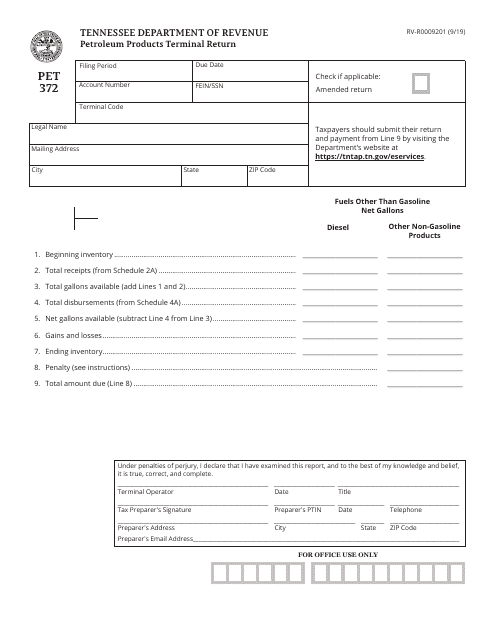

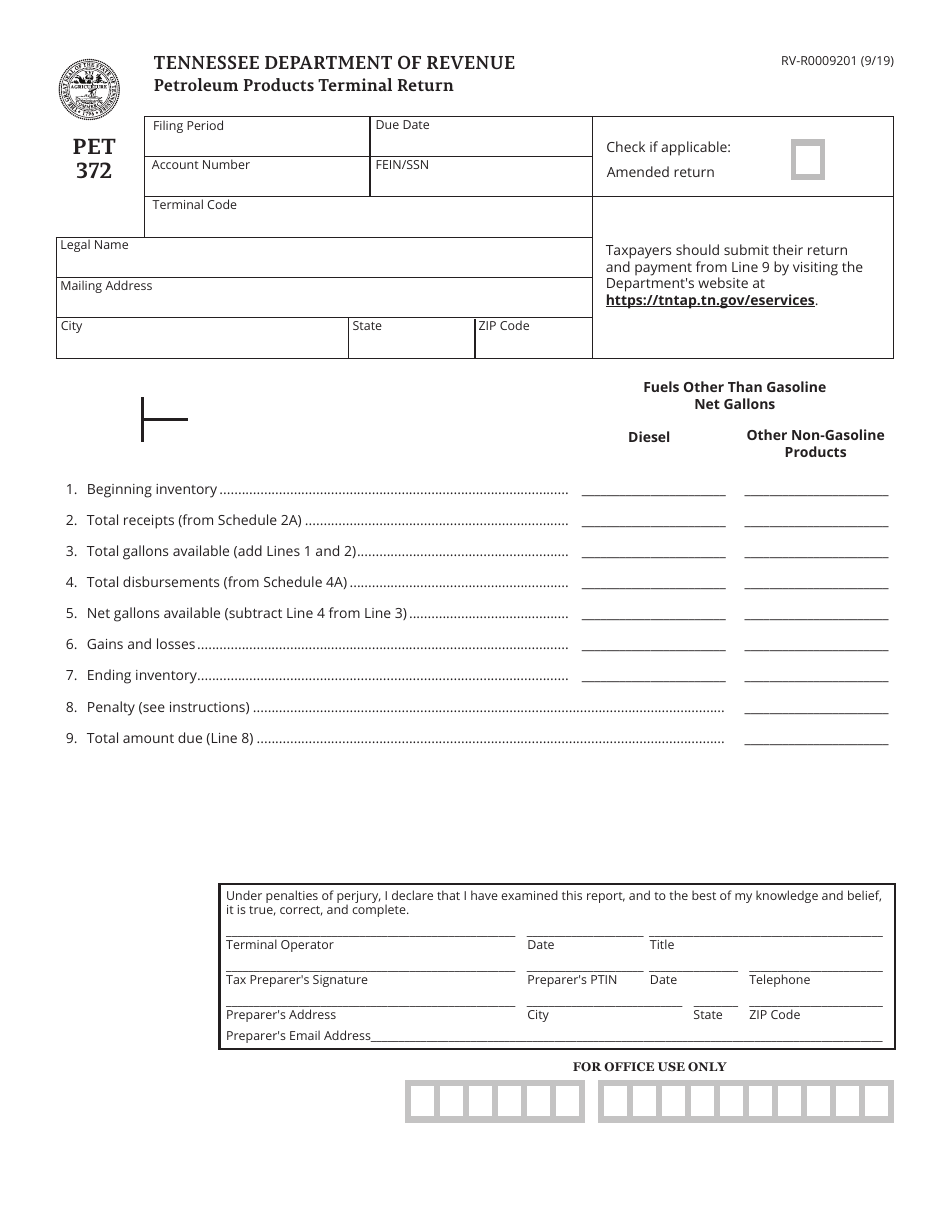

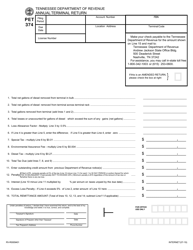

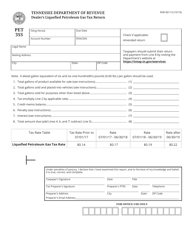

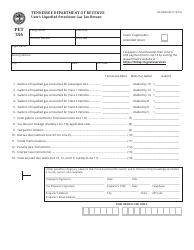

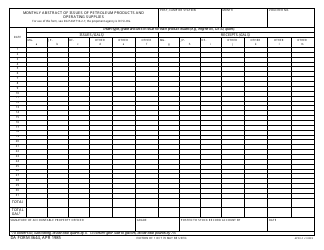

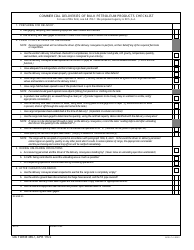

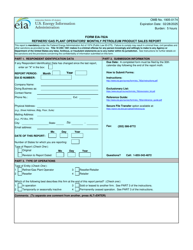

Form PET372 (RV-R0009201) Petroleum Products Terminal Return - Tennessee

What Is Form PET372 (RV-R0009201)?

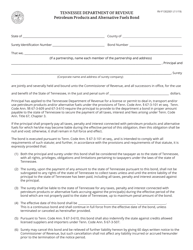

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET372?

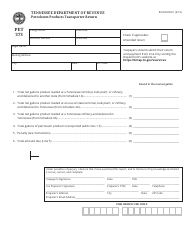

A: Form PET372 is a Petroleum Products Terminal Return specific to Tennessee.

Q: Who is required to file Form PET372?

A: Petroleum product terminal operators in Tennessee are required to file Form PET372.

Q: What is the purpose of Form PET372?

