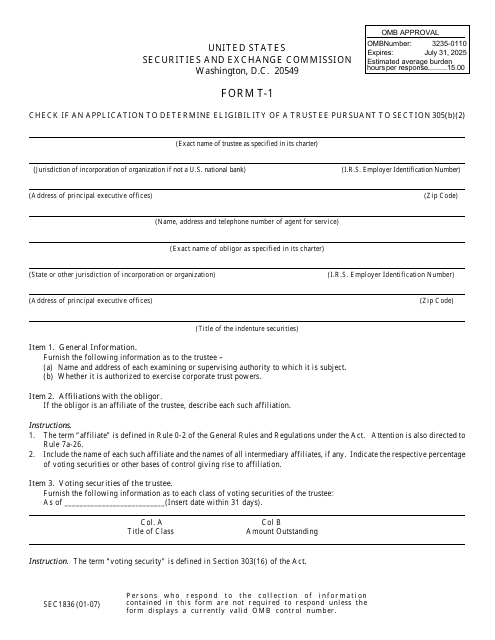

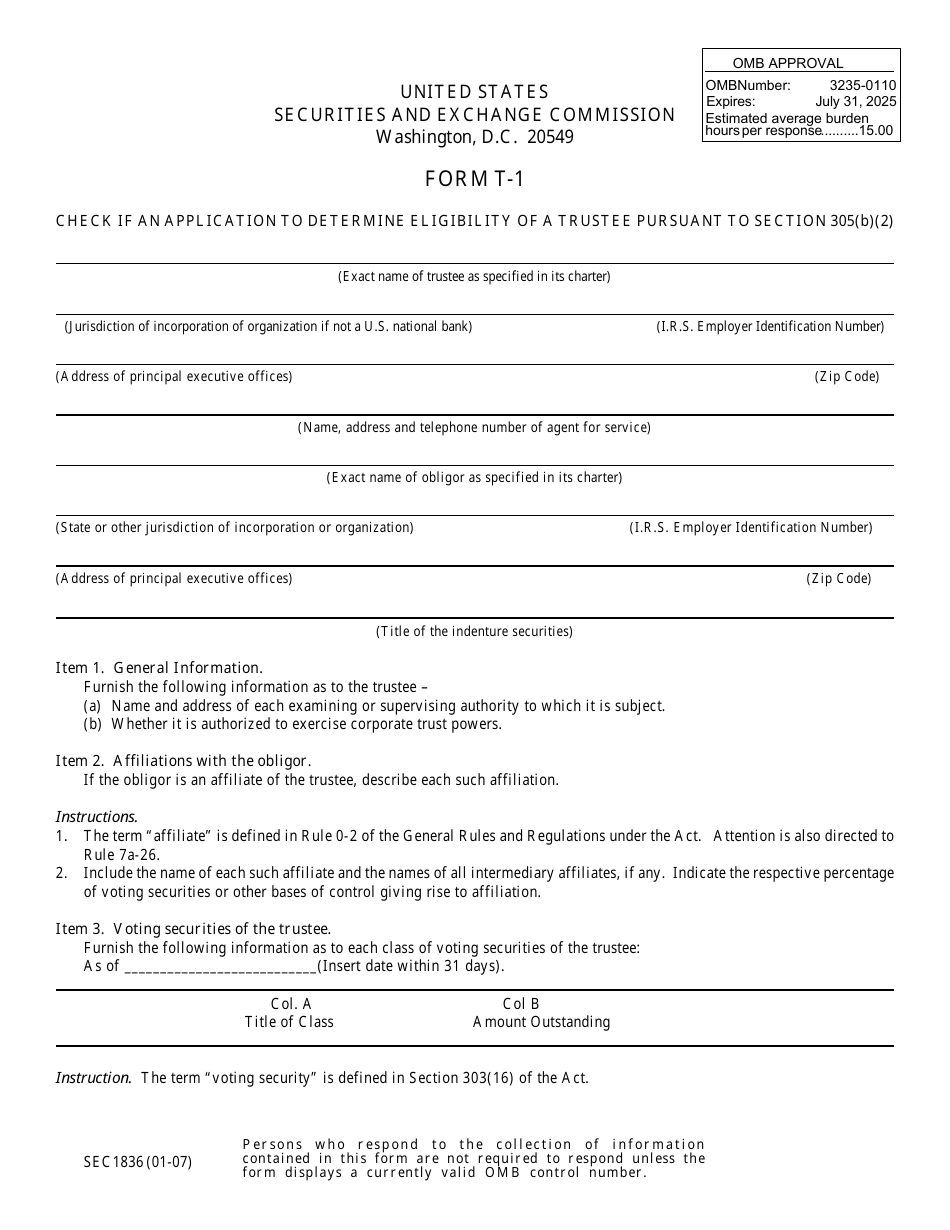

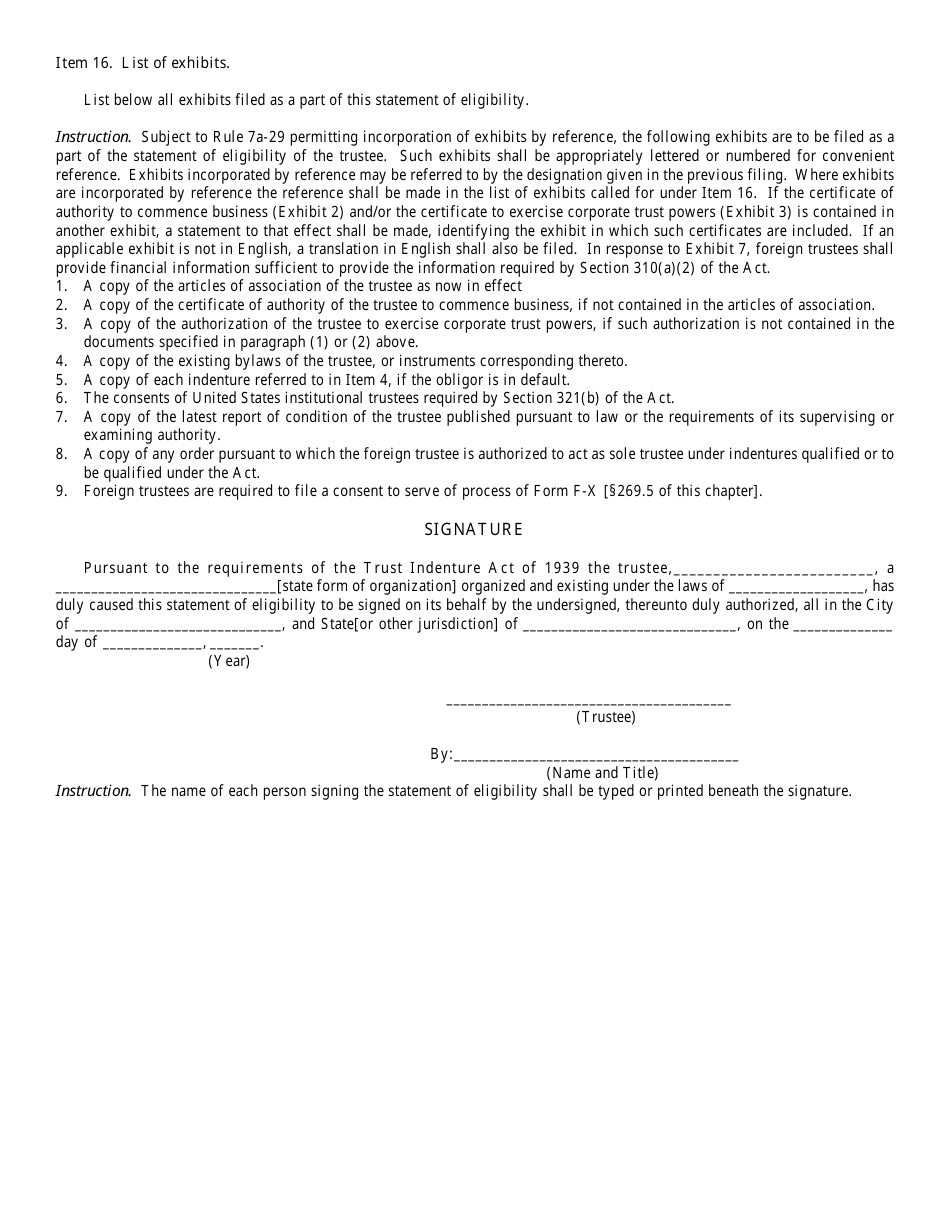

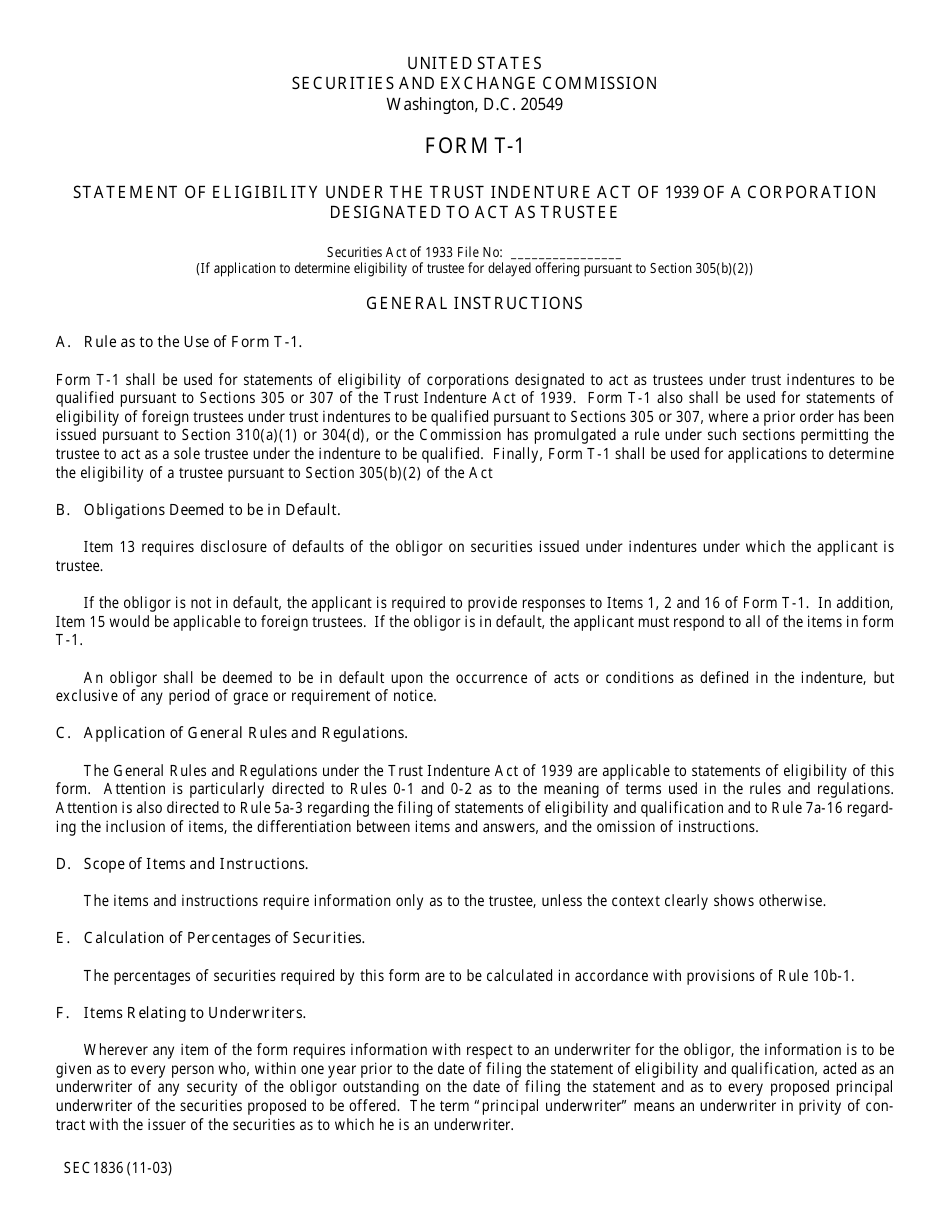

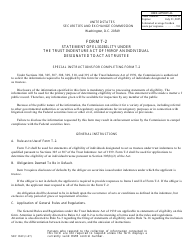

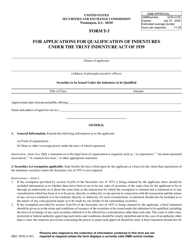

Form T-1 (SEC Form 1836) Statement of Eligibility and Qualification Under the Trust Indenture Act of 1939 of Corporations Designated to Act as Trustees

What Is Form T-1 (SEC Form 1836)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on January 1, 2007 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-1?

