This version of the form is not currently in use and is provided for reference only. Download this version of

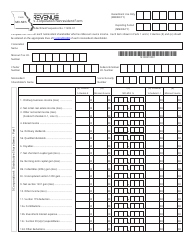

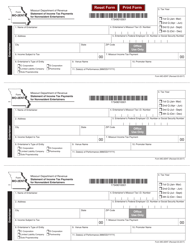

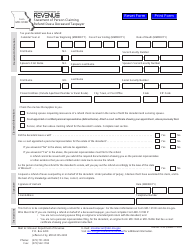

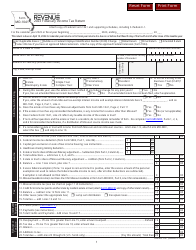

Form MO-NRF

for the current year.

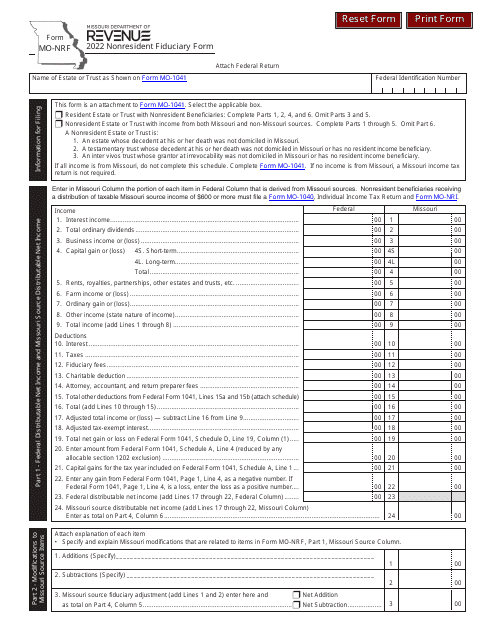

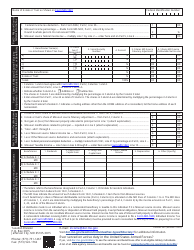

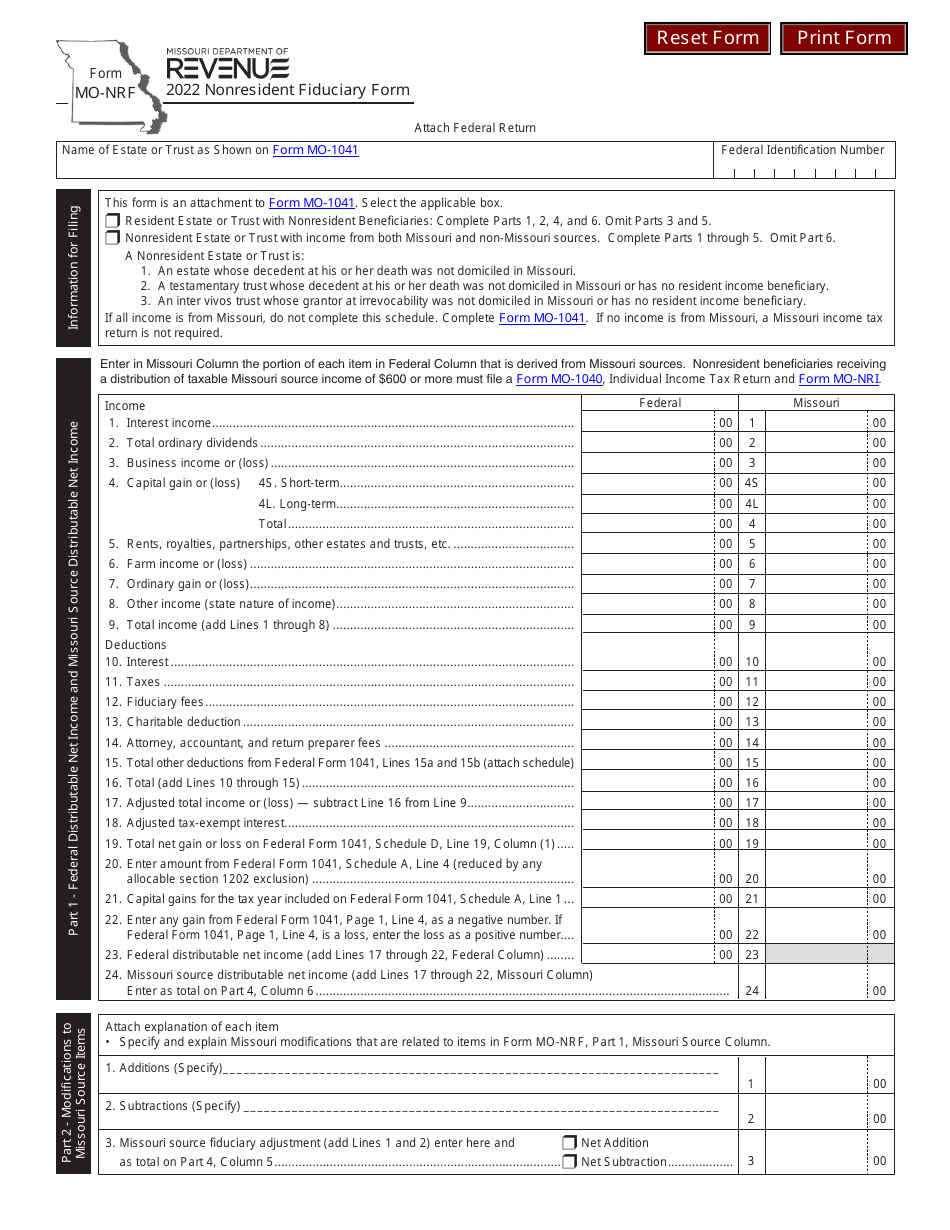

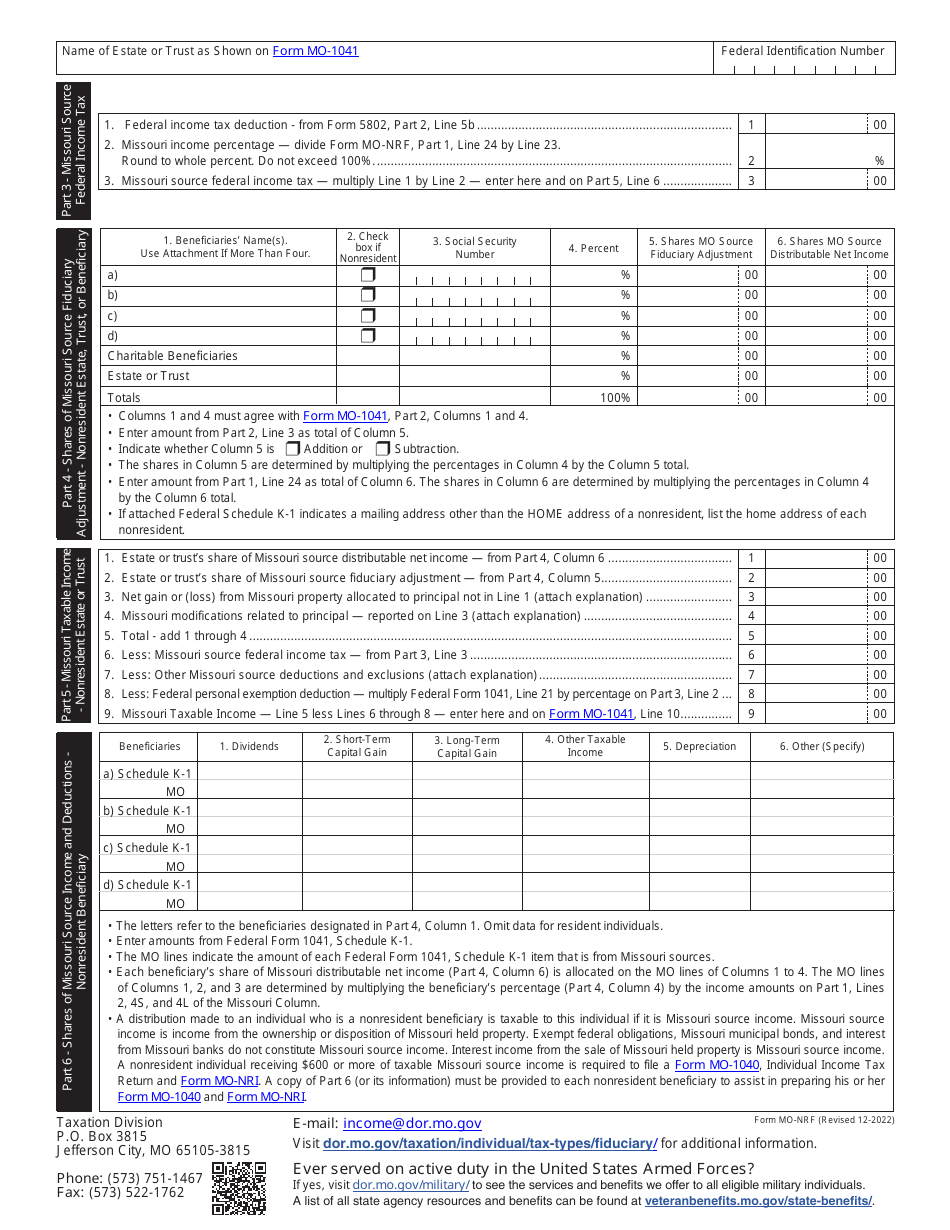

Form MO-NRF Nonresident Fiduciary Form - Missouri

What Is Form MO-NRF?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-NRF Nonresident Fiduciary Form?

A: The MO-NRF Nonresident Fiduciary Form is a form used by nonresident fiduciaries to report income earned or sourced from Missouri.

Q: Who needs to file the MO-NRF Nonresident Fiduciary Form?

A: Nonresident fiduciaries who have income from Missouri sources need to file the MO-NRF Nonresident Fiduciary Form.

Q: What is a fiduciary?

A: A fiduciary is a person or entity that has been appointed to act on behalf of another person or entity in financial and legal matters.

Q: What kind of income should be reported on the MO-NRF Nonresident Fiduciary Form?

A: The MO-NRF Nonresident Fiduciary Form should be used to report income earned or sourced from Missouri, such as rental income or income from a business operating in Missouri.

Q: When is the deadline to file the MO-NRF Nonresident Fiduciary Form?

A: The deadline to file the MO-NRF Nonresident Fiduciary Form is April 15th of the following year.

Q: Are there any penalties for not filing the MO-NRF Nonresident Fiduciary Form?

A: Yes, there may be penalties for not filing the MO-NRF Nonresident Fiduciary Form, including interest charges and possible legal action.

Q: Do I need to include supporting documentation with the MO-NRF Nonresident Fiduciary Form?

A: Yes, you may need to include supporting documentation, such as copies of federal tax returns and schedules, with the MO-NRF Nonresident Fiduciary Form.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-NRF by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.