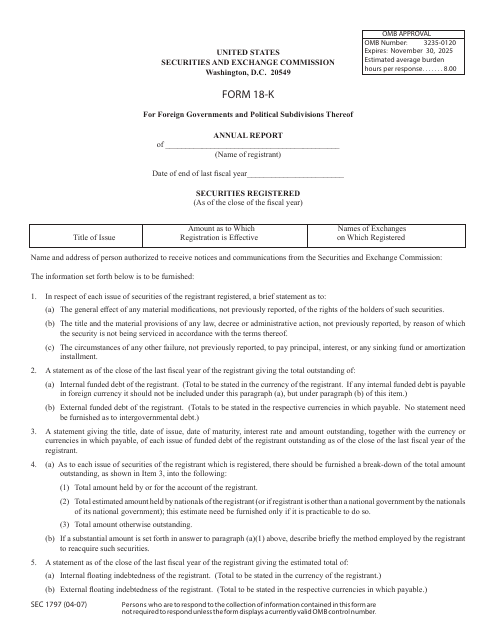

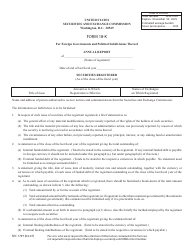

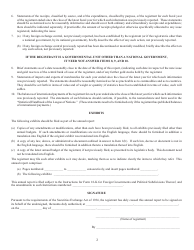

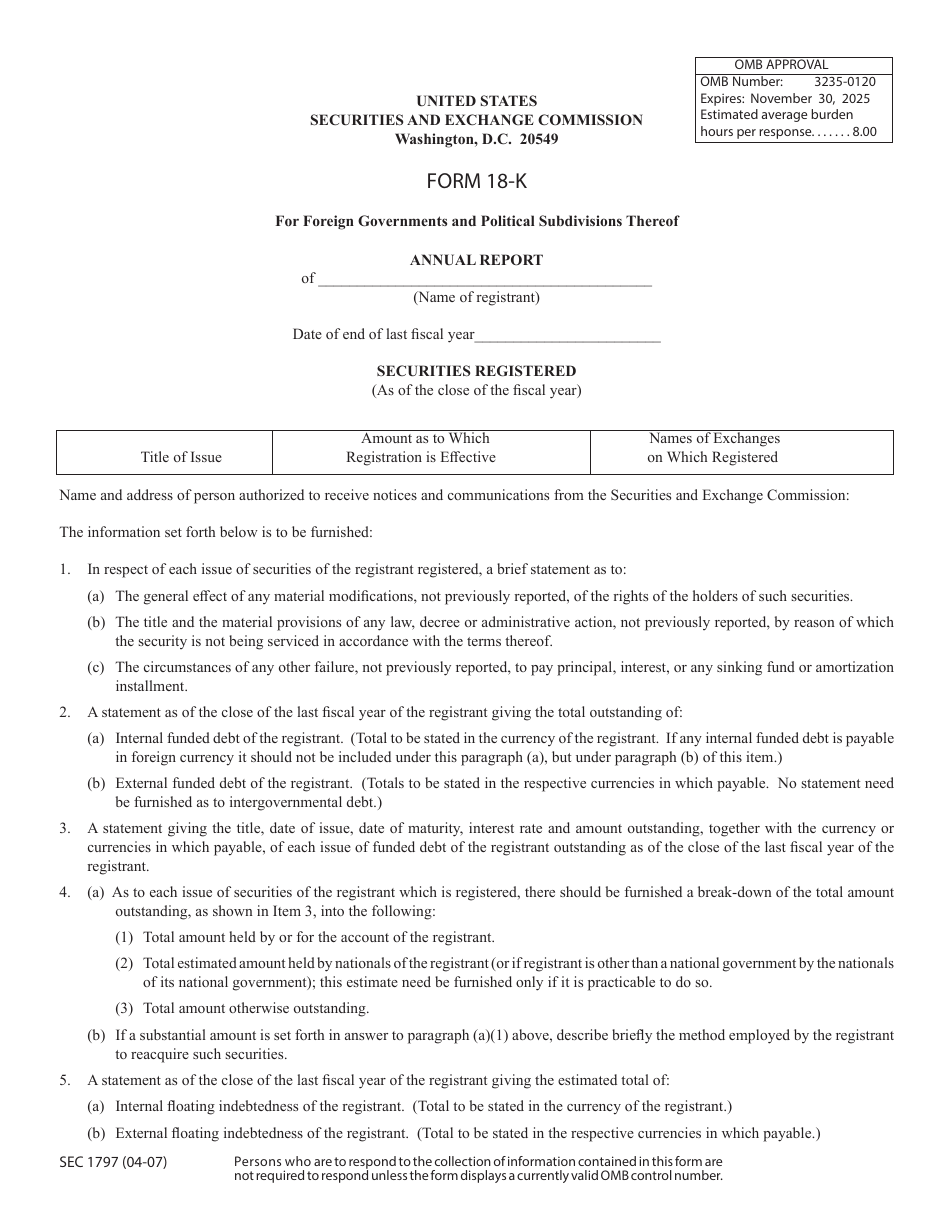

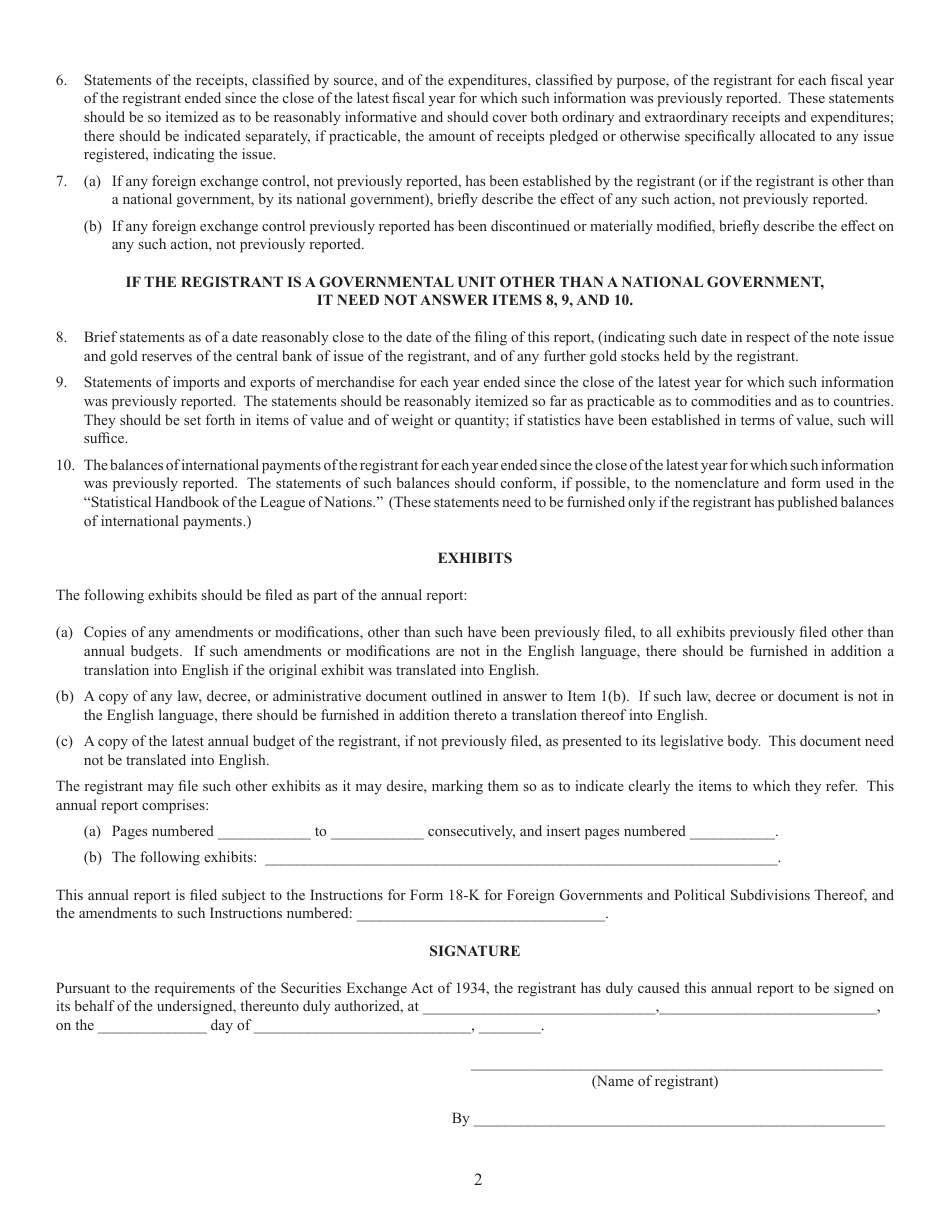

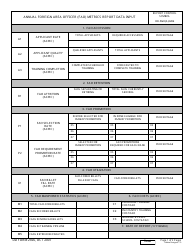

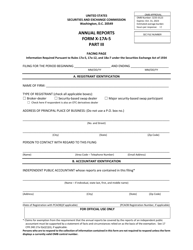

Form 18-K (SEC Form 1797) Annual Report for Foreign Governments and Political Subdivisions Thereof

What Is Form 18-K (SEC Form 1797)?

