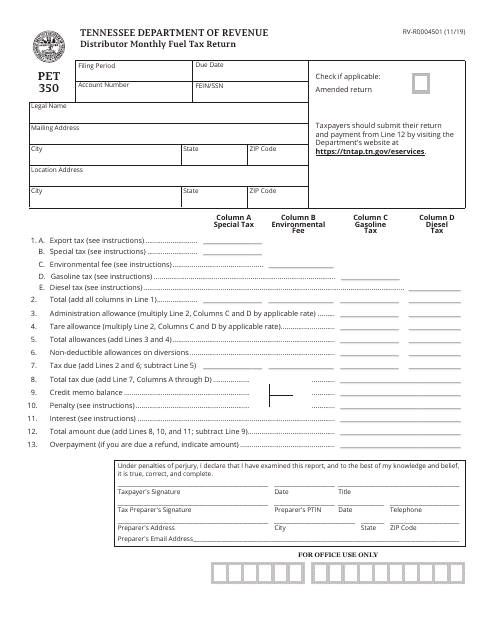

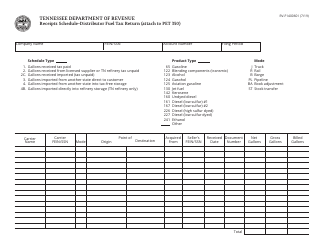

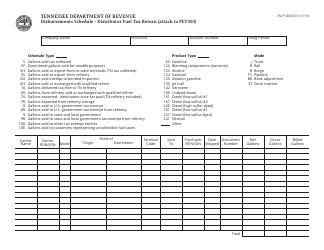

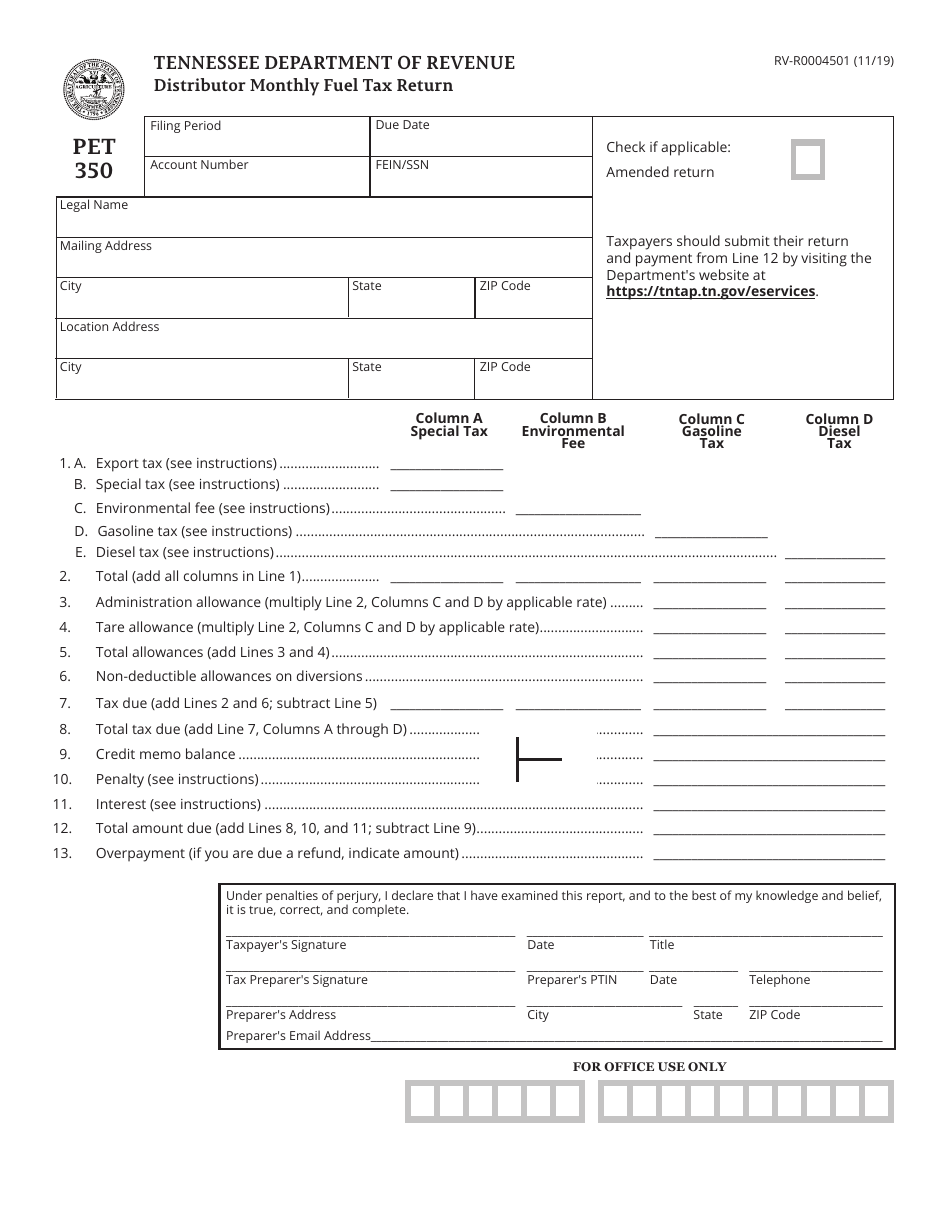

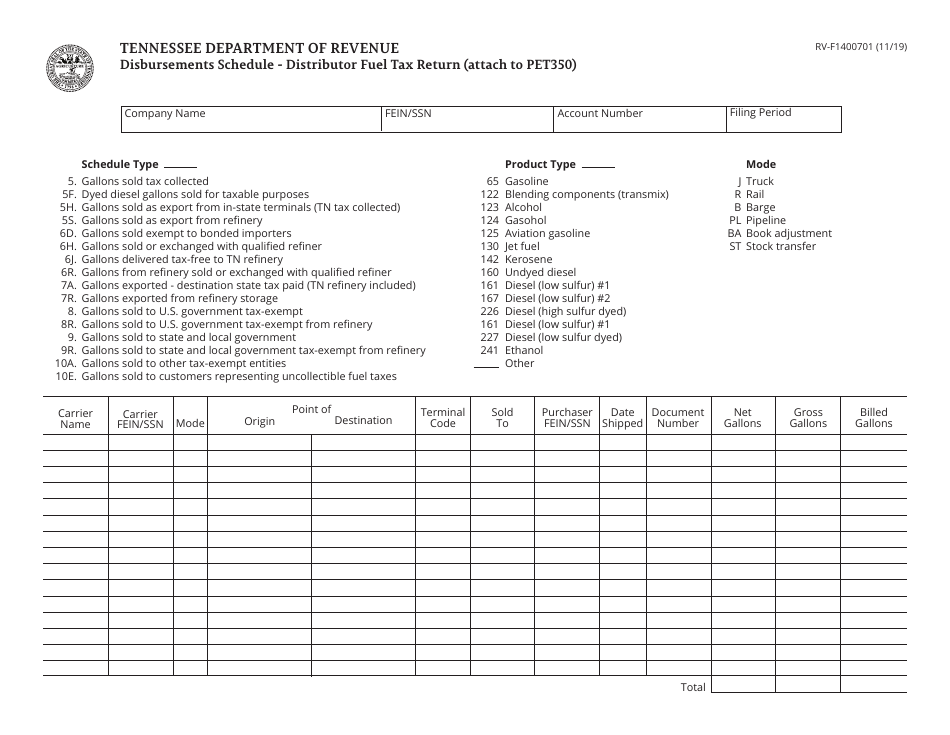

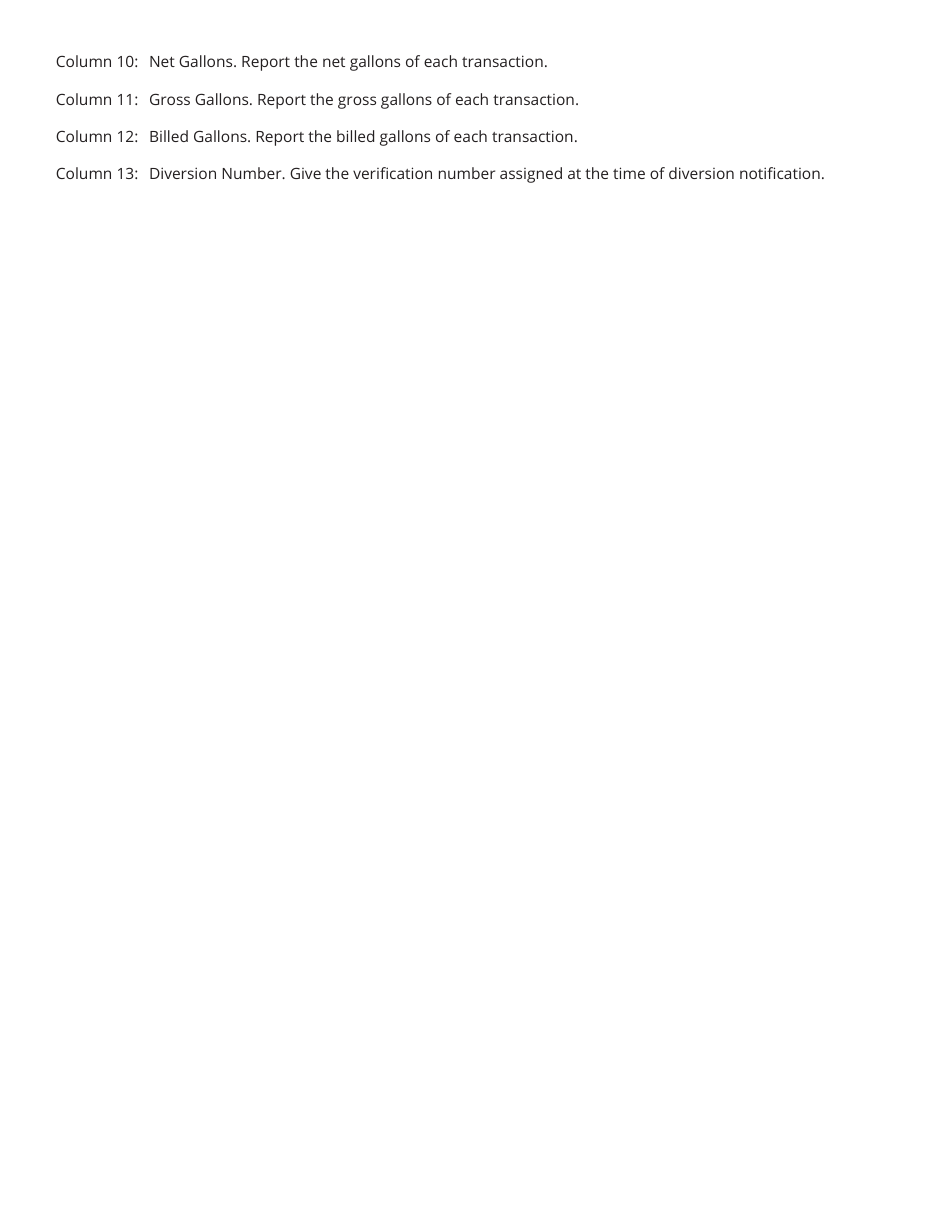

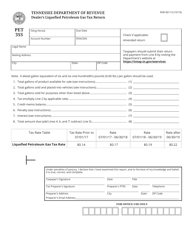

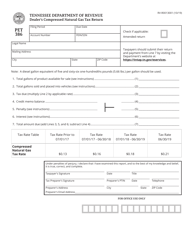

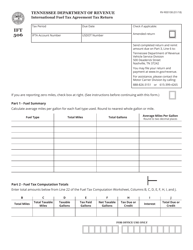

Form PET350 (RV-R0004501) Distributor Monthly Fuel Tax Return - Tennessee

What Is Form PET350 (RV-R0004501)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET350?

