This version of the form is not currently in use and is provided for reference only. Download this version of

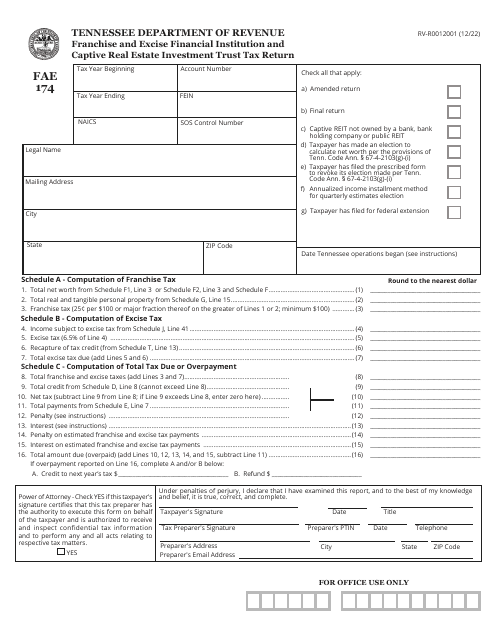

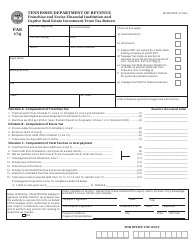

Form FAE174 (RV-R0012001)

for the current year.