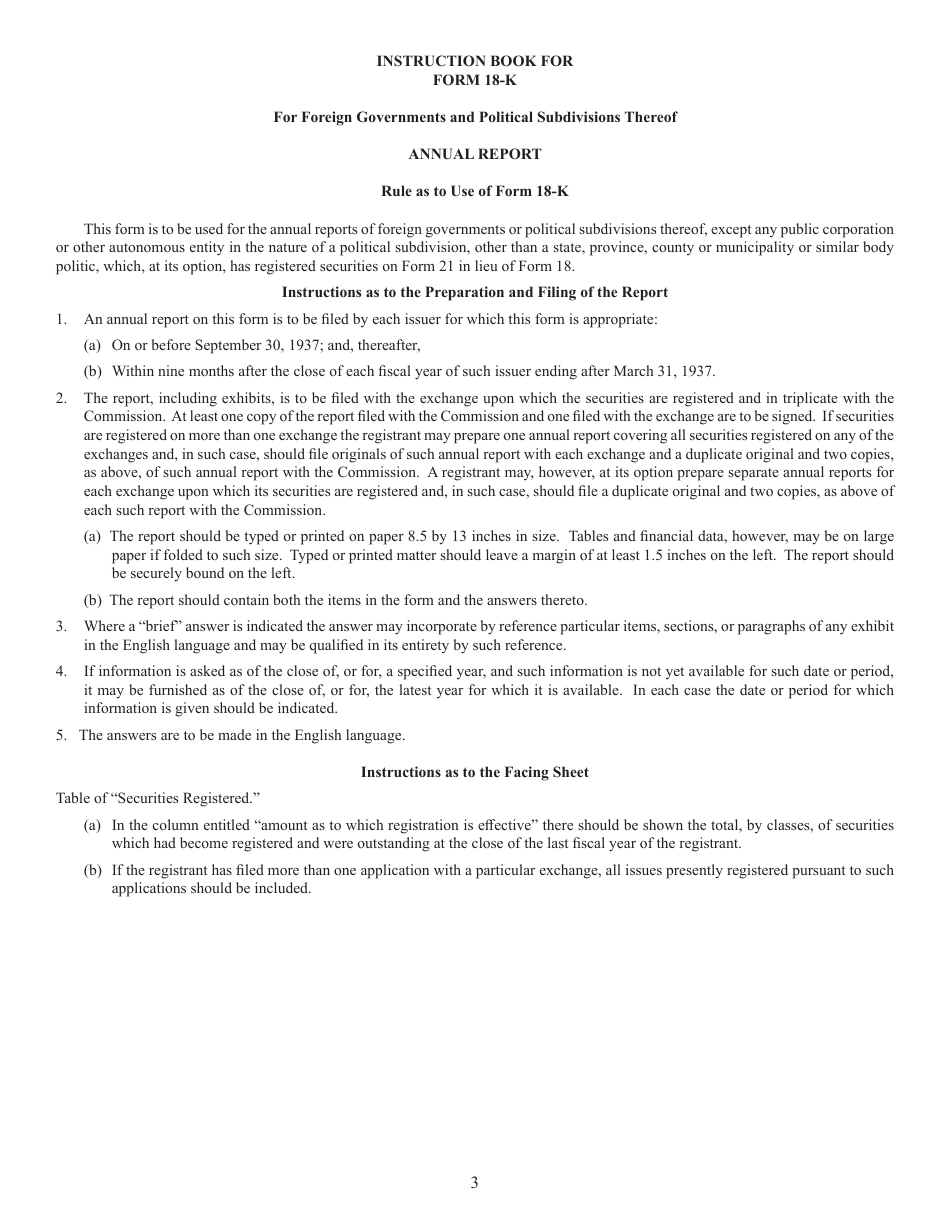

This is a legal form that was released by the U.S. Securities and Exchange Commission on April 1, 2007 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 18-K?

A: Form 18-K is a form used to file an annual report for foreign governments and political subdivisions thereof with the U.S. Securities and Exchange Commission (SEC).

Q: Who is required to file Form 18-K?

A: Foreign governments and political subdivisions thereof are required to file Form 18-K.

Q: What information does Form 18-K require?

A: Form 18-K requires information such as financial statements, foreign activities, indebtedness, and other relevant details.

Q: Why do foreign governments and political subdivisions file Form 18-K?

A: Foreign governments and political subdivisions file Form 18-K to provide transparency and disclose certain financial information to the SEC and the public.

Q: Is Form 18-K only applicable to the United States?

A: No, Form 18-K is applicable to foreign governments and political subdivisions who have securities registered in the United States or who issue securities in certain U.S. offerings.

Q: When is Form 18-K due?

A: The due date for Form 18-K varies depending on the filer's fiscal year end. It is typically due within 120 days of the end of the fiscal year.

Q: Are there any penalties for not filing Form 18-K?

A: Failure to file Form 18-K or filing incomplete or inaccurate information can result in penalties and legal consequences.

Q: Can the public access Form 18-K filings?

A: Yes, Form 18-K filings are publicly available on the U.S. Securities and Exchange Commission's (SEC) EDGAR system.

Q: What other forms are commonly used for SEC filings?

A: Other commonly used forms for SEC filings include Form 10-K, Form 10-Q, and Form 8-K.

Form Details:

- Released on April 1, 2007;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 18-K (SEC Form 1797) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.