A: Form PET350 is the Distributor Monthly Fuel Tax Return in Tennessee.

Q: What is the purpose of Form PET350?

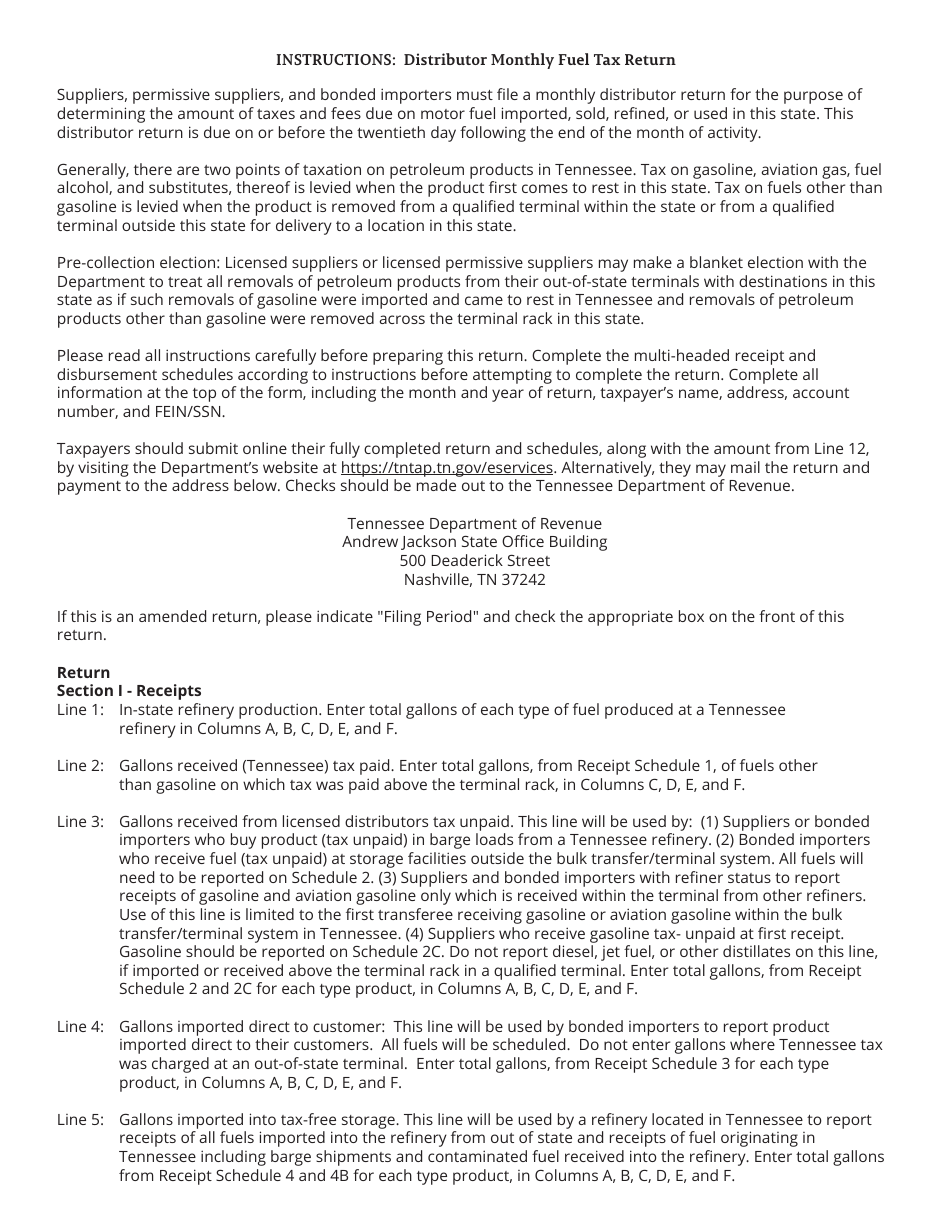

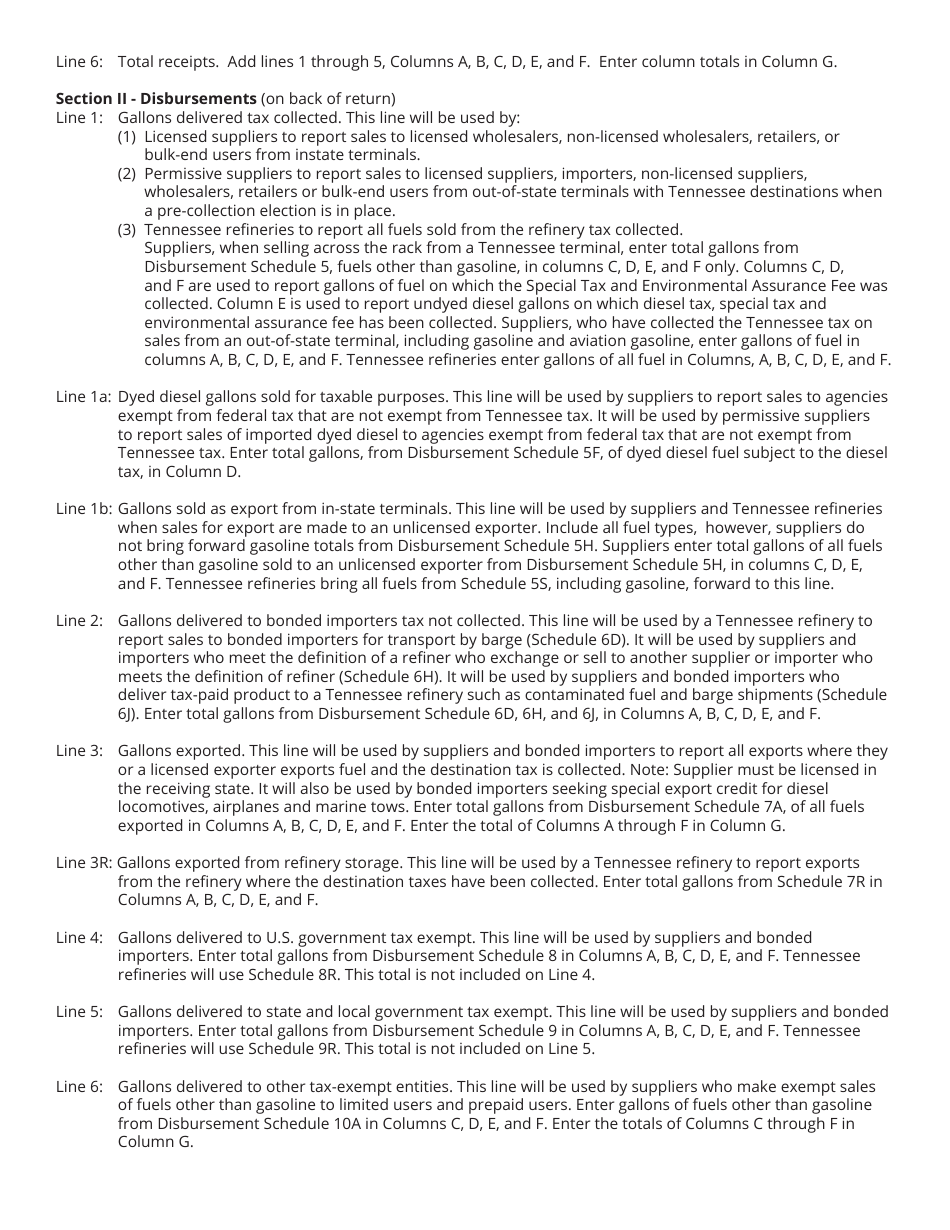