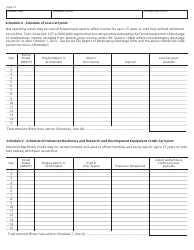

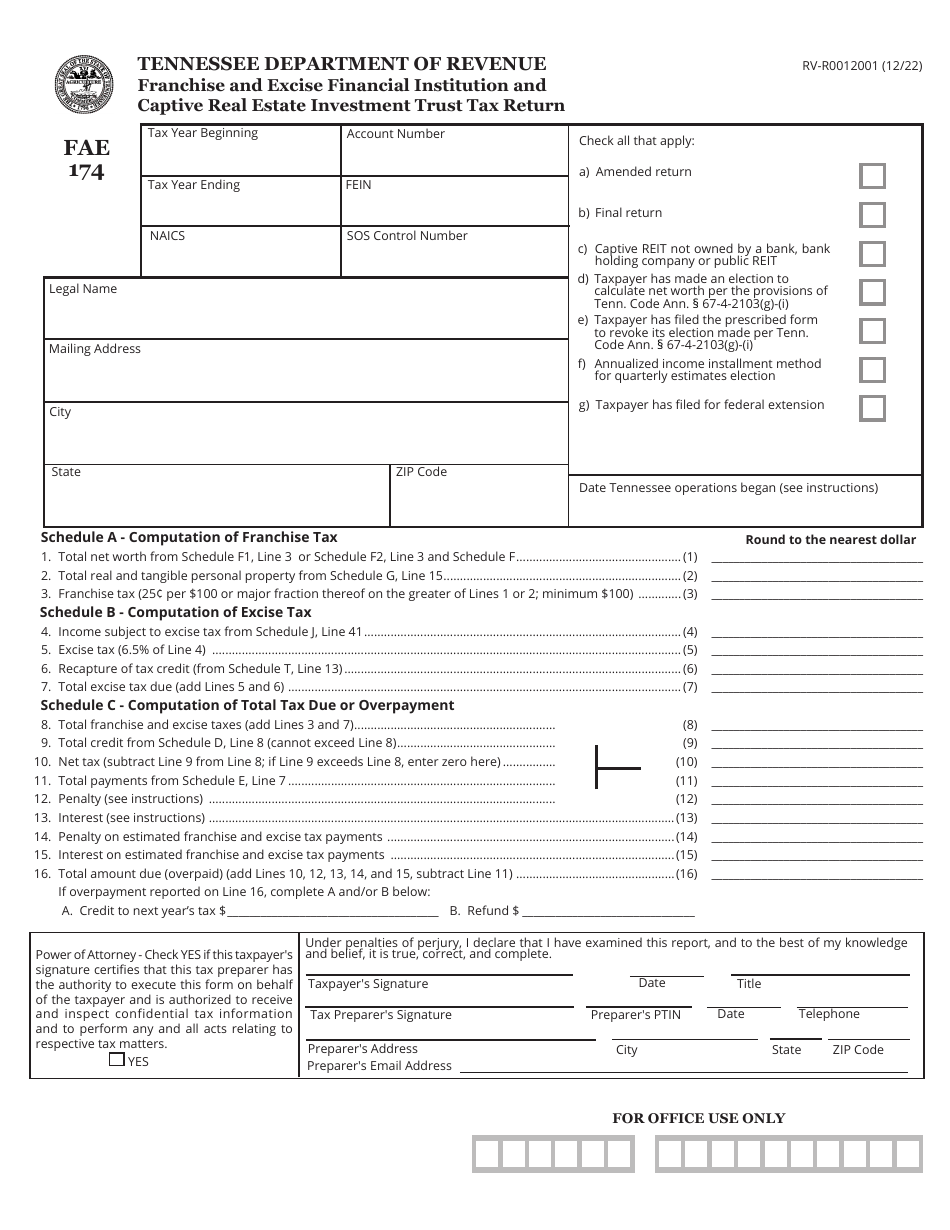

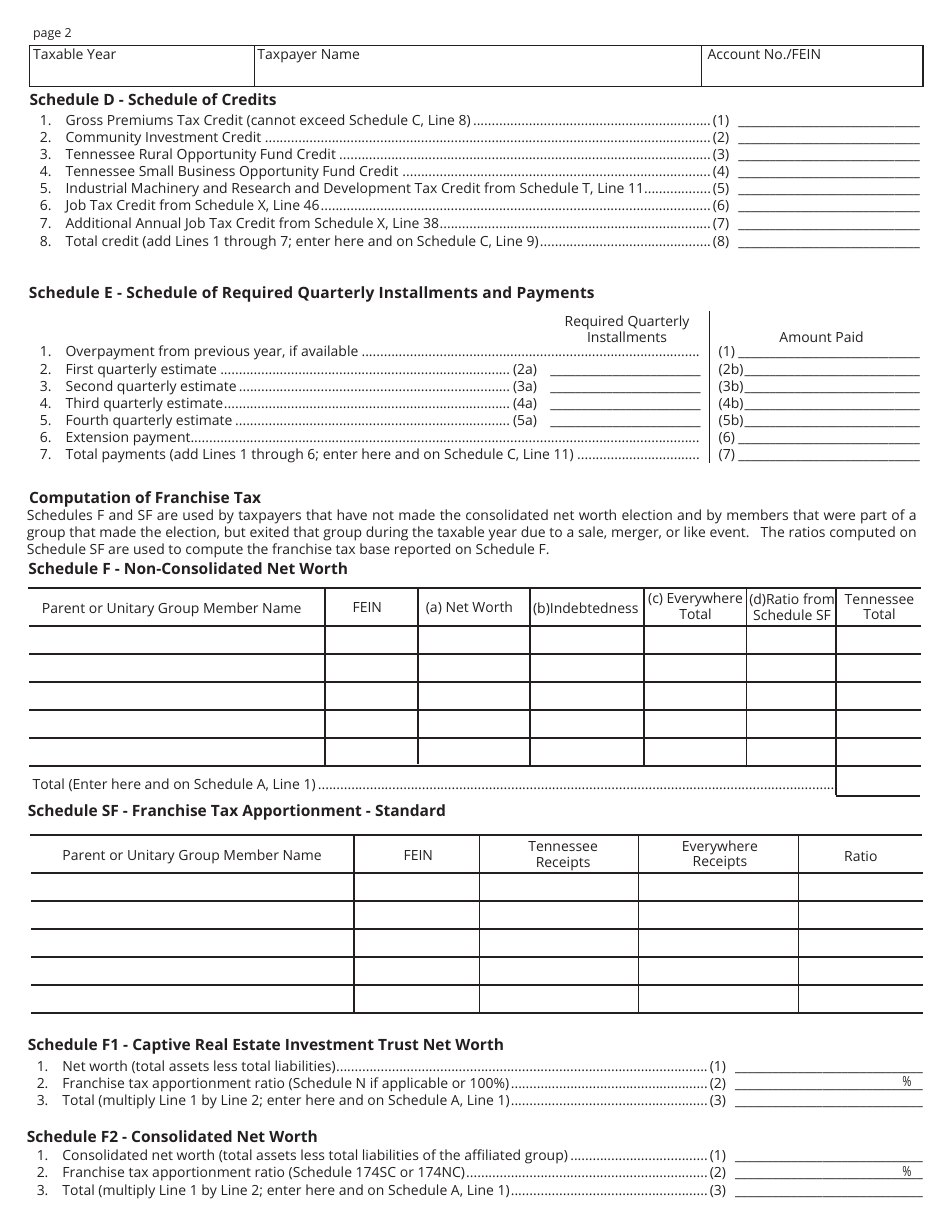

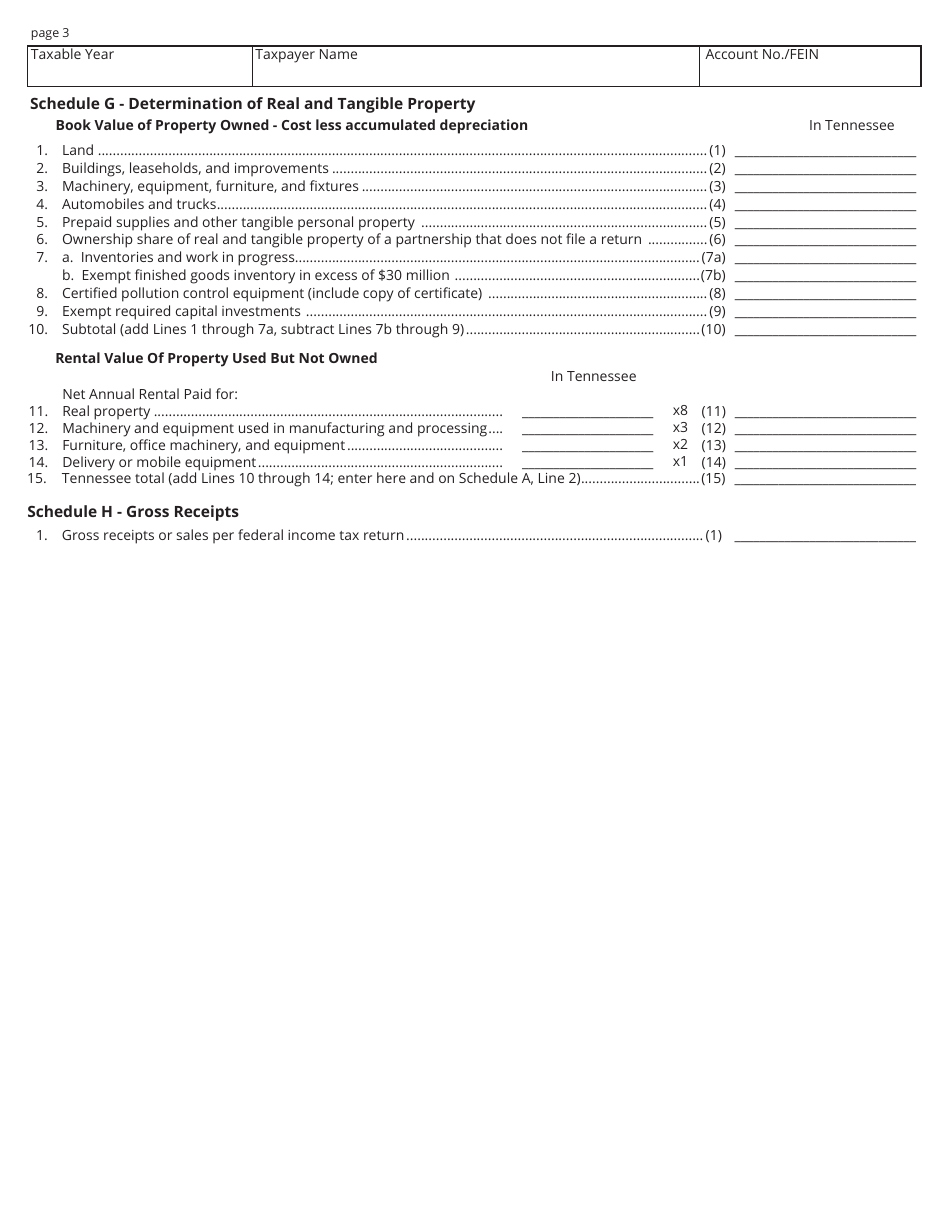

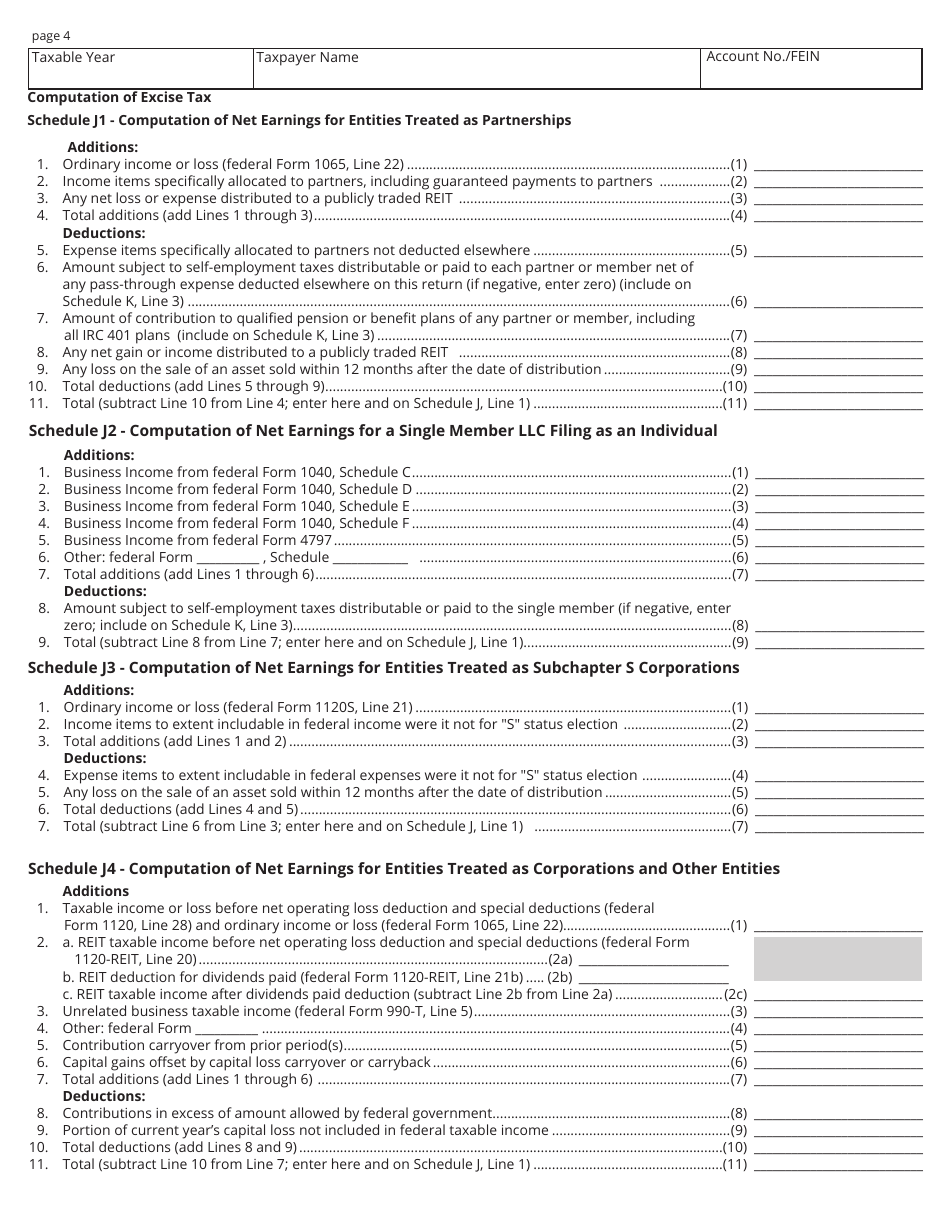

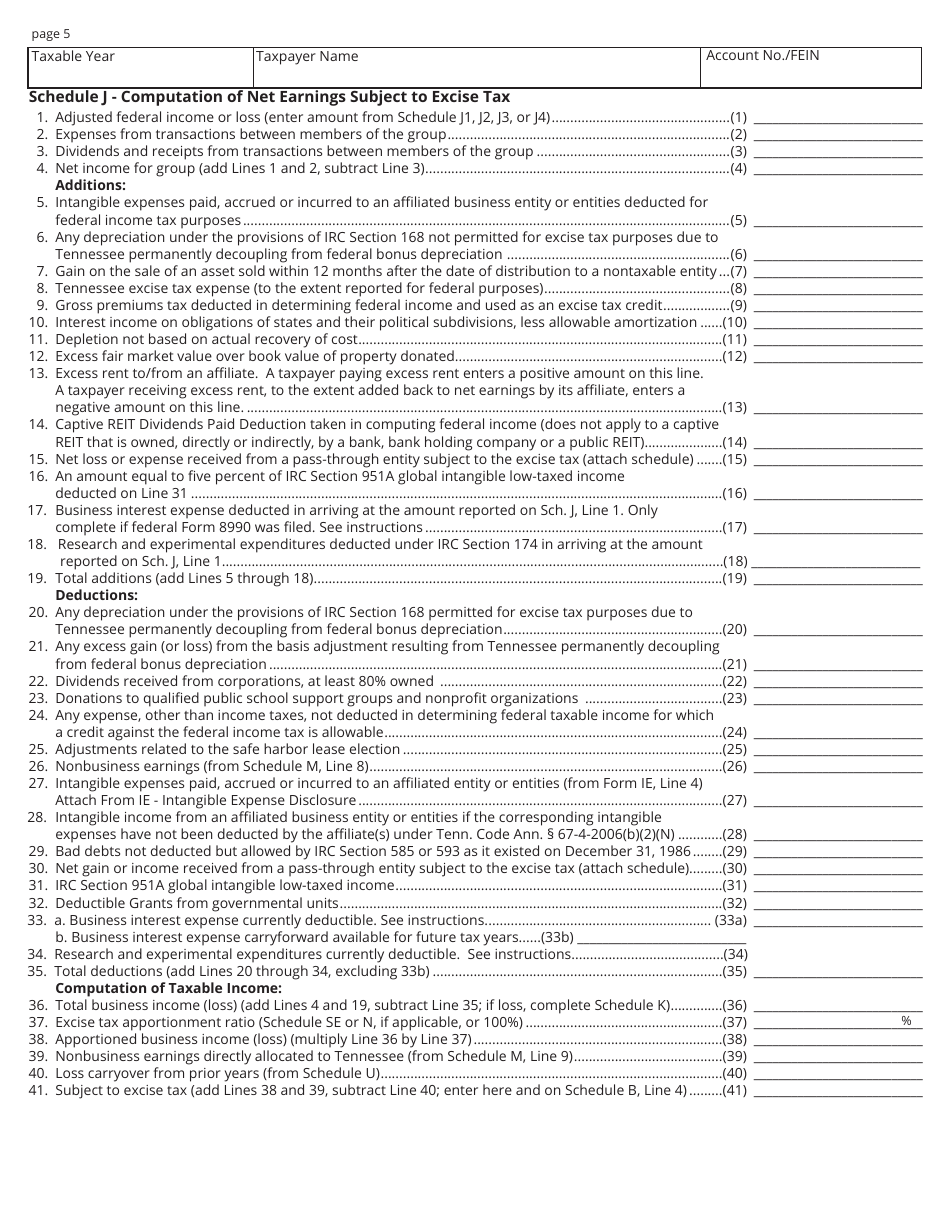

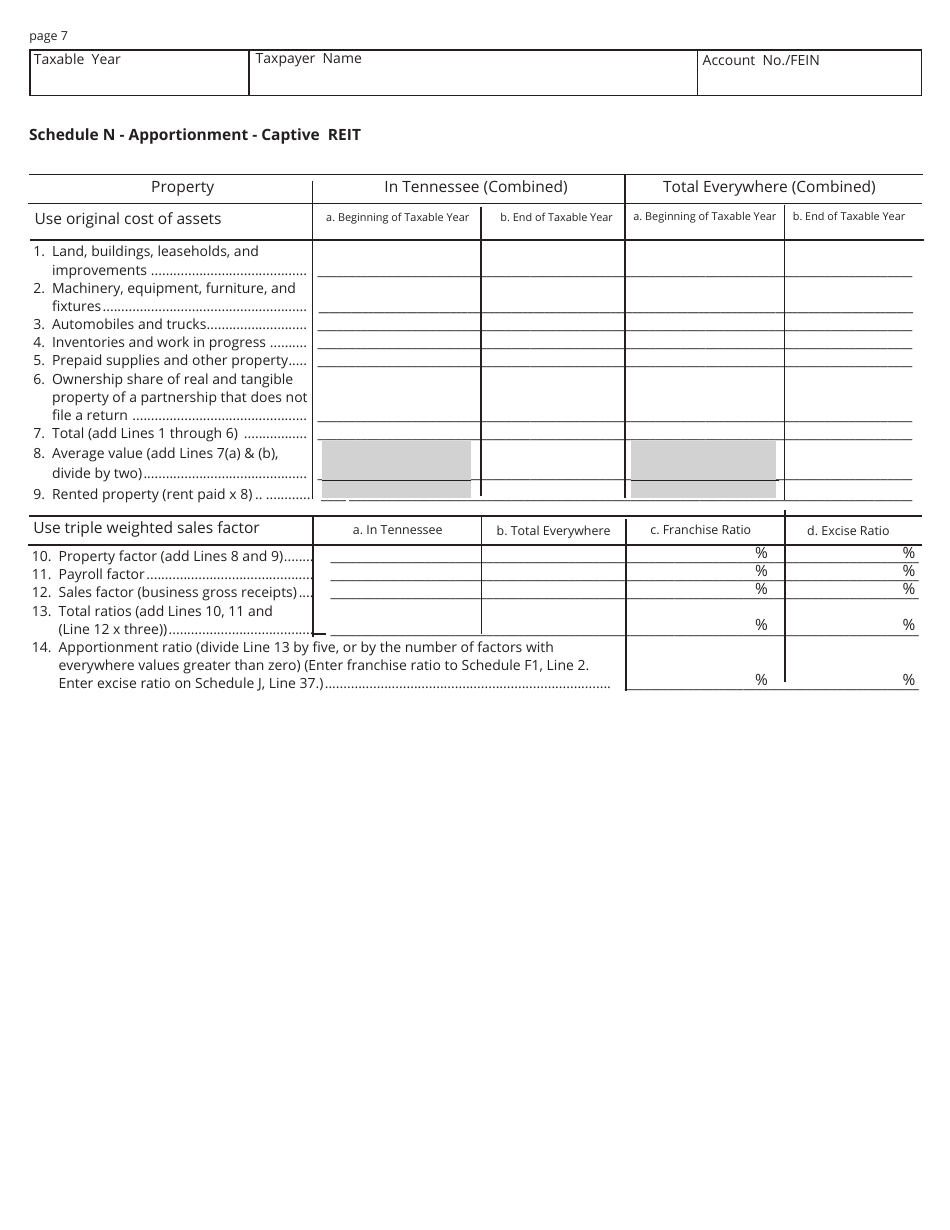

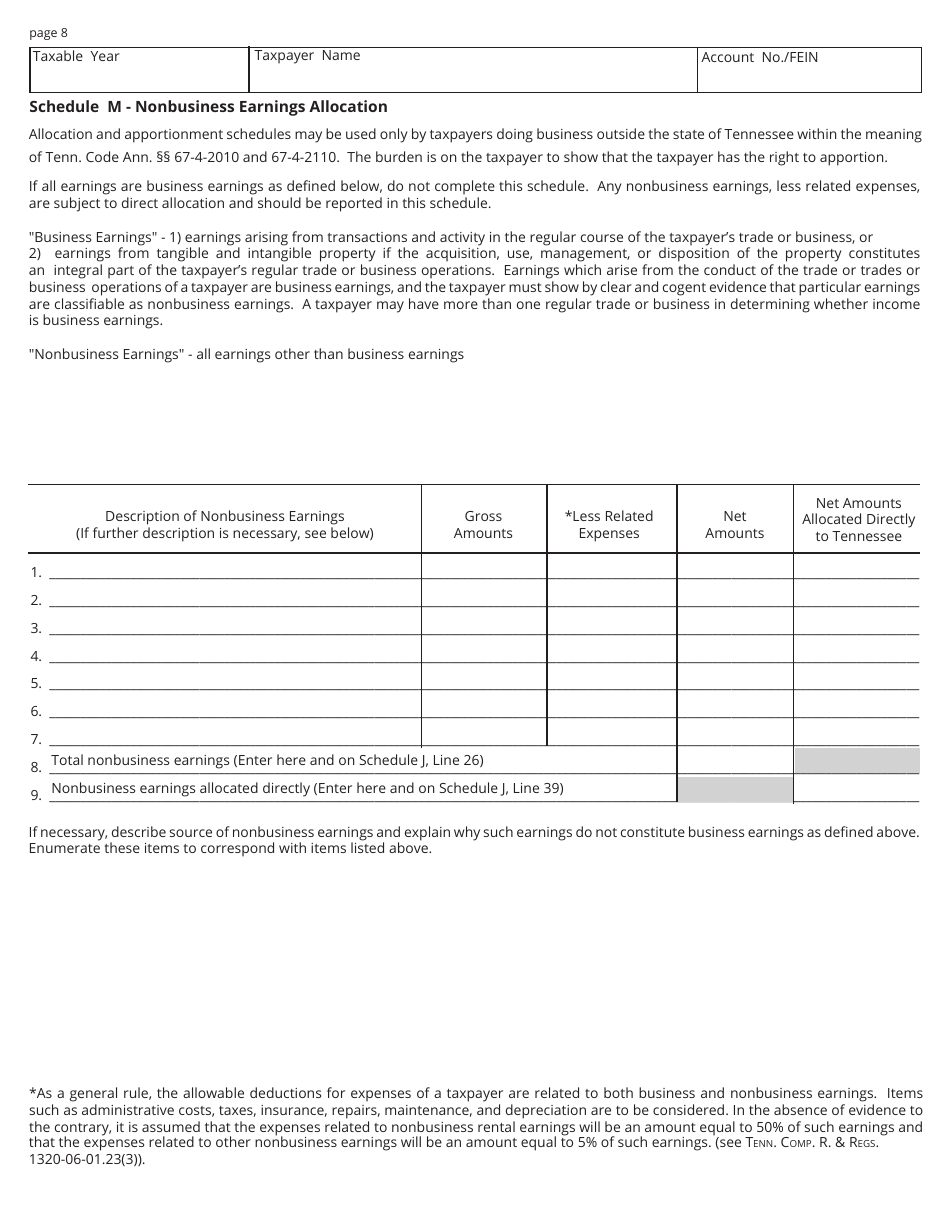

