This version of the form is not currently in use and is provided for reference only. Download this version of

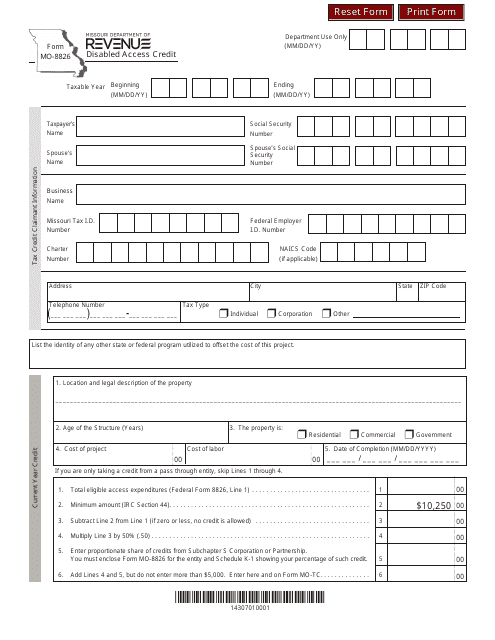

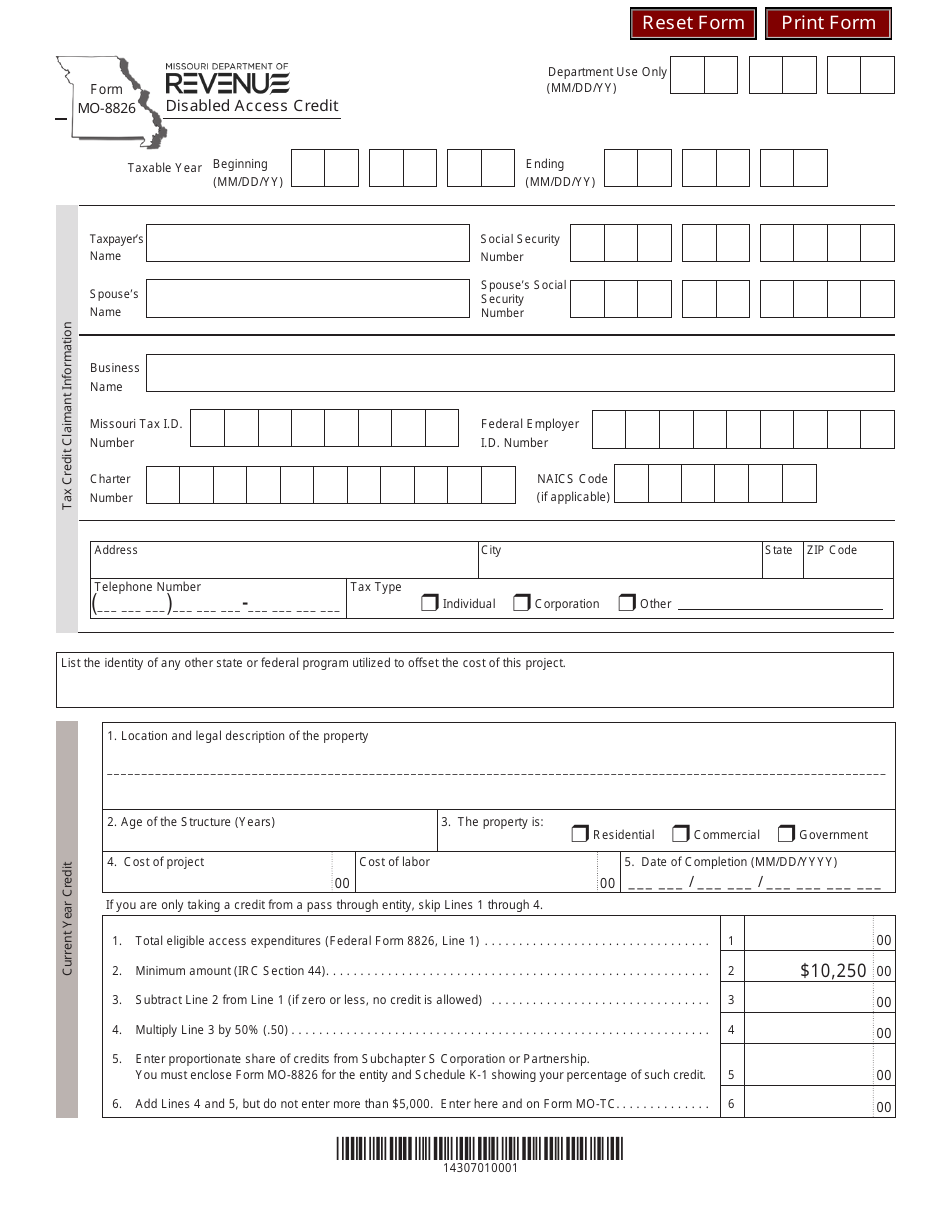

Form MO-8826

for the current year.

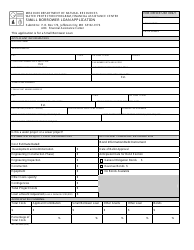

Form MO-8826 Disabled Access Credit - Missouri

What Is Form MO-8826?

