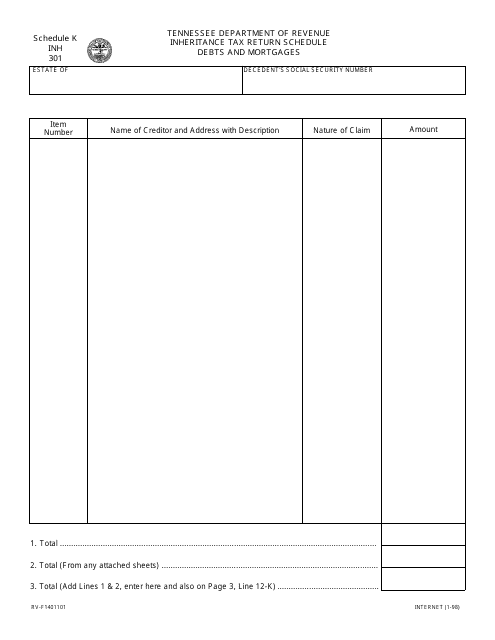

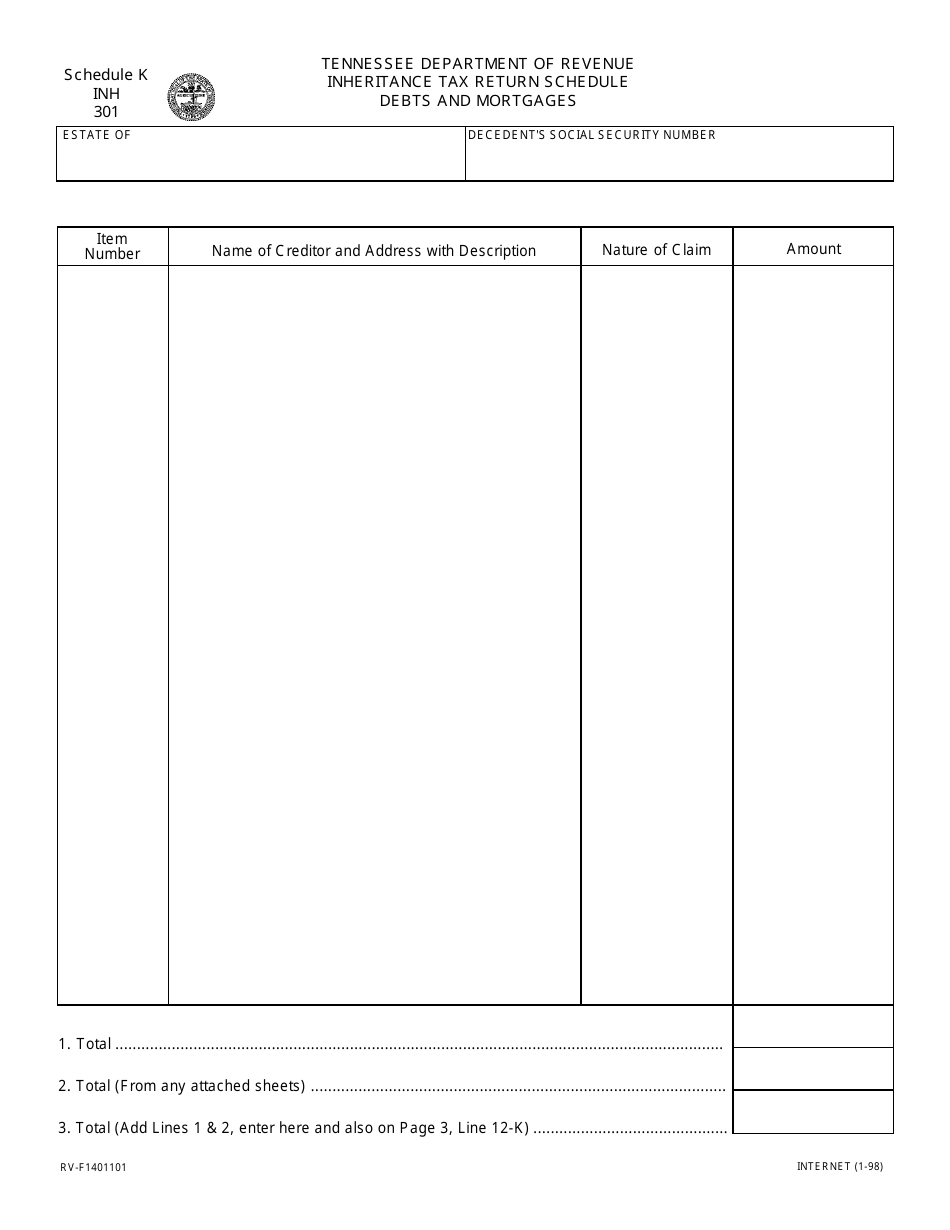

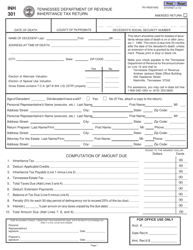

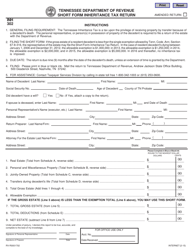

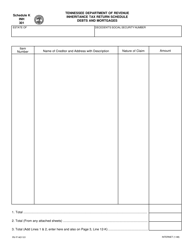

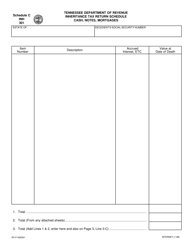

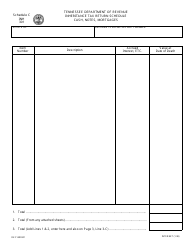

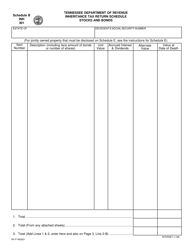

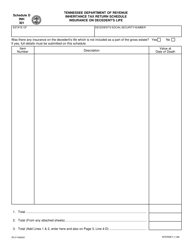

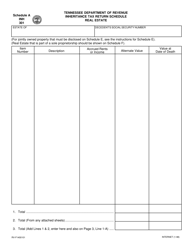

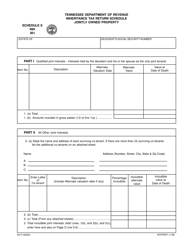

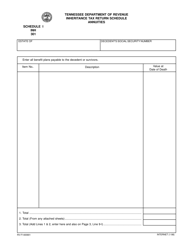

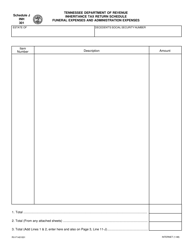

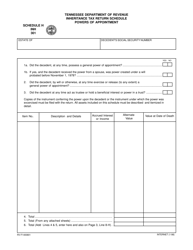

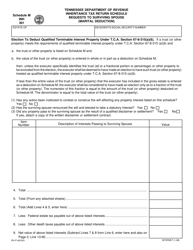

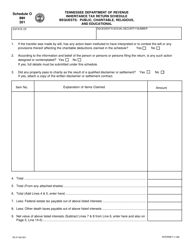

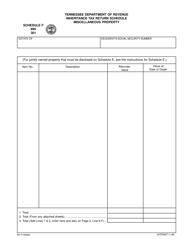

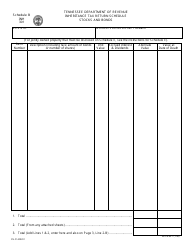

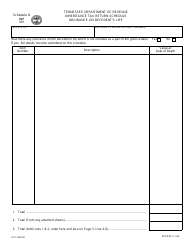

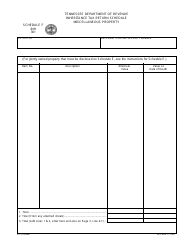

Form INH301 (RV-F1401101) Schedule K Inheritance Tax Return Schedule - Debts and Mortgages - Tennessee

What Is Form INH301 (RV-F1401101) Schedule K?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee.The document is a supplement to Form INH301, Inheritance Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INH301?

A: Form INH301 is the Inheritance Tax Return Schedule for Debts and Mortgages in Tennessee.

Q: What is the purpose of Form INH301?

A: The purpose of Form INH301 is to report the debts and mortgages related to an inheritance for tax purposes in Tennessee.

Q: Who needs to file Form INH301?

A: Anyone who is responsible for filing the Inheritance Tax Return and has debts and mortgages related to the inheritance in Tennessee needs to file Form INH301.

Q: What information is required on Form INH301?

A: Form INH301 requires information about the debts and mortgages related to the inheritance, such as the amount owed and the creditor's information.

Form Details:

- Released on January 1, 1998;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form INH301 (RV-F1401101) Schedule K by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.