A: Form T-1 is a statement of eligibility and qualification for corporations designated to act as trustees under the Trust Indenture Act of 1939.

Q: What is the Trust Indenture Act of 1939?

A: The Trust Indenture Act of 1939 is a federal law that regulates the issuance of corporate bonds and the role of trustees in safeguarding the rights of bondholders.

Q: Who needs to file Form T-1?

A: Corporations designated to act as trustees under the Trust Indenture Act of 1939 need to file Form T-1.

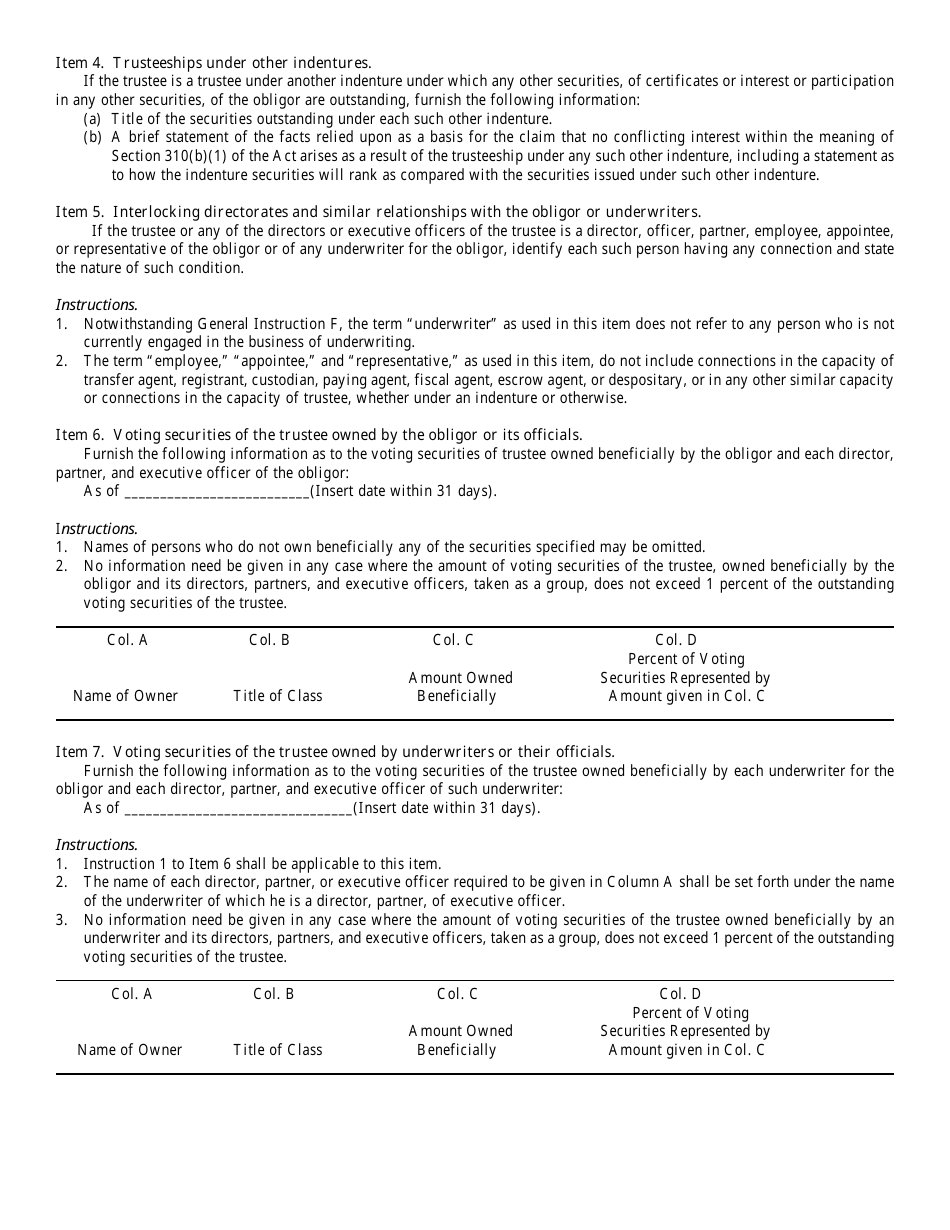