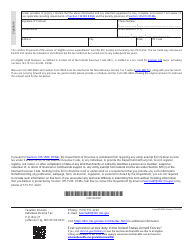

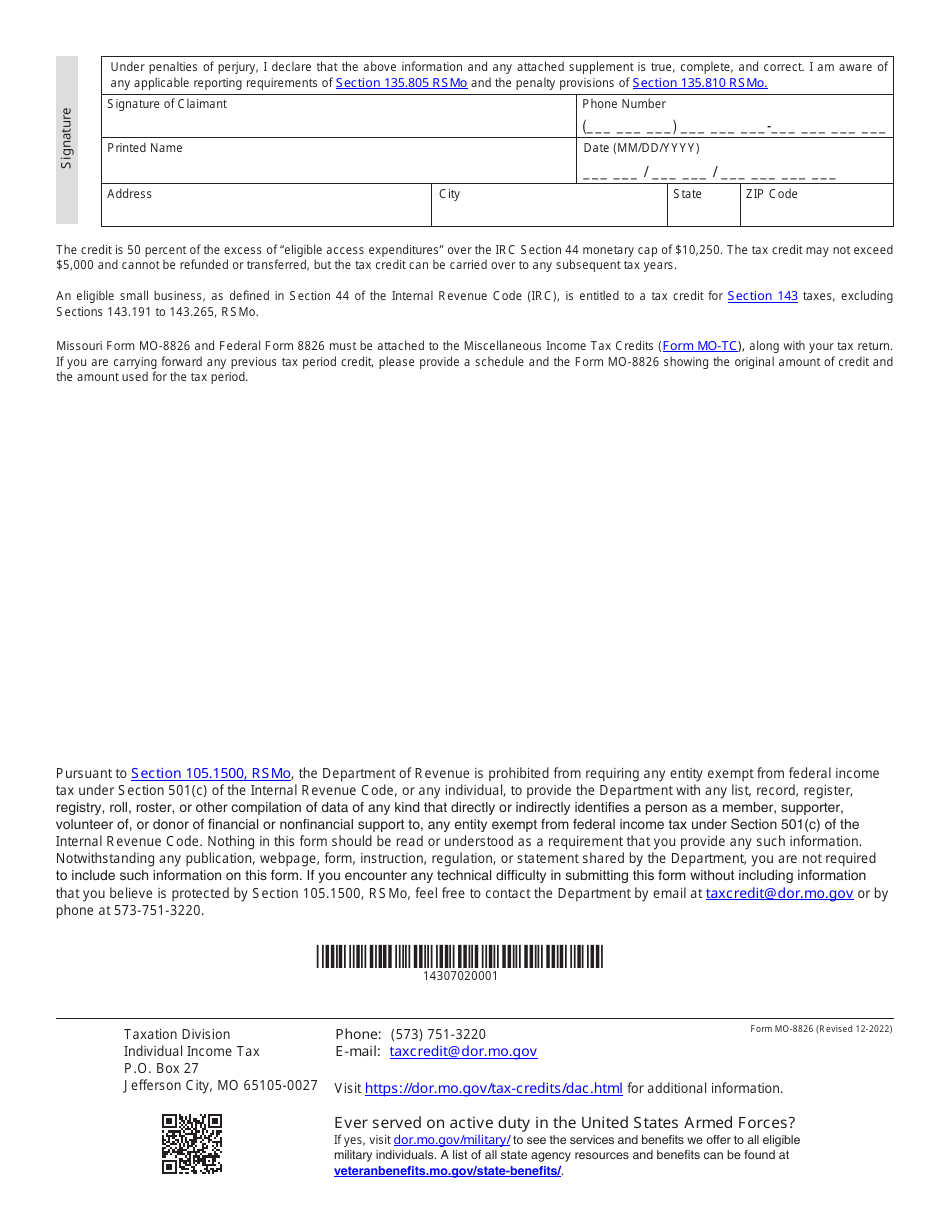

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-8826?

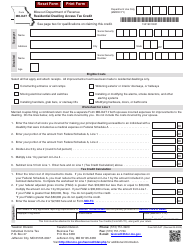

A: Form MO-8826 is the Disabled Access Credit form used in the state of Missouri.

Q: What is the Disabled Access Credit?

A: The Disabled Access Credit is a tax credit provided by the state of Missouri to businesses that make eligible expenditures for providing accessibility to persons with disabilities.

Q: Who can claim the Disabled Access Credit?

A: Businesses in Missouri that incur eligible expenses for providing disability access can claim the Disabled Access Credit.

Q: What expenses are eligible for the Disabled Access Credit?

A: Expenses related to making a business accessible to individuals with disabilities may be eligible for the Disabled Access Credit.

Q: How do I claim the Disabled Access Credit?

A: To claim the Disabled Access Credit, you must complete Form MO-8826 and include it with your Missouri state tax return.

Q: Is there a deadline for filing Form MO-8826?

A: Yes, Form MO-8826 should be filed with your Missouri state tax return by the due date.

Q: Is there a maximum credit amount for the Disabled Access Credit?

A: Yes, the Disabled Access Credit is limited to a maximum of $10,000 per year.

Q: Are there any other requirements or limitations for the Disabled Access Credit?

A: Yes, there are additional requirements and limitations for the Disabled Access Credit. It is recommended to review the instructions and consult with a tax professional for accurate guidance.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-8826 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.