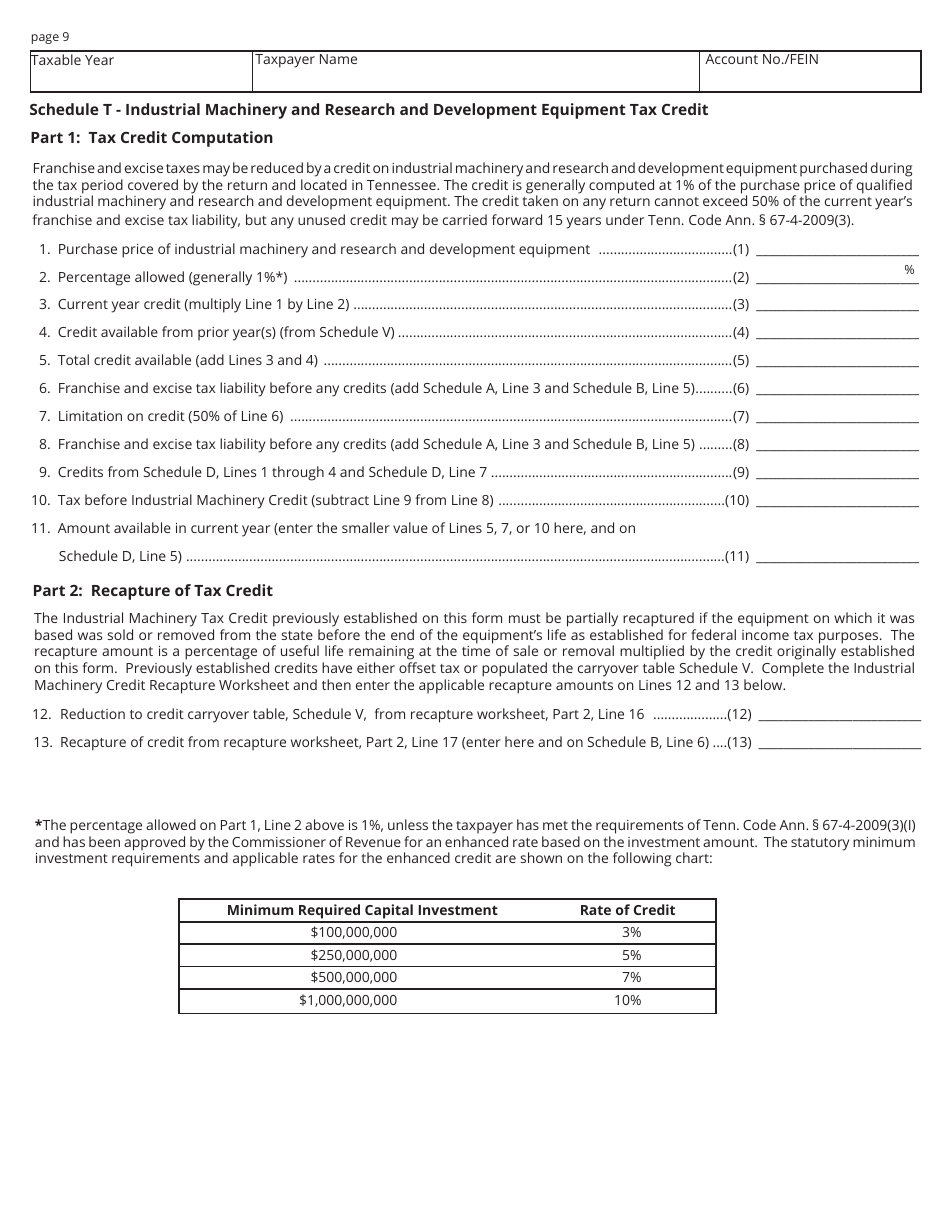

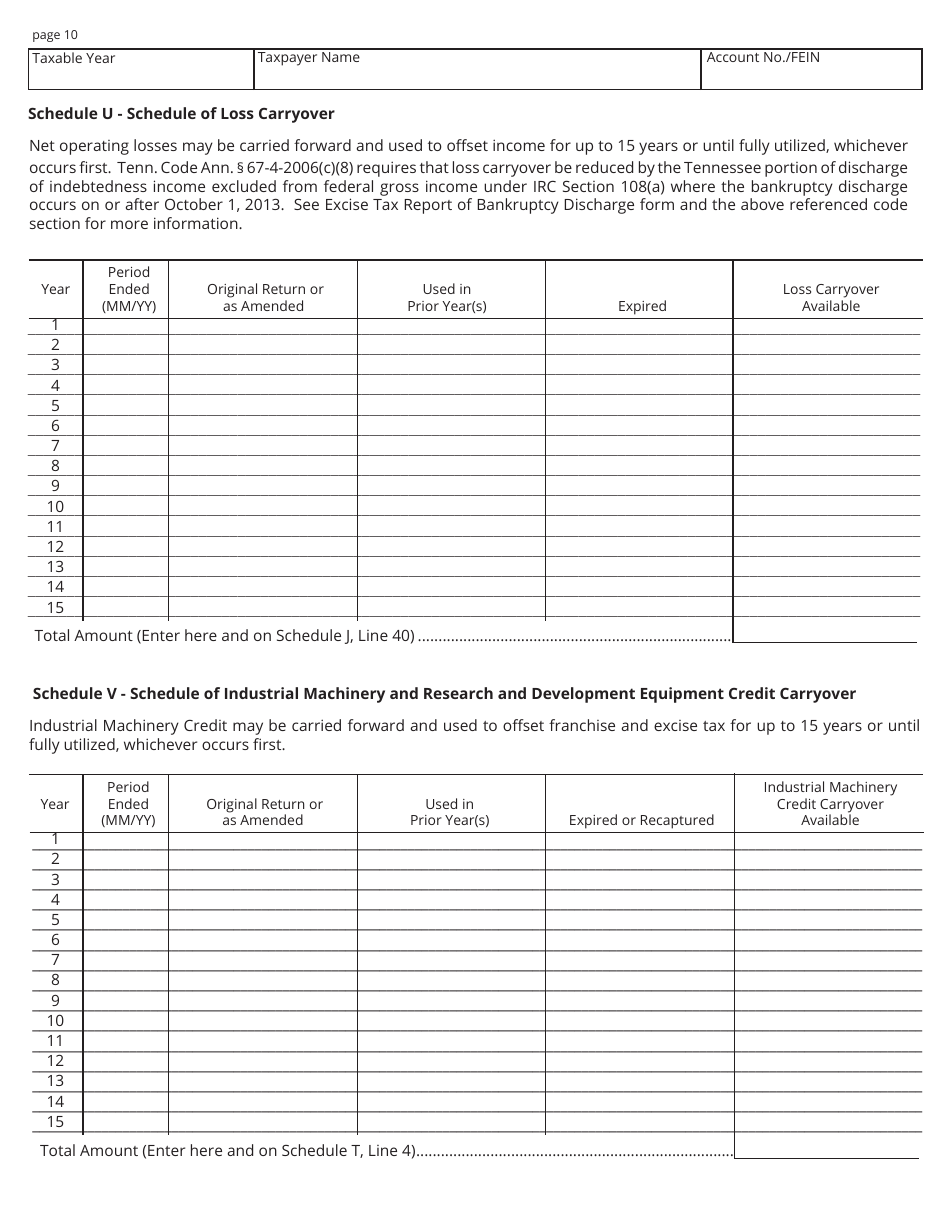

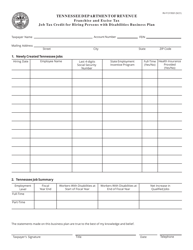

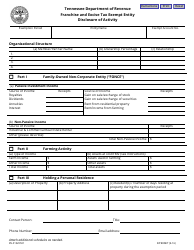

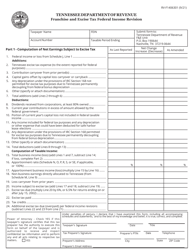

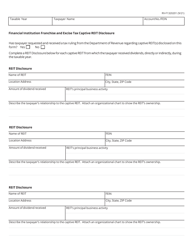

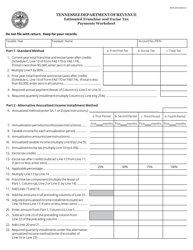

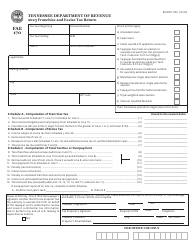

