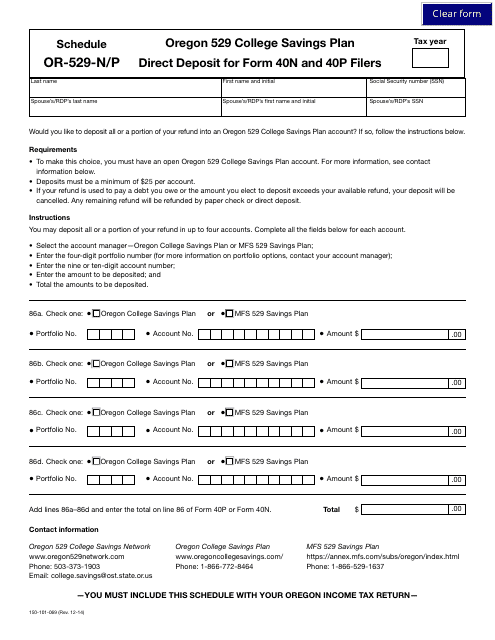

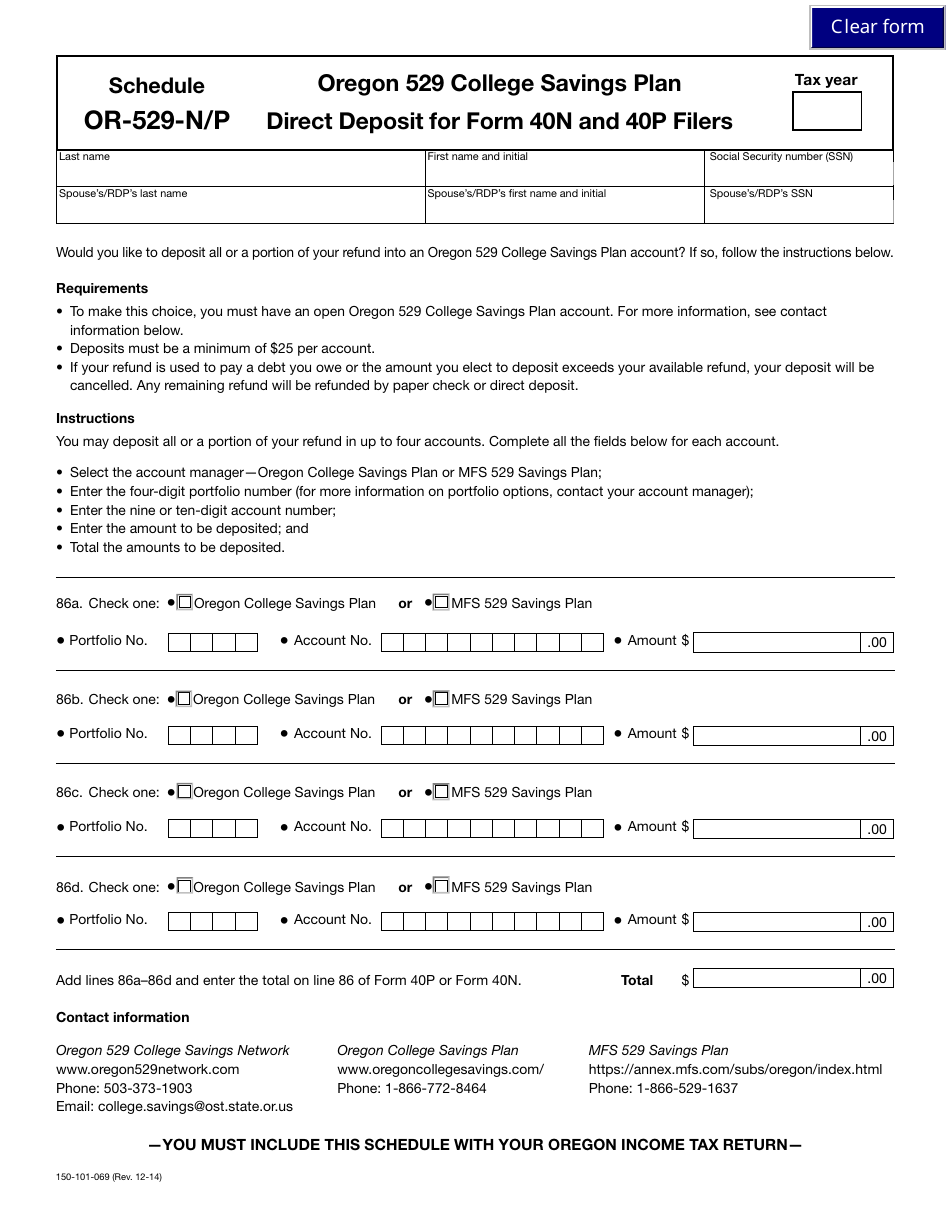

Form 150-101-069 Schedule OR-529-N / P Oregon 529 College Savings Plan Direct Deposit for Form 40n and 40p Filers - Oregon

What Is Form 150-101-069 Schedule OR-529-N/P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-069?

A: Form 150-101-069 is the Schedule OR-529-N/P for the Oregon 529 College Savings Plan Direct Deposit.

Q: Who should file Form 150-101-069?

A: Form 150-101-069 should be filed by Form 40N and 40P filers in Oregon.

Q: What is the Oregon 529 College Savings Plan?

A: The Oregon 529 College Savings Plan is a tax-advantaged savings plan designed to help individuals and families save for education expenses.

Q: What is direct deposit?

A: Direct deposit is a method of electronically transferring funds directly into a bank account, eliminating the need for paper checks.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-069 Schedule OR-529-N/P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.