This version of the form is not currently in use and is provided for reference only. Download this version of

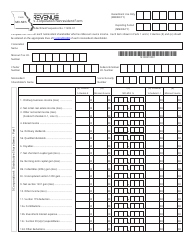

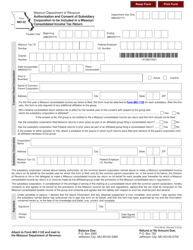

Form MO-MSS

for the current year.

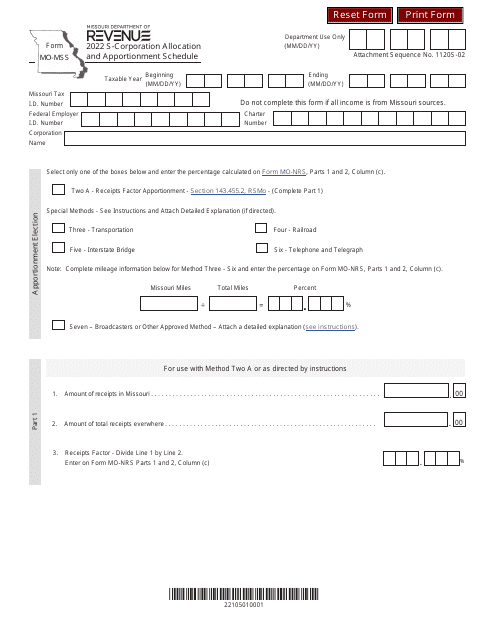

Form MO-MSS S-Corporation Allocation and Apportionment Schedule - Missouri

What Is Form MO-MSS?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

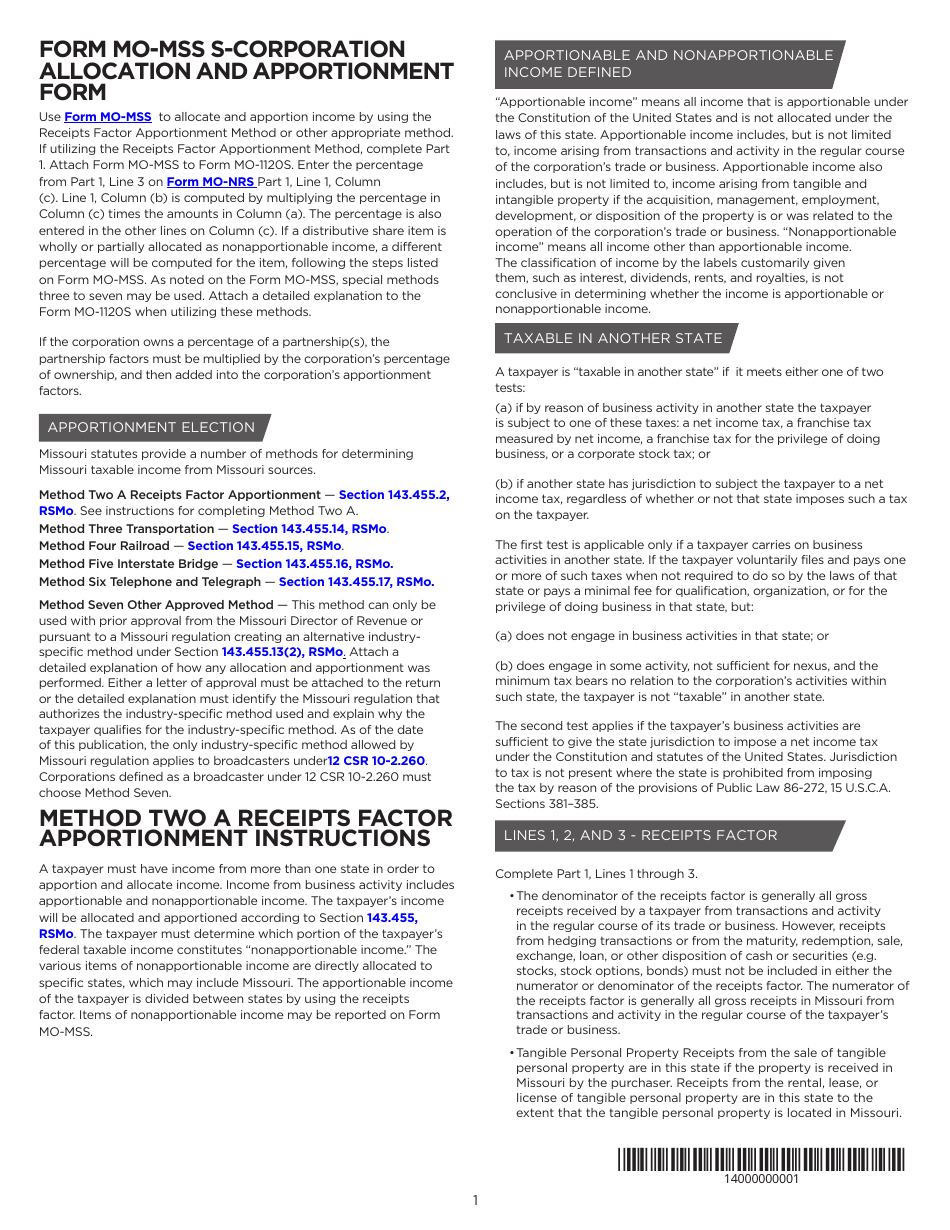

Q: What is Form MO-MSS?

