This version of the form is not currently in use and is provided for reference only. Download this version of

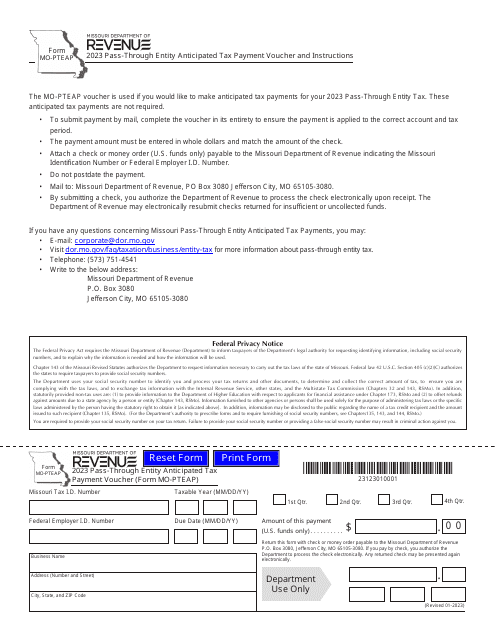

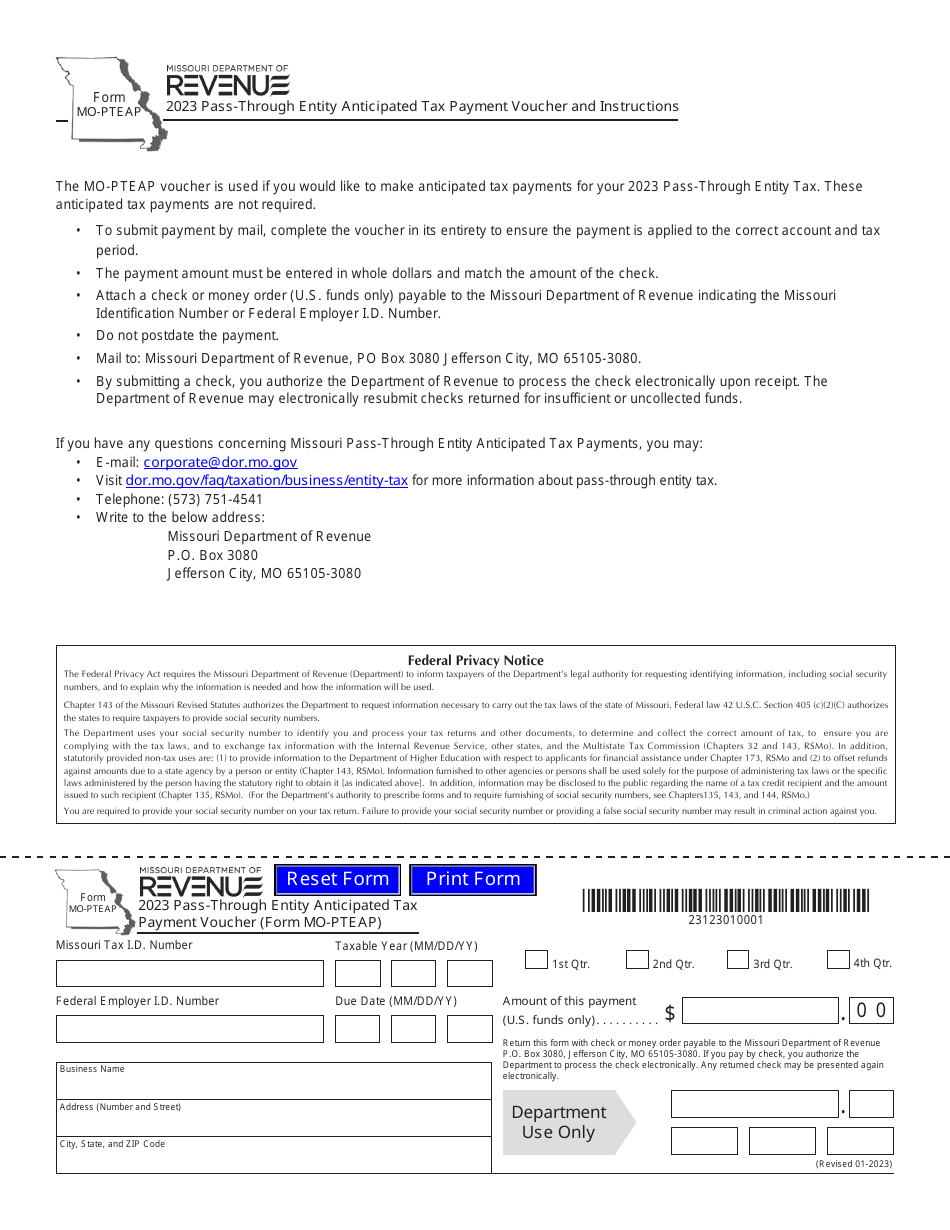

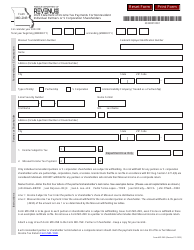

Form MO-PTEAP

for the current year.

Form MO-PTEAP Pass-Through Entity Anticipated Tax Payment Voucher - Missouri

What Is Form MO-PTEAP?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

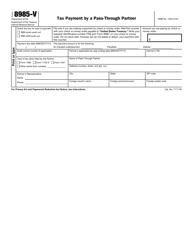

Q: What is MO-PTEAP?

A: MO-PTEAP stands for Pass-Through Entity Anticipated Tax Payment Voucher.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that passes its income through to its owners or partners, who then report the income on their individual tax returns.

Q: Why would I need to use MO-PTEAP?

A: You would need to use MO-PTEAP if you are a pass-through entity and need to make anticipated tax payments to the state of Missouri.

Q: How do I use MO-PTEAP?

A: To use MO-PTEAP, you fill out the voucher with your entity's information, estimate the amount of tax you owe, and send the voucher and payment to the Missouri Department of Revenue.

Q: When is the deadline to submit MO-PTEAP?

A: The deadline to submit MO-PTEAP is typically the 15th day of the month following the end of the entity's tax year.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-PTEAP by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.