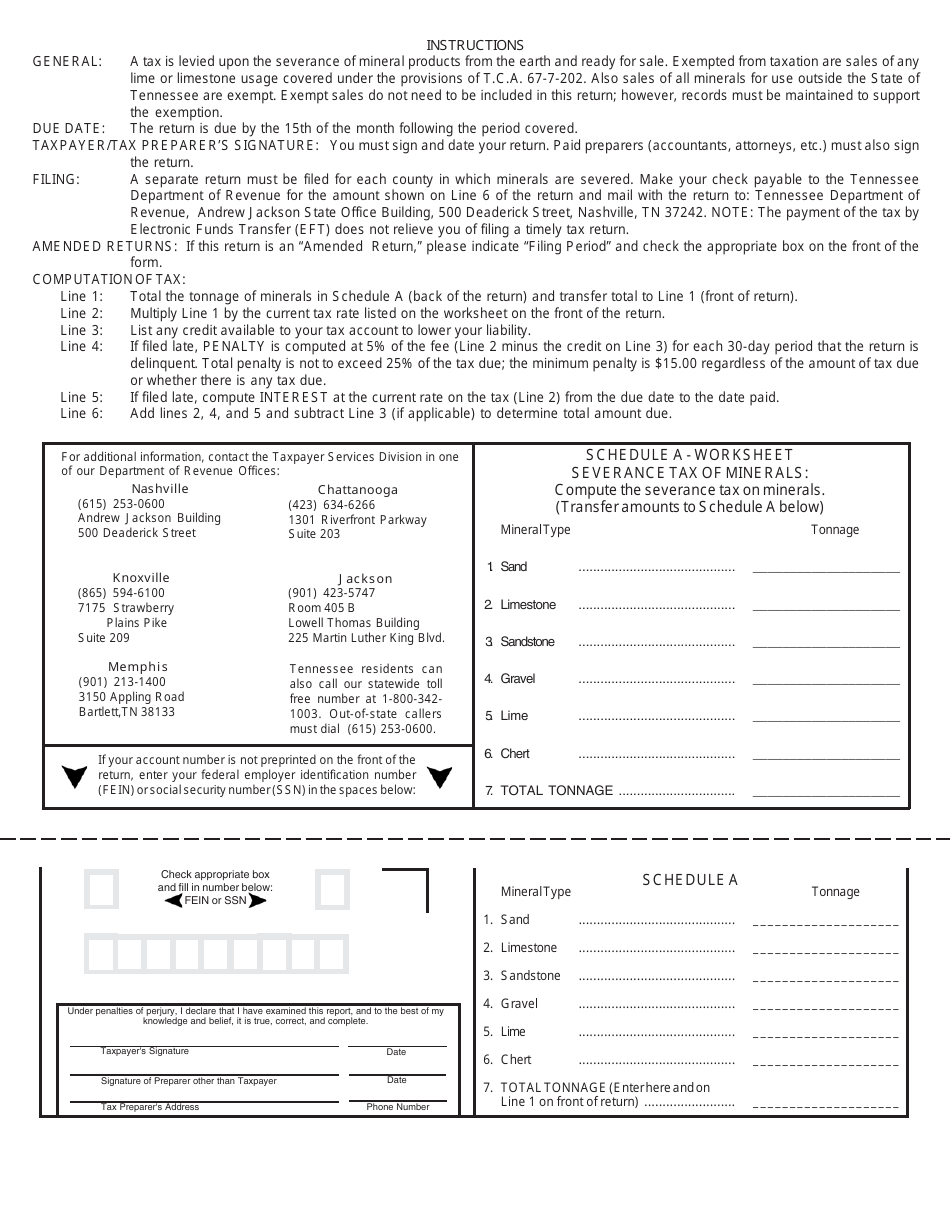

Q: When is Form SEV502 due?

A: Form SEV502 must be filed and the tax paid on or before the 20th day of the month following the tax period.

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing or non-payment, including interest charges and potential legal action.

Q: Can I file Form SEV502 electronically?

A: No, as of the given document's tax periods, electronic filing is not available for Form SEV502.

Q: Are there any exemptions or deductions available for severance tax?

A: The specific exemptions and deductions available for severance tax depend on the laws and regulations of Tennessee. It is recommended to consult the official instructions or a tax professional for detailed information.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SEV502 (RV-R0002101) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.