This version of the form is not currently in use and is provided for reference only. Download this version of

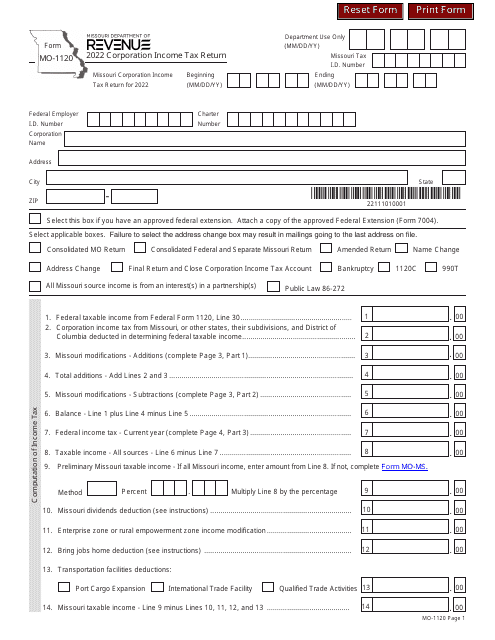

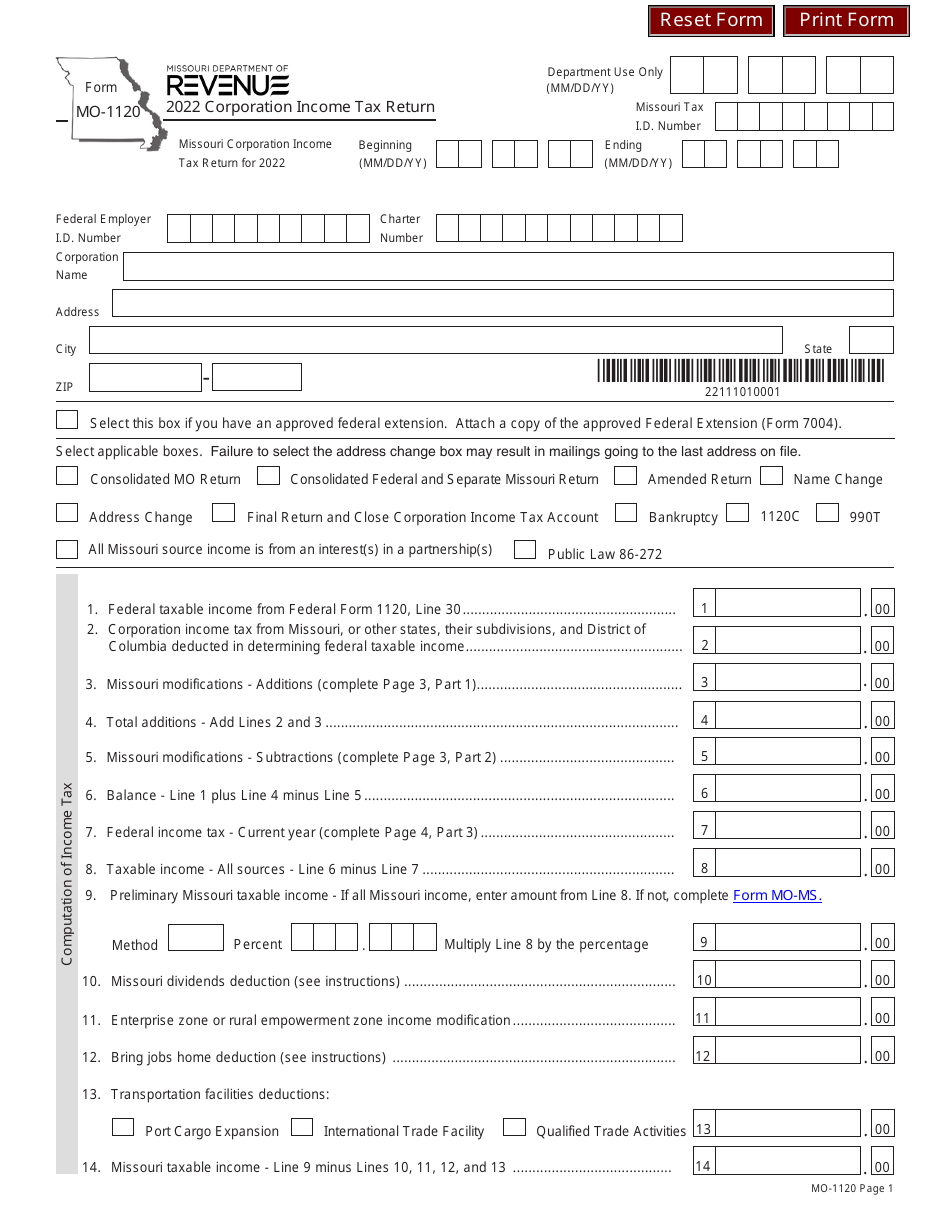

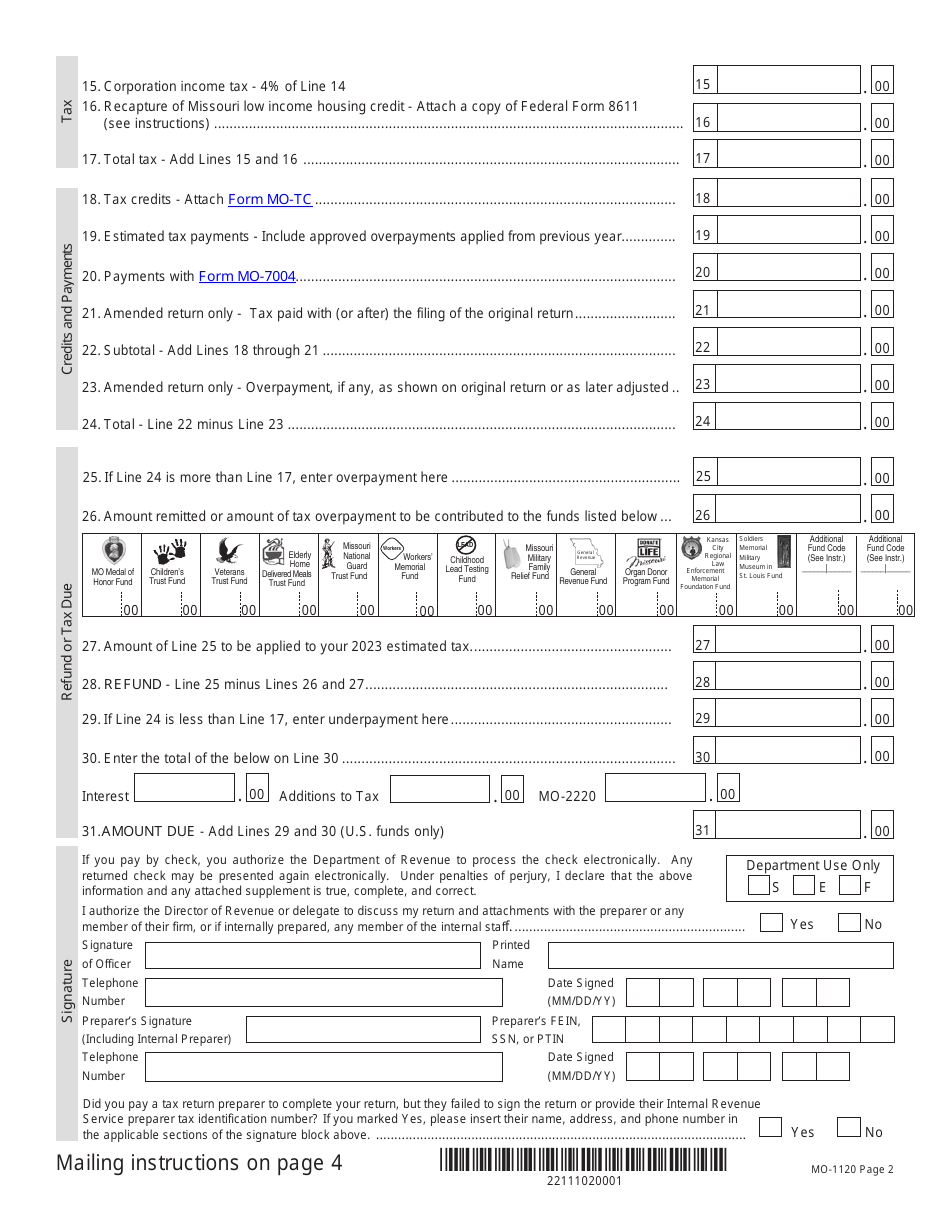

Form MO-1120

for the current year.

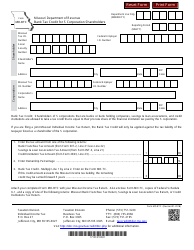

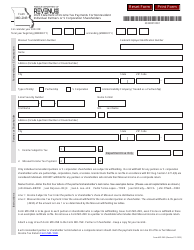

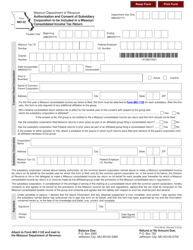

Form MO-1120 Corporation Income Tax Return - Missouri

What Is Form MO-1120?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MO-1120?

