This version of the form is not currently in use and is provided for reference only. Download this version of

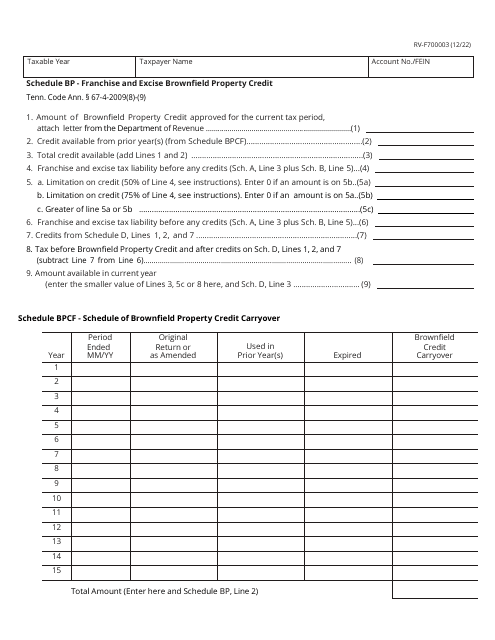

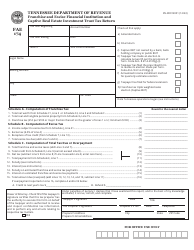

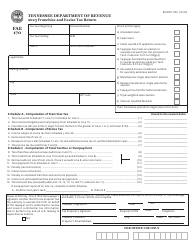

Form RV-F700003 Schedule BP

for the current year.

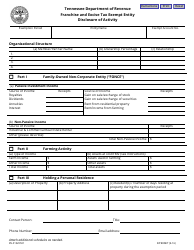

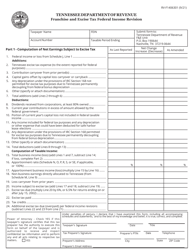

Form RV-F700003 Schedule BP Franchise and Excise Brownfield Property Credit - Tennessee

What Is Form RV-F700003 Schedule BP?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RV-F700003?

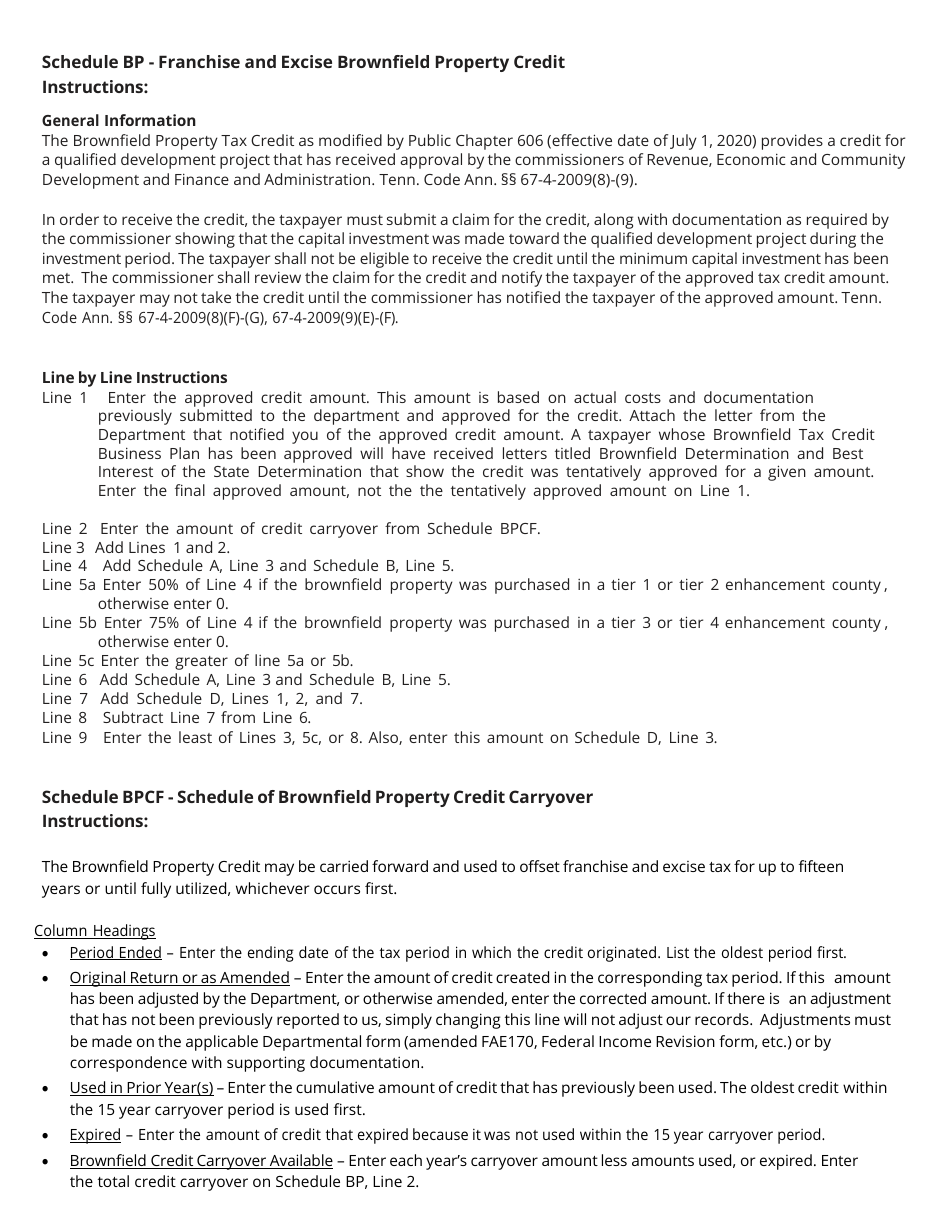

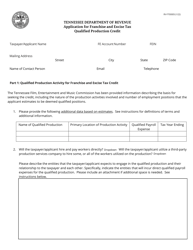

A: Form RV-F700003 is the schedule for claiming the Brownfield Property Credit in Tennessee.

