This version of the form is not currently in use and is provided for reference only. Download this version of

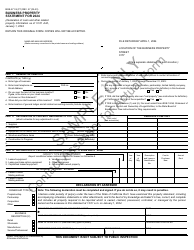

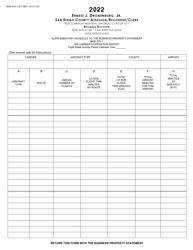

Form BOE-571-L

for the current year.

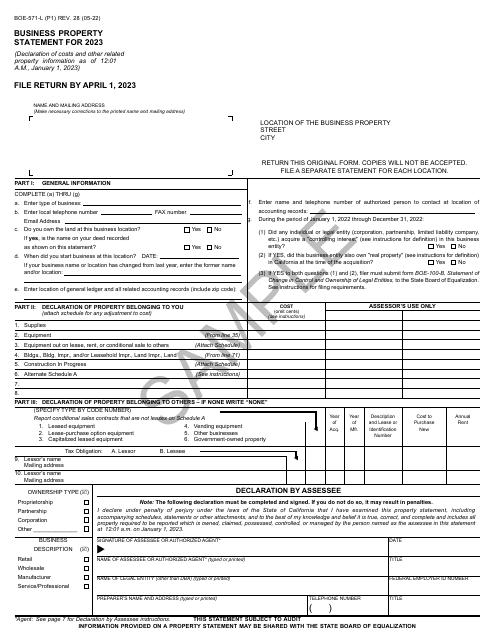

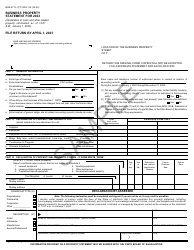