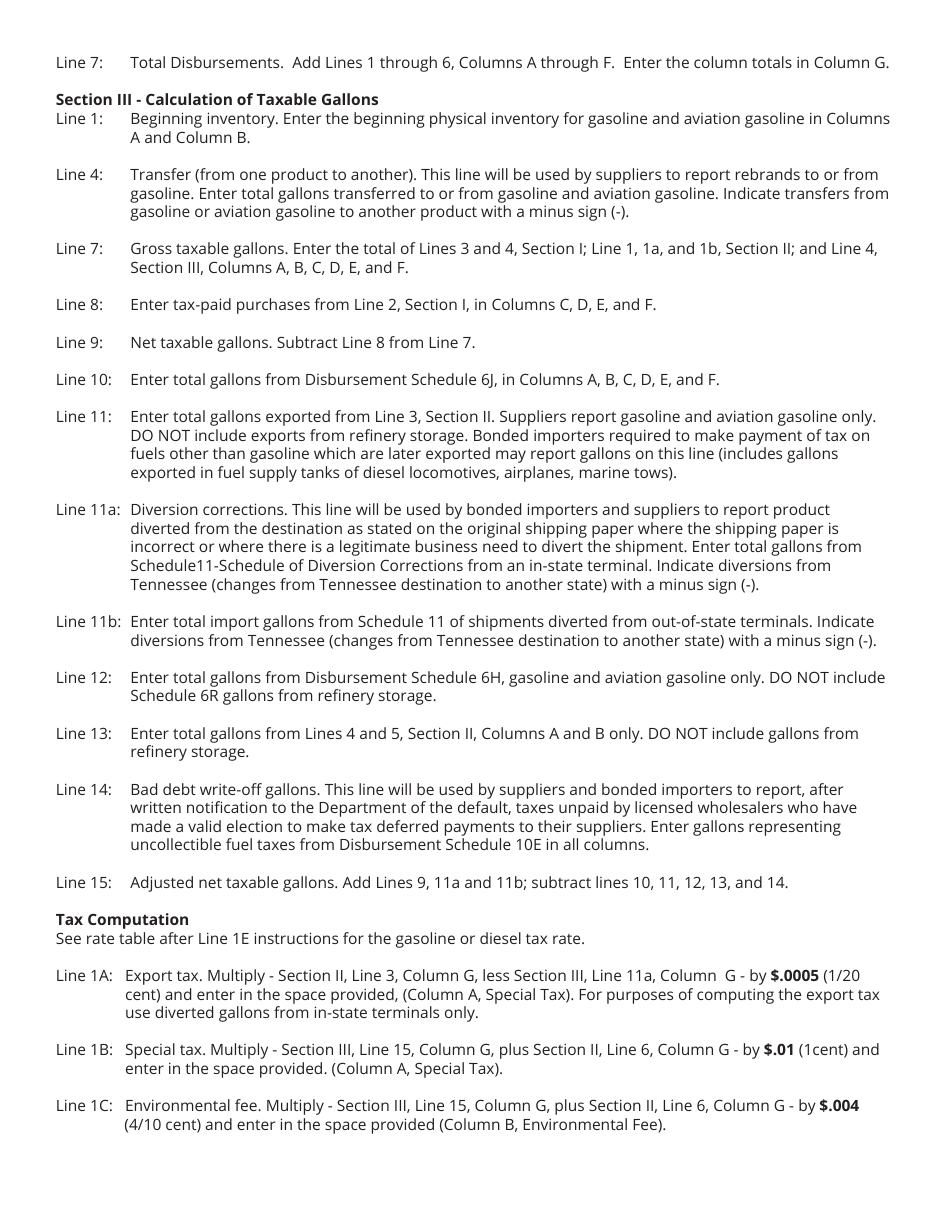

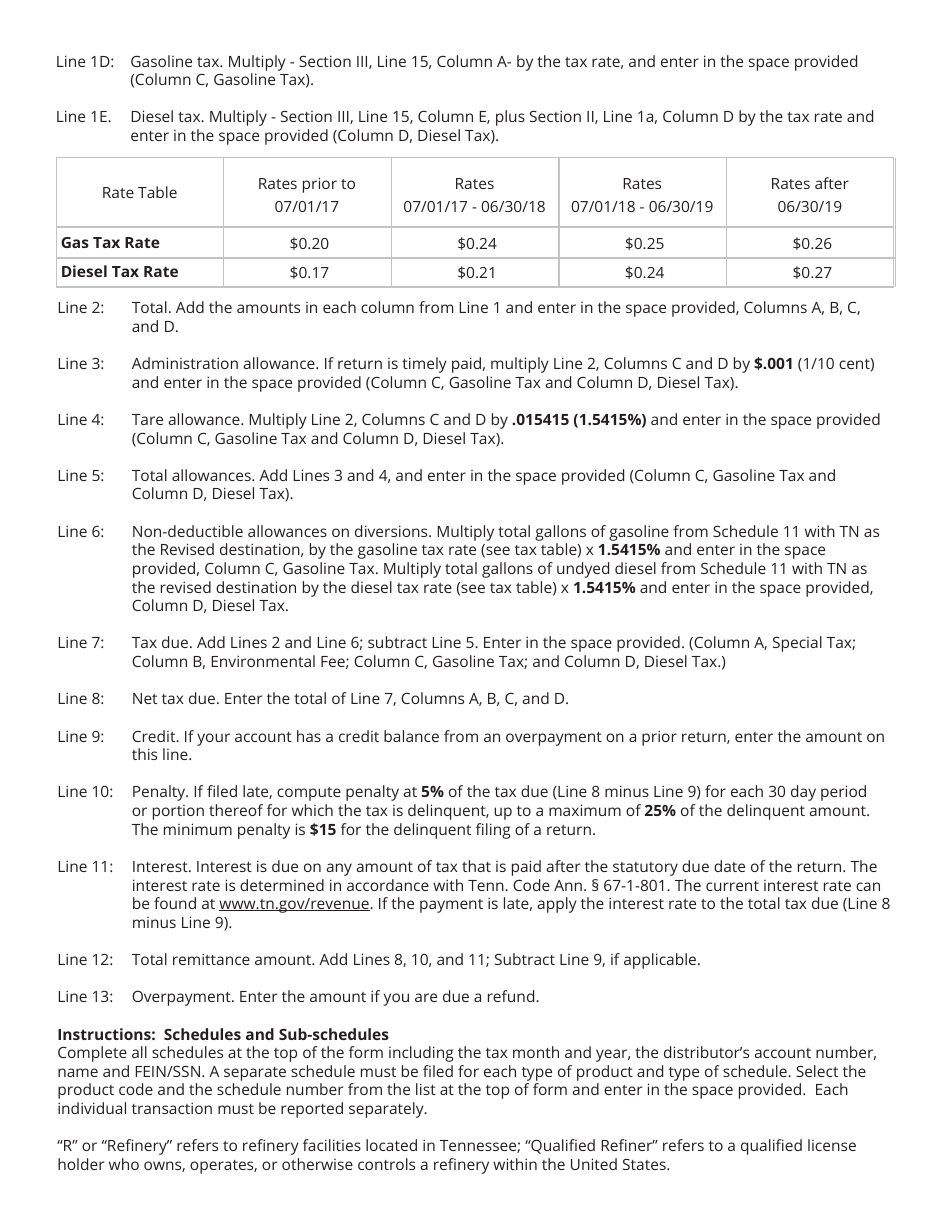

A: The purpose of Form PET350 is to report and pay fuel tax by distributors in Tennessee.

Q: Who needs to file Form PET350?

A: Distributors of fuel in Tennessee need to file Form PET350.

Q: How often do I need to file Form PET350?

A: Form PET350 needs to be filed monthly by distributors.