Q: What is the purpose of the Brownfield Property Credit?

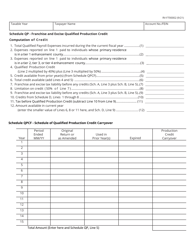

A: The Brownfield Property Credit is a tax credit for certain expenses related to the redevelopment of contaminated properties.

Q: Who is eligible for the Brownfield Property Credit?

A: Property owners who have incurred eligible expenses for the environmental cleanup and redevelopment of brownfield properties may be eligible for the credit.

Q: What expenses are eligible for the Brownfield Property Credit?

A: Eligible expenses may include costs associated with site assessment, remediation, demolition, and infrastructure development.

Q: How do I claim the Brownfield Property Credit?

A: To claim the credit, you must complete Form RV-F700003 and attach it to your Tennessee franchise and excise tax return.

Q: Are there any limitations on the Brownfield Property Credit?

A: Yes, there are limitations on the amount of credit that can be claimed in a single tax year and the total amount of credit that can be claimed.

Q: Is the Brownfield Property Credit available in other states?

A: Each state may have its own brownfield property credit or similar programs, so it's worth checking with the specific state's department of revenue or economic development agency.

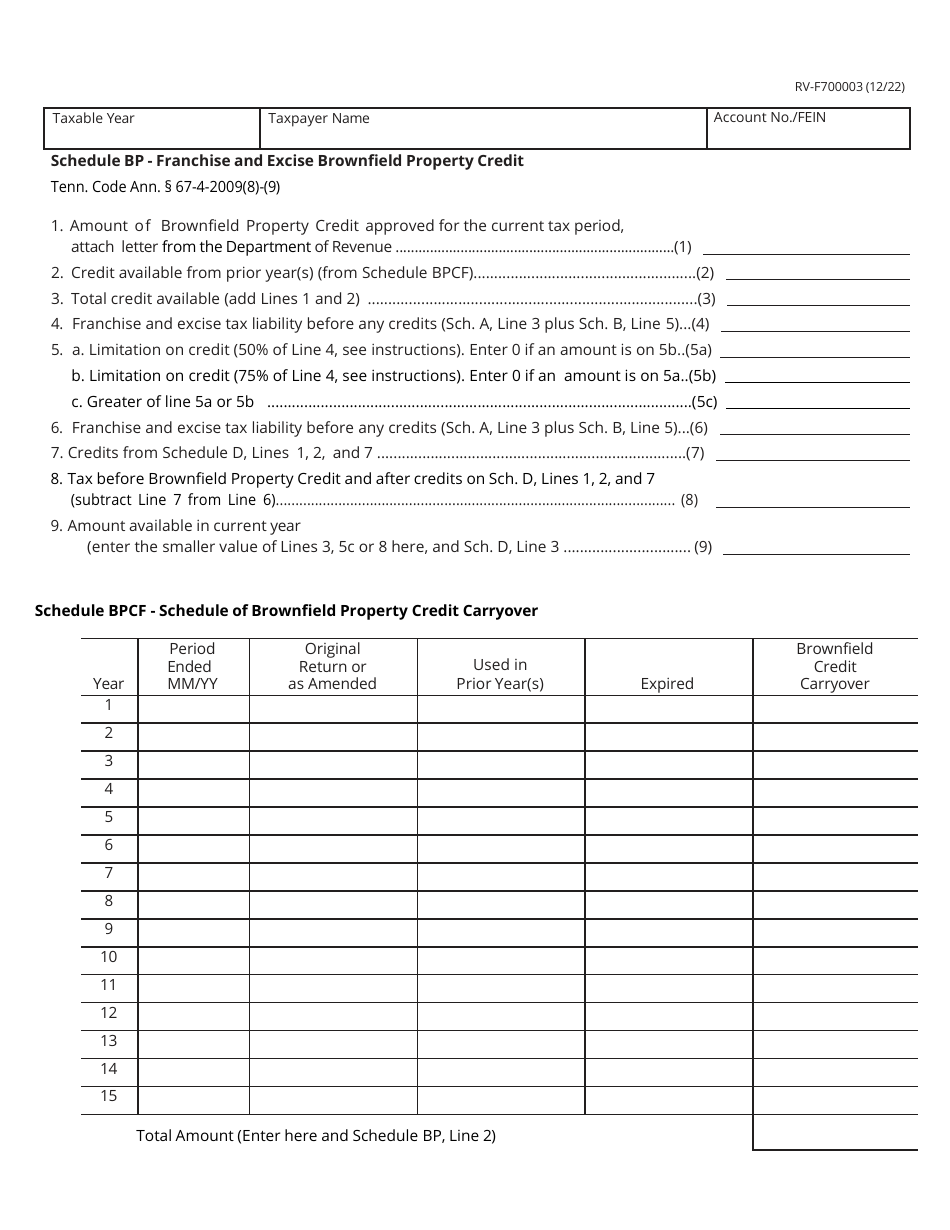

Q: Can I carry forward any unused Brownfield Property Credit?

A: Yes, any unused credit can be carried forward for up to 15 years.

Q: What documentation do I need to support my claim for the Brownfield Property Credit?

A: You should maintain documentation such as invoices, receipts, and other records that substantiate your eligible expenses.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F700003 Schedule BP by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.