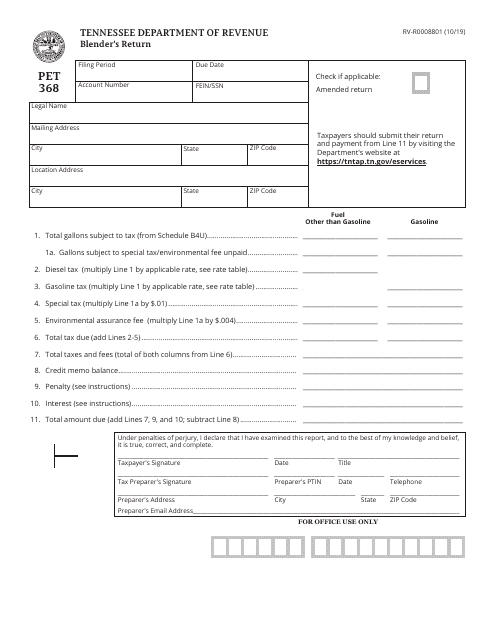

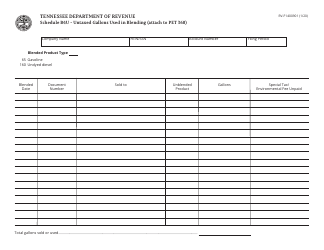

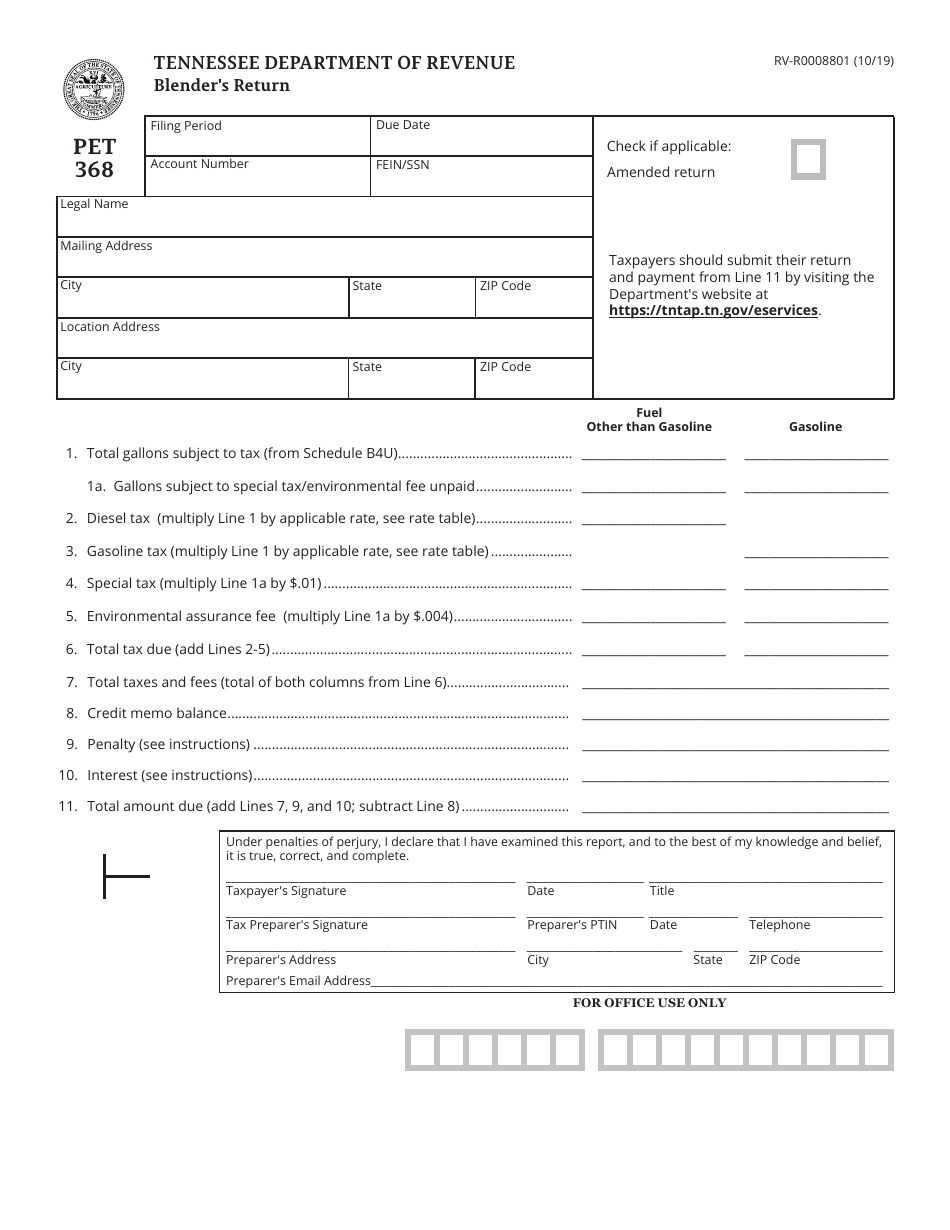

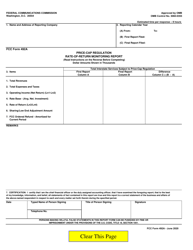

Form PET368 (RV-R0008801) Blender's Return - Tennessee

What Is Form PET368 (RV-R0008801)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET368?

