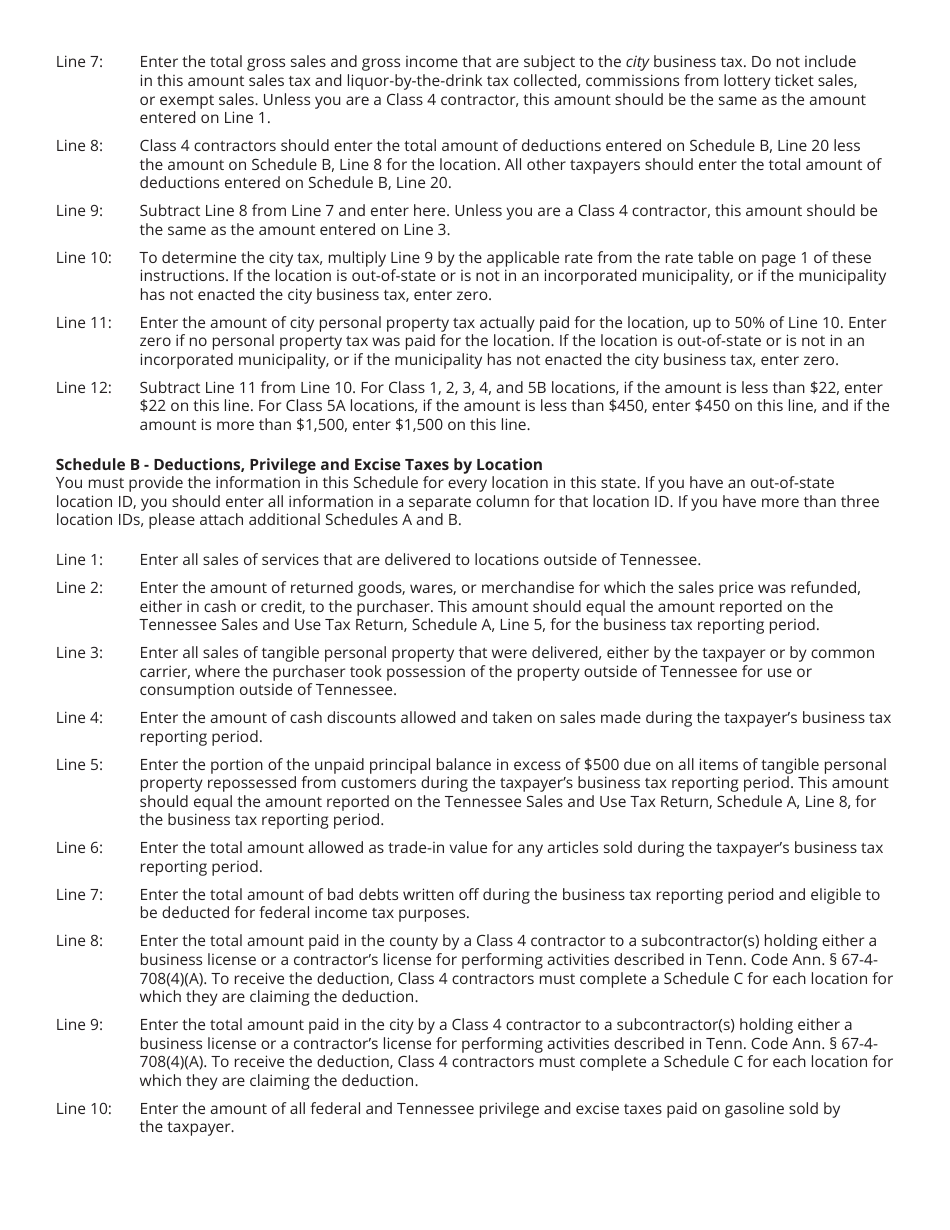

This version of the form is not currently in use and is provided for reference only. Download this version of

