This version of the form is not currently in use and is provided for reference only. Download this version of

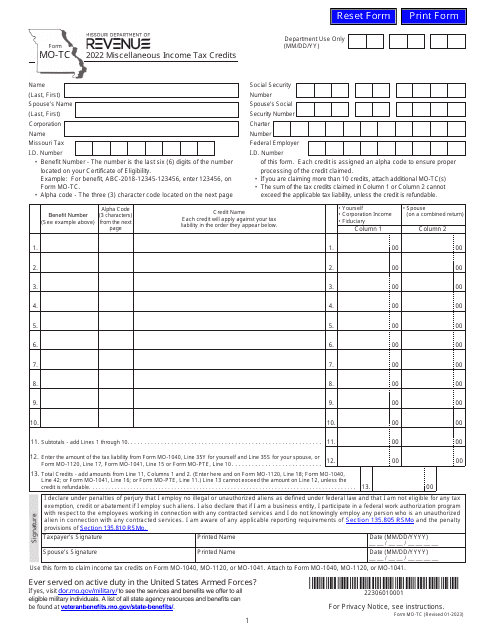

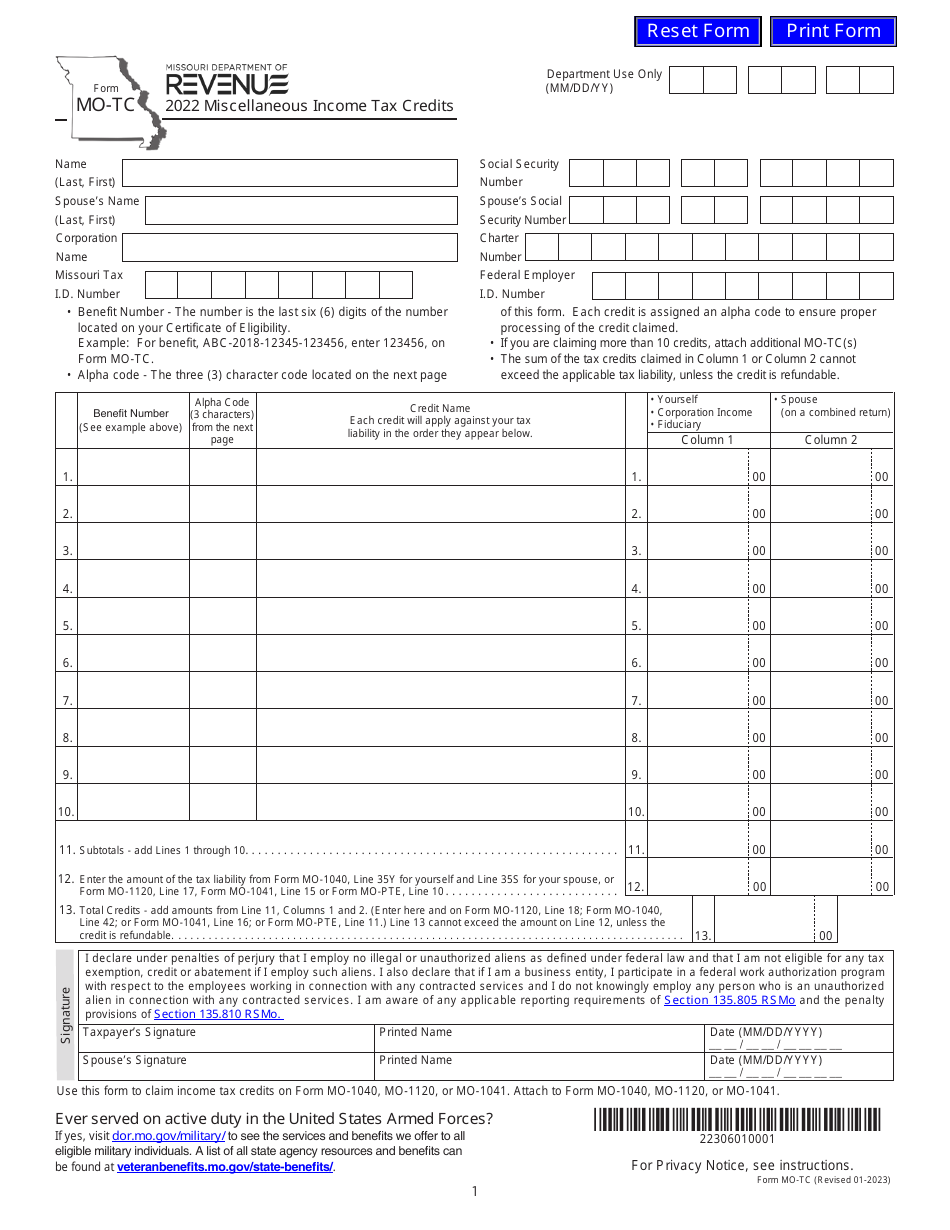

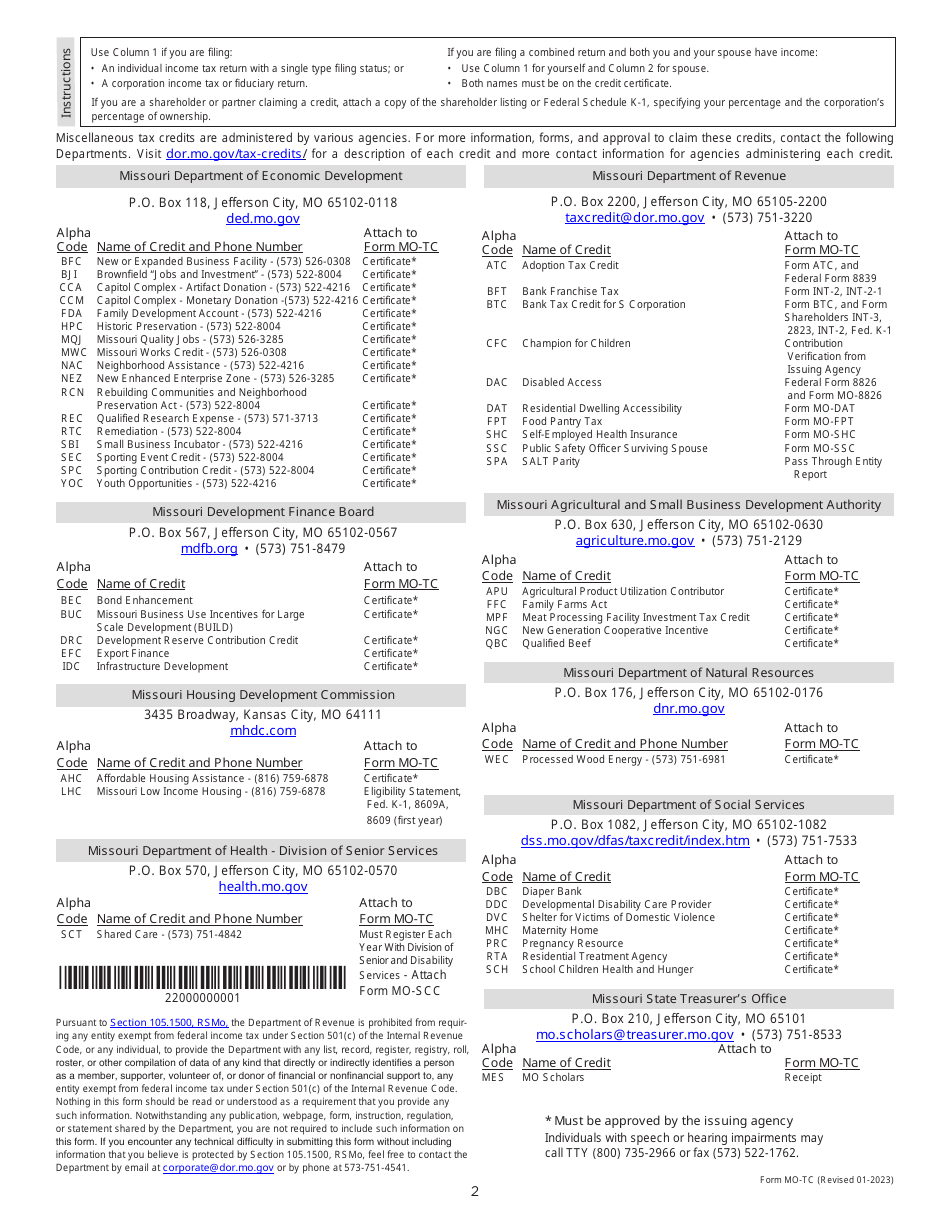

Form MO-TC

for the current year.

Form MO-TC Miscellaneous Income Tax Credits - Missouri

What Is Form MO-TC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-TC?

A: Form MO-TC is the form for claiming miscellaneous income tax credits in Missouri.

Q: What are miscellaneous income tax credits?

A: Miscellaneous income tax credits are tax credits that are available for specific purposes or circumstances.

Q: Who needs to file Form MO-TC?

A: Anyone who wants to claim miscellaneous income tax credits in Missouri needs to file Form MO-TC.

Q: What types of tax credits can I claim on Form MO-TC?

A: Form MO-TC allows you to claim a variety of tax credits, such as the Historic PreservationTax Credit or the Small Business Investment Tax Credit.

Q: Are there any specific requirements for claiming tax credits on Form MO-TC?

A: Yes, each tax credit has its own set of requirements, so you need to carefully review the instructions for Form MO-TC and ensure that you meet all the eligibility criteria.

Q: When is the deadline for filing Form MO-TC?

A: The deadline for filing Form MO-TC is the same as the deadline for filing your Missouri income tax return, which is usually April 15th.

Q: Can I claim tax credits from previous years on Form MO-TC?

A: No, Form MO-TC is used to claim tax credits for the current tax year only. If you have unclaimed tax credits from previous years, you may need to file an amended return.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-TC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.