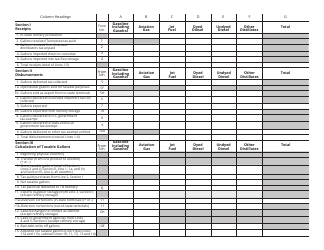

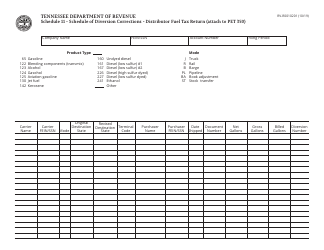

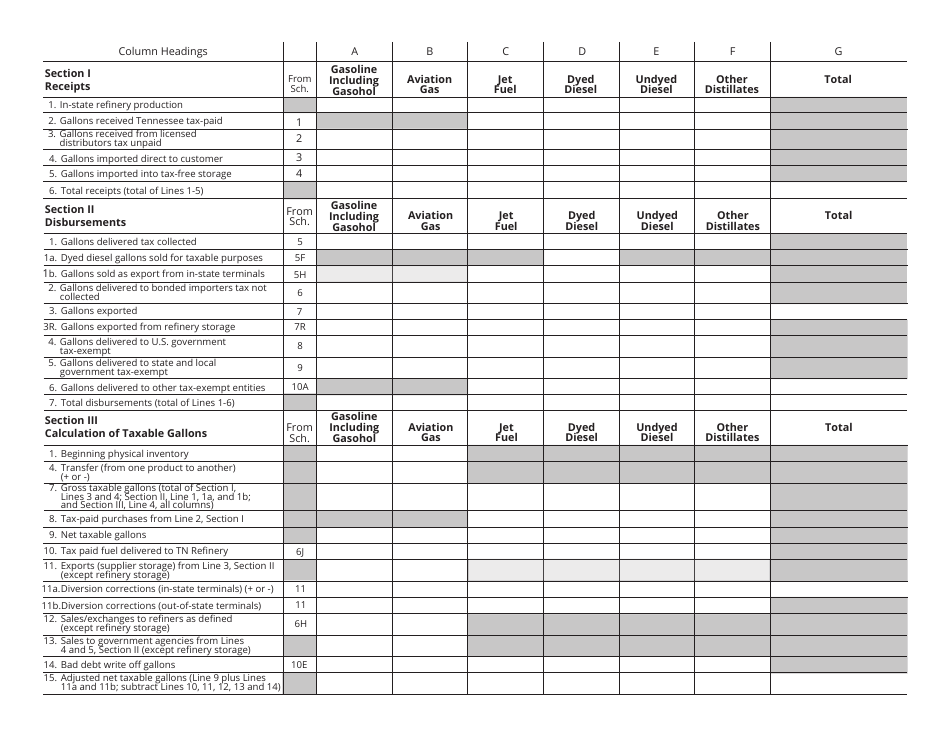

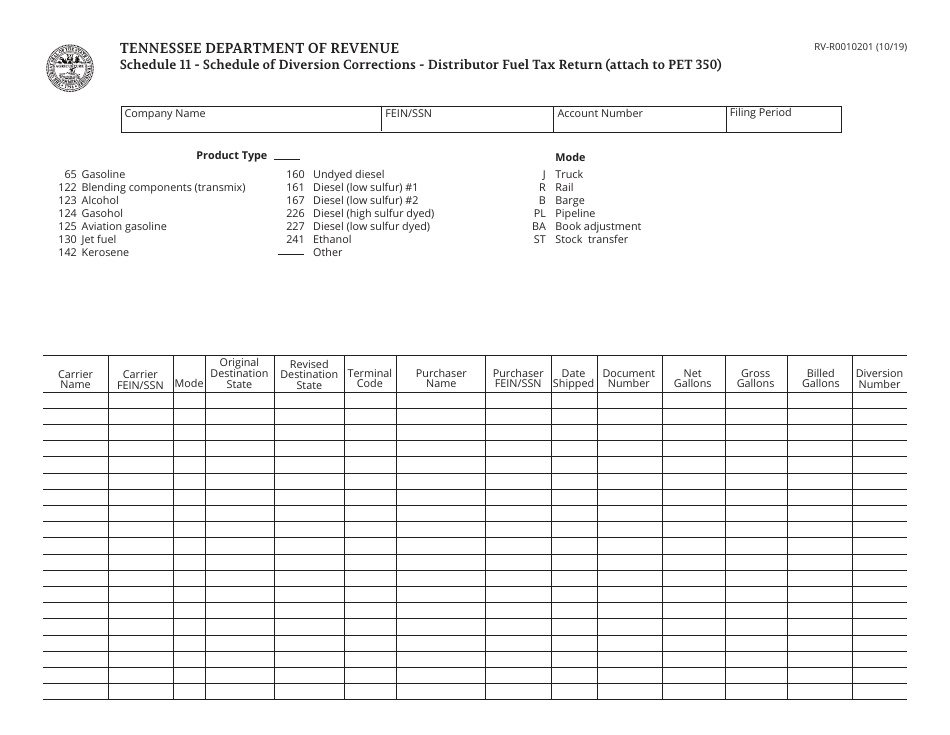

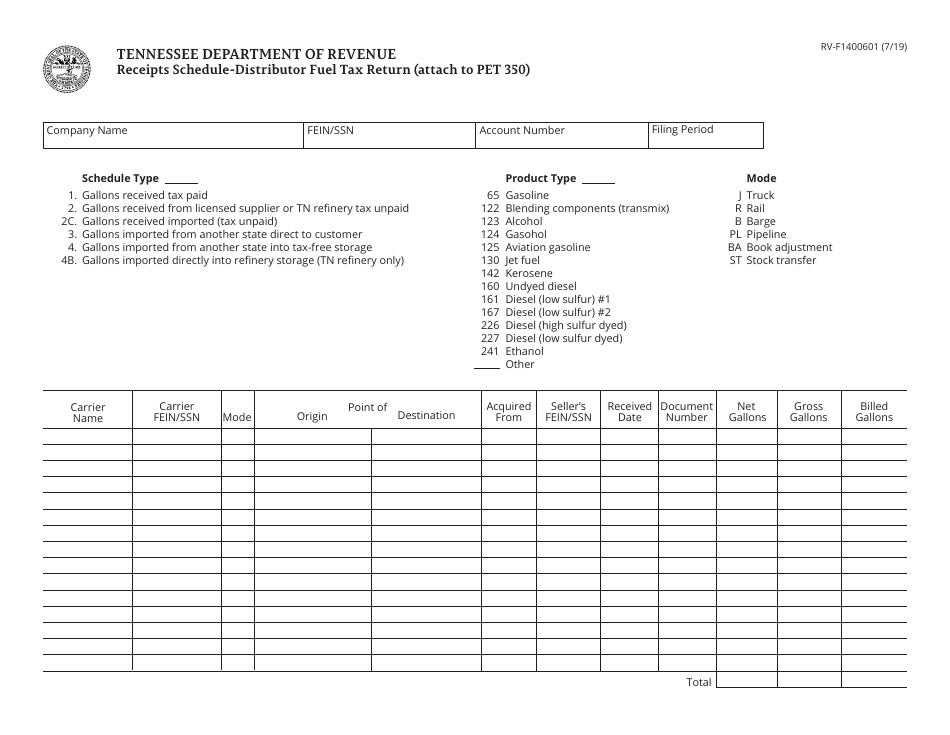

Q: What information do I need to provide on Form PET350?