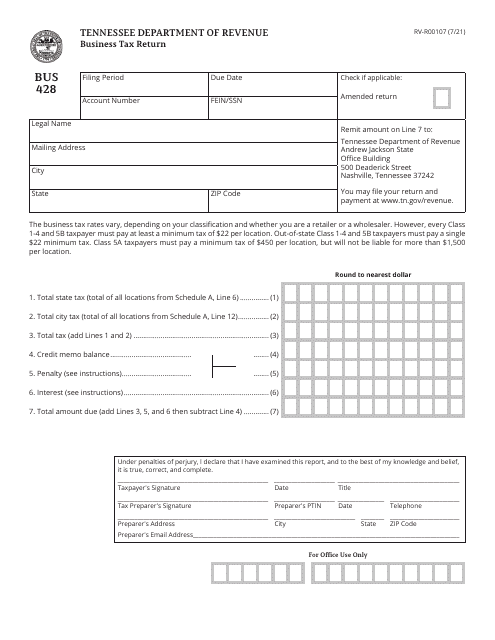

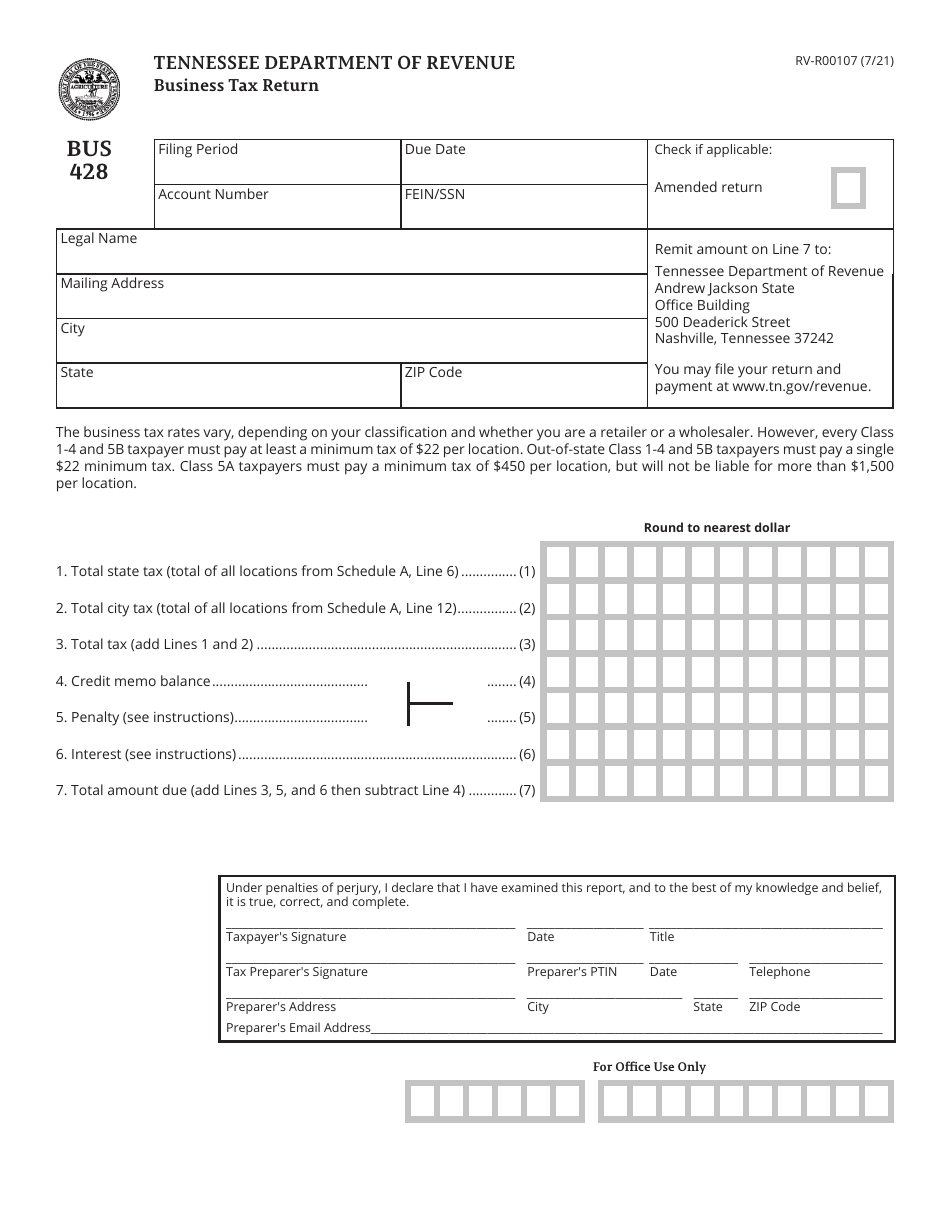

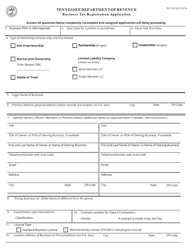

Form BUS428 (RV-R00107)

for the current year.

