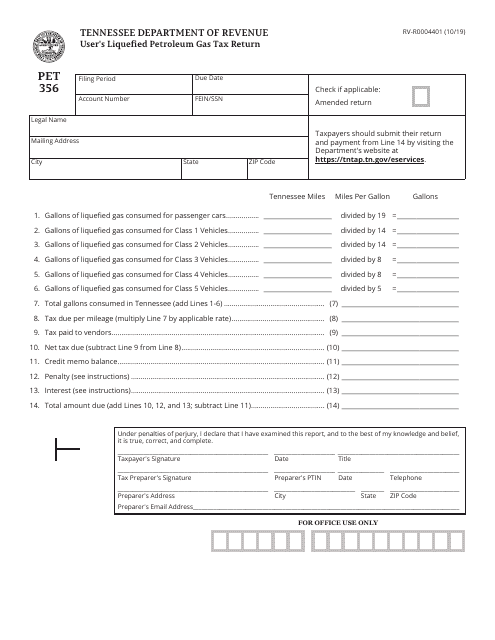

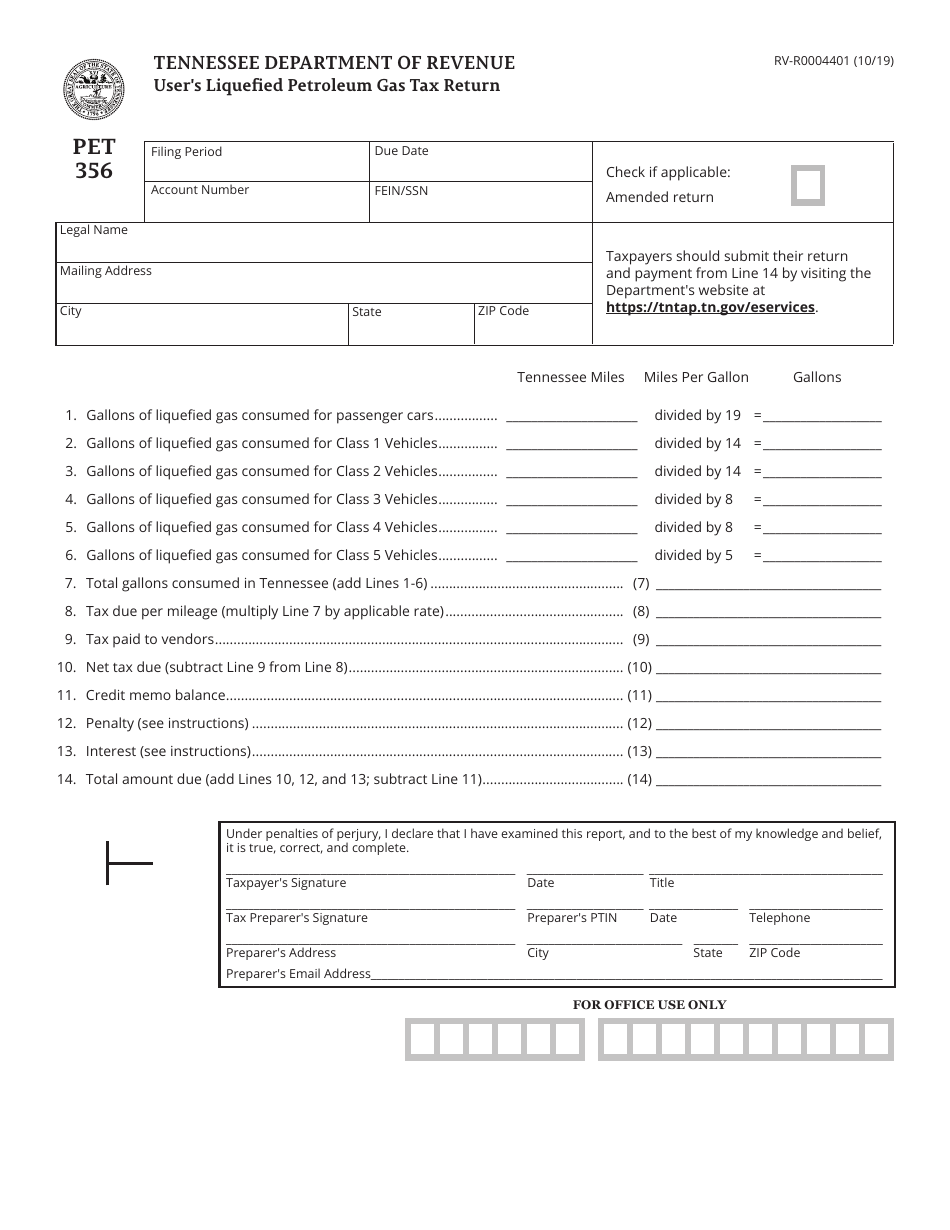

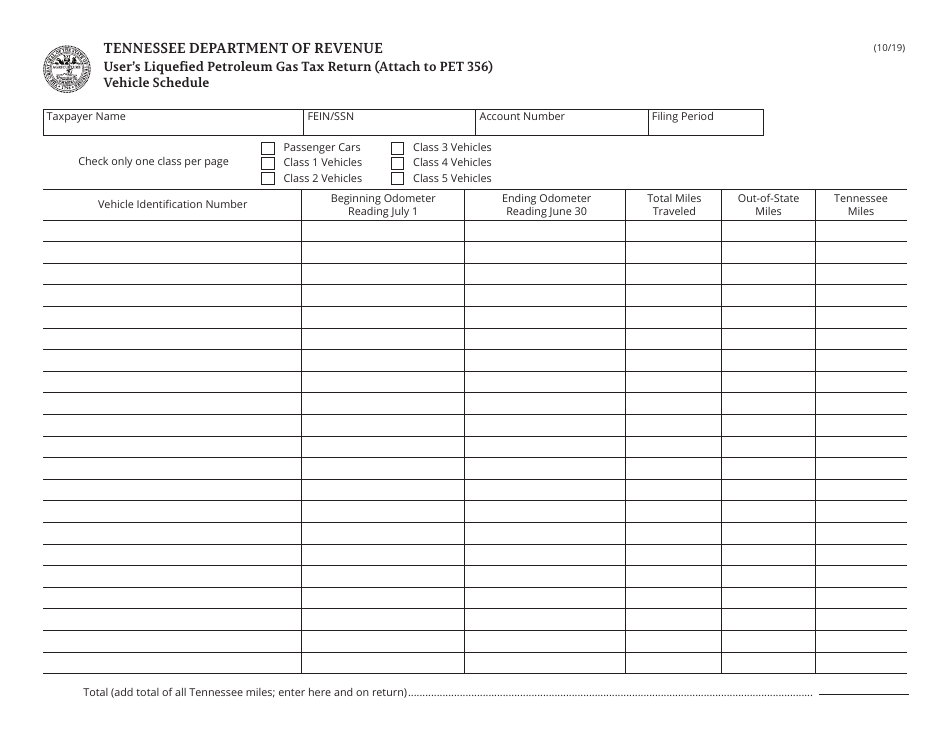

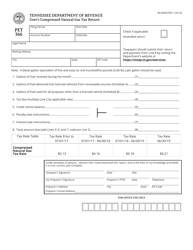

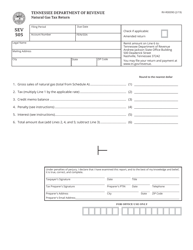

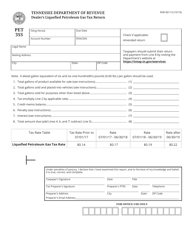

Form PET356 (RV-R0004401) User's Liquefied Petroleum Gas Tax Return - Tennessee

What Is Form PET356 (RV-R0004401)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET356?

A: Form PET356 is the User's Liquefied Petroleum Gas Tax Return for Tennessee.

Q: Who needs to file Form PET356?

A: Anyone who uses liquefied petroleum gas in Tennessee needs to file Form PET356.

Q: What is the purpose of Form PET356?

A: Form PET356 is used to report and pay the state tax on liquefied petroleum gas used in Tennessee.

