This version of the form is not currently in use and is provided for reference only. Download this version of

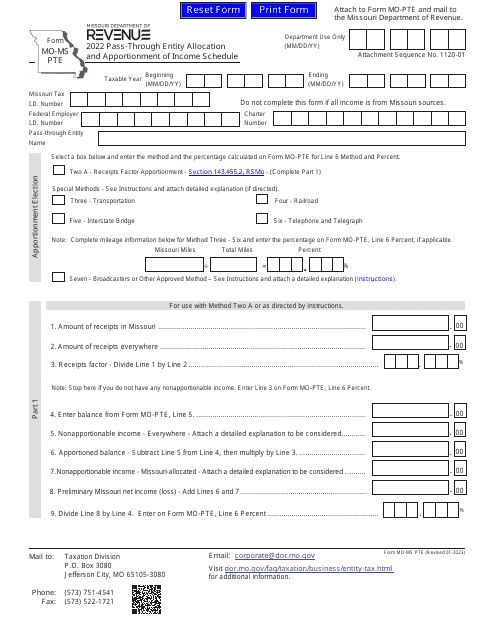

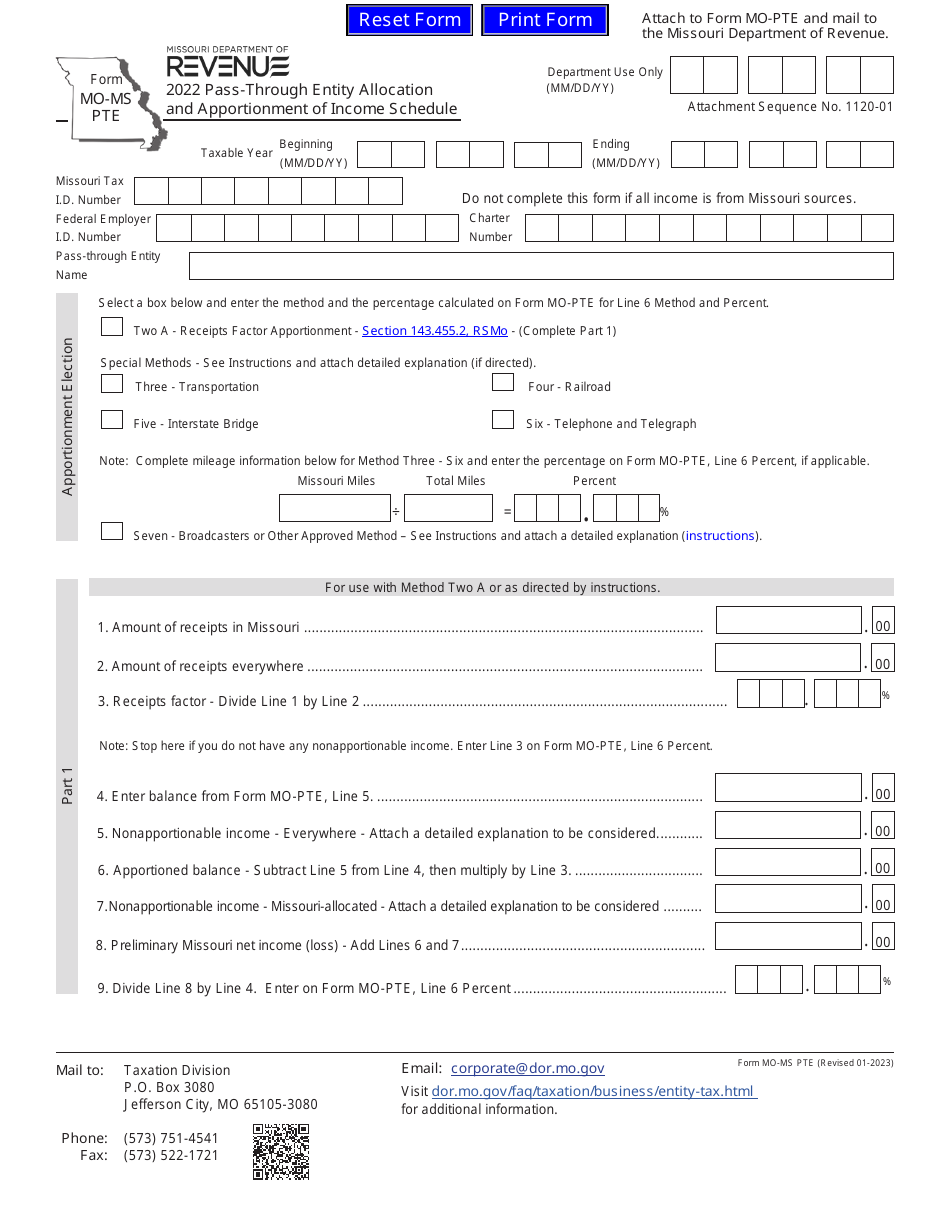

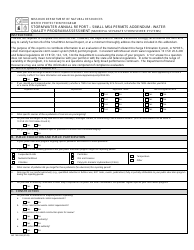

Form MO-MS PTE

for the current year.