A: Form PET368 is a return form for blender units in Tennessee.

Q: What is the purpose of Form PET368?

A: The purpose of Form PET368 is to report the return of blender units in Tennessee.

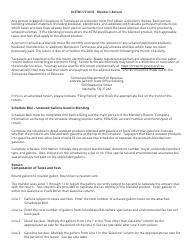

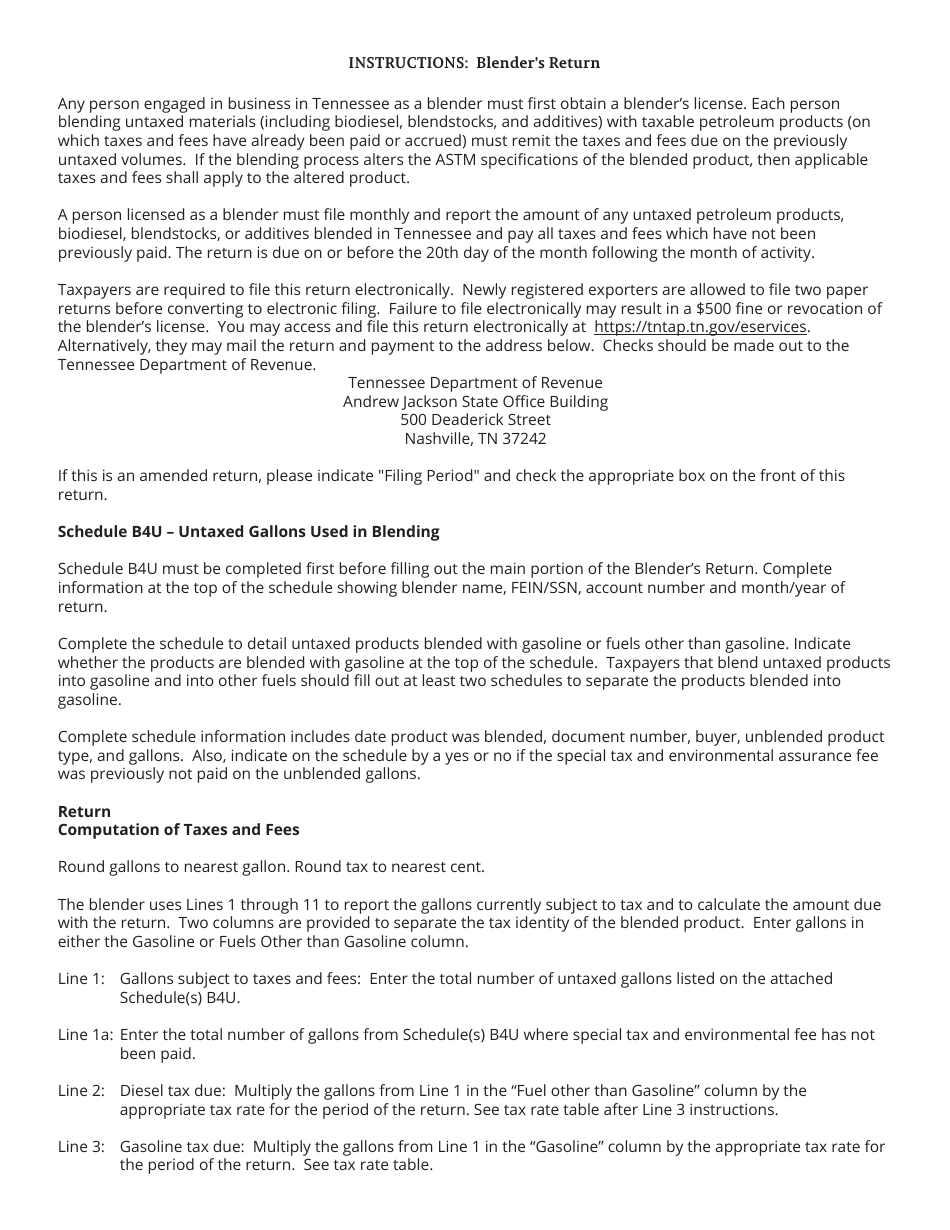

Q: What is a blender unit?

A: A blender unit refers to a blender that is used for blending fuel.

Q: Who needs to file Form PET368?

A: Anyone in Tennessee who receives blender units must file Form PET368.

Q: Are there any filing deadlines for Form PET368?

A: Yes, you must file Form PET368 within 20 days after the blender unit is removed from Tennessee.

Q: Is there a fee for filing Form PET368?

A: No, there is no fee for filing Form PET368.

Q: What happens if I don't file Form PET368?

A: Failure to file Form PET368 may result in penalties and interest charges.

Q: Is Form PET368 applicable only to businesses?

A: No, Form PET368 is applicable to both businesses and individuals who receive blender units in Tennessee.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET368 (RV-R0008801) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.