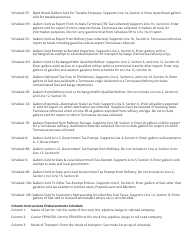

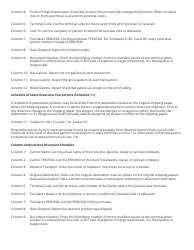

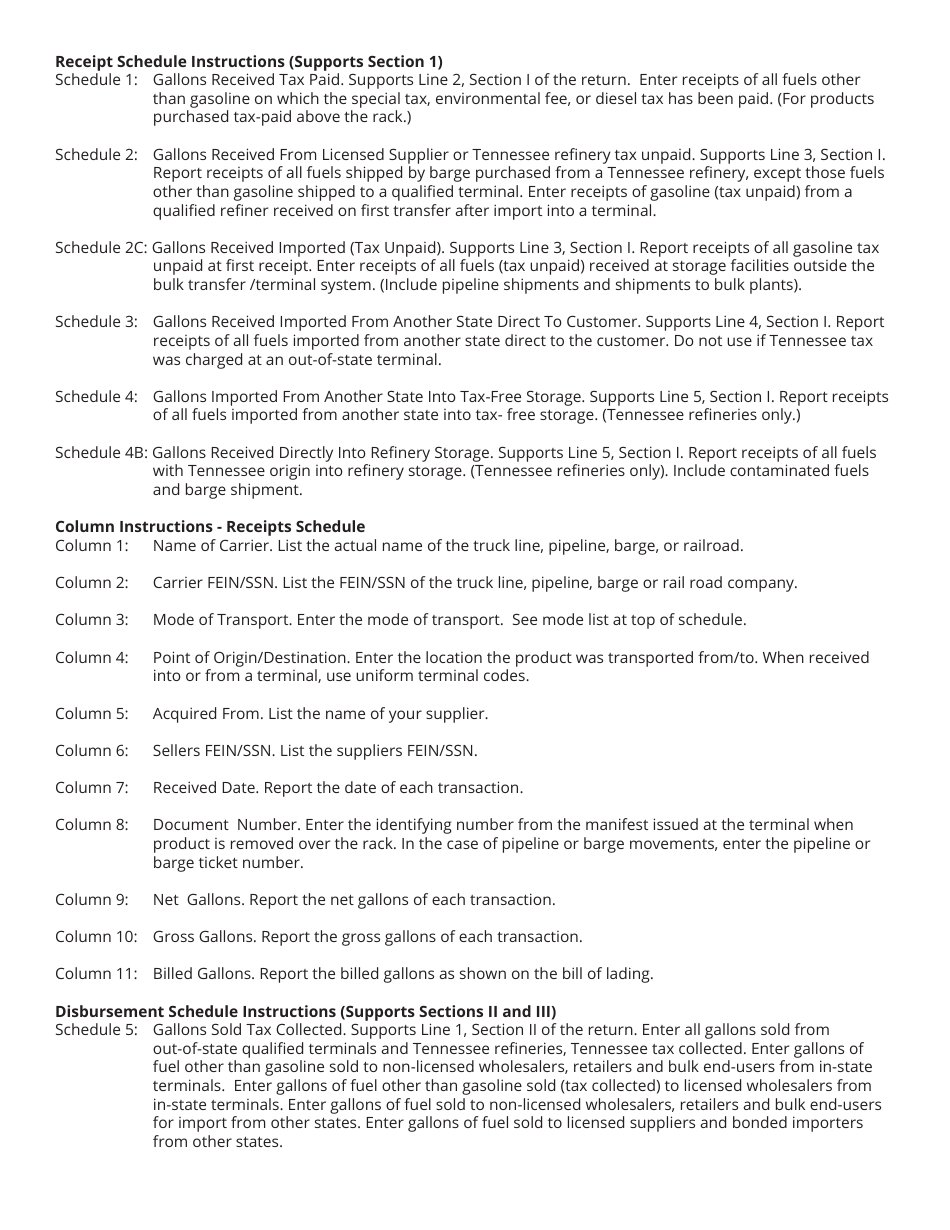

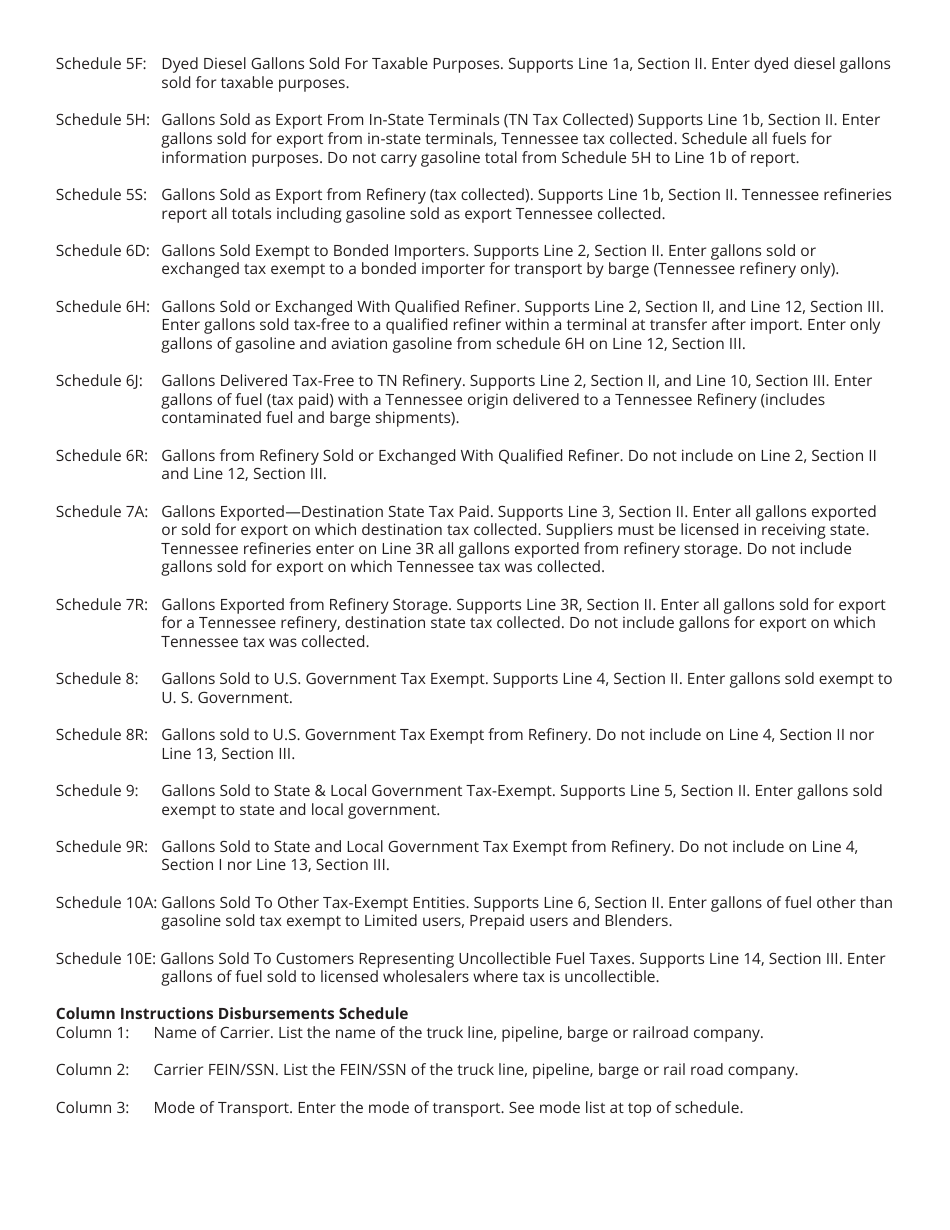

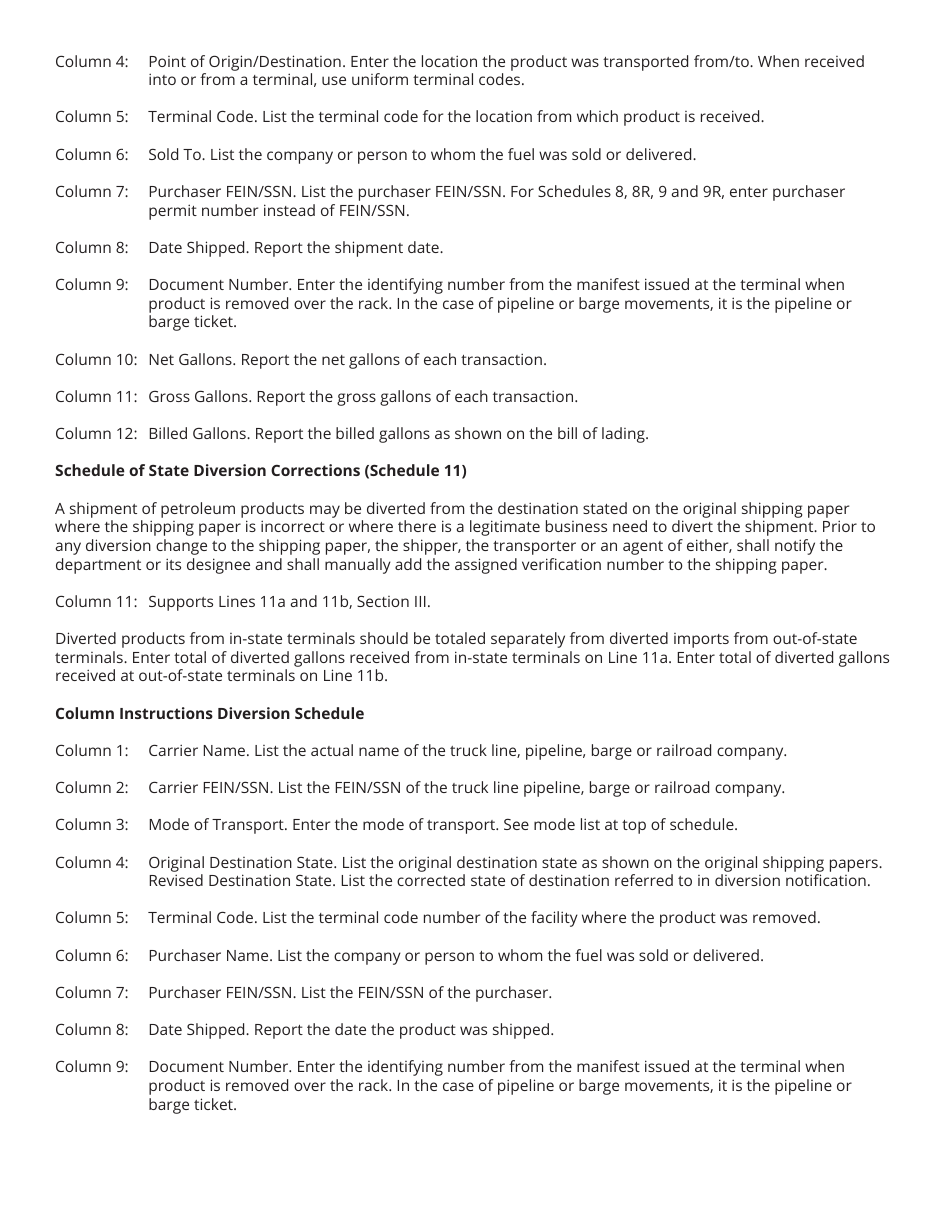

A: You need to provide information such as gallons of fuel sold, taxes collected, and other related data on Form PET350.

Q: Is there a deadline for filing Form PET350?

A: Yes, Form PET350 must be filed by the 20th day of the following month.

Q: Are there any penalties for late filing of Form PET350?

A: Yes, there are penalties for late filing and failure to pay the fuel tax on time.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET350 (RV-R0004501) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.