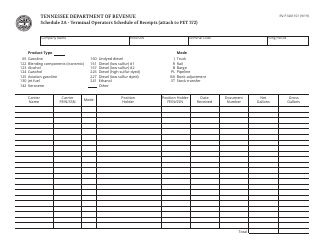

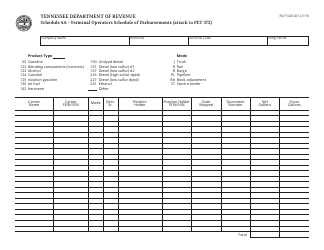

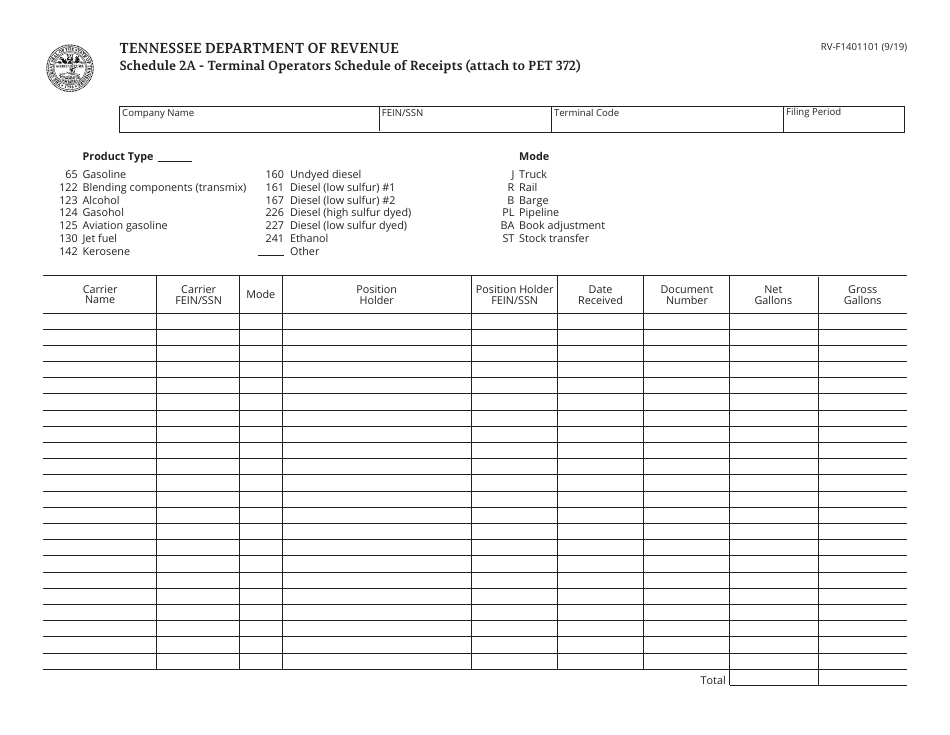

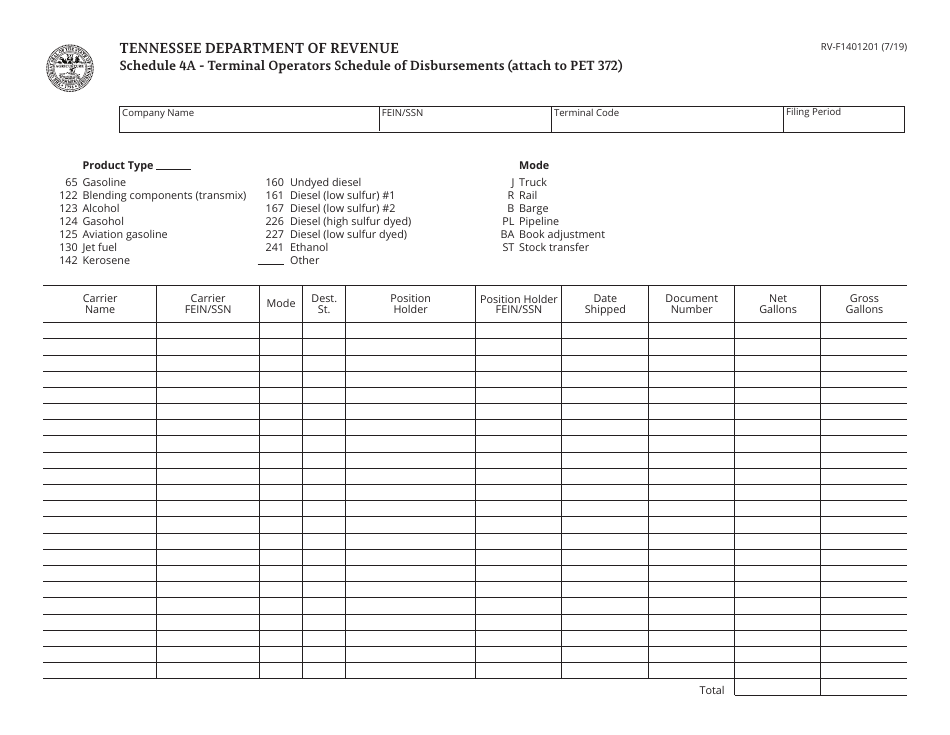

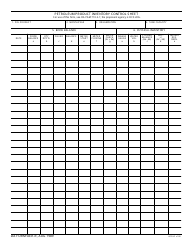

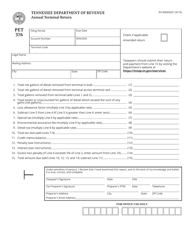

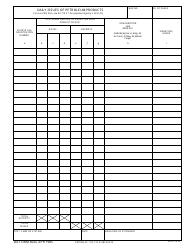

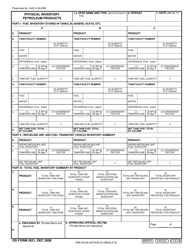

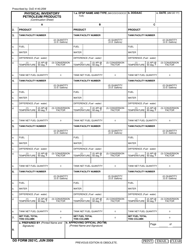

A: The purpose of Form PET372 is to report the quantities of petroleum products received, shipped, and on-hand at a terminal in Tennessee.

Q: How often is Form PET372 filed?

A: Form PET372 is filed on a monthly basis.

Q: What information is required on Form PET372?

A: Form PET372 requires information about the quantities of petroleum products received, shipped, and on-hand, as well as certain tax-related information.

Q: Are there any filing deadlines for Form PET372?

A: Yes, Form PET372 must be filed on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the requirements of Form PET372. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET372 (RV-R0009201) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.