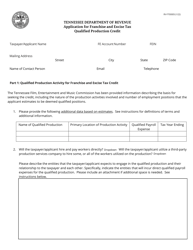

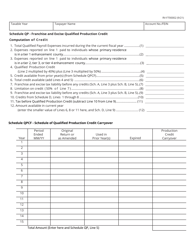

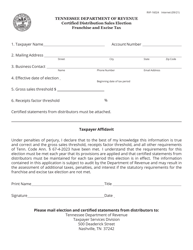

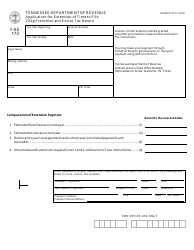

Form FAE174 (RV-R0012001) Franchise and Excise Financial Institution and Captive Real Estate Investment Trust Tax Return - Tennessee

What Is Form FAE174 (RV-R0012001)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FAE174?

A: Form FAE174 is the Franchise and Excise Financial Institution and Captive Real Estate Investment Trust Tax Return in Tennessee.

Q: Who needs to file Form FAE174?

A: Financial institutions and captive real estate investment trusts in Tennessee need to file Form FAE174.

Q: What is the purpose of Form FAE174?

A: Form FAE174 is used to calculate and report franchise and excise taxes for financial institutions and captive real estate investment trusts in Tennessee.

Q: Are there any deadlines for filing Form FAE174?

A: Yes, the deadline for filing Form FAE174 is typically the 15th day of the fourth month following the close of the tax year.

Q: Is there a fee for filing Form FAE174?

A: No, there is no fee for filing Form FAE174.

Q: What supporting documents are required with Form FAE174?

A: The specific supporting documents required with Form FAE174 may vary, but generally include financial statements, schedules, and other relevant documentation.

Q: What if I make a mistake on Form FAE174?

A: If you make a mistake on Form FAE174, you may need to file an amended return or contact the Tennessee Department of Revenue for further guidance.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FAE174 (RV-R0012001) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.