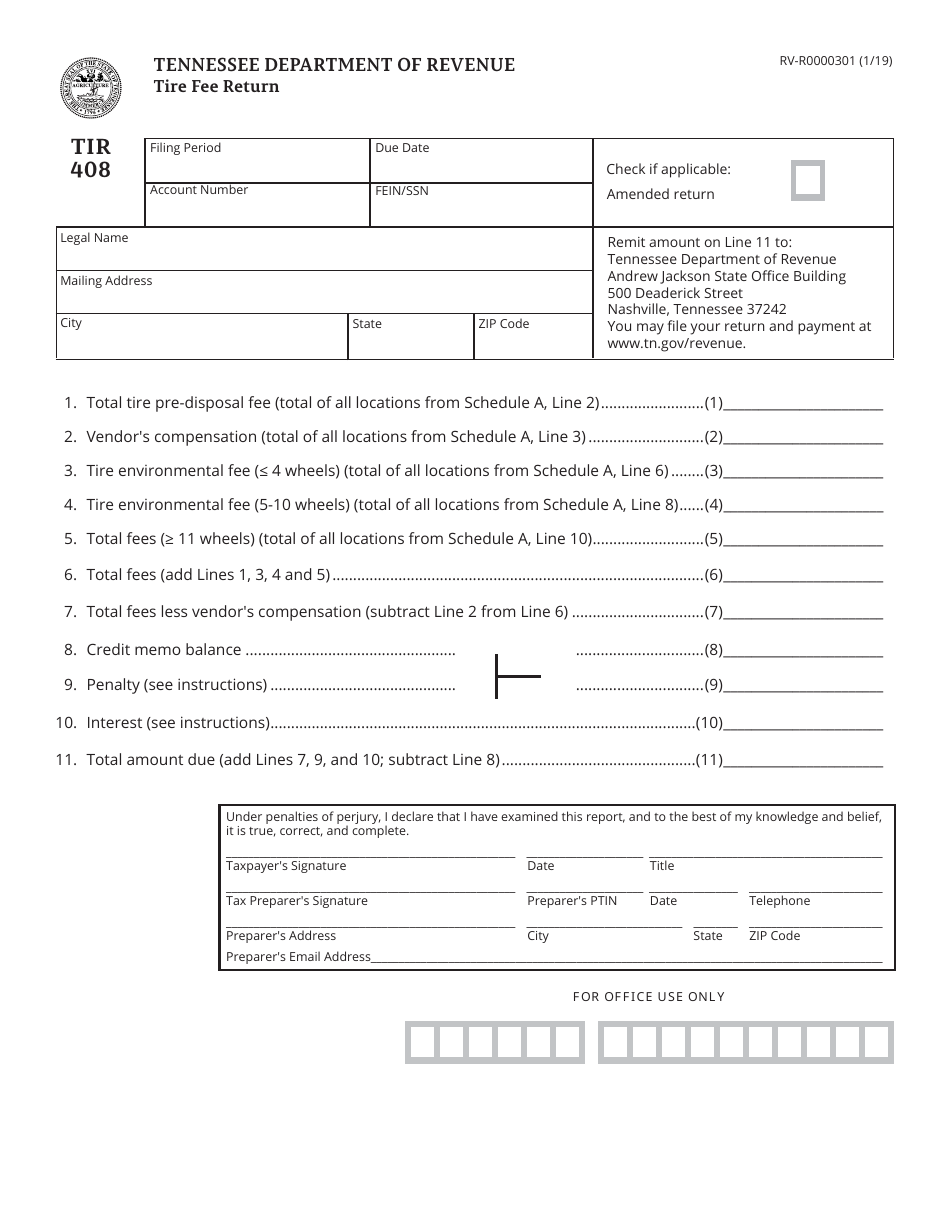

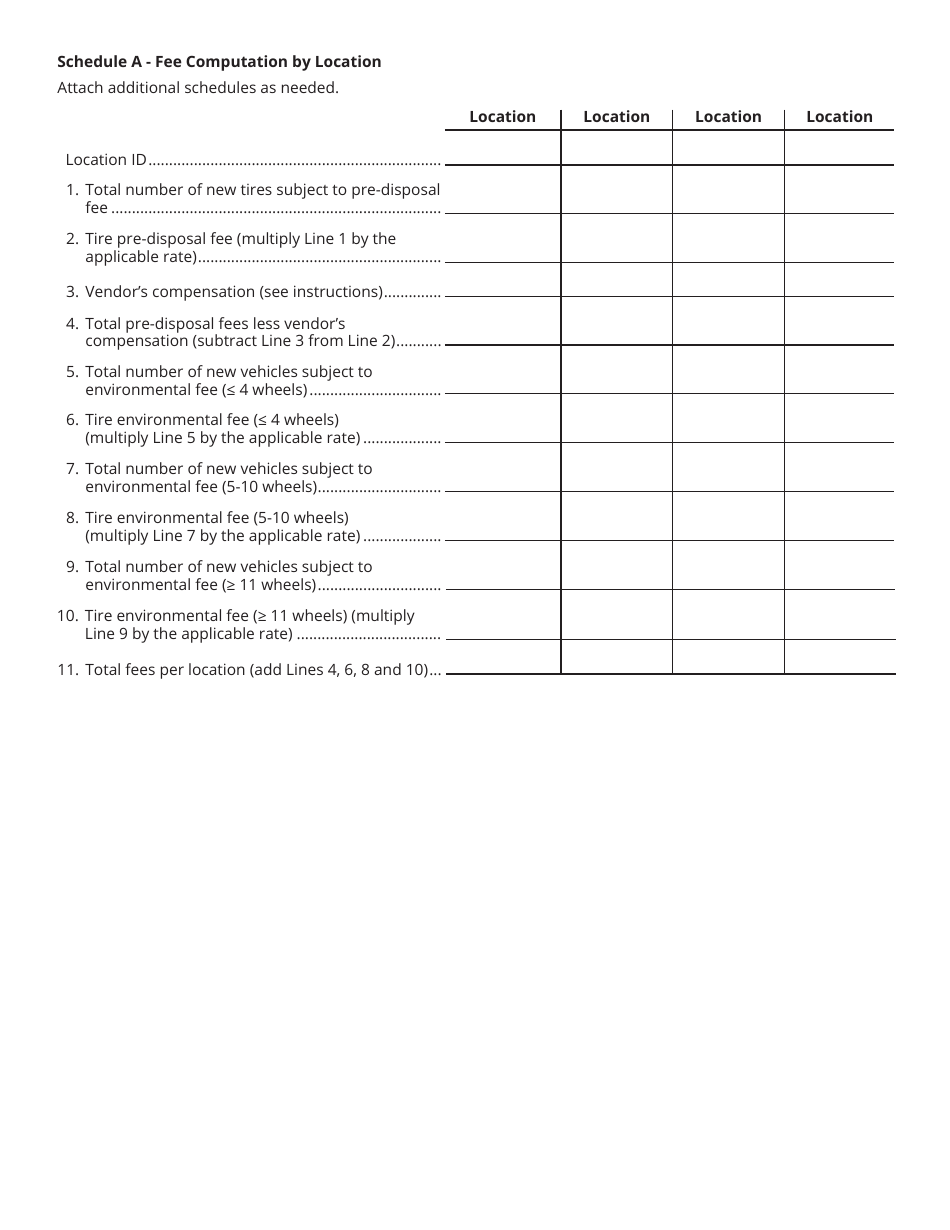

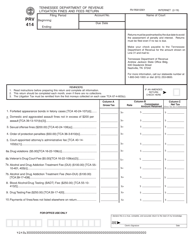

Form TIR408 (RV-R0000301) Tire Pre-disposal Fee Return - Tennessee

What Is Form TIR408 (RV-R0000301)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TIR408?

A: Form TIR408 is the Tire Pre-disposal Fee Return form in Tennessee.

Q: What is the purpose of Form TIR408?

A: The purpose of Form TIR408 is to report and remit the tire pre-disposal fees in Tennessee.

Q: Who needs to file Form TIR408?

A: Anyone who is involved in the sale or transfer of new tires in Tennessee needs to file Form TIR408.

Q: What is the tire pre-disposal fee?

A: The tire pre-disposal fee is a fee collected on each new tire sold or transferred in Tennessee to fund the proper management and disposal of waste tires.

Q: How often is Form TIR408 filed?

A: Form TIR408 is filed on a quarterly basis. The due dates for filing are April 30, July 31, October 31, and January 31.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TIR408 (RV-R0000301) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.