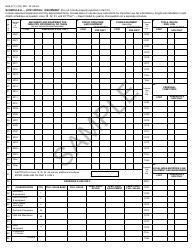

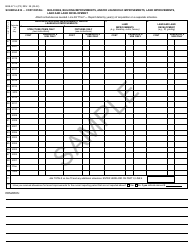

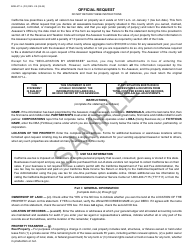

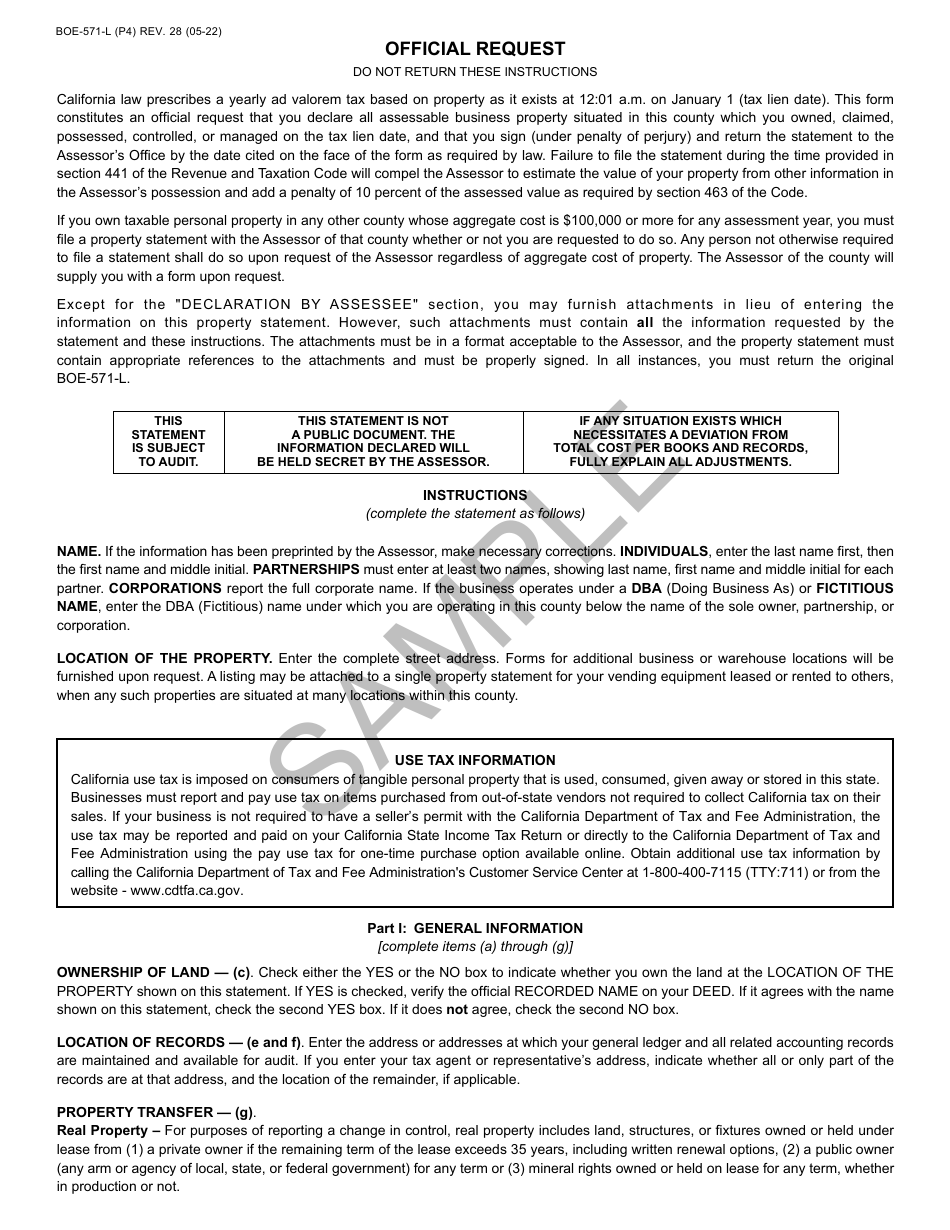

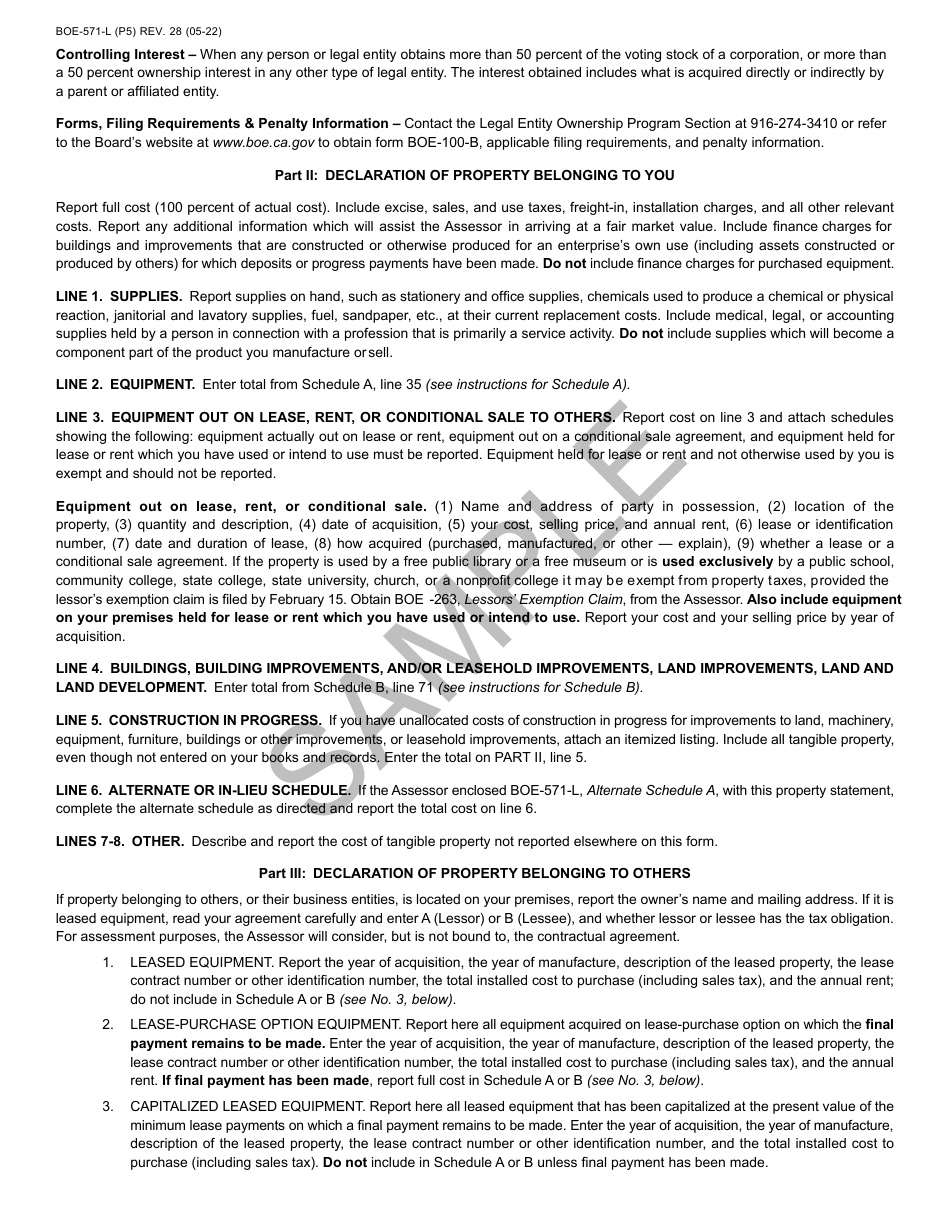

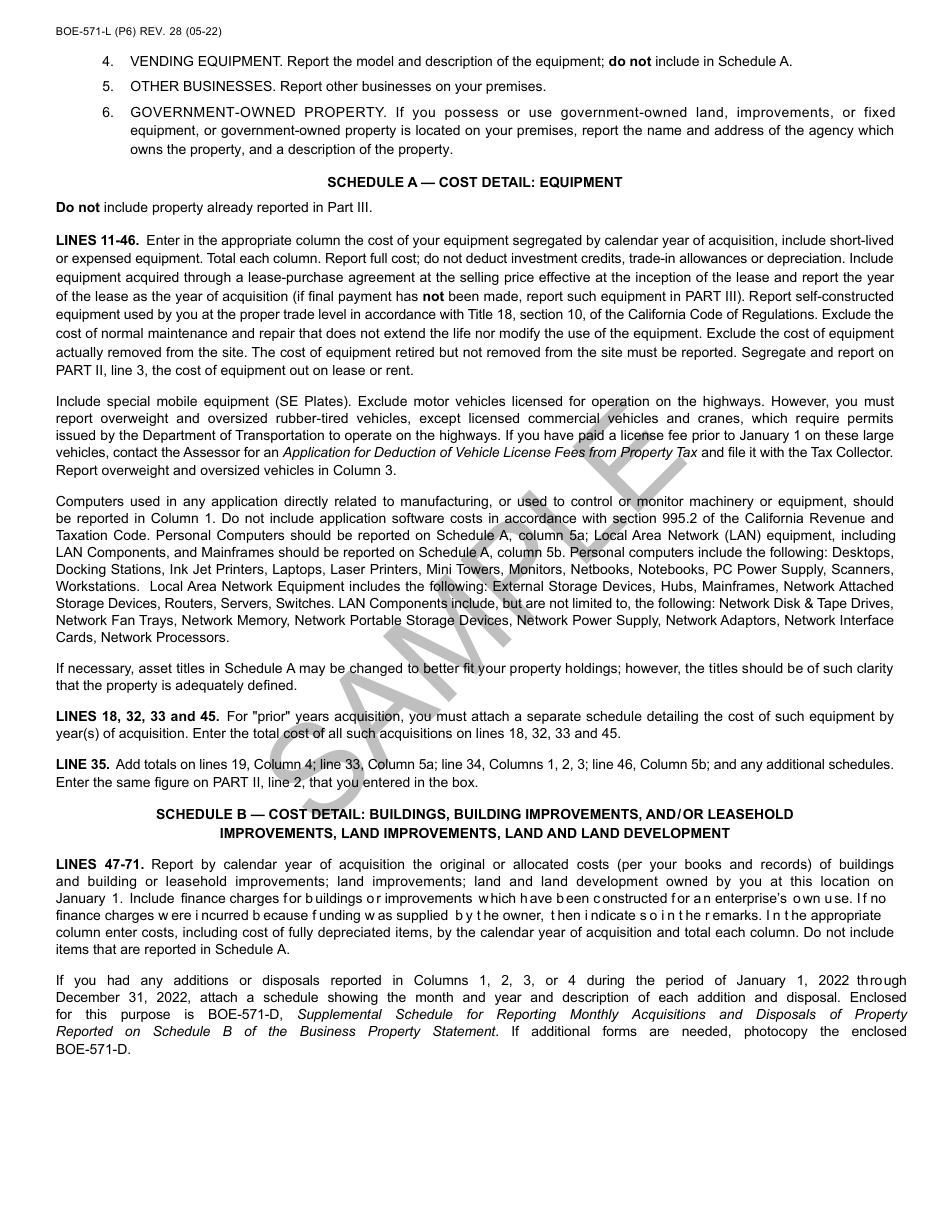

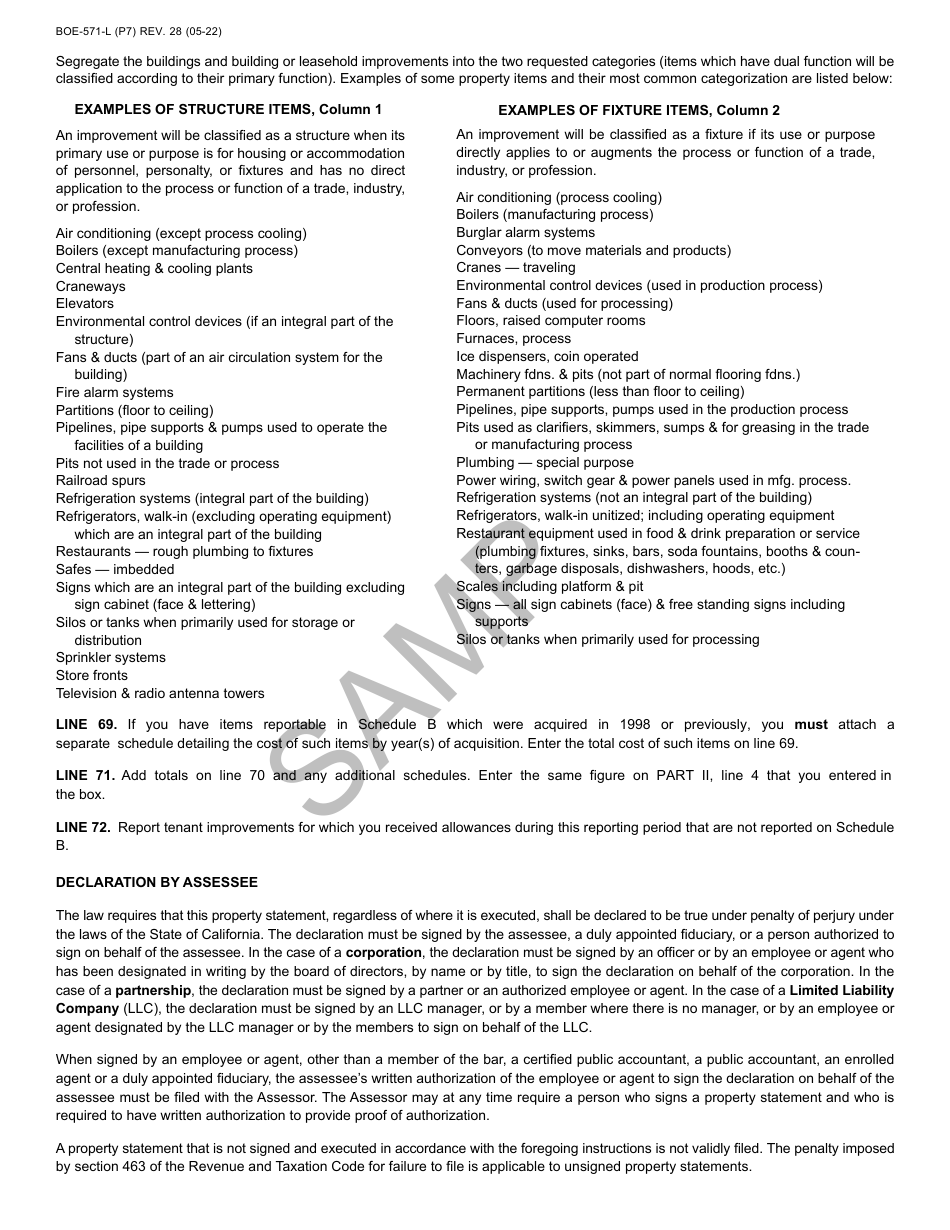