Form MO-MS PTE Pass-Through Entity Allocation and Apportionment of Income Schedule - Missouri

What Is Form MO-MS PTE?

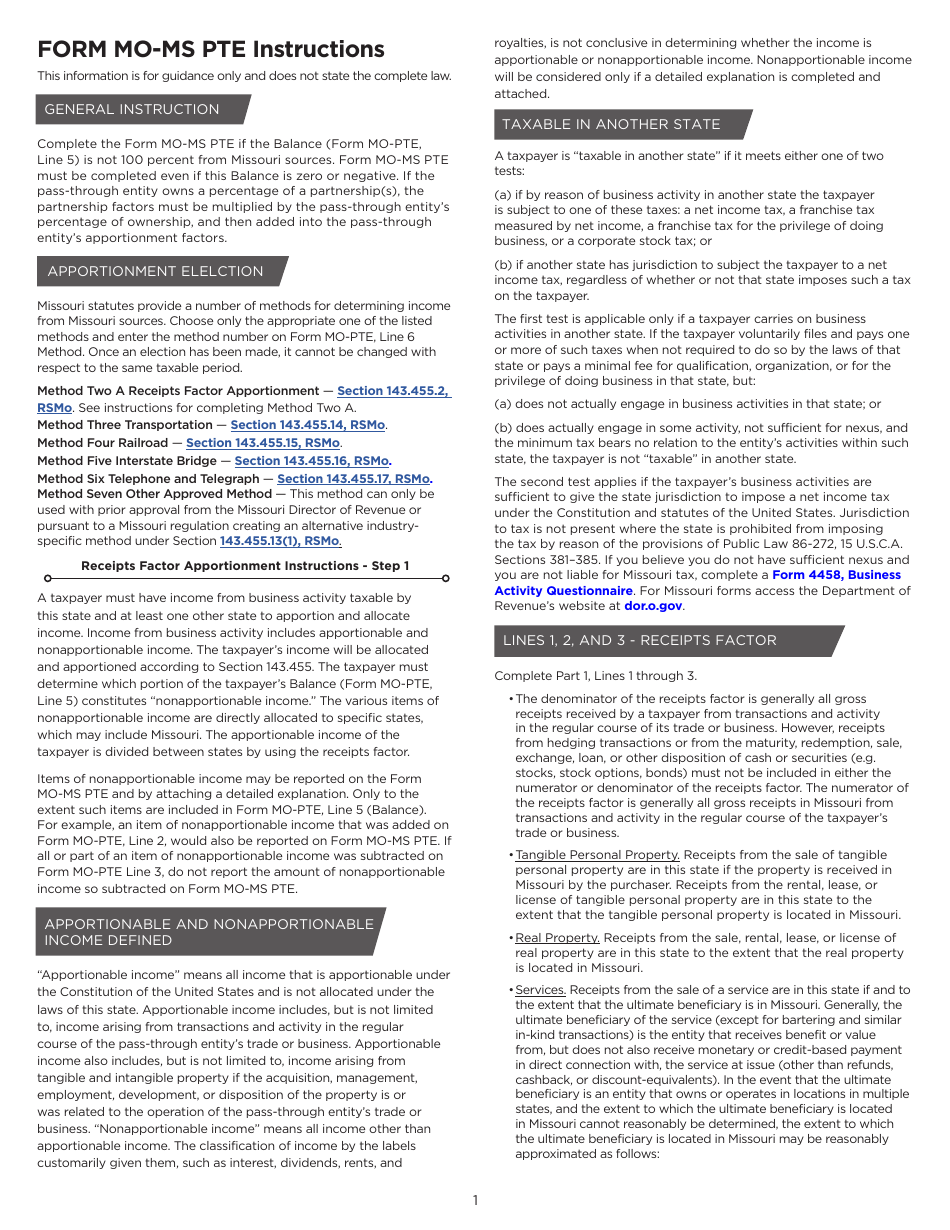

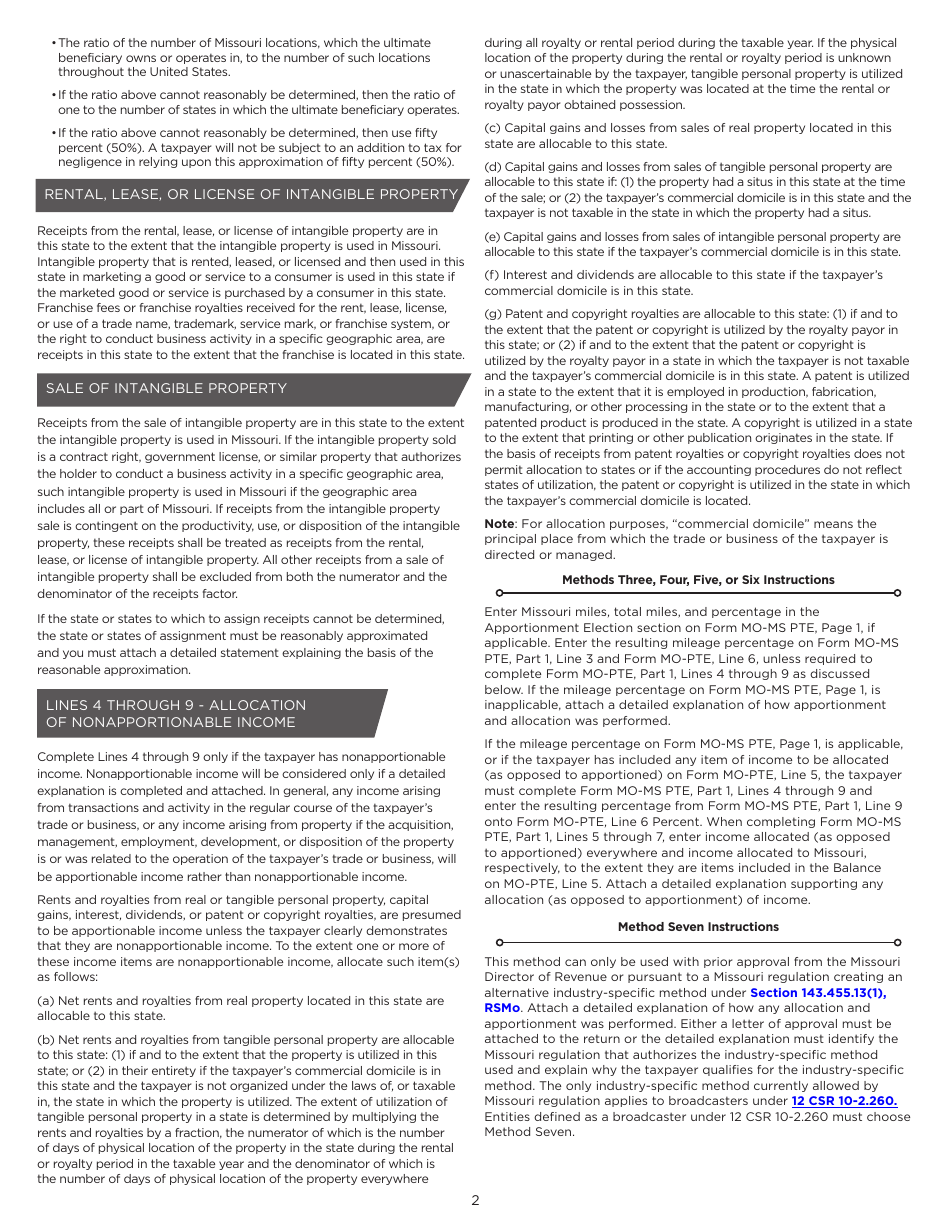

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-MS?

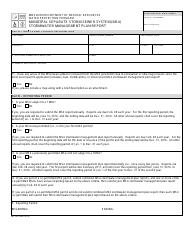

A: Form MO-MS is the Pass-Through Entity Allocation and Apportionment of Income Schedule for Missouri.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income tax itself, but instead passes its income to its owners, who then report the income on their personal tax returns.

Q: Who needs to file Form MO-MS?

A: Pass-through entities that operate in Missouri and have income that is allocated or apportioned to the state need to file Form MO-MS.

Q: What is the purpose of Form MO-MS?

A: Form MO-MS is used to allocate and apportion income for pass-through entities operating in Missouri, in order to determine their state income tax liability.

Q: Are there any specific requirements for completing Form MO-MS?

A: Yes, pass-through entities must follow the instructions provided with the form and provide accurate and complete information about their income allocation and apportionment.

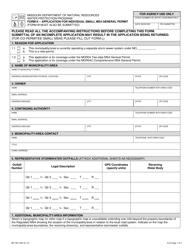

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-MS PTE by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.