This version of the form is not currently in use and is provided for reference only. Download this version of

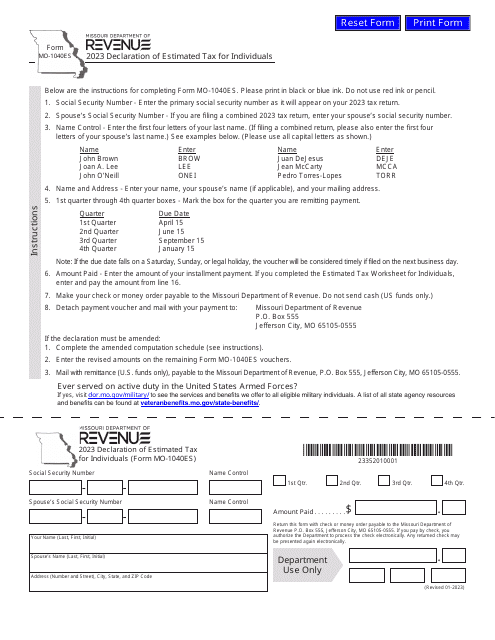

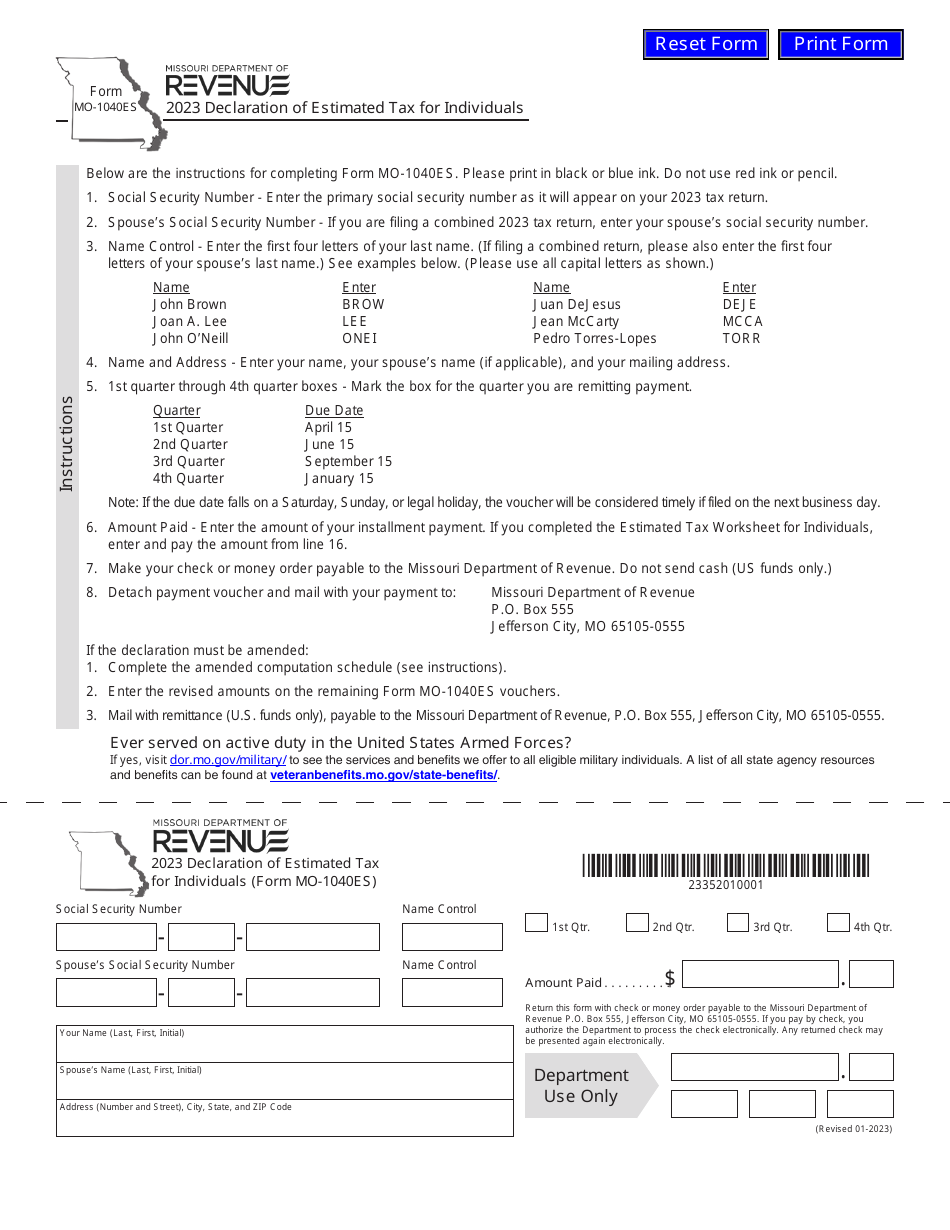

Form MO-1040ES

for the current year.

Form MO-1040ES Declaration of Estimated Tax for Individuals - Missouri

What Is Form MO-1040ES?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1040ES?

