This version of the form is not currently in use and is provided for reference only. Download this version of

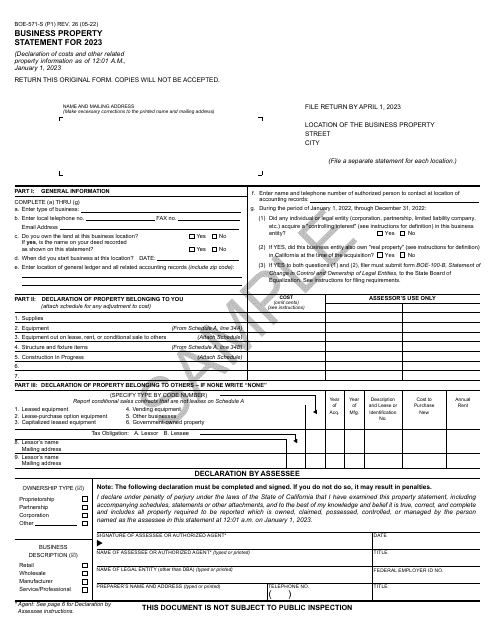

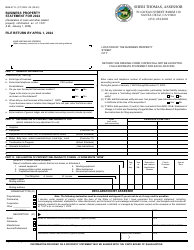

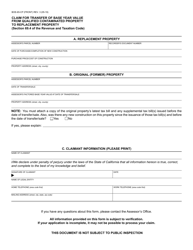

Form BOE-571-S

for the current year.