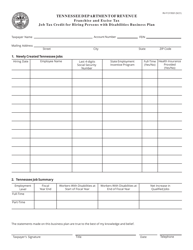

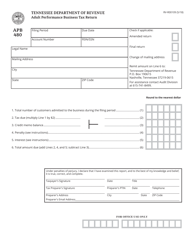

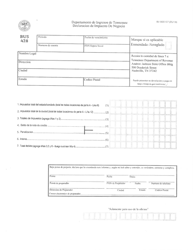

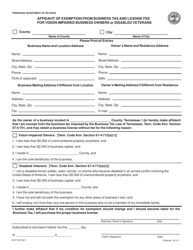

Form BUS428 (RV-R00107) Business Tax Return - Tennessee

What Is Form BUS428 (RV-R00107)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

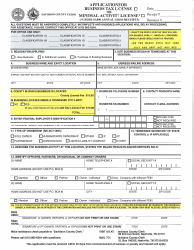

Q: What is the purpose of Form BUS428 (RV-R00107)?

A: Form BUS428 (RV-R00107) is the Business Tax Return for Tennessee.

Q: Who needs to file Form BUS428 (RV-R00107)?

A: Businesses operating in Tennessee need to file Form BUS428 (RV-R00107).

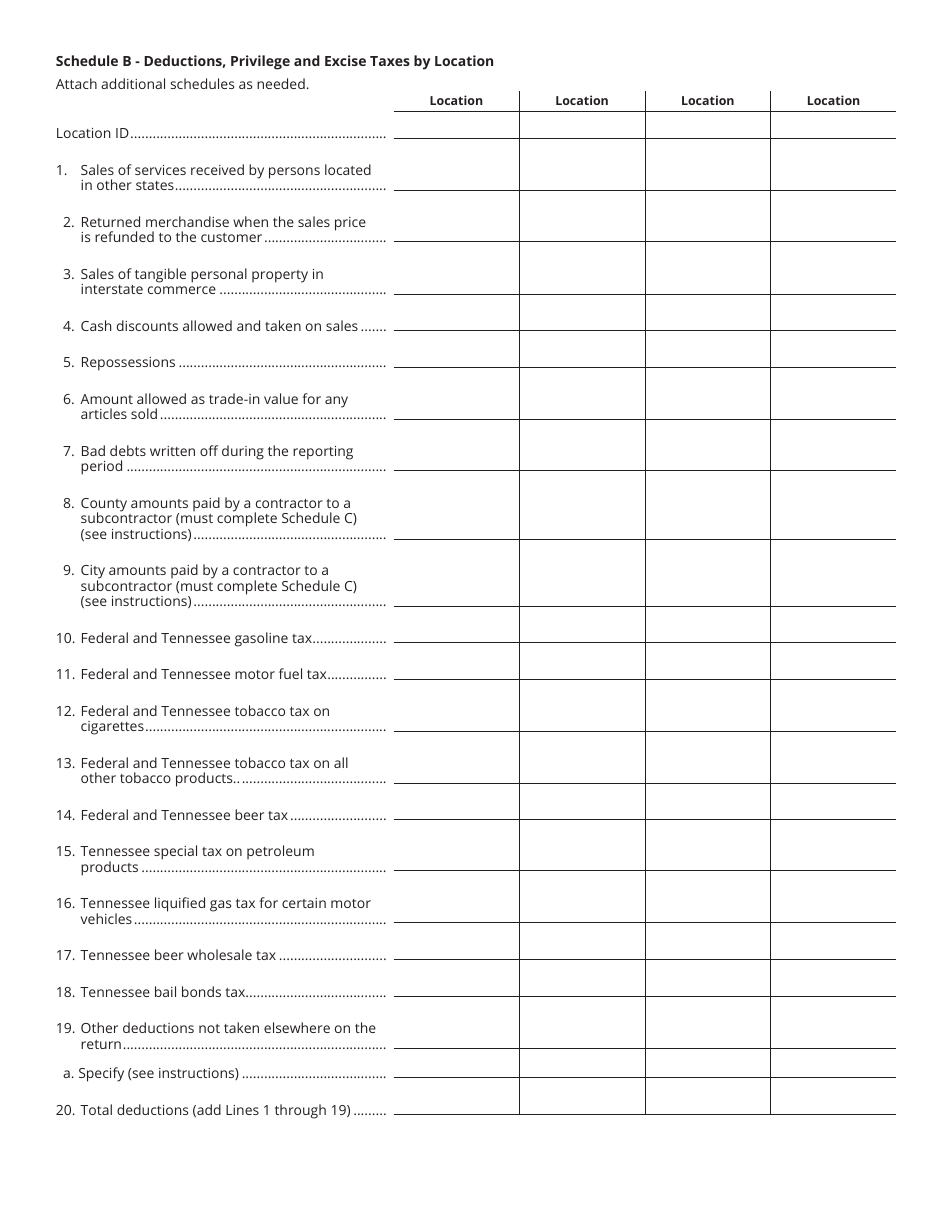

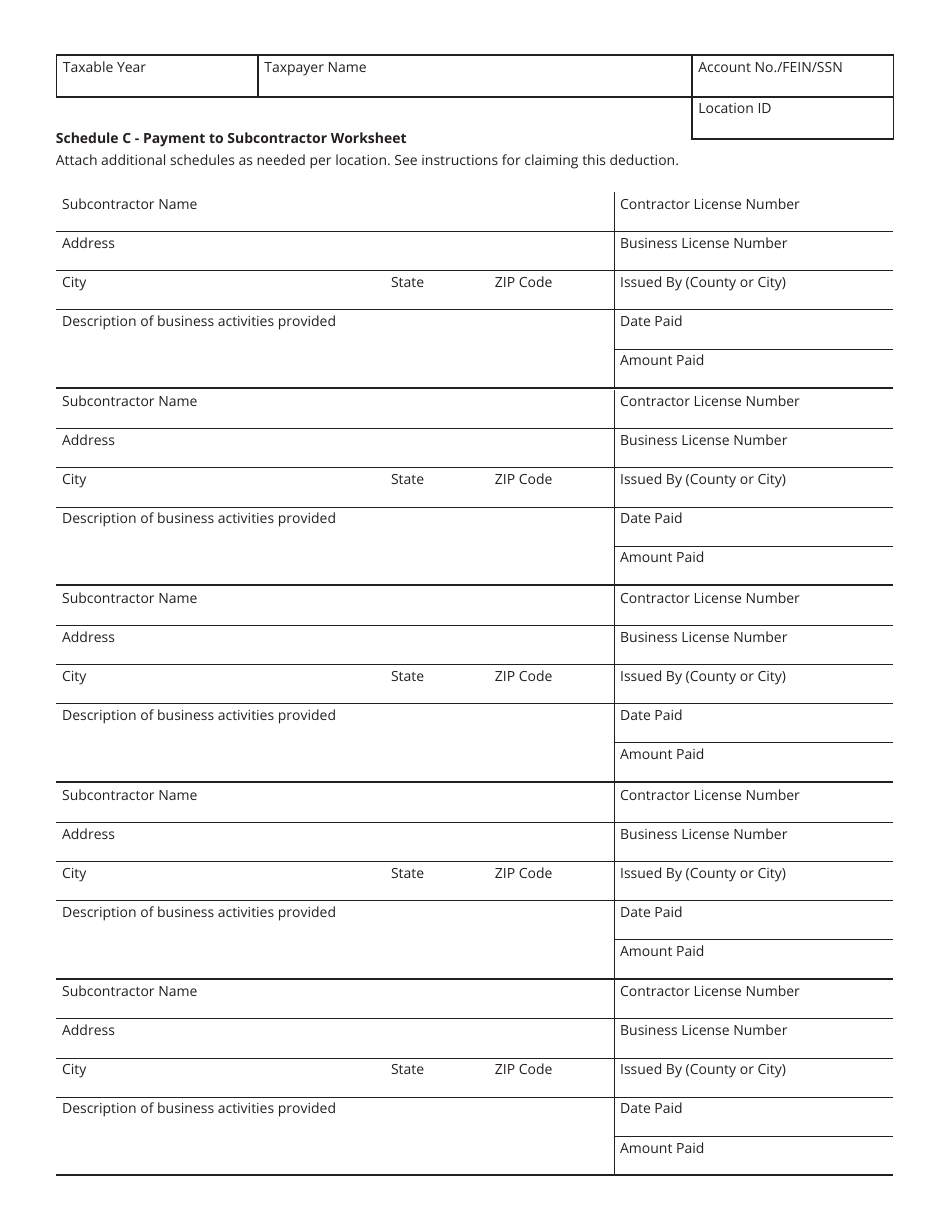

Q: What information is required on Form BUS428 (RV-R00107)?