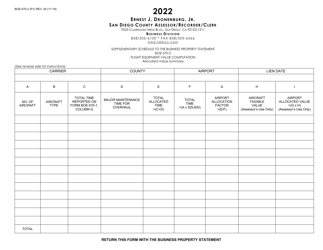

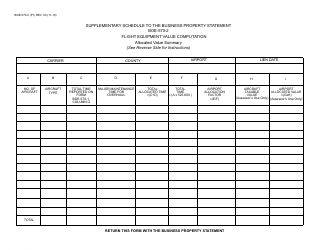

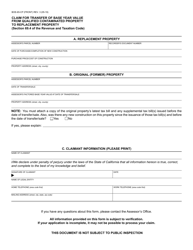

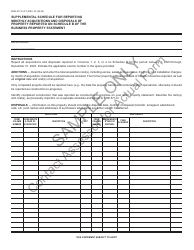

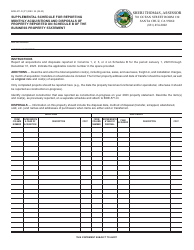

Form BOE-571-L Business Property Statement, Long Form - Sample - California

What Is Form BOE-571-L?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form BOE-571-L?

A: Form BOE-571-L is a business property statement used in California to report the value of business personal property owned or controlled by a business entity.

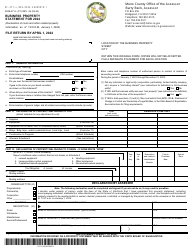

Q: Who needs to fill out form BOE-571-L?

A: Businesses in California that own or control taxable business personal property with a total cost of $100,000 or more are required to fill out form BOE-571-L.

Q: When is the deadline to submit form BOE-571-L?

A: In most cases, form BOE-571-L must be filed with the county assessor's office by April 1st of each year.

