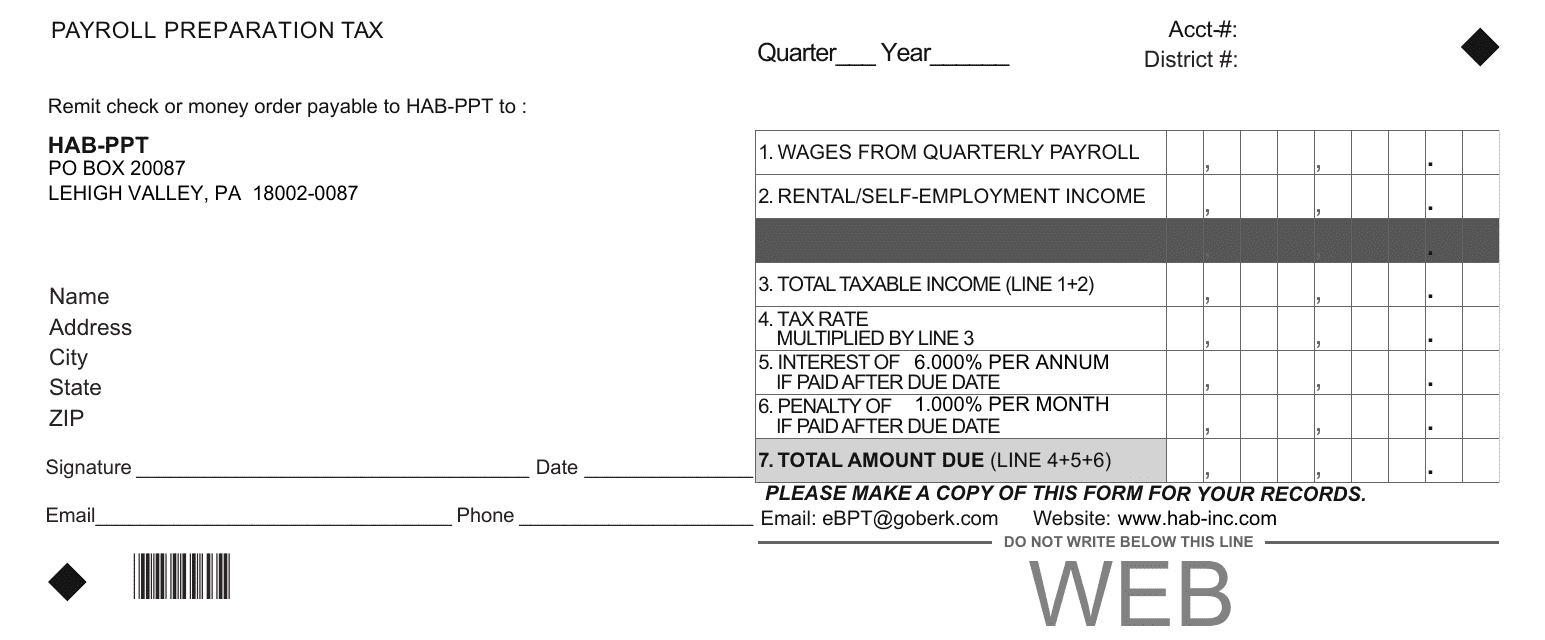

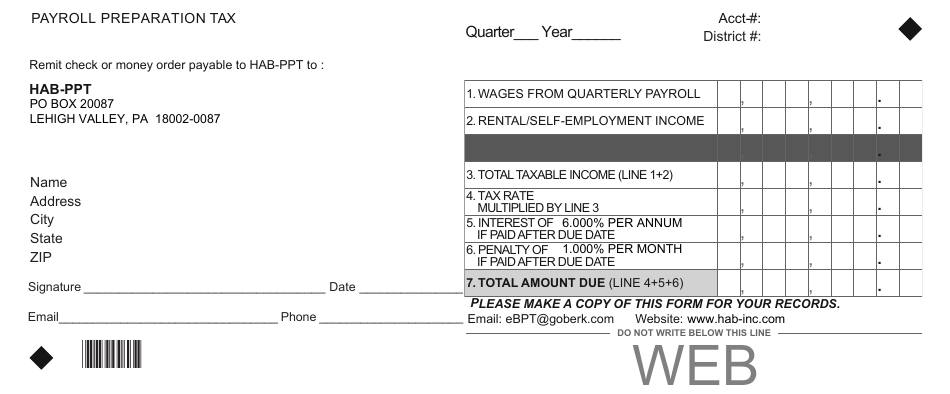

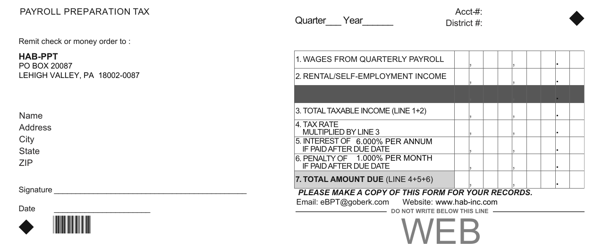

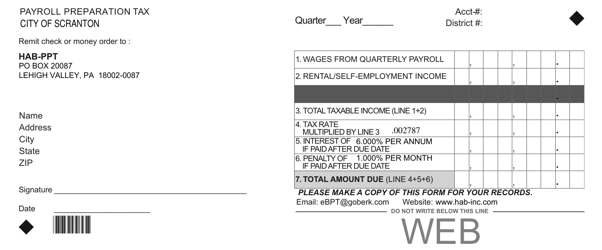

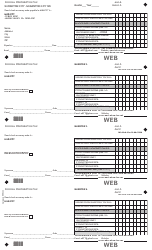

Payroll Preparation Tax - Pennsylvania

Payroll Preparation Tax is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

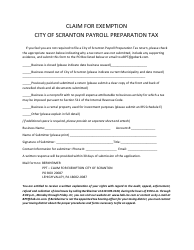

Q: What is the payroll preparation tax in Pennsylvania?

A: The payroll preparation tax in Pennsylvania is a tax imposed on employers for the preparation and filing of annual withholding tax returns.

Q: Who is responsible for paying the payroll preparation tax in Pennsylvania?

A: Employers are responsible for paying the payroll preparation tax in Pennsylvania.

Q: How is the payroll preparation tax in Pennsylvania calculated?

A: The payroll preparation tax in Pennsylvania is calculated based on the total amount of Pennsylvania income tax withheld from employee wages.

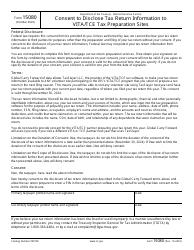

Q: Are there any exemptions or deductions available for the payroll preparation tax in Pennsylvania?

A: No, there are no exemptions or deductions available for the payroll preparation tax in Pennsylvania.

Q: When is the payroll preparation tax in Pennsylvania due?

A: The payroll preparation tax in Pennsylvania is due on or before January 31st of the following year.

Form Details:

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.