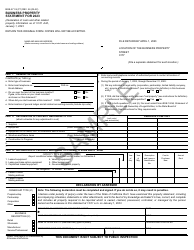

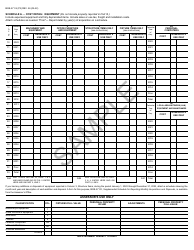

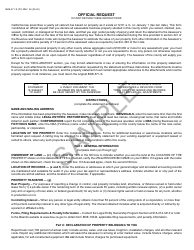

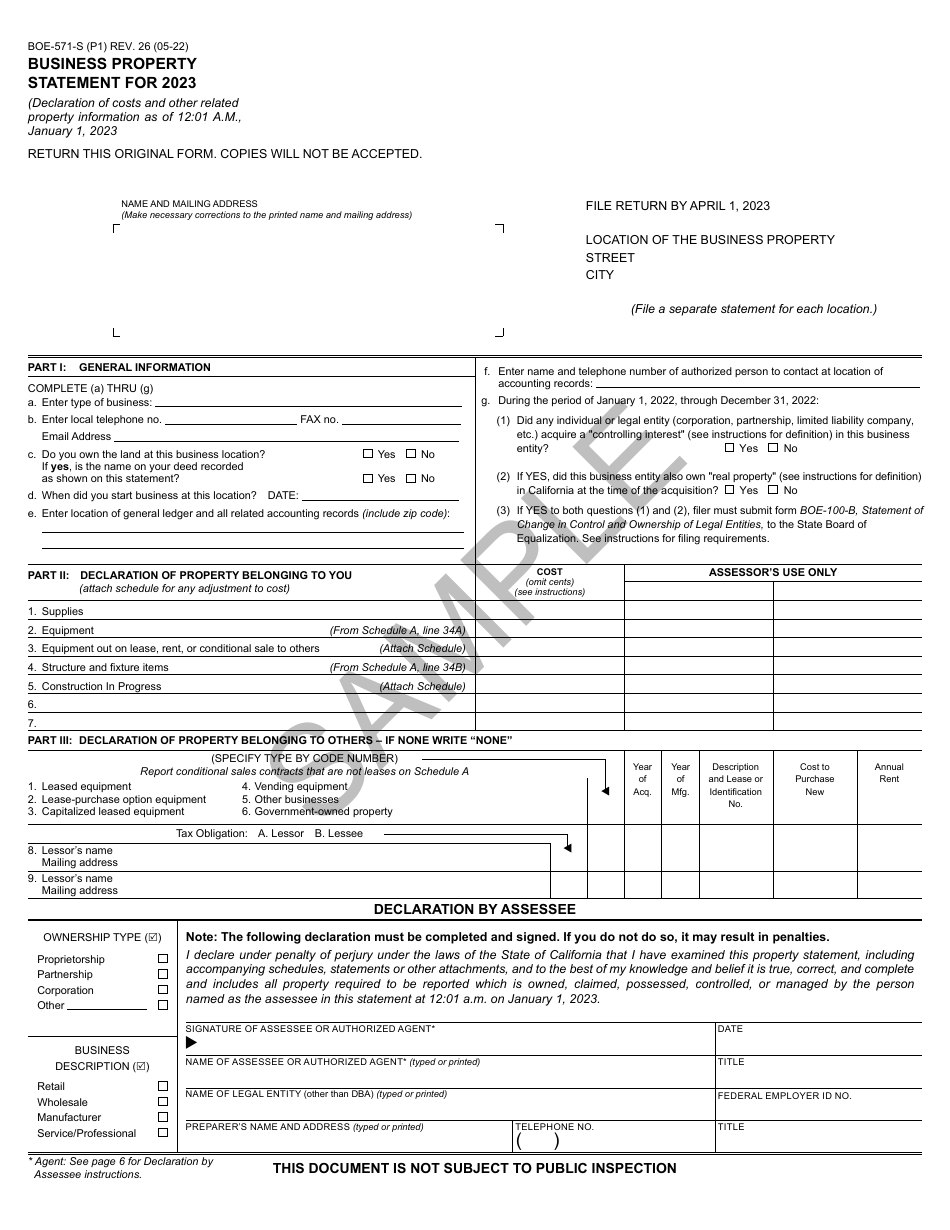

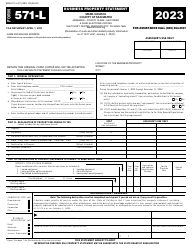

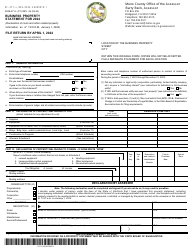

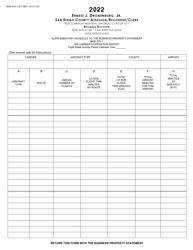

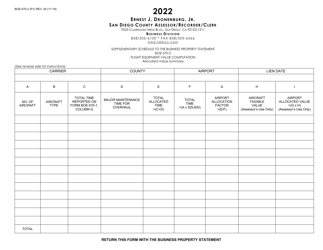

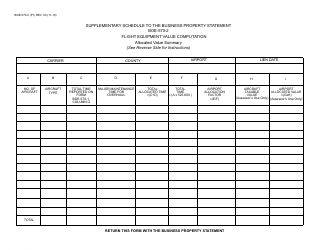

Form BOE-571-S Business Property Statement - Sample - California

What Is Form BOE-571-S?