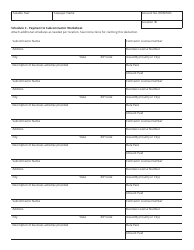

A: Form BUS428 (RV-R00107) requires information about the business's income, deductions, and credits.

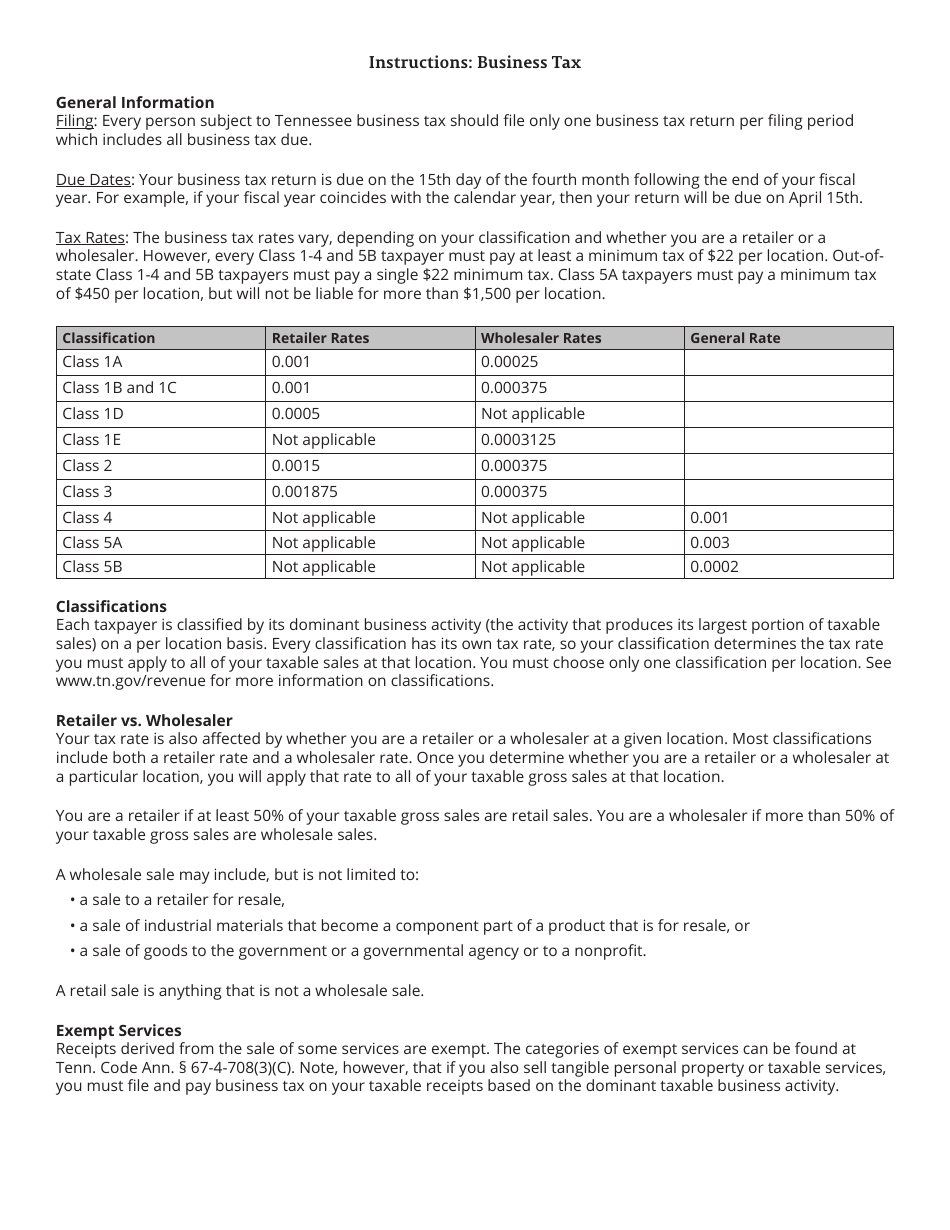

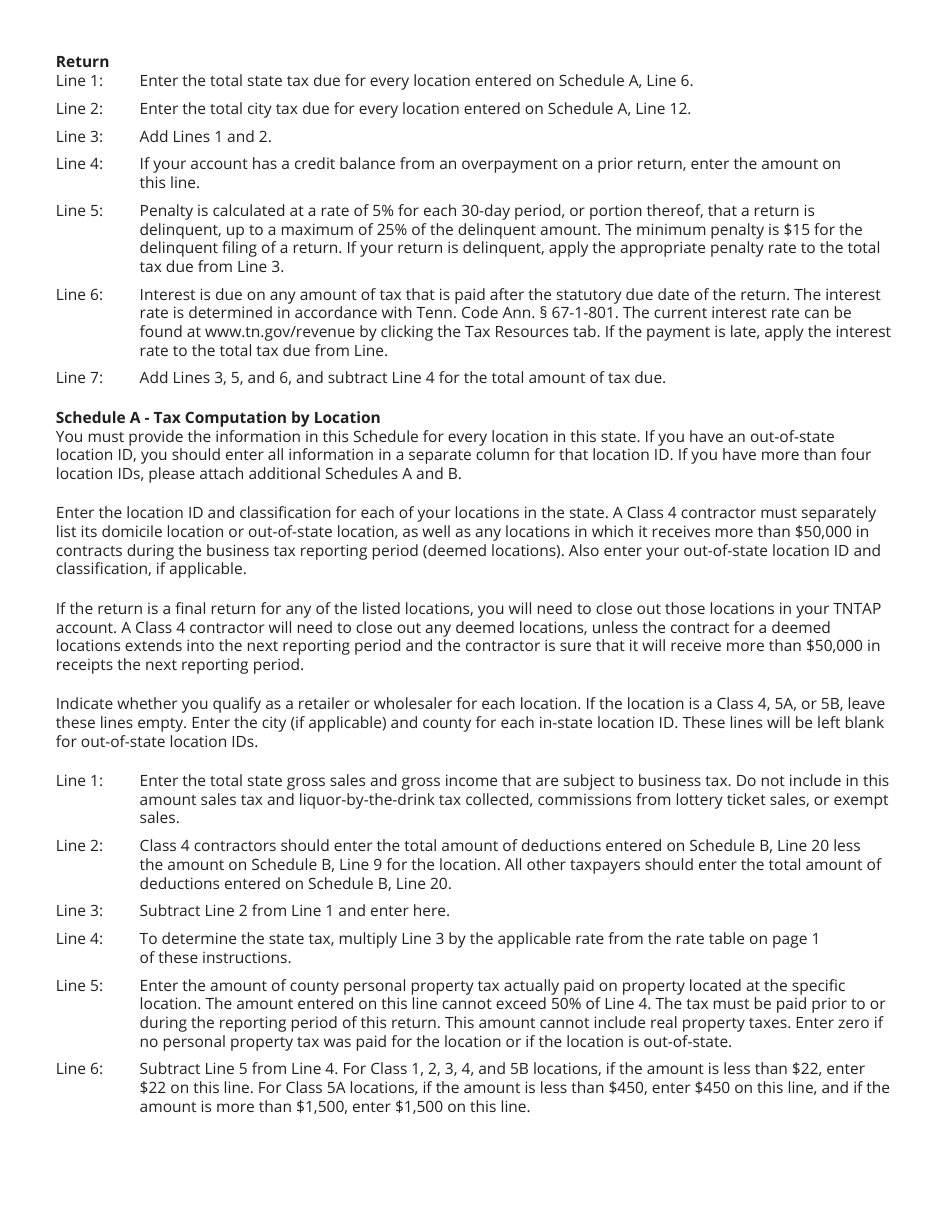

Q: When is the deadline to file Form BUS428 (RV-R00107)?

A: The deadline to file Form BUS428 (RV-R00107) is usually April 15th, or the 15th day of the fourth month after the end of the tax year.

Q: Is there a fee to file Form BUS428 (RV-R00107)?

A: No, there is no fee to file Form BUS428 (RV-R00107).

Q: What should I do if I need an extension to file Form BUS428 (RV-R00107)?

A: If you need an extension to file Form BUS428 (RV-R00107), you can request an extension through the Tennessee Department of Revenue.

Q: Are there any penalties for late filing of Form BUS428 (RV-R00107)?

A: Yes, there are penalties for late filing of Form BUS428 (RV-R00107), including possible interest charges and penalties.

Q: What supporting documents should be attached to Form BUS428 (RV-R00107)?

A: Supporting documents such as profit and loss statements, receipts, and expense records should be attached to Form BUS428 (RV-R00107).

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BUS428 (RV-R00107) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.