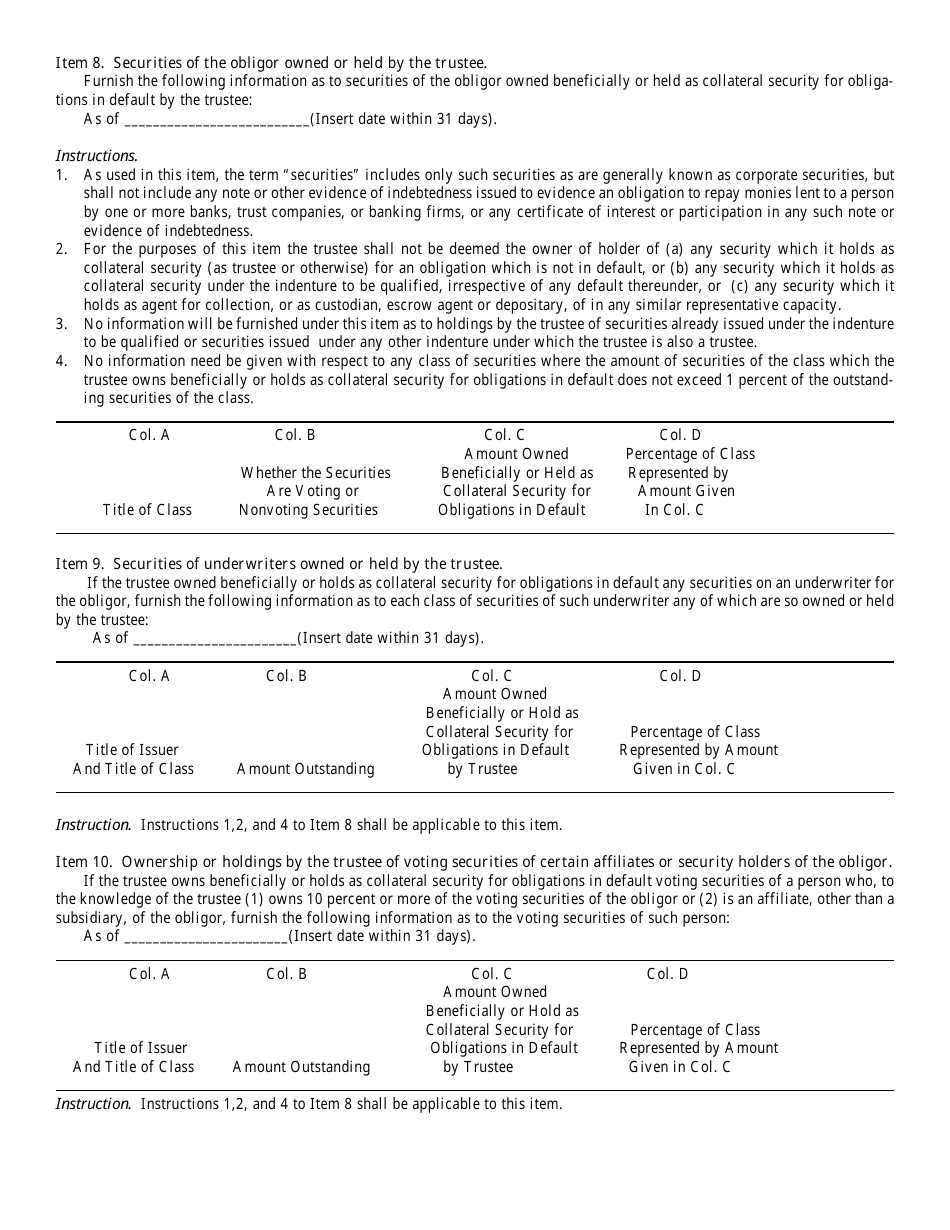

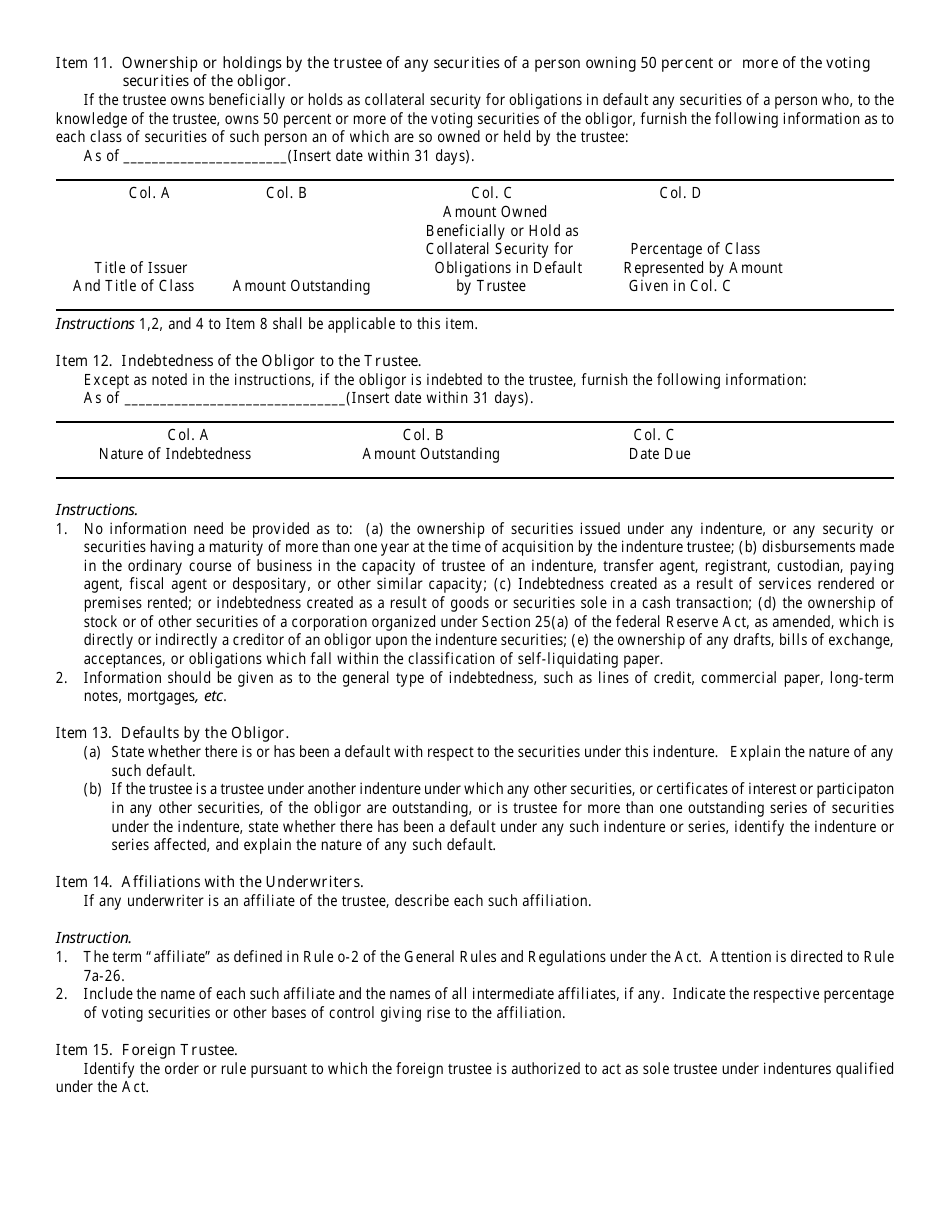

Q: What information does Form T-1 require?

A: Form T-1 requires information about the trustee's eligibility and qualifications, as well as details about the indentures and bonds they are responsible for.

Q: Is Form T-1 required for all trustees?

A: No, Form T-1 is only required for corporations designated to act as trustees under the Trust Indenture Act of 1939.

Q: What happens if Form T-1 is not filed?

A: Failure to file Form T-1 by the required deadline may result in penalties or other legal consequences.

Q: Can Form T-1 be filed electronically?

A: Yes, Form T-1 can be filed electronically through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

Q: Does Form T-1 need to be notarized?

A: No, Form T-1 does not need to be notarized as part of the filing process.

Form Details:

- Released on January 1, 2007;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form T-1 (SEC Form 1836) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.