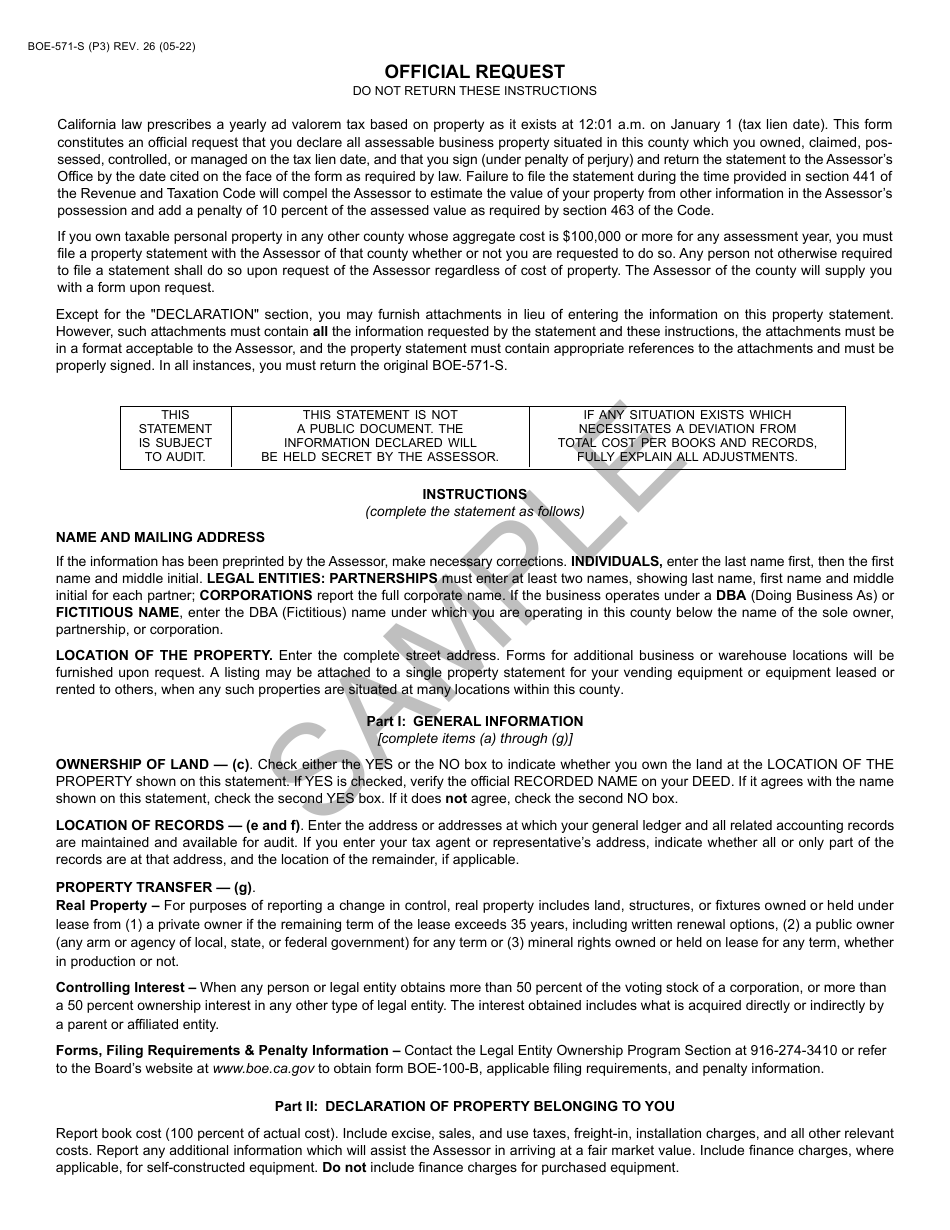

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-571-S?

A: BOE-571-S is a Business Property Statement form used in California.

Q: What is a Business Property Statement?

A: A Business Property Statement is a legal document that California businesses are required to file annually to report their taxable business personal property.

Q: Who needs to file BOE-571-S?

A: All businesses in California that own taxable business personal property with a total cost of $100,000 or more are required to file BOE-571-S.

