This version of the form is not currently in use and is provided for reference only. Download this version of

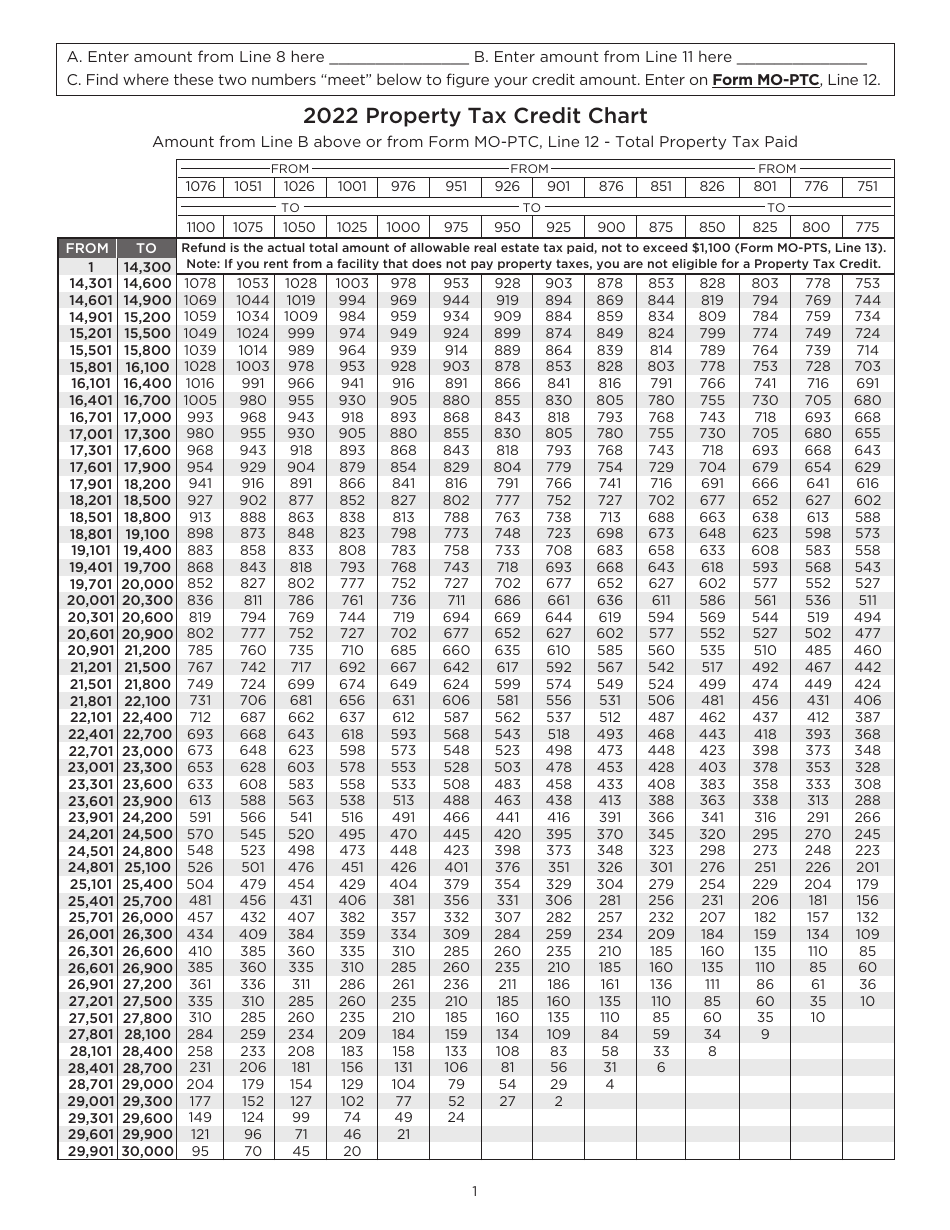

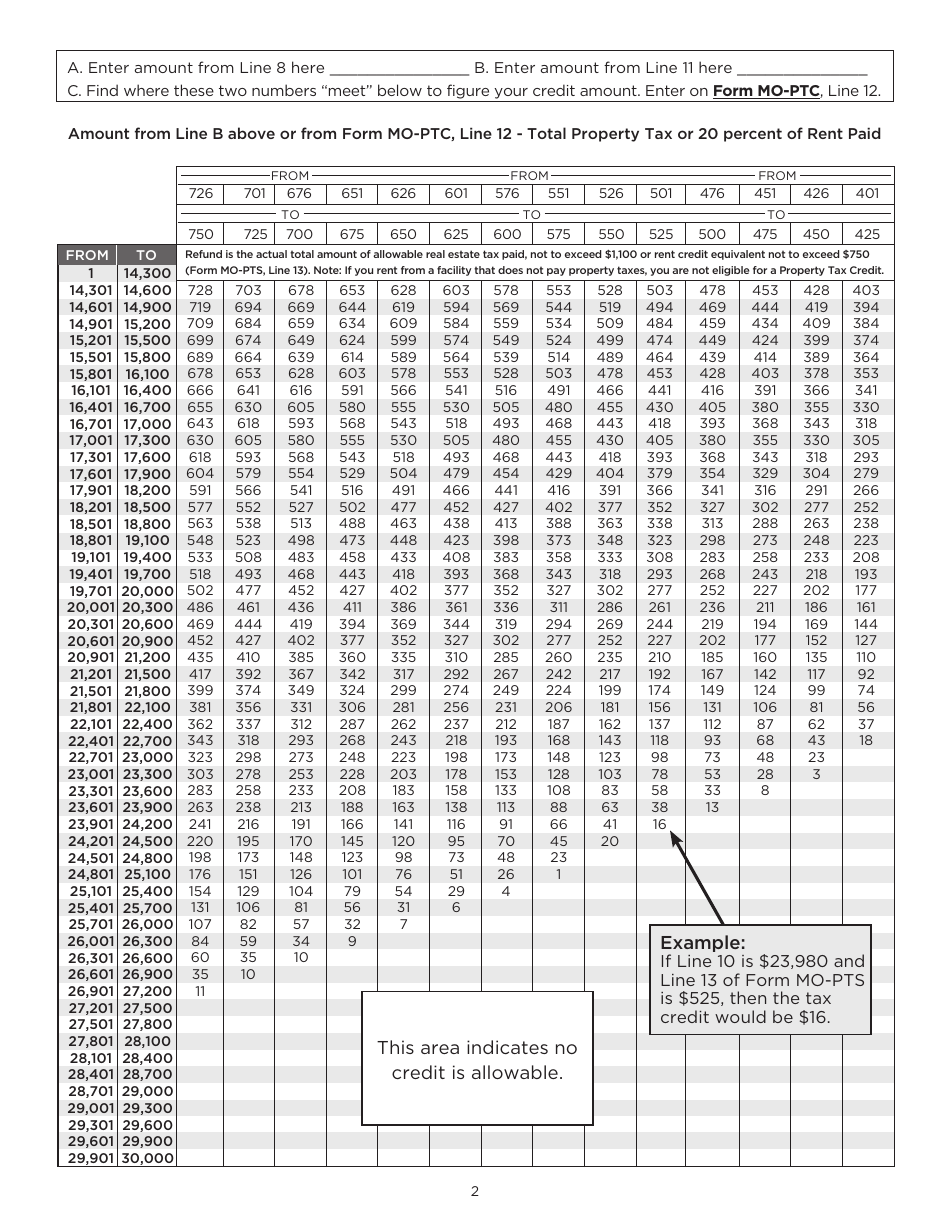

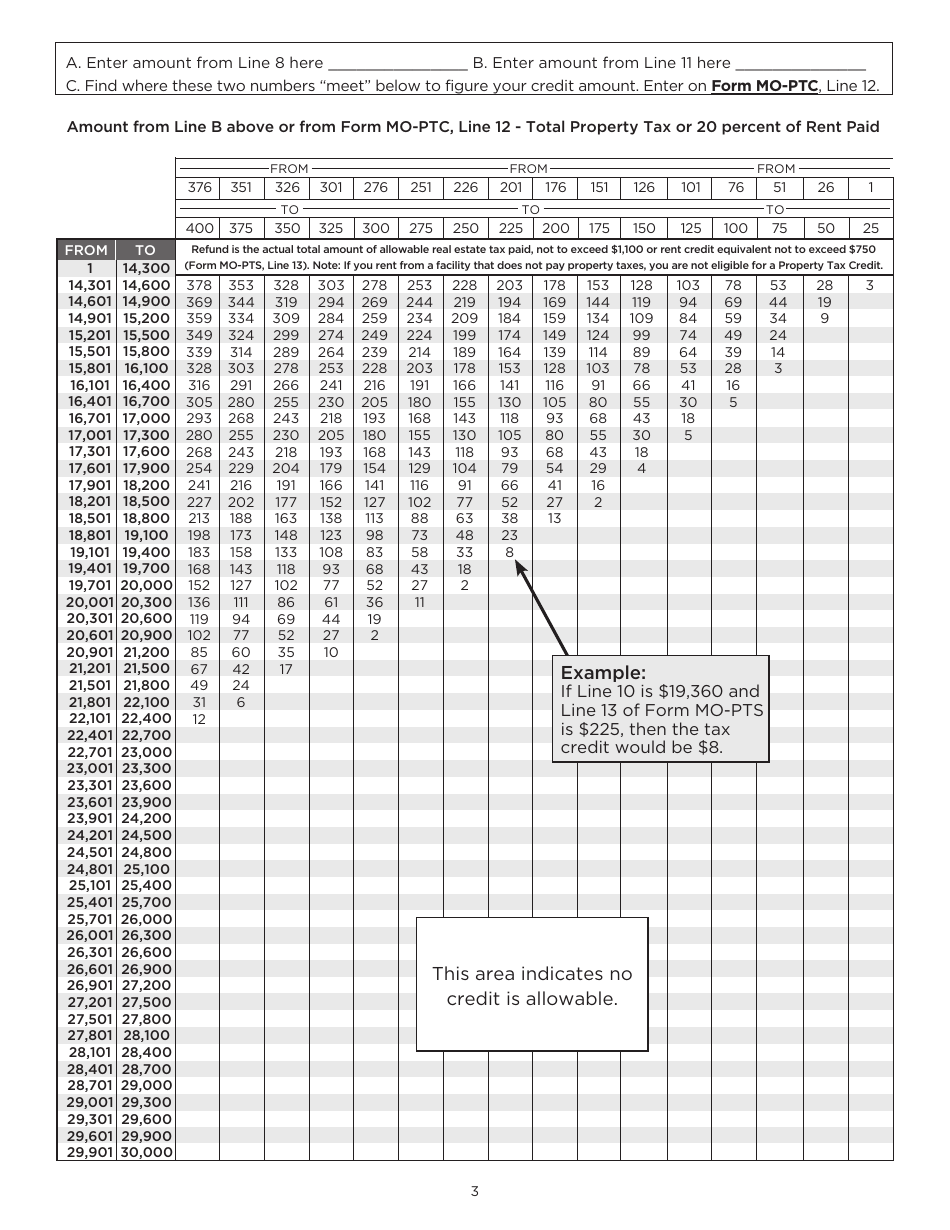

Form MO-PTC

for the current year.

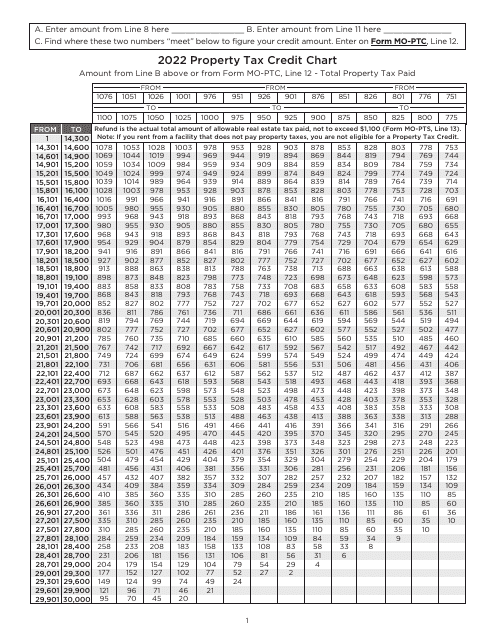

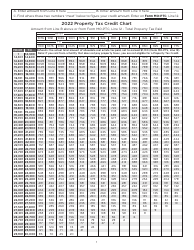

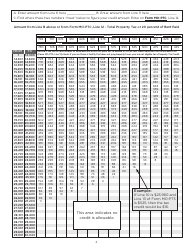

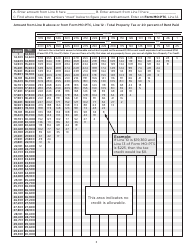

Form MO-PTC Property Tax Credit Chart - Missouri

What Is Form MO-PTC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-PTC?

A: Form MO-PTC is the Property Tax Credit Chart for Missouri.

Q: What is the purpose of Form MO-PTC?

A: The purpose of Form MO-PTC is to calculate the property tax credit that eligible residents can claim in Missouri.

Q: Who is eligible to claim the property tax credit in Missouri?

A: Eligible residents of Missouri who meet certain criteria can claim the property tax credit.

Q: What criteria must be met to claim the property tax credit in Missouri?

A: To claim the property tax credit in Missouri, you must meet income, age, and residency requirements set by the state.

Q: How does Form MO-PTC help calculate the property tax credit?

A: Form MO-PTC provides a chart that helps calculate the property tax credit based on your income, age, and other factors.

Q: When is the deadline to file Form MO-PTC?

A: The deadline to file Form MO-PTC is typically April 15th, the same as the federal tax filing deadline.

Q: Can I claim the property tax credit if I rent a property in Missouri?

A: No, the property tax credit is only available to homeowners in Missouri.

Q: Is the property tax credit refundable?

A: Yes, if the property tax credit exceeds your tax liability, you may be eligible for a refund.

Q: Are there any other forms or documents required to claim the property tax credit in Missouri?

A: In addition to Form MO-PTC, you may need to provide documentation such as proof of income and property tax payments.

Form Details:

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MO-PTC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.