A: Form MO-MSS is the S-Corporation Allocation and Apportionment Schedule for Missouri.

Q: What is an S-Corporation?

A: An S-Corporation is a type of corporation that elects to pass income, losses, deductions, and credits through to their shareholders for federal tax purposes.

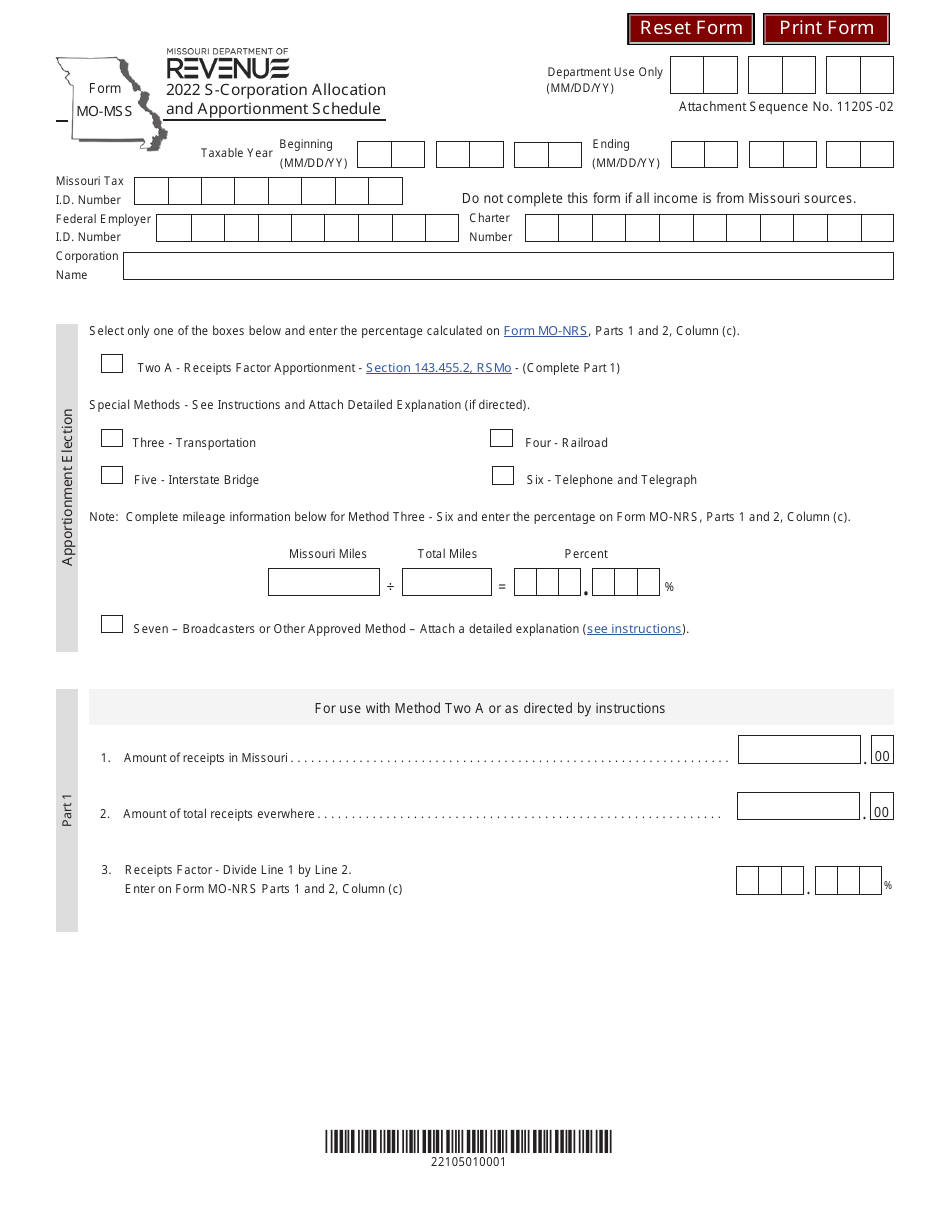

Q: Why do I need to fill out Form MO-MSS?

A: You need to fill out Form MO-MSS to allocate and apportion income, deductions, and credits for your S-Corporation in Missouri.