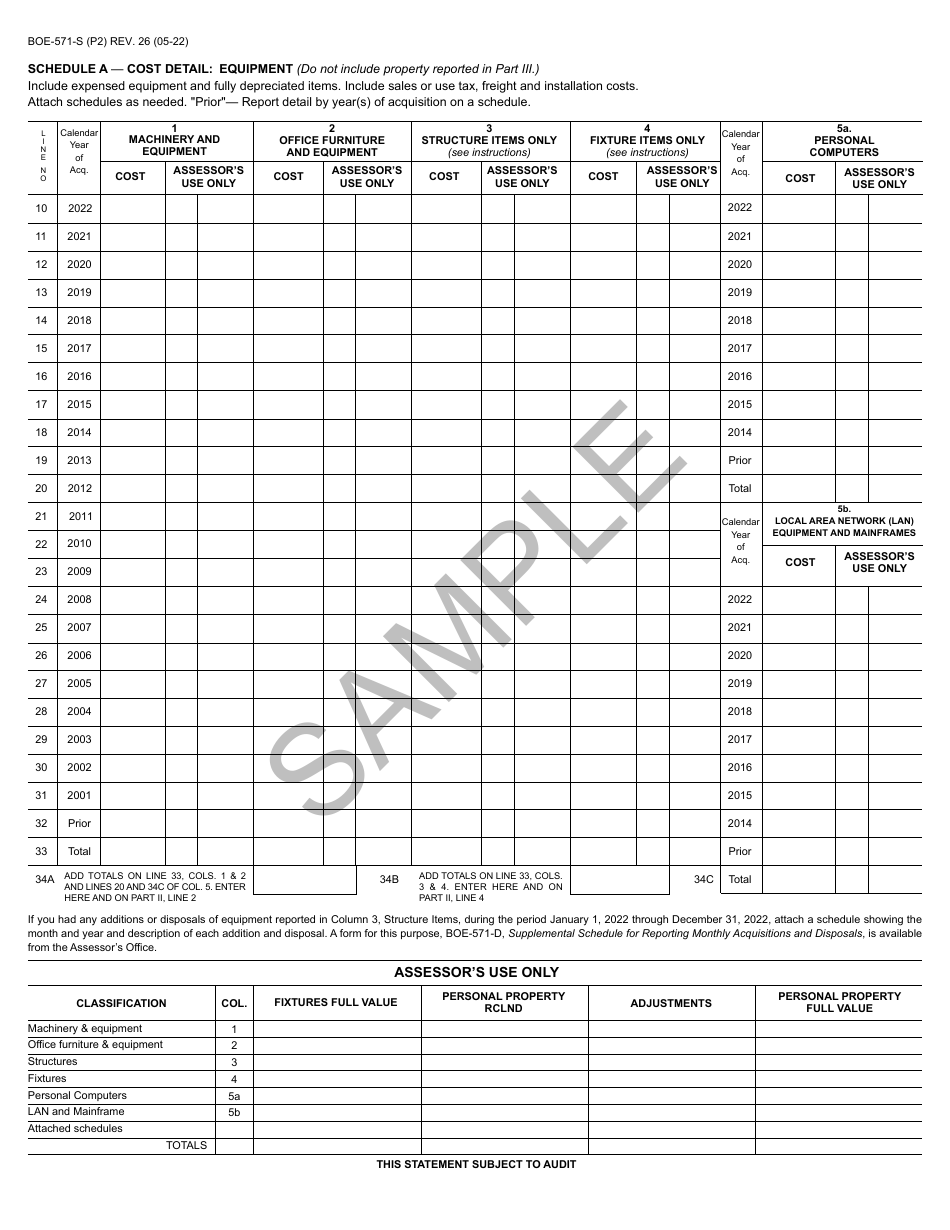

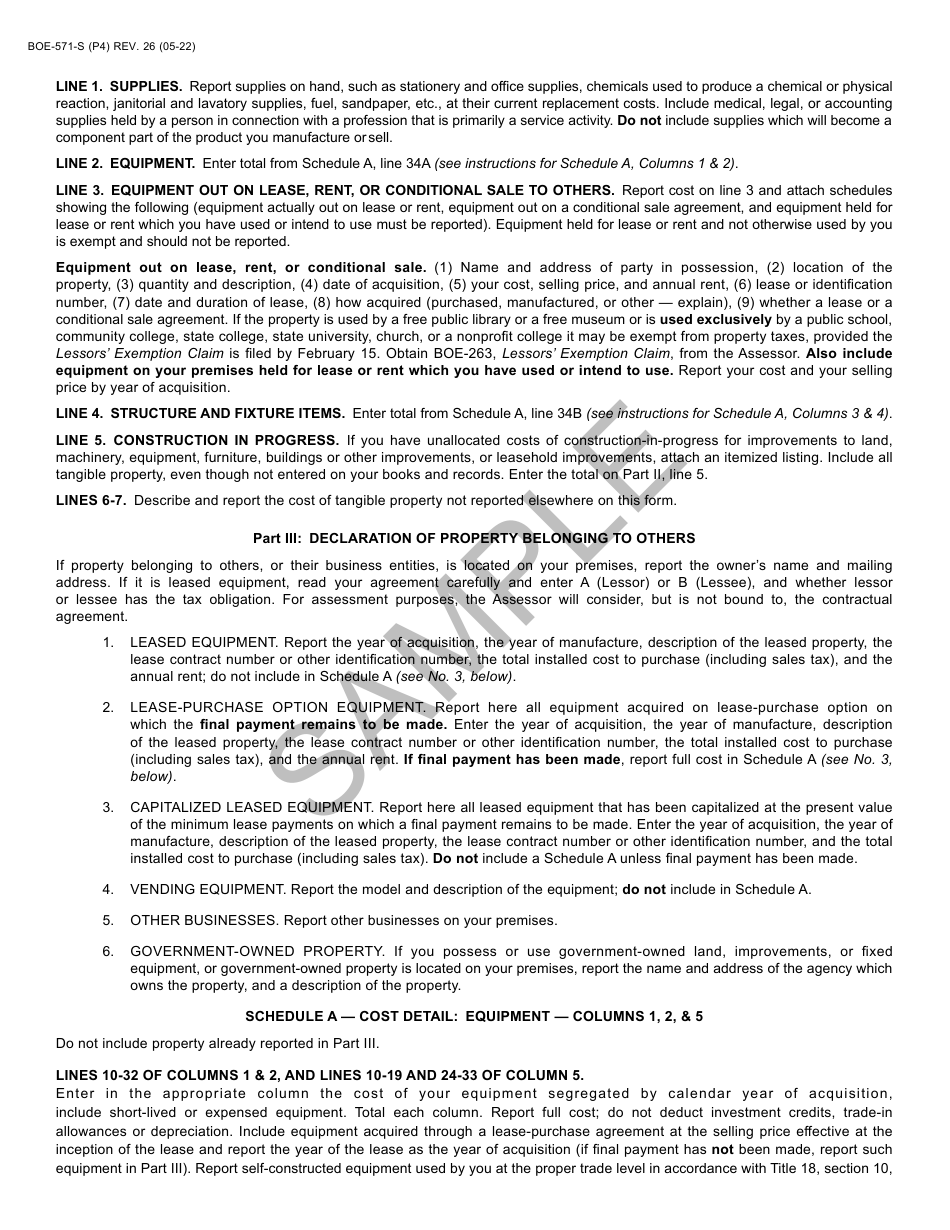

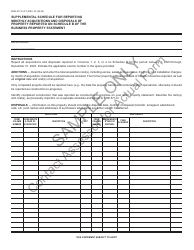

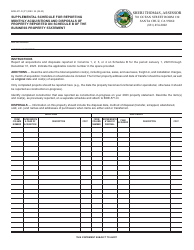

Q: What is considered taxable business personal property?

A: Taxable business personal property includes furniture, machinery, equipment, supplies, leased equipment, fixtures, and other property used by a business.

Q: What is the purpose of filing BOE-571-S?

A: The purpose of filing BOE-571-S is to report the value of taxable business personal property, which is used to calculate property taxes owed by the business.

Q: When is the deadline to file BOE-571-S?

A: The deadline to file BOE-571-S is April 1st of each year.

Q: What happens if I don't file BOE-571-S?

A: Failure to file BOE-571-S may result in penalties and fines imposed by the county assessor's office.

Q: Is there a fee to file BOE-571-S?

A: No, there is no fee to file BOE-571-S.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-571-S by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.