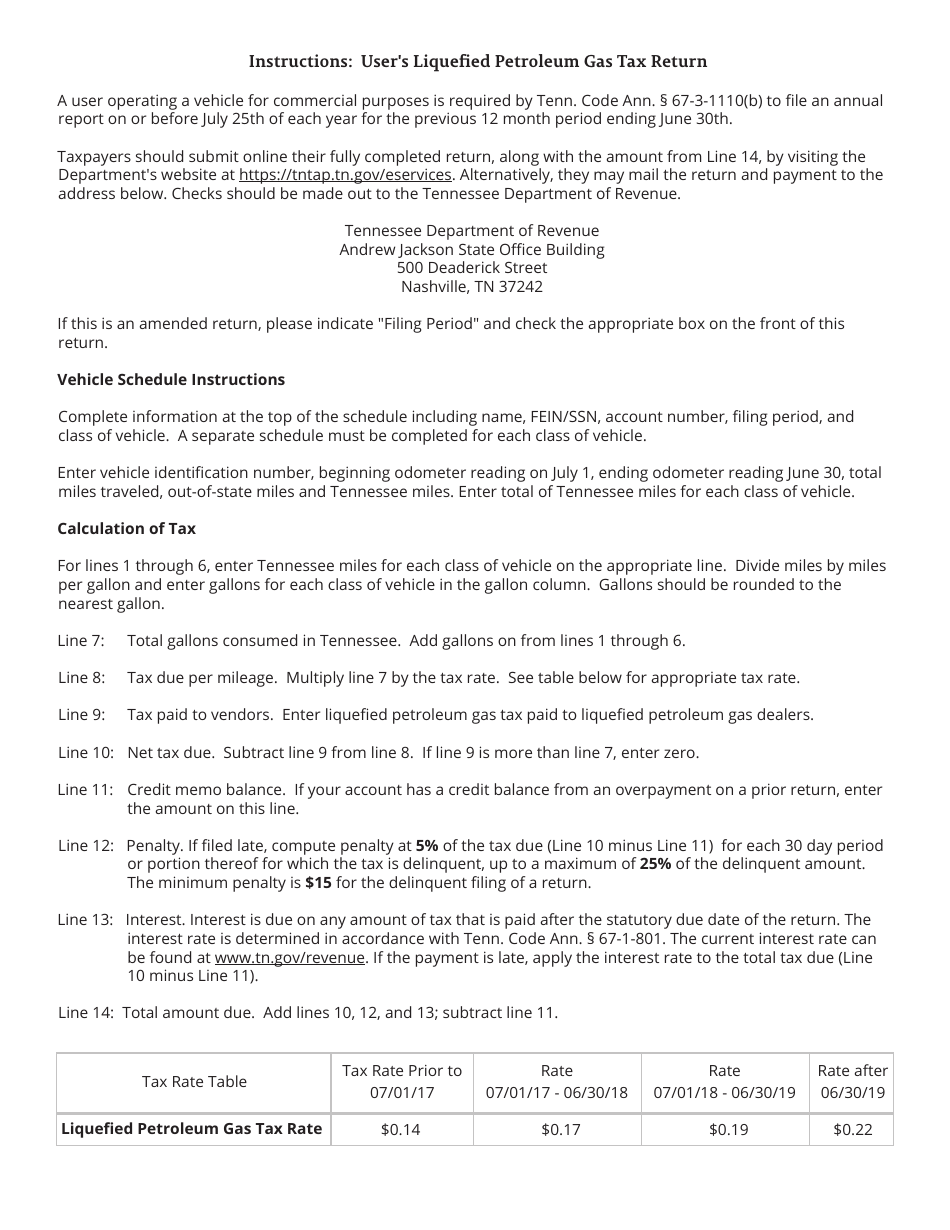

Q: When is Form PET356 due?

A: Form PET356 is due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing or non-payment. It is important to file and pay on time to avoid these penalties.

Q: Do I need to keep a copy of my filed Form PET356?

A: Yes, it is important to keep a copy of your filed Form PET356 for your records.

Q: What information do I need to complete Form PET356?

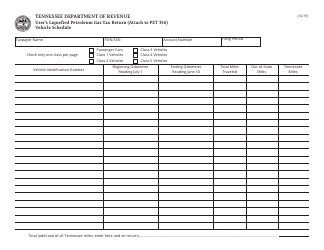

A: You will need information such as the amount of liquefied petroleum gas used, the tax rate, and any other relevant information for the reporting period.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET356 (RV-R0004401) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.