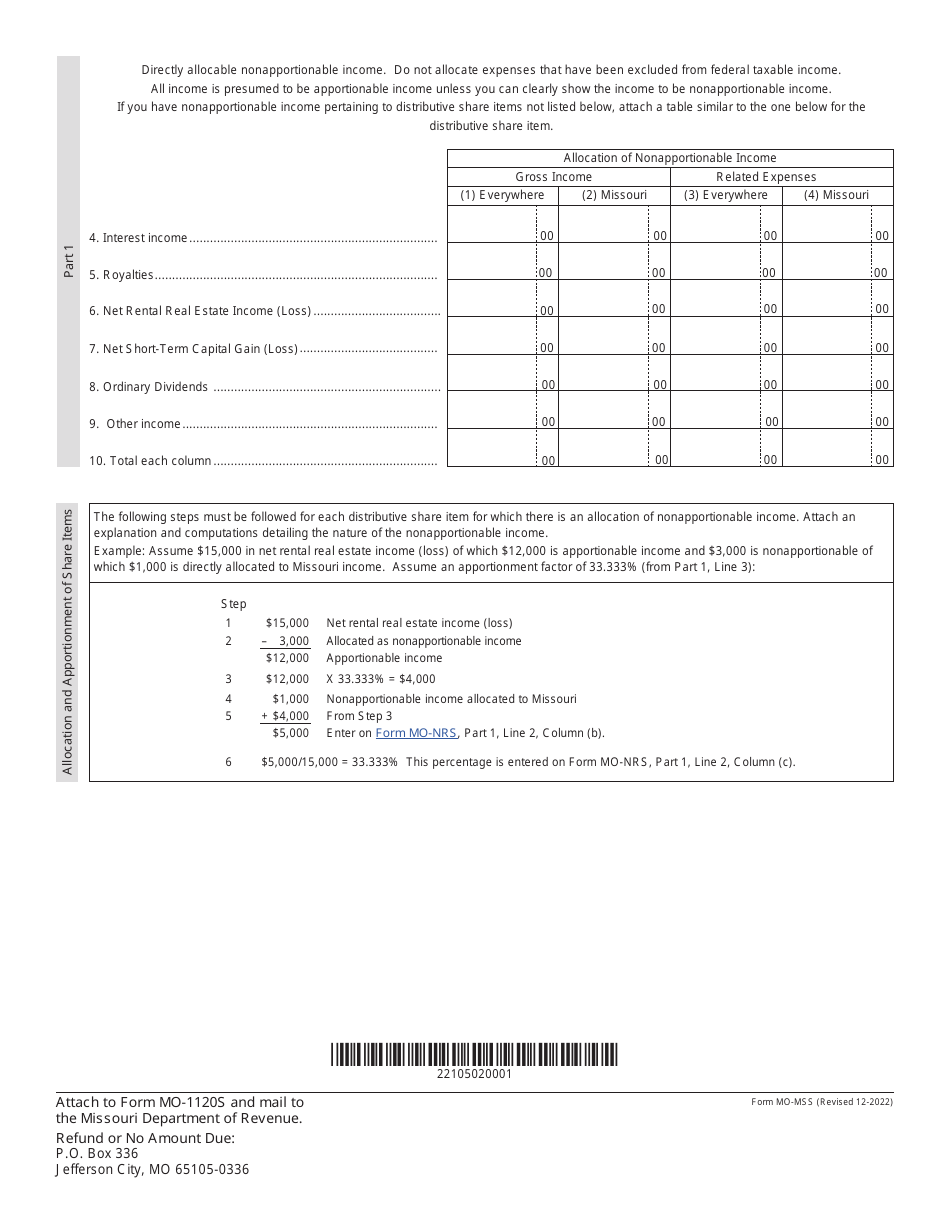

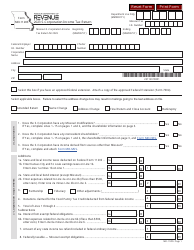

Q: What is allocation and apportionment?

A: Allocation and apportionment is the process of dividing income, deductions, and credits among different states, based on the amount of business activity conducted in each state.

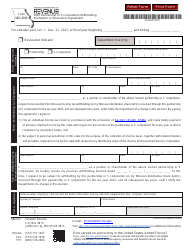

Q: When is Form MO-MSS due?

A: Form MO-MSS is typically due on the same day as your S-Corporation income tax return, which is the 15th day of the third month after the close of your tax year.

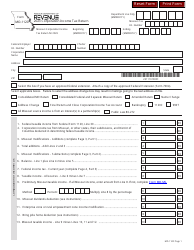

Q: What information do I need to fill out Form MO-MSS?

A: You will need information about your S-Corporation's income, deductions, and apportionment factors, which may include sales, payroll, and property.

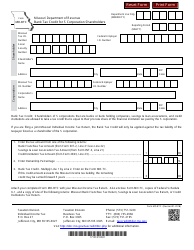

Q: What if I have questions or need assistance with Form MO-MSS?

A: If you have questions or need assistance with Form MO-MSS, you can contact the Missouri Department of Revenue or seek help from a tax professional.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-MSS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.