A: Form MO-1040ES is a declaration of estimated tax for individuals in Missouri.

Q: Who needs to file Form MO-1040ES?

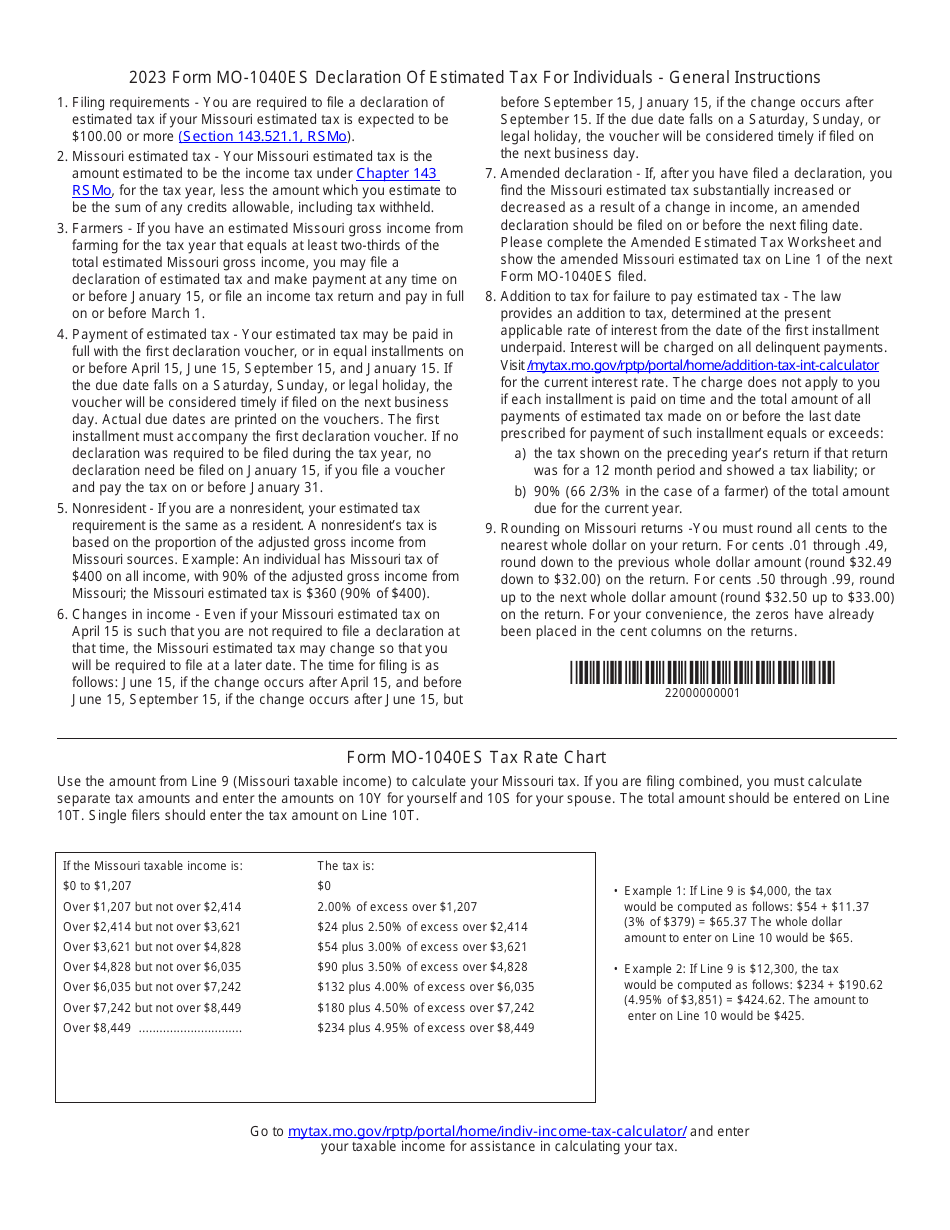

A: Individuals who expect to owe taxes in Missouri and meet certain income criteria need to file Form MO-1040ES.

Q: What is the purpose of Form MO-1040ES?

A: The purpose of Form MO-1040ES is to help individuals estimate and pay their income taxes throughout the year to avoid underpayment penalties.

Q: When is Form MO-1040ES due?

A: Form MO-1040ES is due on April 15th of each year, or the next business day if April 15th falls on a weekend or holiday.

Q: How do I calculate my estimated tax liability on Form MO-1040ES?

A: You can use the estimation worksheet provided with Form MO-1040ES to calculate your estimated tax liability.

Q: What happens if I don't file Form MO-1040ES?

A: If you don't file Form MO-1040ES and underpay your taxes, you may be subject to penalties and interest.

Q: Do I need to file Form MO-1040ES if I receive a refund every year?

A: If you receive a refund every year, you may not need to file Form MO-1040ES, but it's always a good idea to review your tax situation with a tax professional.

Q: Can I change my estimated tax payments if my income or deductions change?

A: Yes, you can adjust your estimated tax payments throughout the year if your income or deductions change. It's important to review and update your estimates regularly.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1040ES by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.