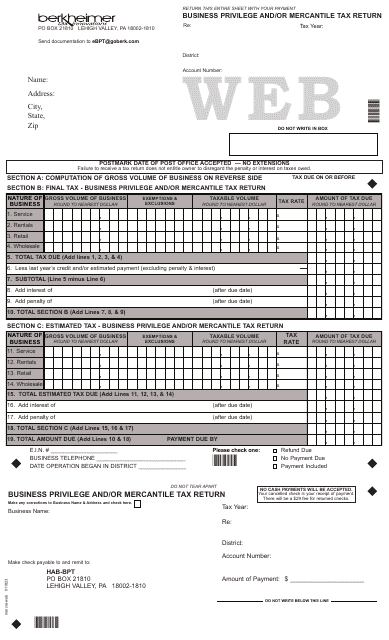

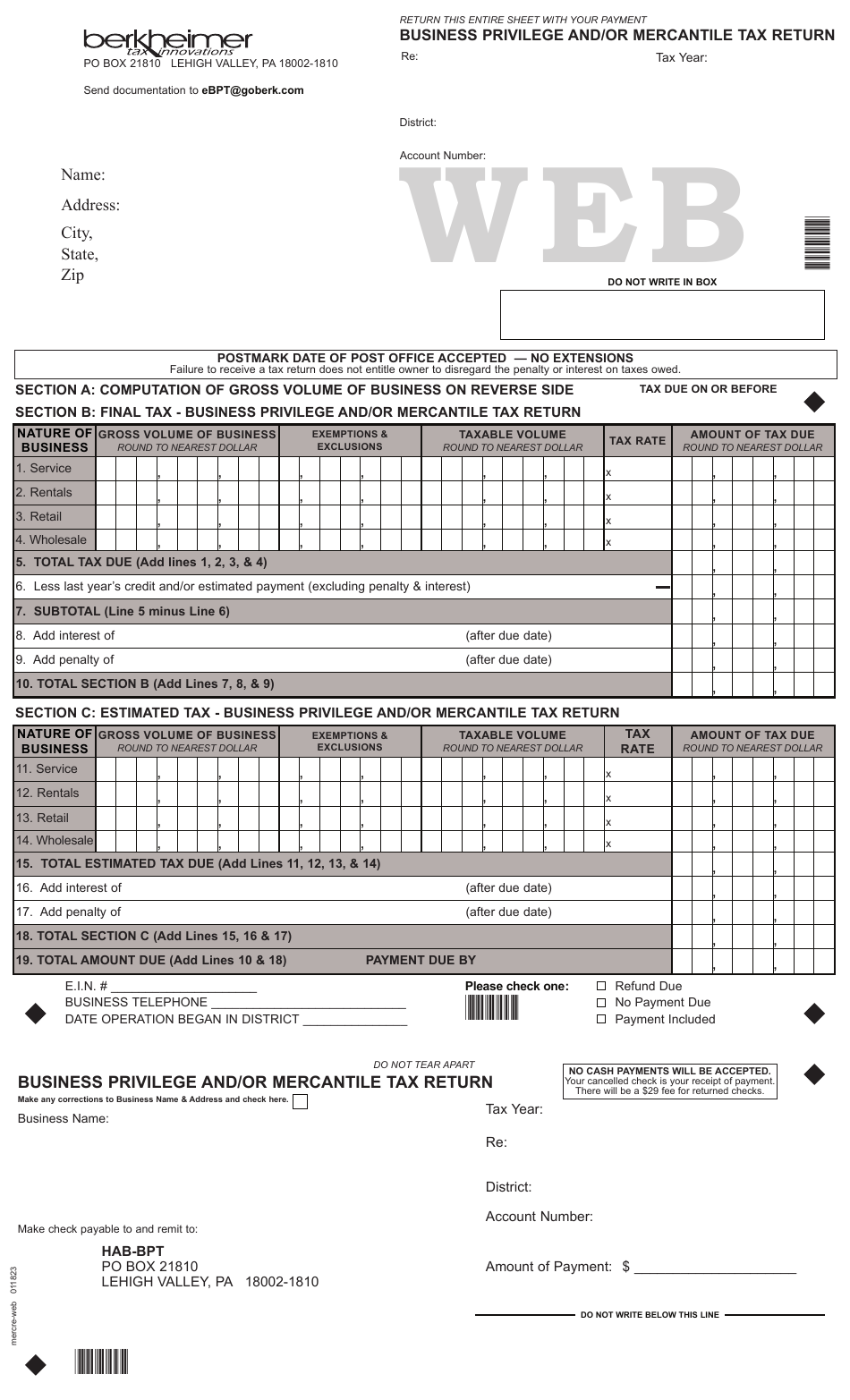

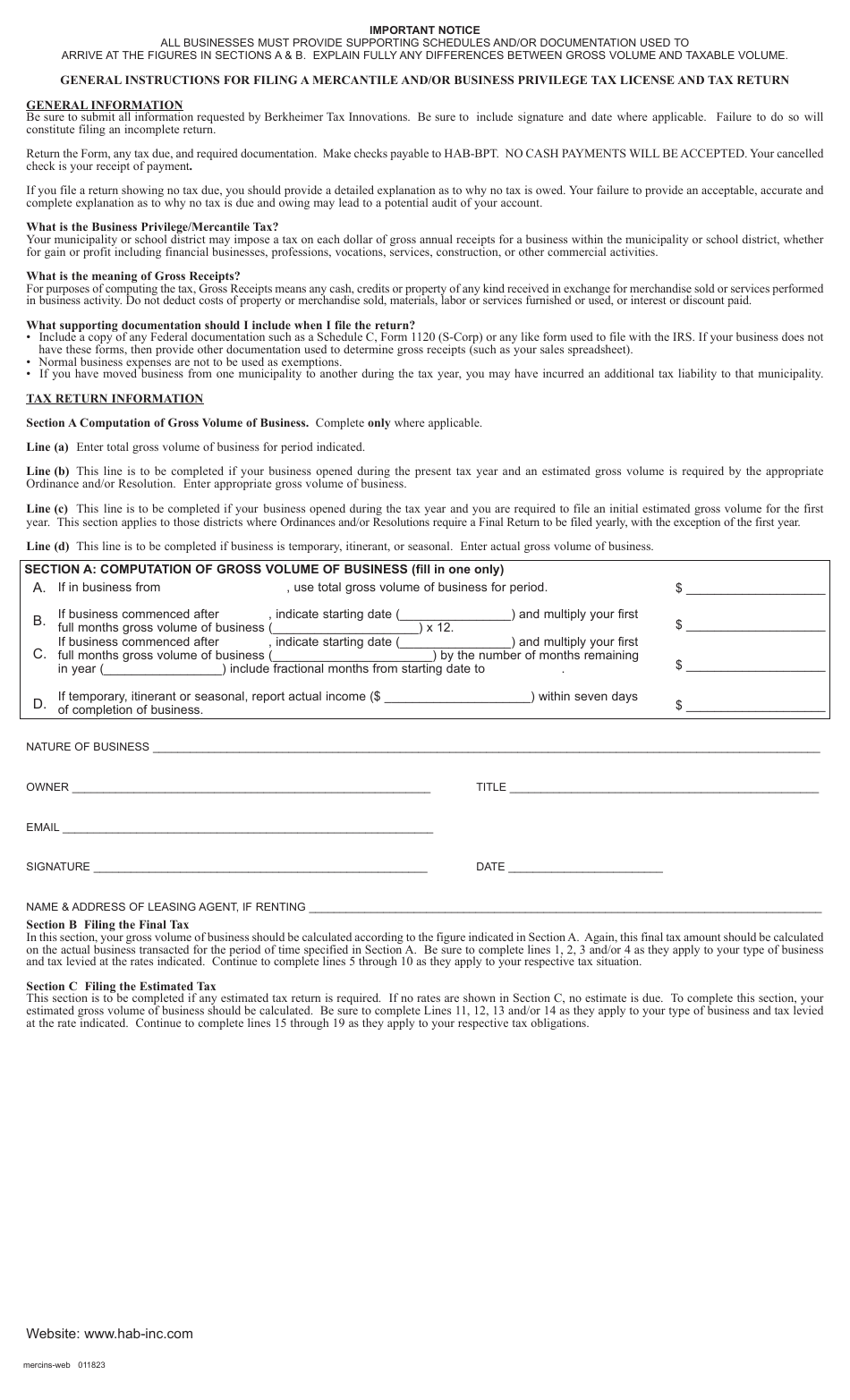

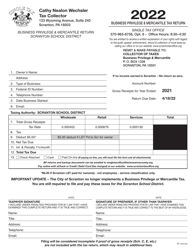

Business Privilege and / or Mercantile Tax Return - Pennsylvania

Business Privilege and/or Mercantile Tax Return is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

Q: What is a Business Privilege and/or Mercantile Tax Return?

A: It is a tax return filed by businesses in Pennsylvania.

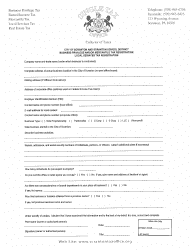

Q: Who needs to file a Business Privilege and/or Mercantile Tax Return?

A: Businesses operating in Pennsylvania.

Q: What is the purpose of the tax return?

A: To report and pay the Business Privilege and/or Mercantile Tax.

Q: What is the Business Privilege Tax?

A: It is a tax imposed on the privilege of doing business in Pennsylvania.

Q: What is the Mercantile Tax?

A: It is a tax imposed on gross receipts or gross sales of certain business activities.

Q: How often do businesses need to file the tax return?

A: Typically on an annual basis, but some cities may require quarterly or monthly filings.

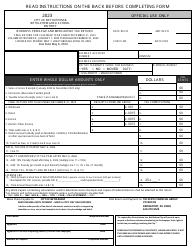

Q: Are there any exemptions or deductions available for businesses?

A: Yes, there are certain exemptions and deductions available. Consult the instructions on the tax return forms for more information.

Q: What happens if a business fails to file or pay the tax?

A: Penalties and interest may be assessed, and legal action could be taken.

Q: Can I file the tax return electronically?

A: Yes, electronic filing options are available for the Business Privilege and/or Mercantile Tax Return.

Form Details:

- Released on January 18, 2023;

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.