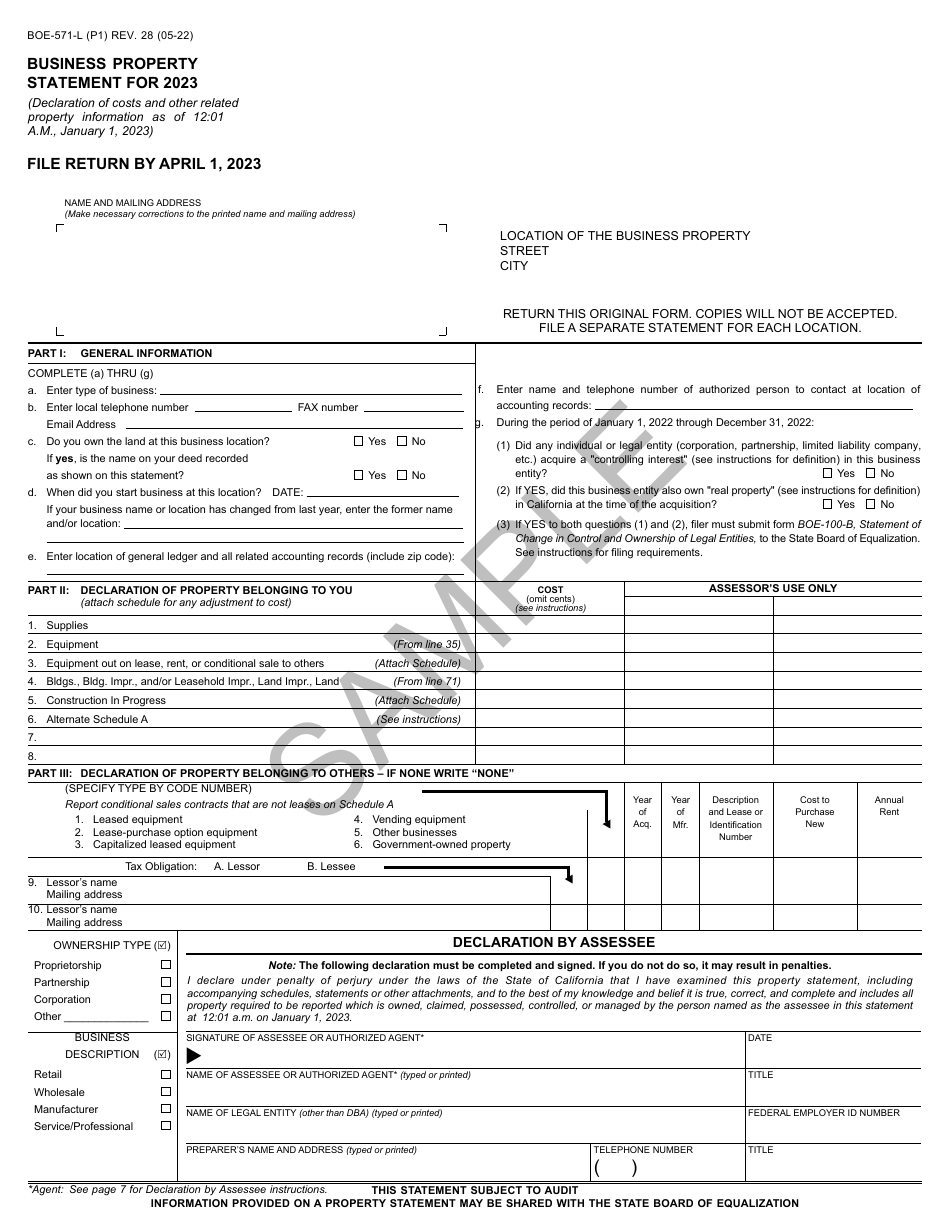

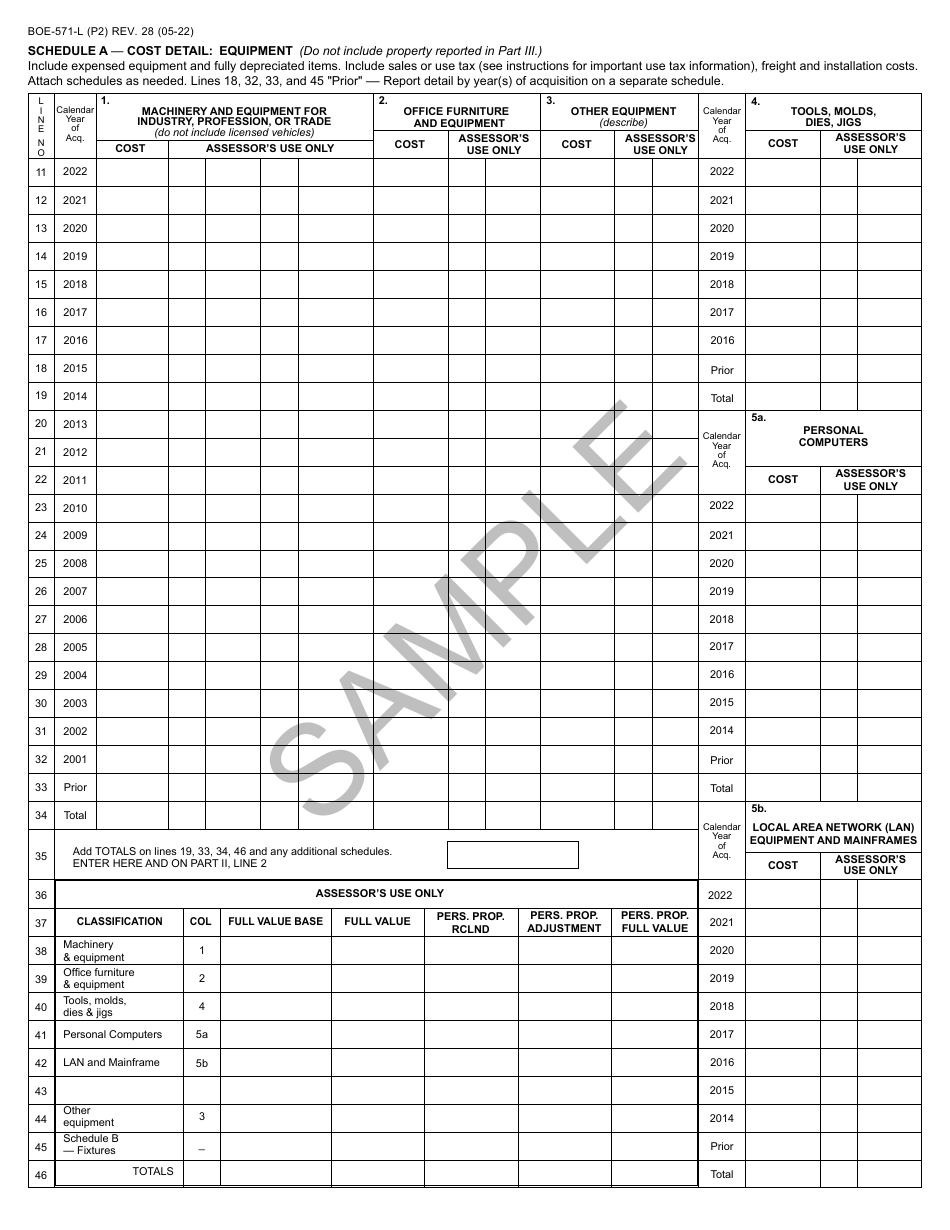

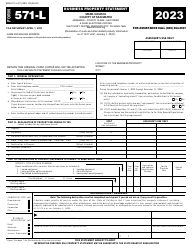

Q: What information is required on form BOE-571-L?

A: Form BOE-571-L requires detailed information about the business property, including its description, acquisition date, cost, and current market value.

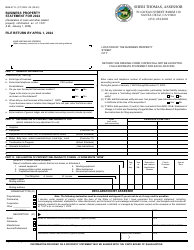

Q: Are there any exemptions or exclusions from filing form BOE-571-L?

A: Yes, there are certain exemptions and exclusions available for specific types of property or businesses. It is recommended to consult with the county assessor's office or a tax professional to determine eligibility for exemptions or exclusions.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-571-L by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.