A: Form MO-1120 is the Corporation Income Tax Return used in the state of Missouri.

Q: Who needs to file Form MO-1120?

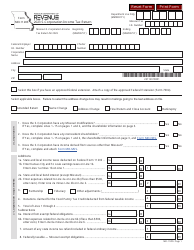

A: Any corporation doing business in Missouri or having Missouri source income is required to file Form MO-1120.

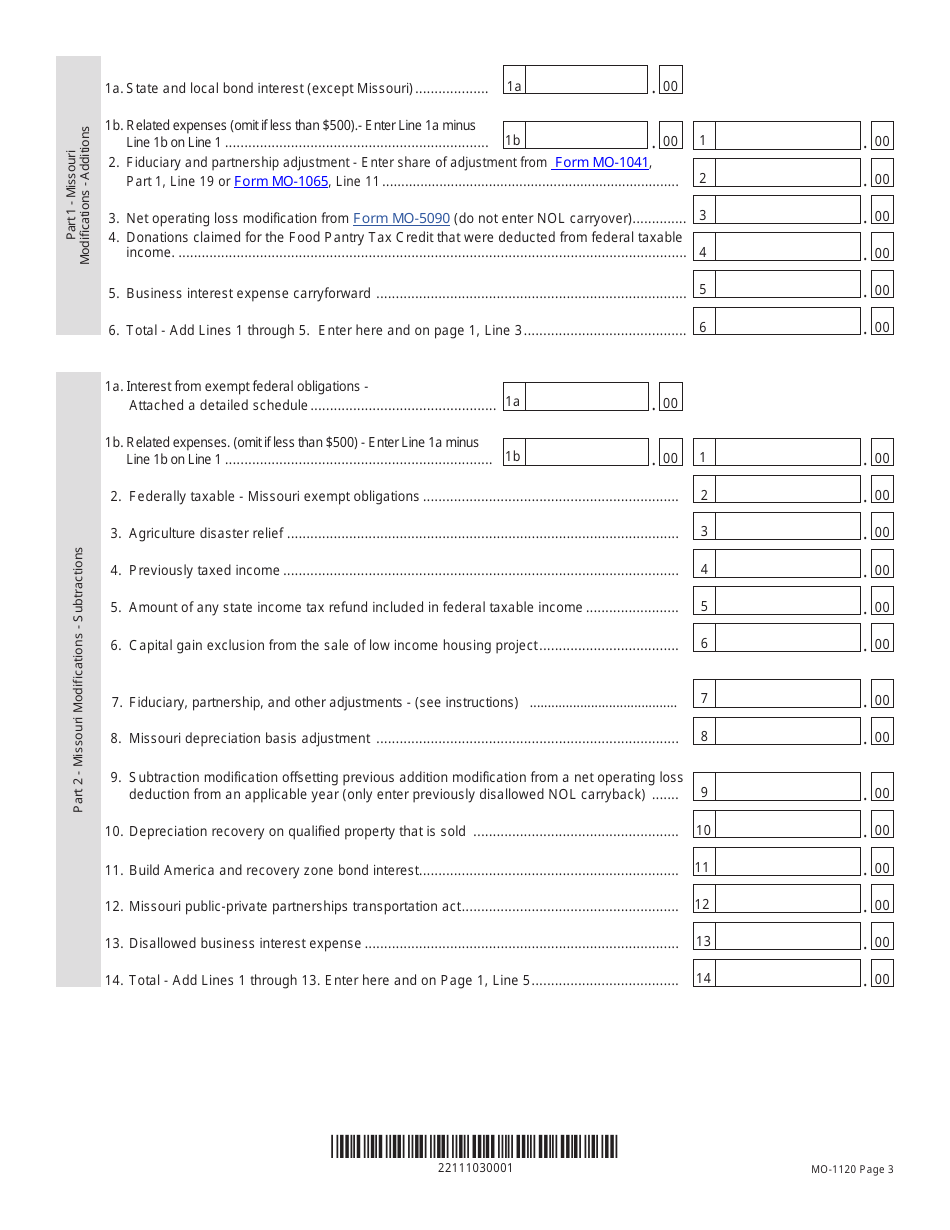

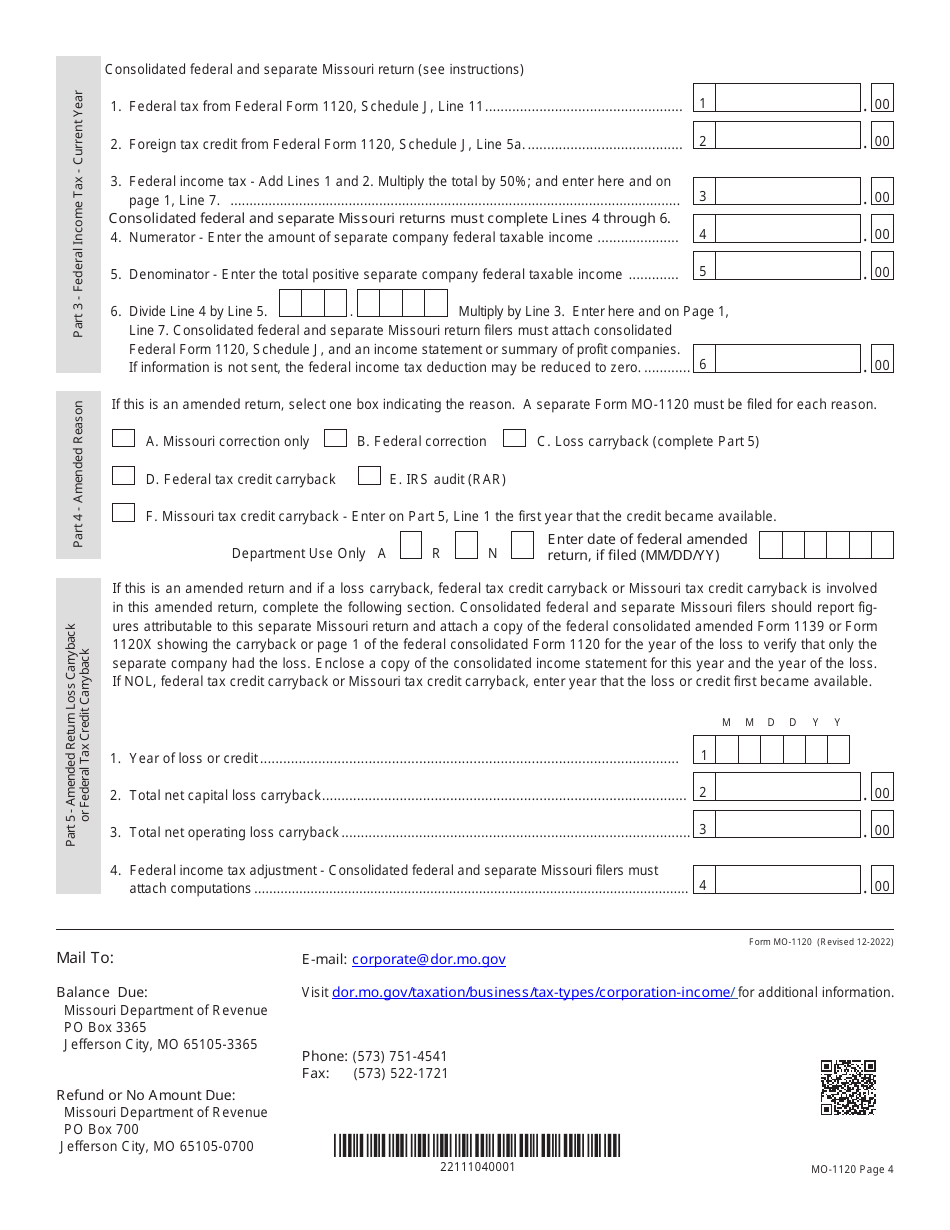

Q: What information is required on Form MO-1120?

A: Form MO-1120 requires information about the corporation's income, deductions, credits, and tax liability.

Q: When is Form MO-1120 due?

A: Form MO-1120 is due on or before the 15th day of the third month following the end of the corporation's tax year.

Q: Are there any penalties for late filing of Form MO-1120?

A: Yes, there are penalties for late filing of Form MO-1120. It is important to file the return and pay any taxes owed by the due date to avoid penalties and interest.

Q: Do I need to include supporting documents with Form MO-1120?

A: You may need to include supporting documents such as schedules, forms, or other attachments depending on the specific circumstances of your corporation.

Q: What should I do if I have questions or need assistance with Form MO-1120?

A: If you have questions or need assistance with Form MO-1120, you can contact the Missouri Department of Revenue or consult a tax professional.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.